1 DE-RISKING FOR BETTER GROWTH Investor Presentation – NAREIT June 2019

2 FORWARD-LOOKING STATEMENTS AND USE OF NON-GAAP FINANCIAL MEASURES Forward-Looking Statements Certain statements in this press release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Such statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Washington REIT to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to the risks associated with the ownership of real estate in general and our real estate assets in particular; the risk of failure to complete contemplated acquisitions and dispositions; the economic health of the greater Washington Metro region; fluctuations in interest rates; reductions in or actual or threatened changes to the timing of federal government spending; the risks related to use of third-party providers and joint venture partners; the ability to control our operating expenses; the economic health of our tenants; the supply of competing properties; shifts away from brick and mortar stores to ecommerce; the availability and terms of financing and capital and the general volatility of securities markets; compliance with applicable laws, including those concerning the environment and access by persons with disabilities; terrorist attacks or actions and/or cyber attacks; weather conditions and natural disasters; ability to maintain key personnel; failure to qualify and maintain our qualification as a REIT and the risks of changes in laws affecting REITs; and other risks and uncertainties detailed from time to time in our filings with the SEC, including our 2018 Form 10-K and subsequent Quarterly Reports on Form 10-Q. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We undertake no obligation to update our forward-looking statements or risk factors or risk factors to reflect new information, future events, or otherwise. Use of Non-GAAP Financial Measures and other Definitions This presentation contains certain non-GAAP financial measures and other terms that have particular definitions when used by us. The definitions and calculations of these non-GAAP financial measures and other terms may differ from those used by other REITs and, accordingly, may not be comparable. Please refer to the definitions and calculations of these terms and the reasons for their use, and reconciliations to the most directly comparable GAAP measures included later in this investor presentation.

3 WE’RE LOOKING FORWARD TO De-risking and stabilizing our cash flows and NOI by acquiring value-add multifamily assets selling retail and office assets leasing up key vacancies across our commercial portfolio and delivering our multifamily development, the Trove Through strong, swift execution in as compressed a time frame as possible.

01 TRANSACTION SUMMARY 4 Strategic rationale and timing update 02 TRACK OUR PROGRESS Progression toward lower risk and higher quality cash flows 03 CAPITAL ALLOCATION STRATEGY Multifamily growth strategy and capital allocation strategy 04 THE ACQUISITION PORTFOLIO Map and overview of the seven value-add multifamily assets Here’s how 05 INVESTMENT RATIONALE Addressing affordability, aging millennials, submarket data to navigate our story 06 EXISTING MULTIFAMILY PORTFOLIO Track record and value-add exposure 07 EMBEDDED GROWTH OPPORTUNITIES Across the office, multifamily and retail portfolios 08 BALANCE SHEET Leverage ratios and debt maturity ladder 09 MARKET GROWTH OPPORTUNITIES Federal spending, Amazon HQ2 10 MANAGEMENT TEAM & APPENDIX Everything else you may want to know

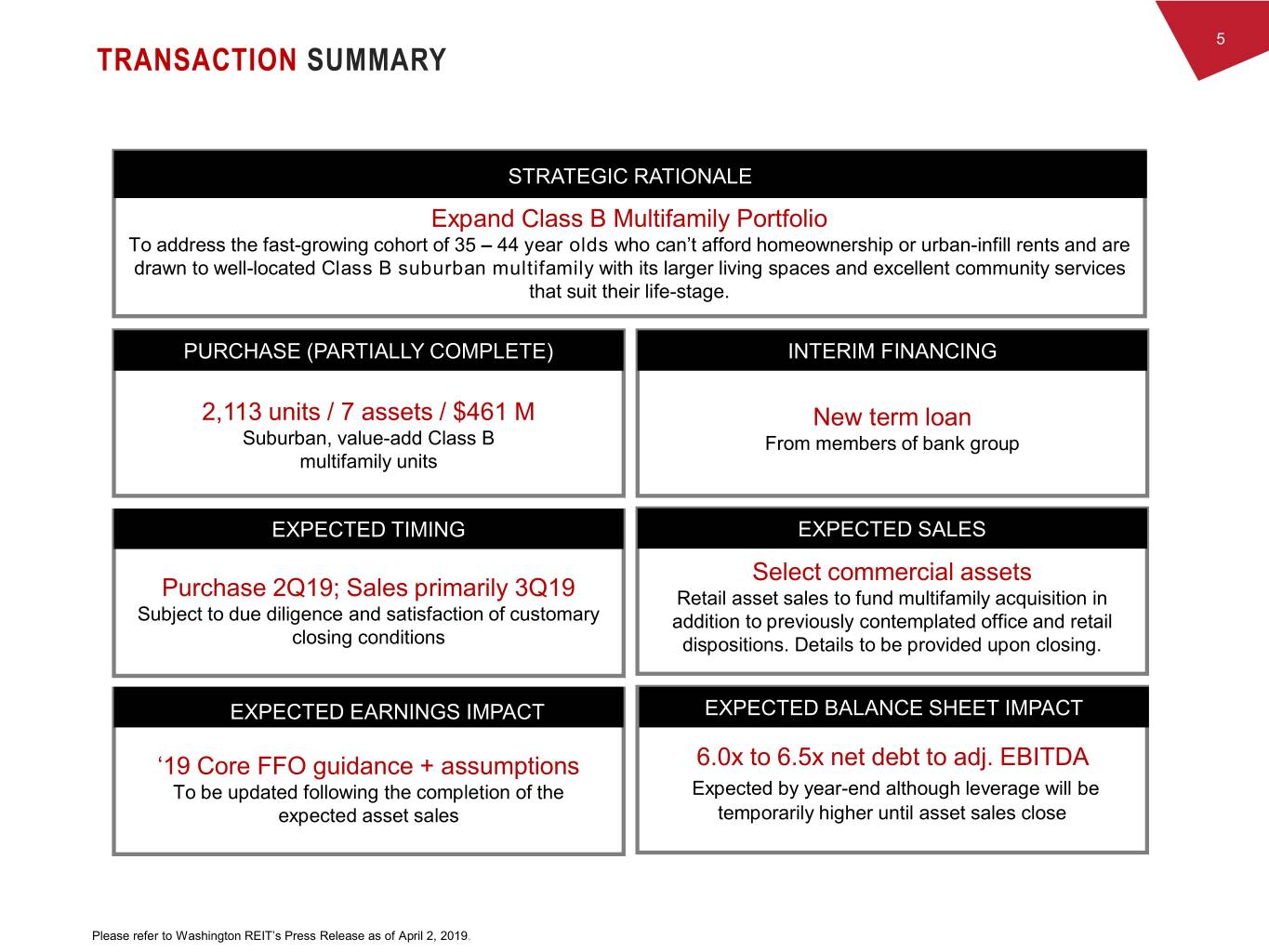

5 TRANSACTION SUMMARY STRATEGIC RATIONALE Expand Class B Multifamily Portfolio To address the fast-growing cohort of 35 – 44 year olds who can’t afford homeownership or urban-infill rents and are drawn to well-located Class B suburban multifamily with its larger living spaces and excellent community services that suit their life-stage. PURCHASE (PARTIALLY COMPLETE) INTERIM FINANCING 2,113 units / 7 assets / $461 M New term loan Suburban, value-add Class B From members of bank group multifamily units EXPECTED TIMING EXPECTED SALES Select commercial assets Purchase 2Q19; Sales primarily 3Q19 Retail asset sales to fund multifamily acquisition in Subject to due diligence and satisfaction of customary addition to previously contemplated office and retail closing conditions dispositions. Details to be provided upon closing. EXPECTED EARNINGS IMPACT EXPECTED BALANCE SHEET IMPACT ‘19 Core FFO guidance + assumptions 6.0x to 6.5x net debt to adj. EBITDA To be updated following the completion of the Expected by year-end although leverage will be expected asset sales temporarily higher until asset sales close Please refer to Washington REIT’s Press Release as of April 2, 2019.

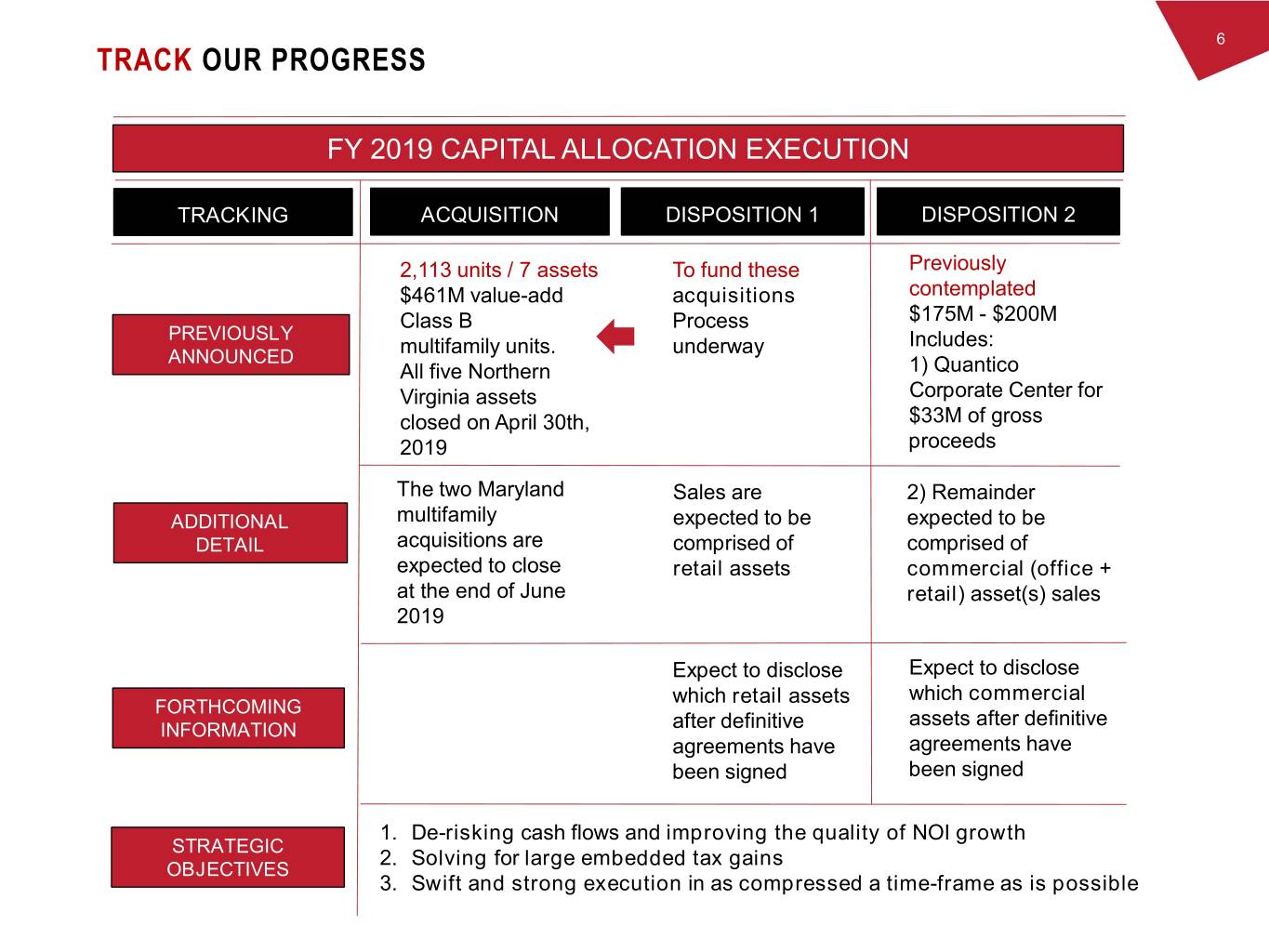

6 TRACK OUR PROGRESS FY 2019 CAPITAL ALLOCATION EXECUTION TRACKING ACQUISITION DISPOSITION 1 DISPOSITION 2 2,113 units / 7 assets To fund these Previously $461M value-add acquisitions contemplated Class B Process $175M - $200M PREVIOUSLY Includes: ANNOUNCED multifamily units. underway All five Northern 1) Quantico Virginia assets Corporate Center for closed on April 30th, $33M of gross 2019 proceeds The two Maryland Sales are 2) Remainder ADDITIONAL multifamily expected to be expected to be DETAIL acquisitions are comprised of comprised of expected to close retail assets commercial (office + at the end of June retail) asset(s) sales 2019 Expect to disclose Expect to disclose which retail assets which commercial FORTHCOMING assets after definitive INFORMATION after definitive agreements have agreements have been signed been signed 1. De-risking cash flows and improving the quality of NOI growth STRATEGIC 2. Solving for large embedded tax gains OBJECTIVES 3. Swift and strong execution in as compressed a time-frame as is possible

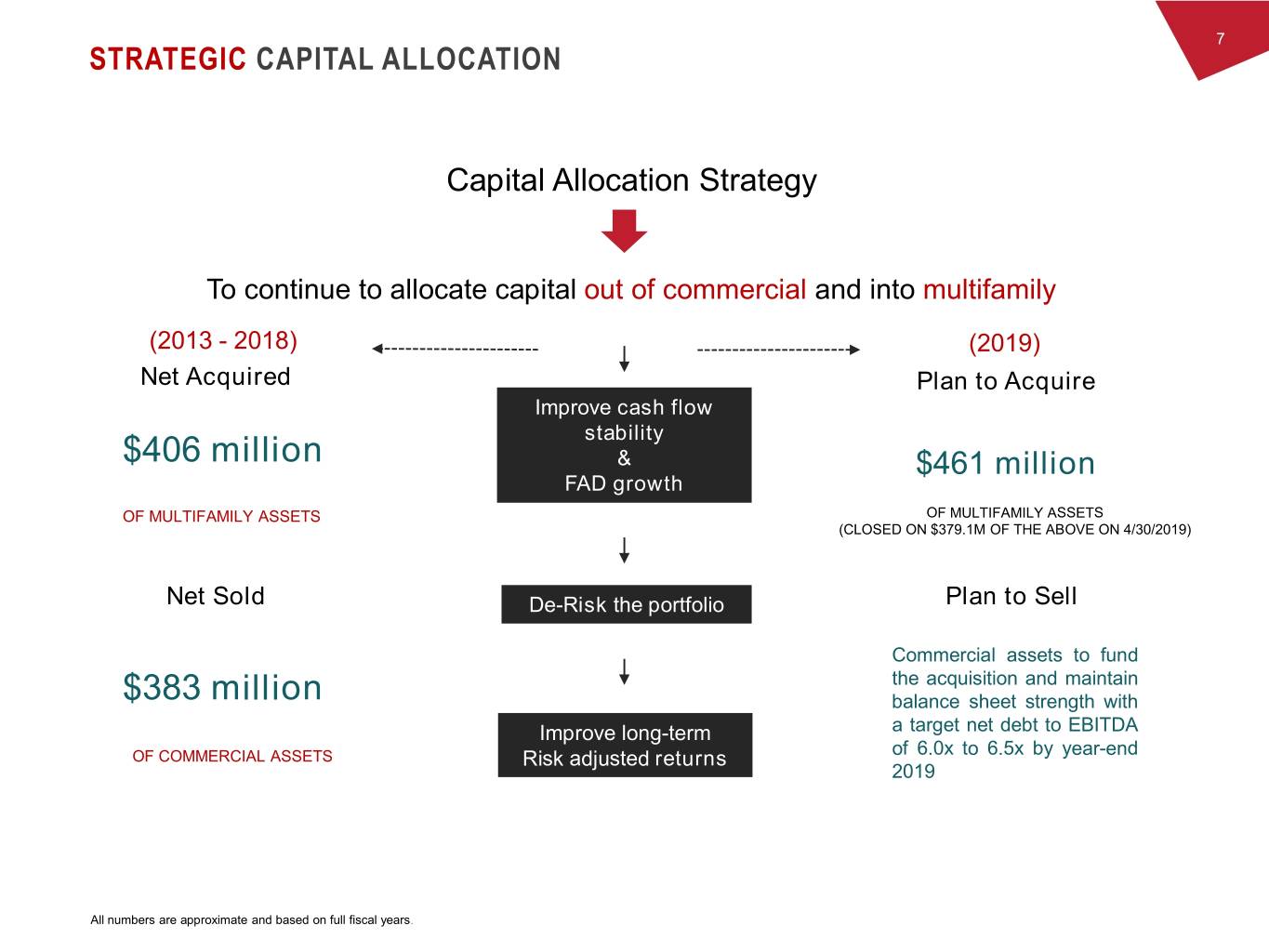

7 STRATEGIC CAPITAL ALLOCATION Capital Allocation Strategy To continue to allocate capital out of commercial and into multifamily (2013 - 2018) (2019) Net Acquired Plan to Acquire Improve cash flow stability $406 million & $461 million FAD growth OF MULTIFAMILY ASSETS OF MULTIFAMILY ASSETS (CLOSED ON $379.1M OF THE ABOVE ON 4/30/2019) Net Sold De-Risk the portfolio Plan to Sell Commercial assets to fund the acquisition and maintain $383 million balance sheet strength with Improve long-term a target net debt to EBITDA of 6.0x to 6.5x by year-end OF COMMERCIAL ASSETS Risk adjusted returns 2019 All numbers are approximate and based on full fiscal years.

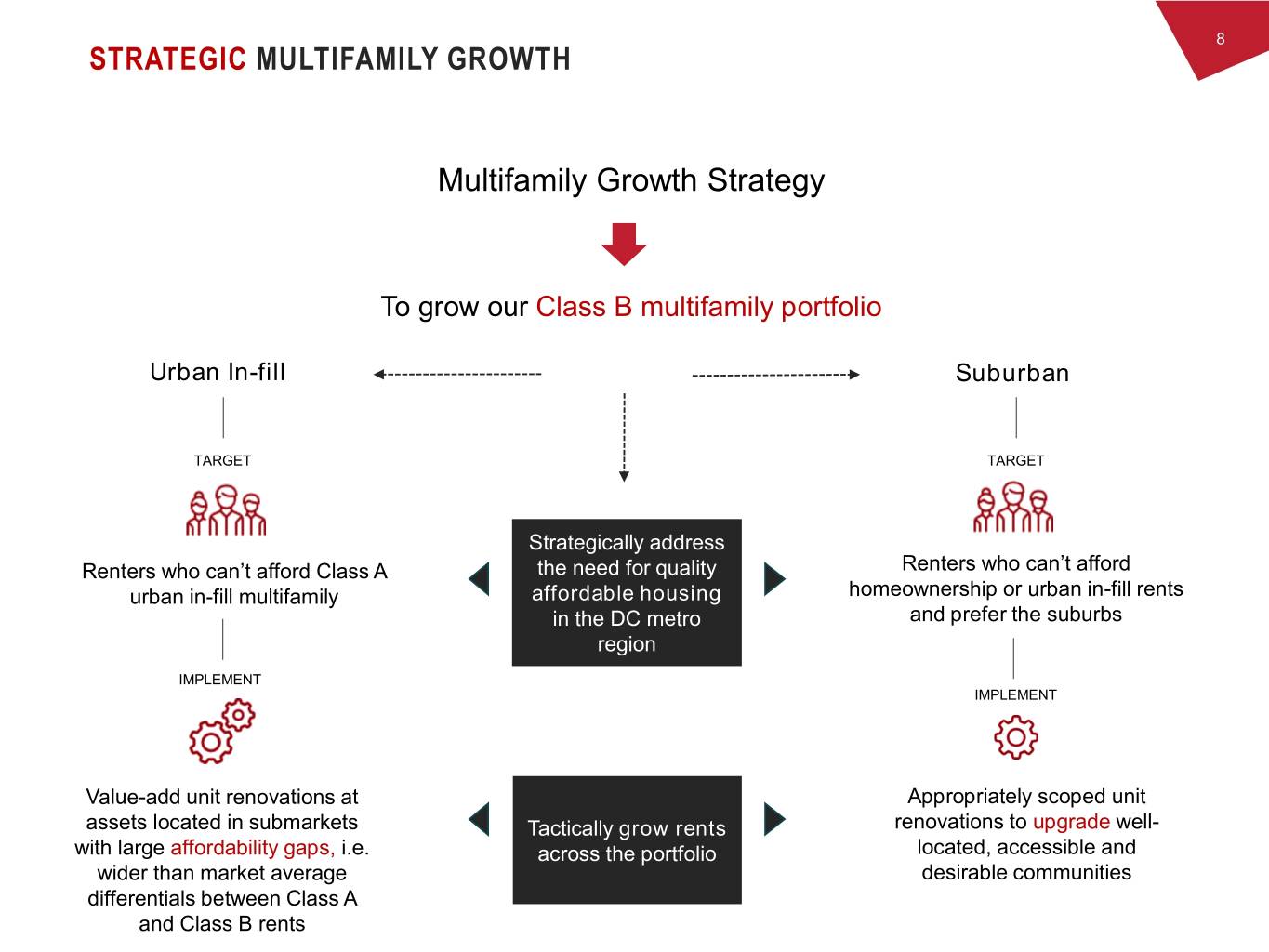

8 STRATEGIC MULTIFAMILY GROWTH Multifamily Growth Strategy To grow our Class B multifamily portfolio Urban In-fill Suburban TARGET TARGET Strategically address Renters who can’t afford Class A the need for quality Renters who can’t afford urban in-fill multifamily affordable housing homeownership or urban in-fill rents in the DC metro and prefer the suburbs region IMPLEMENT IMPLEMENT Value-add unit renovations at Appropriately scoped unit assets located in submarkets Tactically grow rents renovations to upgrade well- with large affordability gaps, i.e. across the portfolio located, accessible and wider than market average desirable communities differentials between Class A and Class B rents

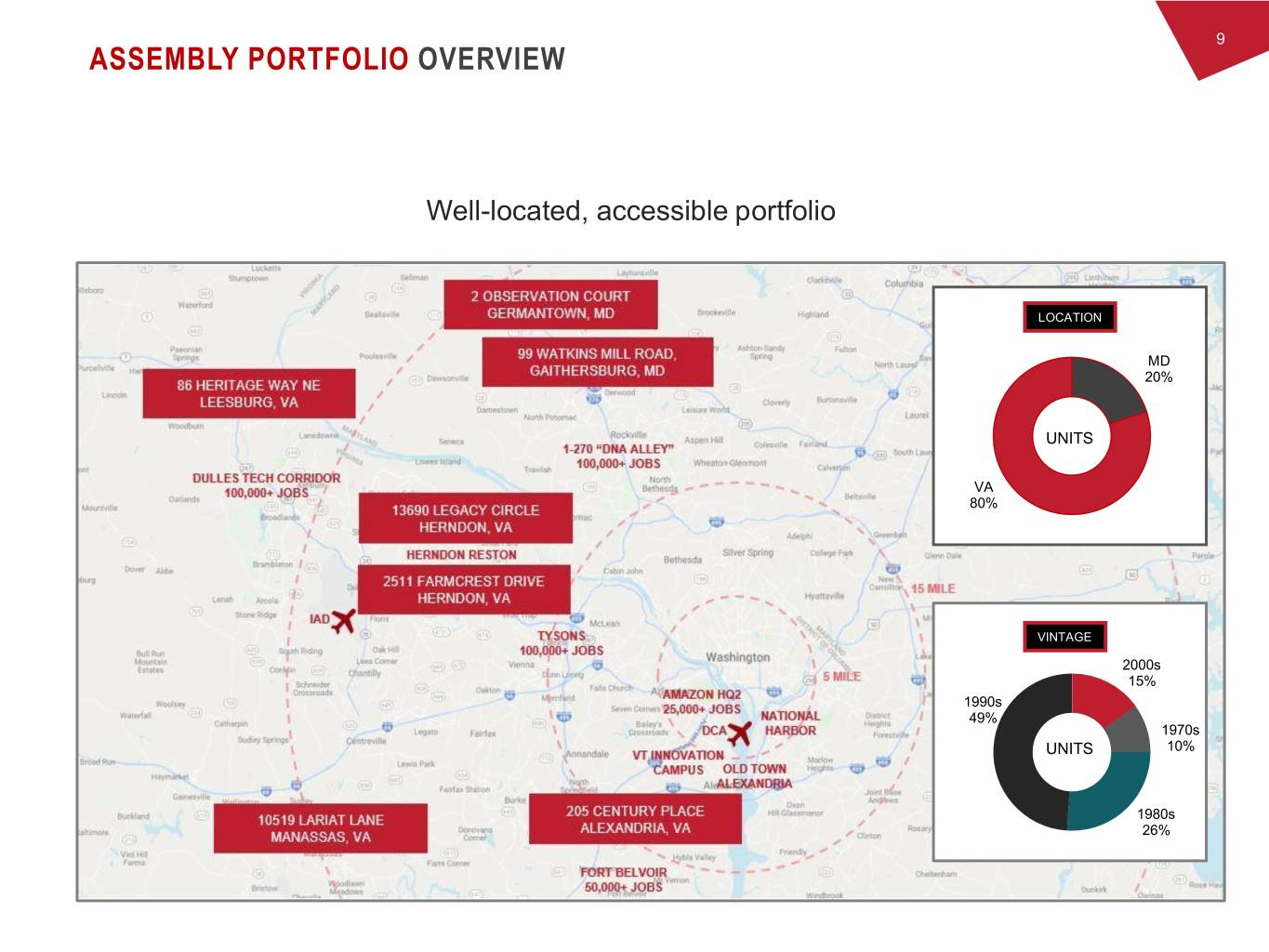

9 ASSEMBLY PORTFOLIO OVERVIEW Well-located, accessible portfolio LOCATION MD 20% UNITS VA 80% VINTAGE 2000s 15% 1990s 49% 1970s UNITS 10% 1980s 26%

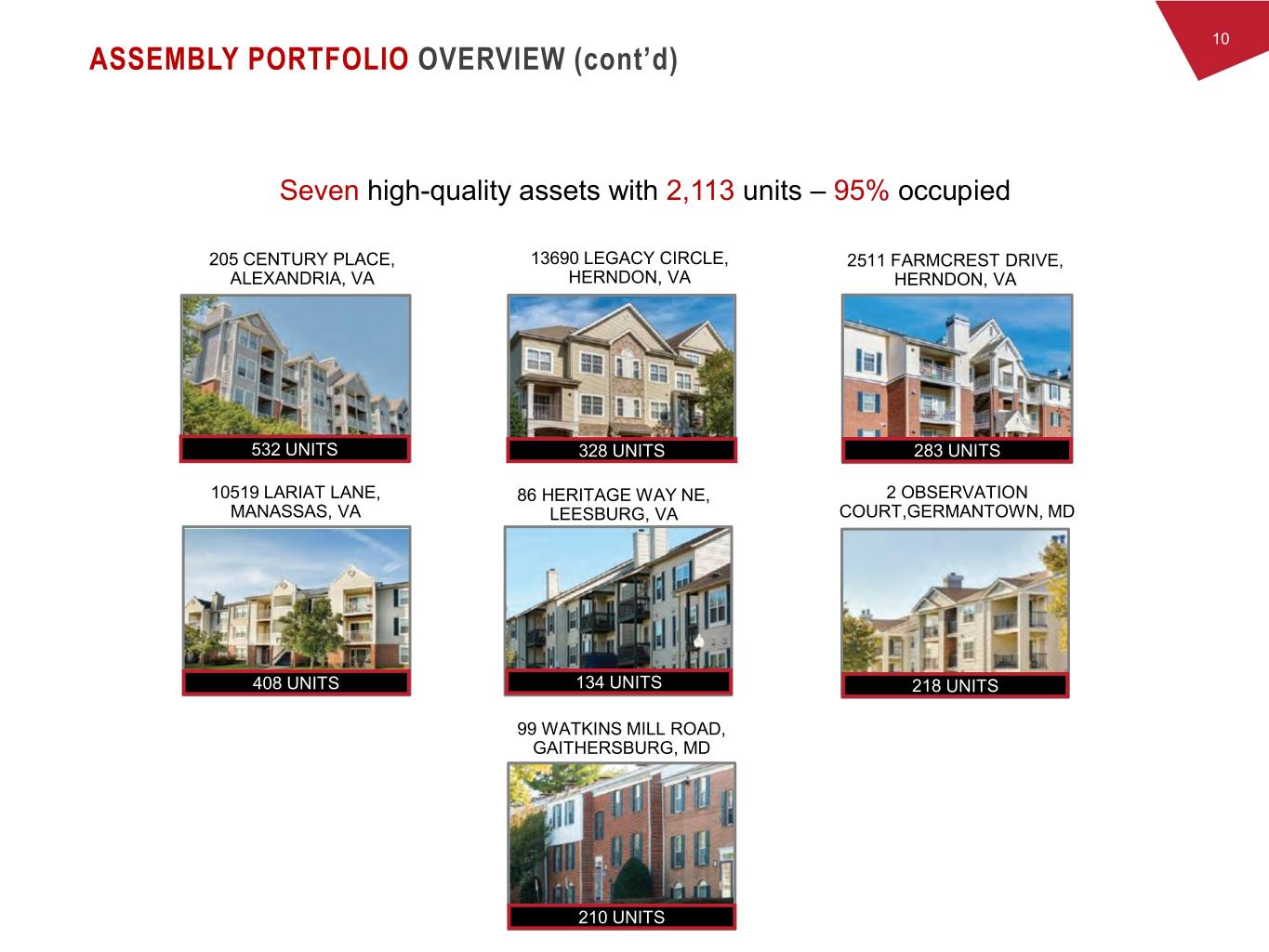

10 ASSEMBLY PORTFOLIO OVERVIEW (cont’d) Seven high-quality assets with 2,113 units – 95% occupied 205 CENTURY PLACE, 13690 LEGACY CIRCLE, 2511 FARMCREST DRIVE, ALEXANDRIA, VA HERNDON, VA HERNDON, VA 532 UNITS 328 UNITS 283 UNITS 10519 LARIAT LANE, 86 HERITAGE WAY NE, 2 OBSERVATION MANASSAS, VA LEESBURG, VA COURT,GERMANTOWN, MD 408 UNITS 134 UNITS 218 UNITS 99 WATKINS MILL ROAD, GAITHERSBURG, MD 210 UNITS

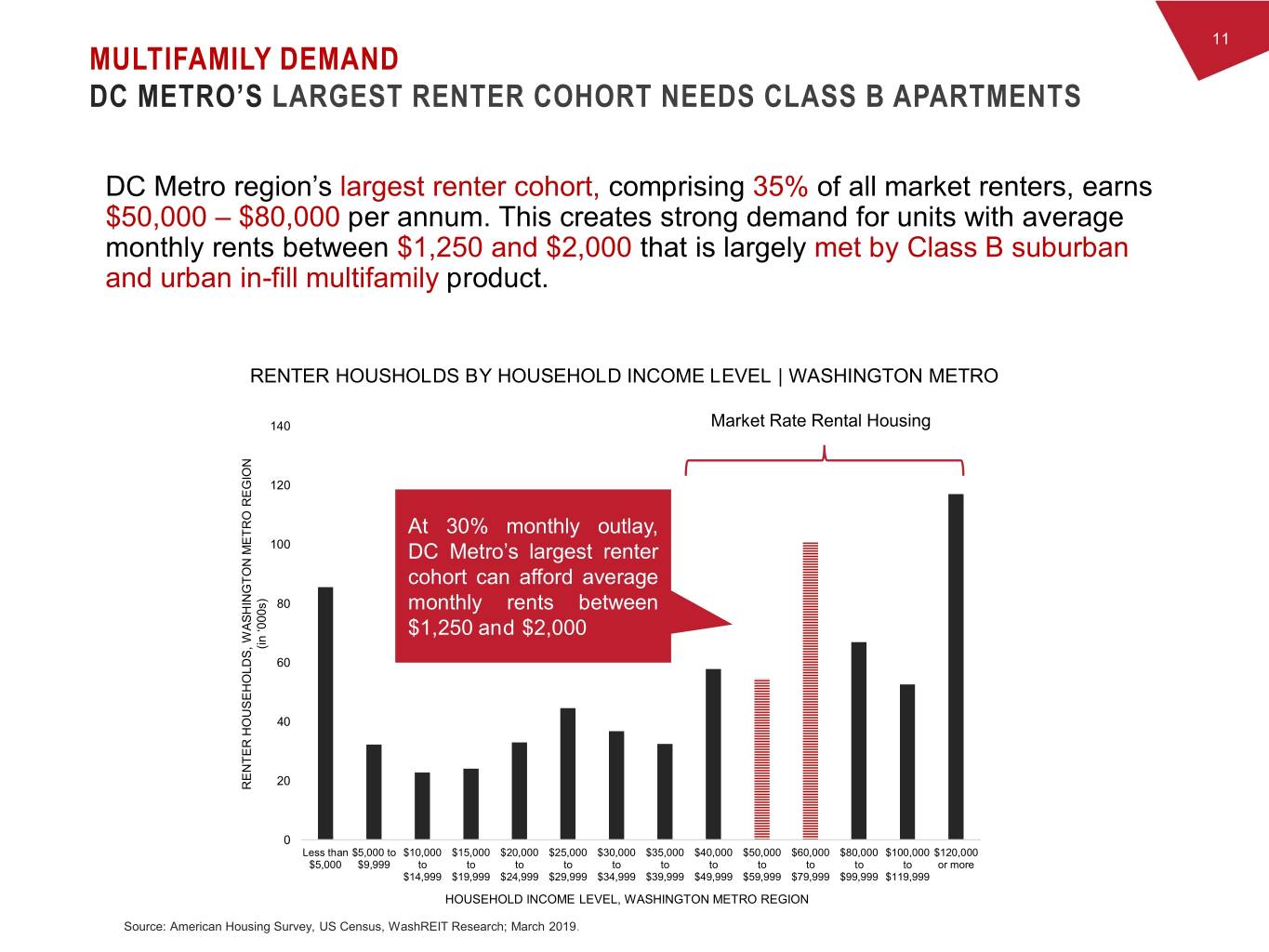

11 MULTIFAMILY DEMAND DC METRO’S LARGEST RENTER COHORT NEEDS CLASS B APARTMENTS DC Metro region’s largest renter cohort, comprising 35% of all market renters, earns $50,000 – $80,000 per annum. This creates strong demand for units with average monthly rents between $1,250 and $2,000 that is largely met by Class B suburban and urban in-fill multifamily product. RENTER HOUSHOLDS BY HOUSEHOLD INCOME LEVEL | WASHINGTON METRO 140 Market Rate Rental Housing 120 At 30% monthly outlay, 100 DC Metro’s largest renter cohort can afford average 80 monthly rents between $1,250 and $2,000 (in (in ‘000s) 60 40 20 RENTER HOUSEHOLDS,RENTER WASHINGTON METRO REGION 0 Less than $5,000 to $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $50,000 $60,000 $80,000 $100,000 $120,000 $5,000 $9,999 to to to to to to to to to to to or more $14,999 $19,999 $24,999 $29,999 $34,999 $39,999 $49,999 $59,999 $79,999 $99,999 $119,999 HOUSEHOLD INCOME LEVEL, WASHINGTON METRO REGION Source: American Housing Survey, US Census, WashREIT Research; March 2019.

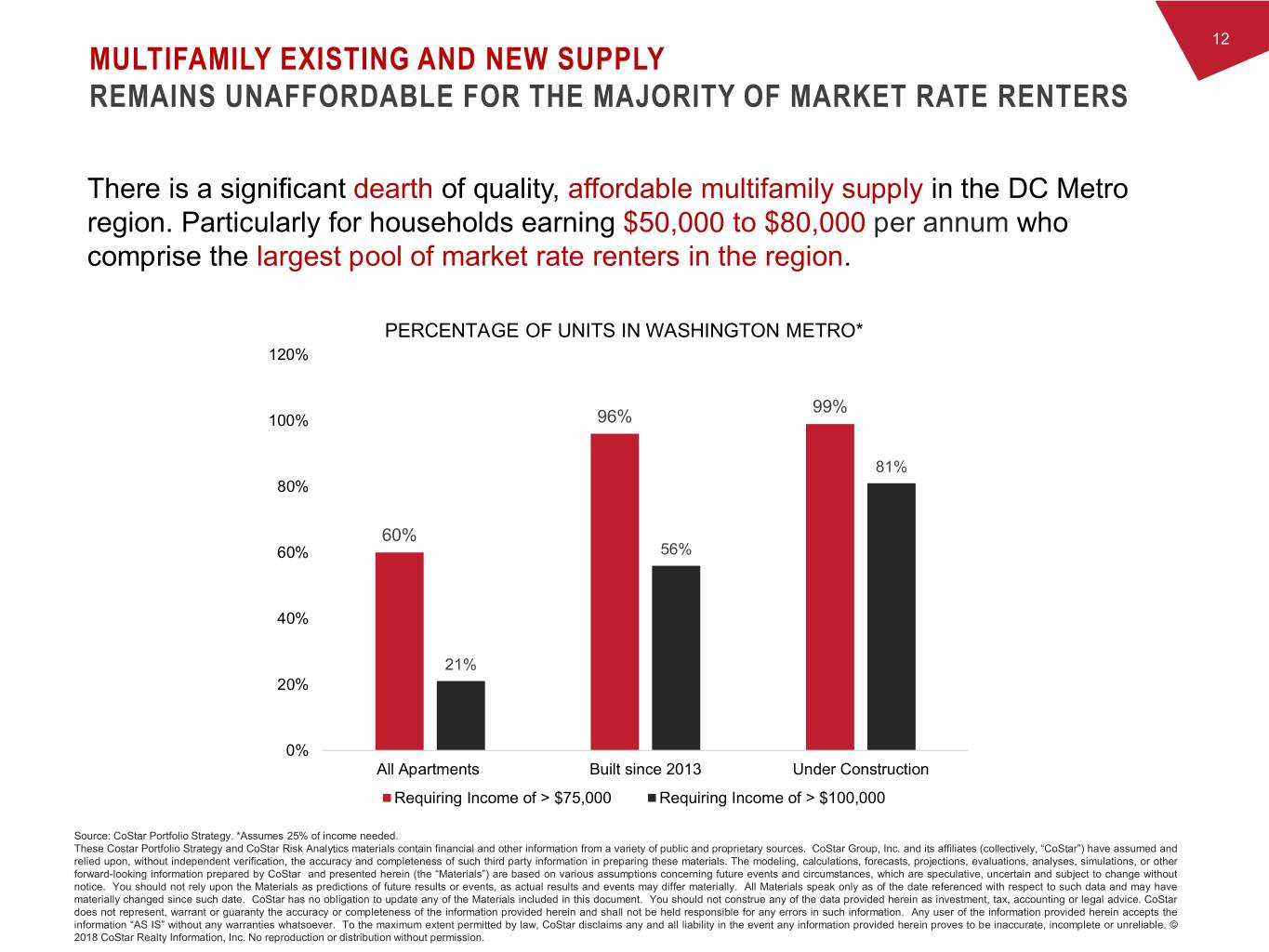

12 MULTIFAMILY EXISTING AND NEW SUPPLY REMAINS UNAFFORDABLE FOR THE MAJORITY OF MARKET RATE RENTERS There is a significant dearth of quality, affordable multifamily supply in the DC Metro region. Particularly for households earning $50,000 to $80,000 per annum who comprise the largest pool of market rate renters in the region. PERCENTAGE OF UNITS IN WASHINGTON METRO* 120% 99% 100% 96% 81% 80% 60% 60% 56% 40% 21% 20% 0% All Apartments Built since 2013 Under Construction Requiring Income of > $75,000 Requiring Income of > $100,000 Source: CoStar Portfolio Strategy. *Assumes 25% of income needed. These Costar Portfolio Strategy and CoStar Risk Analytics materials contain financial and other information from a variety of public and proprietary sources. CoStar Group, Inc. and its affiliates (collectively, “CoStar”) have assumed and relied upon, without independent verification, the accuracy and completeness of such third party information in preparing these materials. The modeling, calculations, forecasts, projections, evaluations, analyses, simulations, or other forward-looking information prepared by CoStar and presented herein (the “Materials”) are based on various assumptions concerning future events and circumstances, which are speculative, uncertain and subject to change without notice. You should not rely upon the Materials as predictions of future results or events, as actual results and events may differ materially. All Materials speak only as of the date referenced with respect to such data and may have materially changed since such date. CoStar has no obligation to update any of the Materials included in this document. You should not construe any of the data provided herein as investment, tax, accounting or legal advice. CoStar does not represent, warrant or guaranty the accuracy or completeness of the information provided herein and shall not be held responsible for any errors in such information. Any user of the information provided herein accepts the information “AS IS” without any warranties whatsoever. To the maximum extent permitted by law, CoStar disclaims any and all liability in the event any information provided herein proves to be inaccurate, incomplete or unreliable. © 2018 CoStar Realty Information, Inc. No reproduction or distribution without permission.

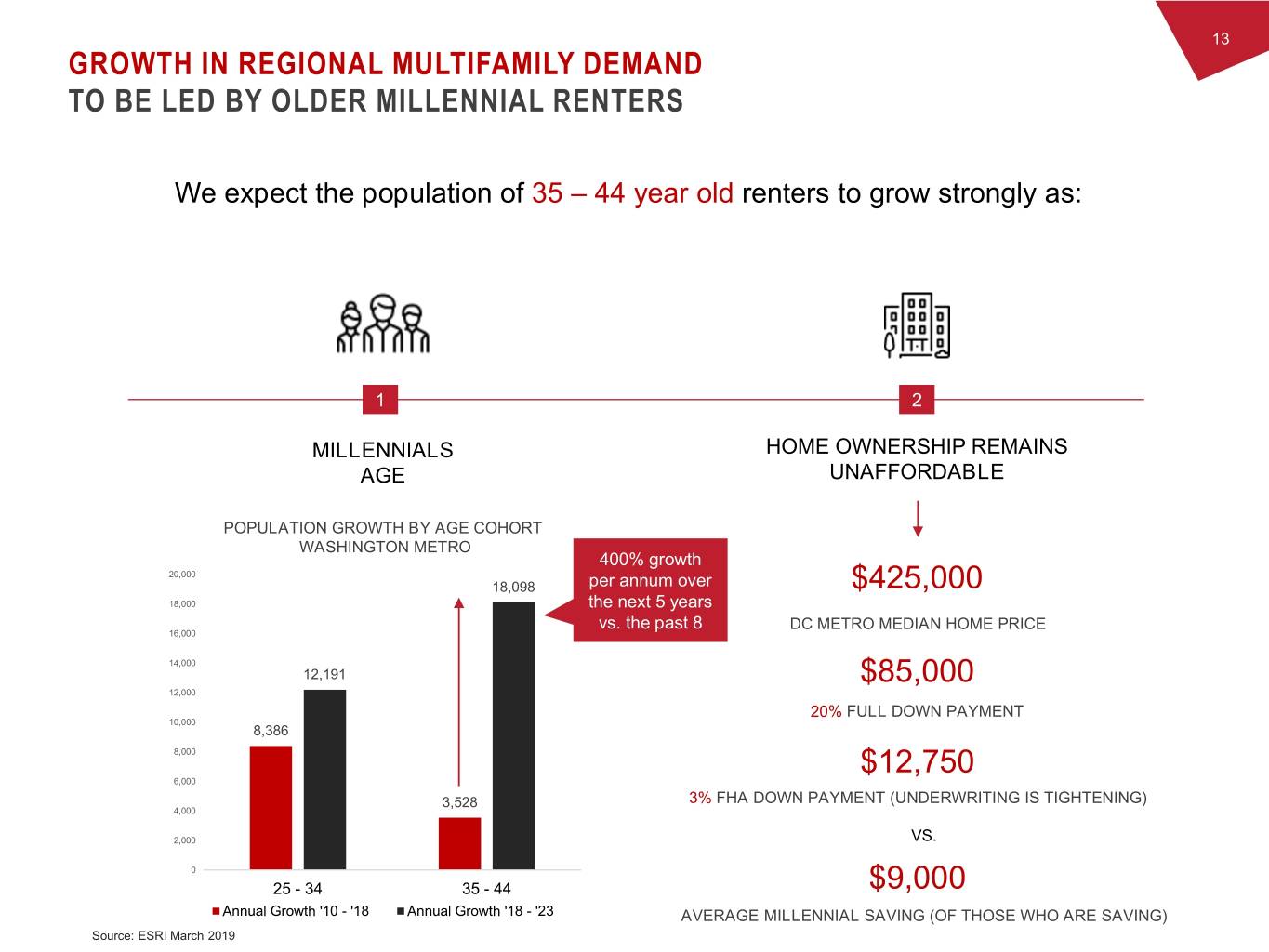

13 GROWTH IN REGIONAL MULTIFAMILY DEMAND TO BE LED BY OLDER MILLENNIAL RENTERS We expect the population of 35 – 44 year old renters to grow strongly as: 1 2 MILLENNIALS HOME OWNERSHIP REMAINS AGE UNAFFORDABLE POPULATION GROWTH BY AGE COHORT WASHINGTON METRO 400% growth 20,000 18,098 per annum over $425,000 18,000 the next 5 years vs. the past 8 DC METRO MEDIAN HOME PRICE 16,000 14,000 12,191 $85,000 12,000 20% FULL DOWN PAYMENT 10,000 8,386 8,000 $12,750 6,000 3,528 3% FHA DOWN PAYMENT (UNDERWRITING IS TIGHTENING) 4,000 2,000 VS. 0 25 - 34 35 - 44 $9,000 Annual Growth '10 - '18 Annual Growth '18 - '23 AVERAGE MILLENNIAL SAVING (OF THOSE WHO ARE SAVING) Source: ESRI March 2019

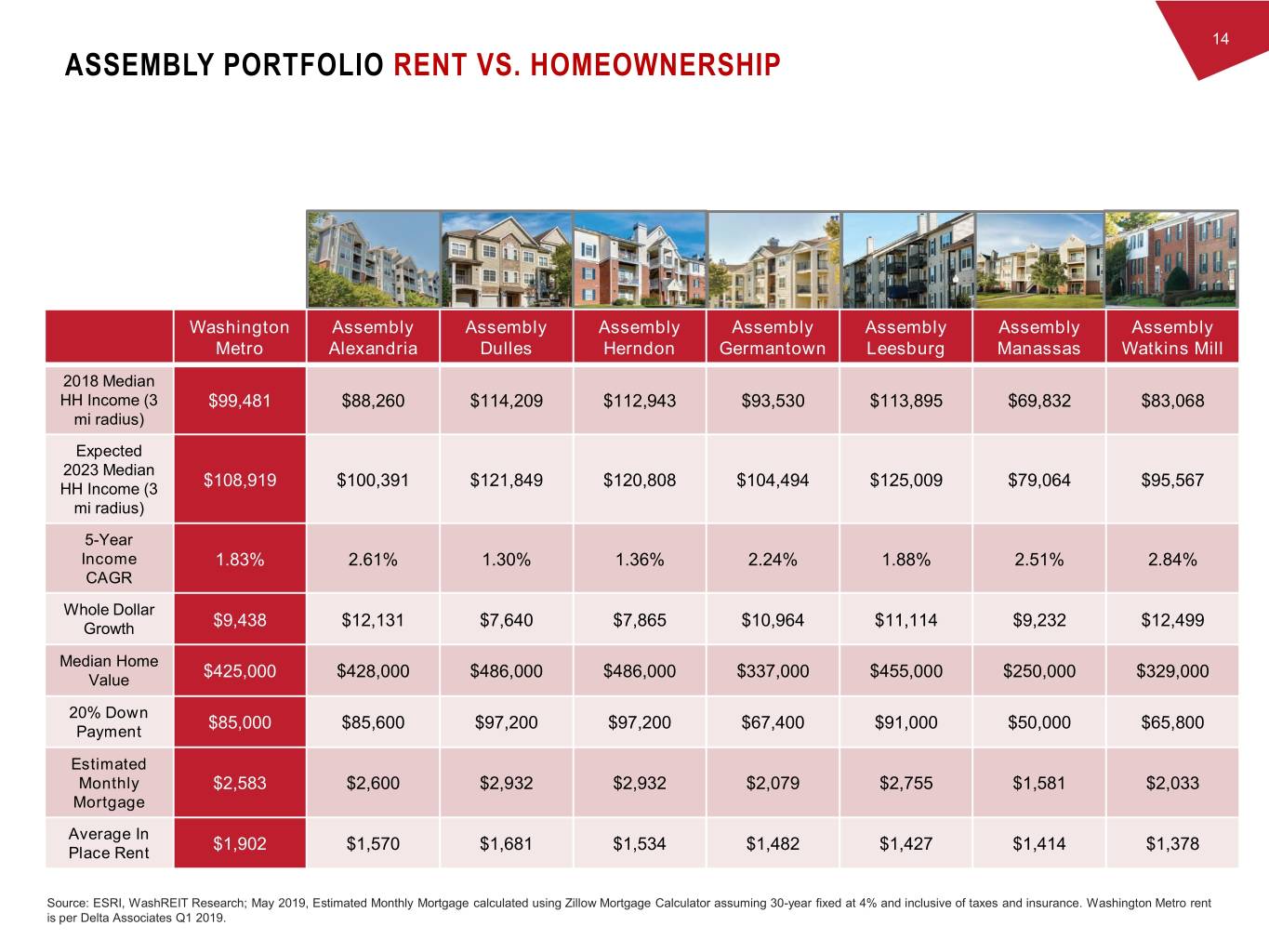

14 ASSEMBLY PORTFOLIO RENT VS. HOMEOWNERSHIP Washington Assembly Assembly Assembly Assembly Assembly Assembly Assembly Metro Alexandria Dulles Herndon Germantown Leesburg Manassas Watkins Mill 2018 Median HH Income (3 $99,481 $88,260 $114,209 $112,943 $93,530 $113,895 $69,832 $83,068 mi radius) Expected 2023 Median HH Income (3 $108,919 $100,391 $121,849 $120,808 $104,494 $125,009 $79,064 $95,567 mi radius) 5-Year Income 1.83% 2.61% 1.30% 1.36% 2.24% 1.88% 2.51% 2.84% CAGR Whole Dollar Growth $9,438 $12,131 $7,640 $7,865 $10,964 $11,114 $9,232 $12,499 Median Home $425,000 $428,000 $486,000 $486,000 $337,000 $455,000 $250,000 $329,000 Value 20% Down $85,000 $85,600 $97,200 $97,200 $67,400 $91,000 $50,000 $65,800 Payment Estimated Monthly $2,583 $2,600 $2,932 $2,932 $2,079 $2,755 $1,581 $2,033 Mortgage Average In $1,902 $1,570 $1,681 $1,534 $1,482 $1,427 $1,414 $1,378 Place Rent Source: ESRI, WashREIT Research; May 2019, Estimated Monthly Mortgage calculated using Zillow Mortgage Calculator assuming 30-year fixed at 4% and inclusive of taxes and insurance. Washington Metro rent is per Delta Associates Q1 2019.

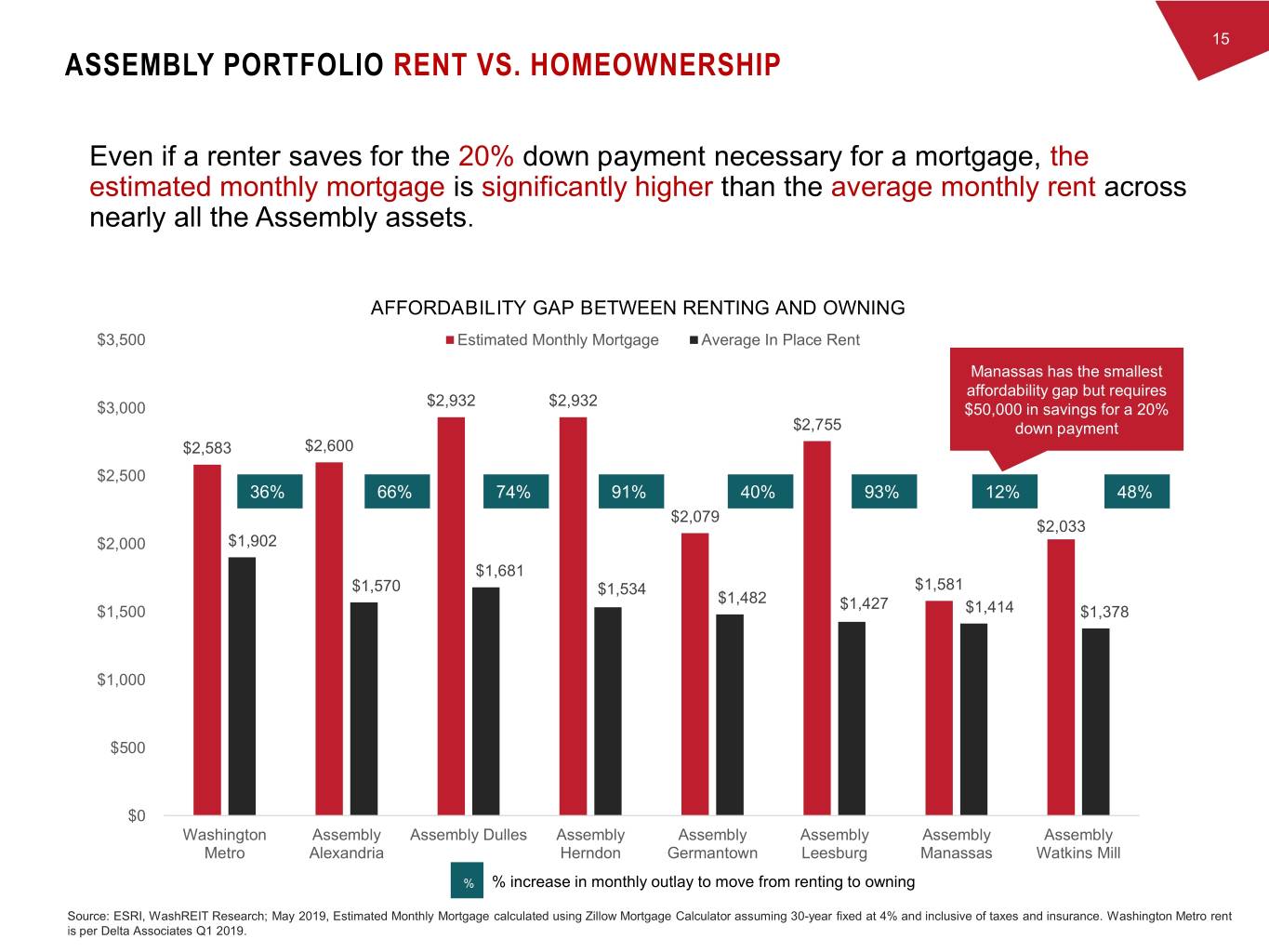

15 ASSEMBLY PORTFOLIO RENT VS. HOMEOWNERSHIP Even if a renter saves for the 20% down payment necessary for a mortgage, the estimated monthly mortgage is significantly higher than the average monthly rent across nearly all the Assembly assets. AFFORDABILITY GAP BETWEEN RENTING AND OWNING $3,500 Estimated Monthly Mortgage Average In Place Rent Manassas has the smallest affordability gap but requires $2,932 $2,932 $3,000 $50,000 in savings for a 20% $2,755 down payment $2,583 $2,600 $2,500 36% 66% 74% 91% 40% 93% 12% 48% $2,079 $2,033 $2,000 $1,902 $1,681 $1,570 $1,534 $1,581 $1,482 $1,427 $1,500 $1,414 $1,378 $1,000 $500 $0 Washington Assembly Assembly Dulles Assembly Assembly Assembly Assembly Assembly Metro Alexandria Herndon Germantown Leesburg Manassas Watkins Mill % % increase in monthly outlay to move from renting to owning Source: ESRI, WashREIT Research; May 2019, Estimated Monthly Mortgage calculated using Zillow Mortgage Calculator assuming 30-year fixed at 4% and inclusive of taxes and insurance. Washington Metro rent is per Delta Associates Q1 2019.

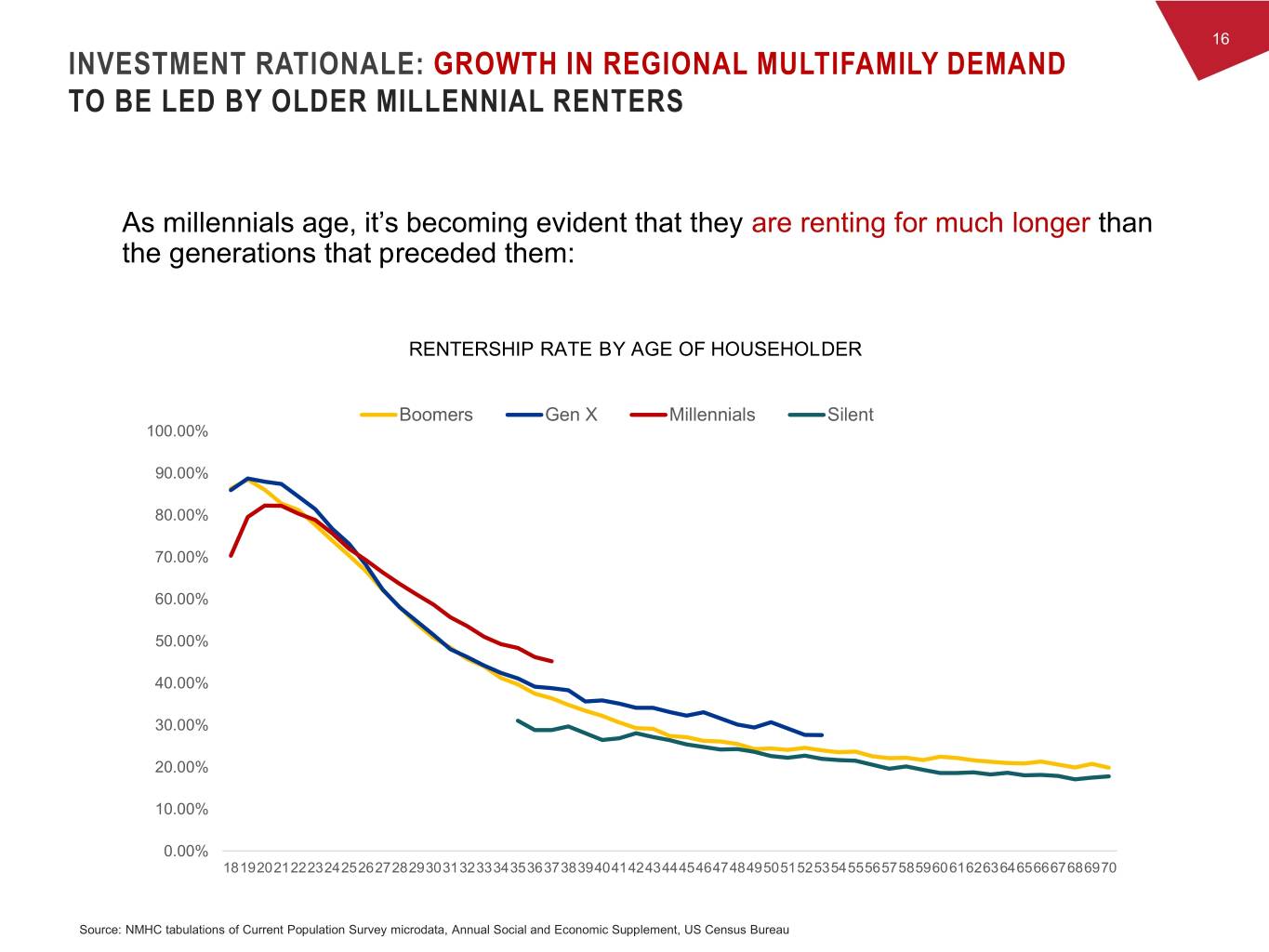

16 INVESTMENT RATIONALE: GROWTH IN REGIONAL MULTIFAMILY DEMAND TO BE LED BY OLDER MILLENNIAL RENTERS As millennials age, it’s becoming evident that they are renting for much longer than the generations that preceded them: RENTERSHIP RATE BY AGE OF HOUSEHOLDER Boomers Gen X Millennials Silent 100.00% 90.00% 80.00% 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 1819202122232425262728293031323334353637383940414243444546474849505152535455565758596061626364656667686970 Source: NMHC tabulations of Current Population Survey microdata, Annual Social and Economic Supplement, US Census Bureau

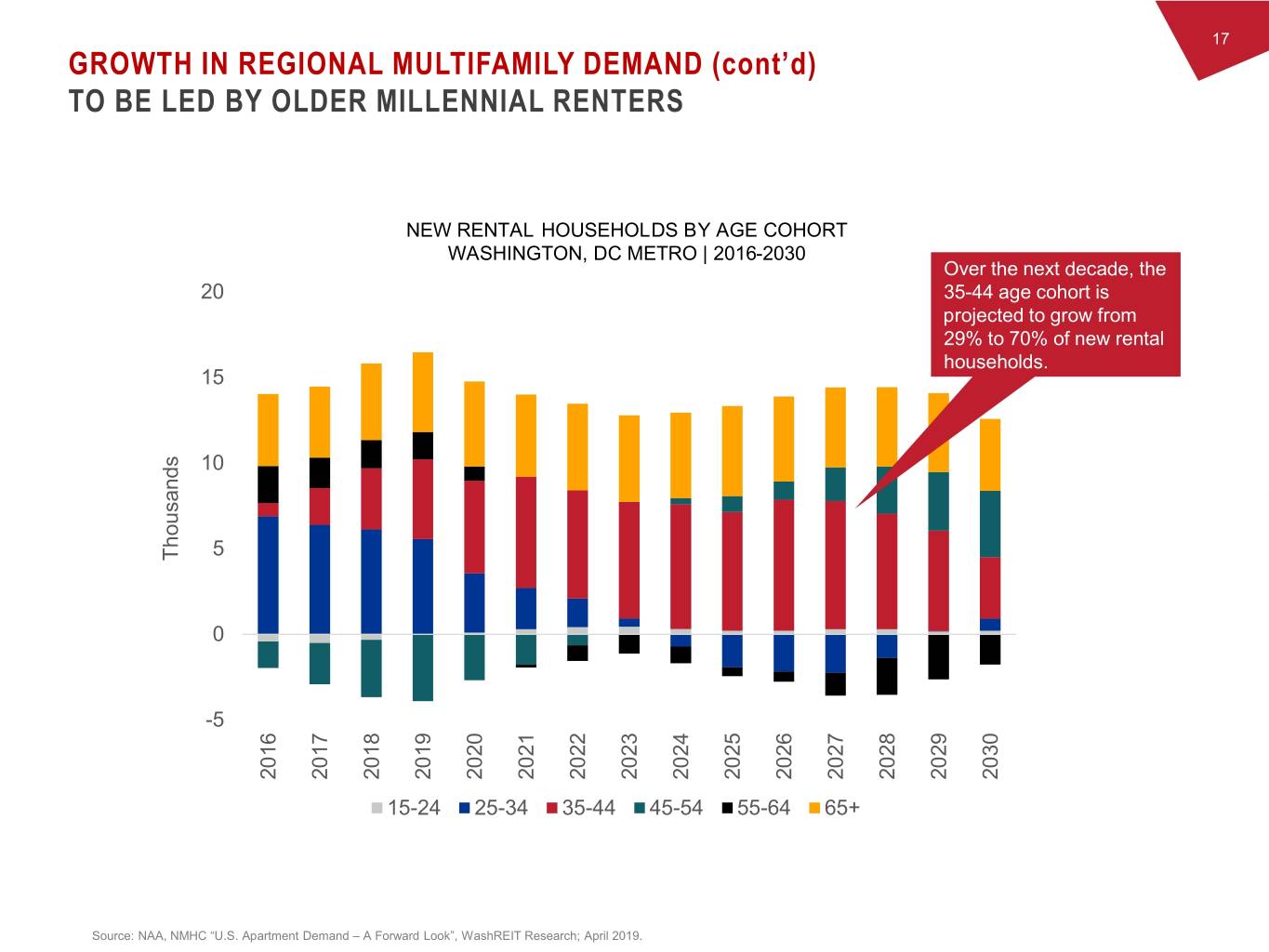

17 GROWTH IN REGIONAL MULTIFAMILY DEMAND (cont’d) TO BE LED BY OLDER MILLENNIAL RENTERS NEW RENTAL HOUSEHOLDS BY AGE COHORT WASHINGTON, DC METRO | 2016-2030 Over the next decade, the 20 35-44 age cohort is projected to grow from 29% to 70% of new rental households. 15 10 5 Thousands 0 -5 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 15-24 25-34 35-44 45-54 55-64 65+ Source: NAA, NMHC “U.S. Apartment Demand – A Forward Look”, WashREIT Research; April 2019.

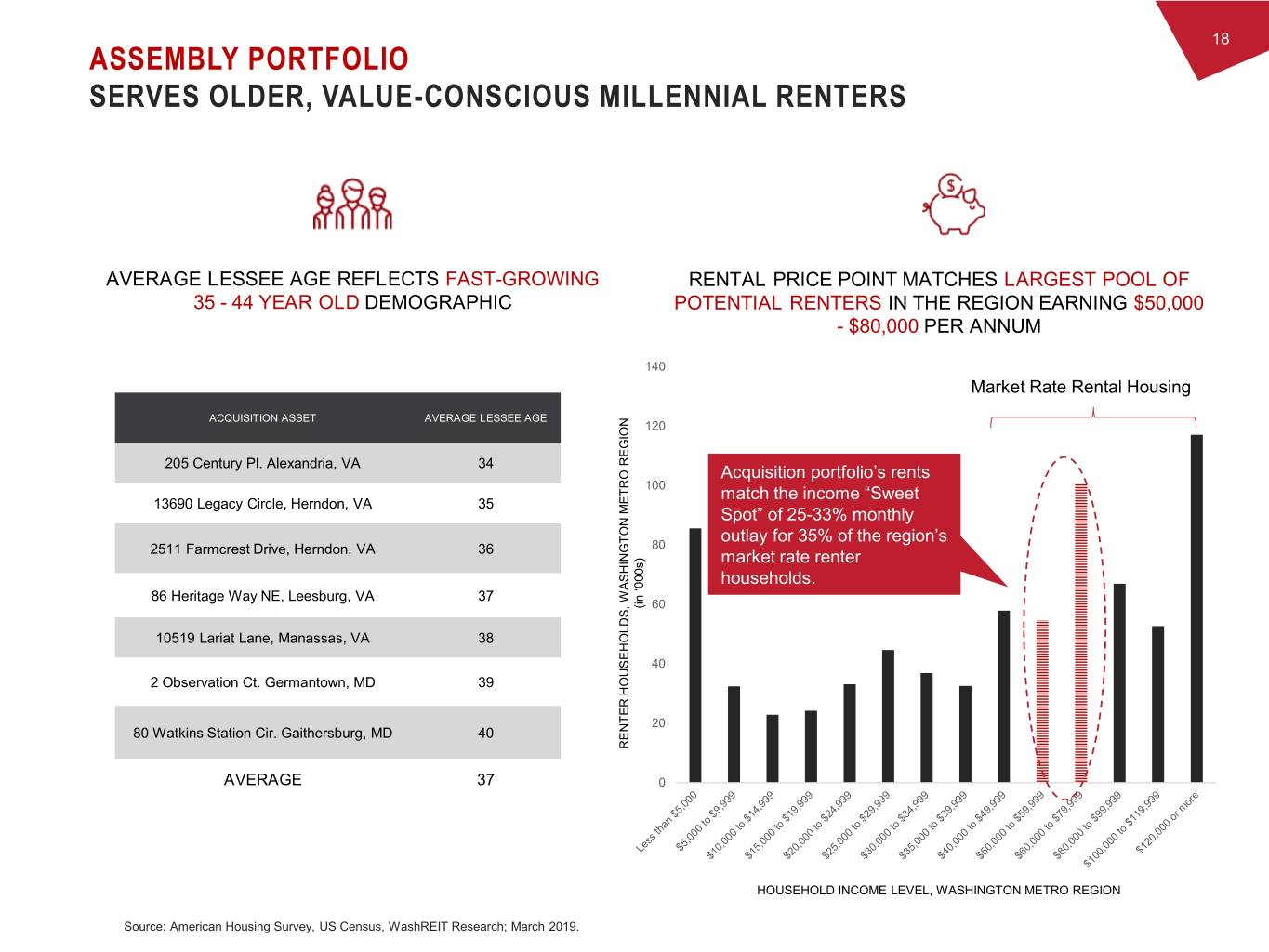

18 ASSEMBLY PORTFOLIO SERVES OLDER, VALUE-CONSCIOUS MILLENNIAL RENTERS AVERAGE LESSEE AGE REFLECTS FAST-GROWING RENTAL PRICE POINT MATCHES LARGEST POOL OF 35 - 44 YEAR OLD DEMOGRAPHIC POTENTIAL RENTERS IN THE REGION EARNING $50,000 - $80,000 PER ANNUM 140 Market Rate Rental Housing ACQUISITION ASSET AVERAGE LESSEE AGE 120 205 Century Pl. Alexandria, VA 34 Acquisition portfolio’s rents 100 match the income “Sweet 13690 Legacy Circle, Herndon, VA 35 Spot” of 25-33% monthly outlay for 35% of the region’s 80 2511 Farmcrest Drive, Herndon, VA 36 market rate renter households. 86 Heritage Way NE, Leesburg, VA 37 (in (in ‘000s) 60 10519 Lariat Lane, Manassas, VA 38 40 2 Observation Ct. Germantown, MD 39 20 80 Watkins Station Cir. Gaithersburg, MD 40 RENTER HOUSEHOLDS, WASHINGTON METRO METRO HOUSEHOLDS, WASHINGTON REGION RENTER AVERAGE 37 0 HOUSEHOLD INCOME LEVEL, WASHINGTON METRO REGION Source: American Housing Survey, US Census, WashREIT Research; March 2019.

19 ASSEMBLY PORTFOLIO POSSESSES KEY ATTRIBUTES THAT APPEAL TO OLDER, VALUE-CONSCIOUS MILLENNIAL RENTERS We believe the fast-growing 35 – 44 year old, value-conscious renter cohort is drawn to the acquisition portfolio’s mature suburban locations for the following reasons: ACCESS TO: LARGER UNIT SIZES AFFORDABLE RENTAL RATES Suburban units are 15% larger Suburban units are 22% than urban units on average cheaper than urban units on average MAJOR EMPLOYMENT CENTERS RETAIL INFRASTRUCTURE GOOD SCHOOL DISTRICTS Metro-accessible or will be Mature suburban communities Located in counties upon the completion of the that offer a number of shops, where schools rank Silver Line restaurants and other among the best in the Close proximity to major community serving retail within country regional highways with a short drive of the assets excellent access to employment concentrations Source: CoStar Portfolio Strategy. Niche.com, WashREIT Research; March 2019.

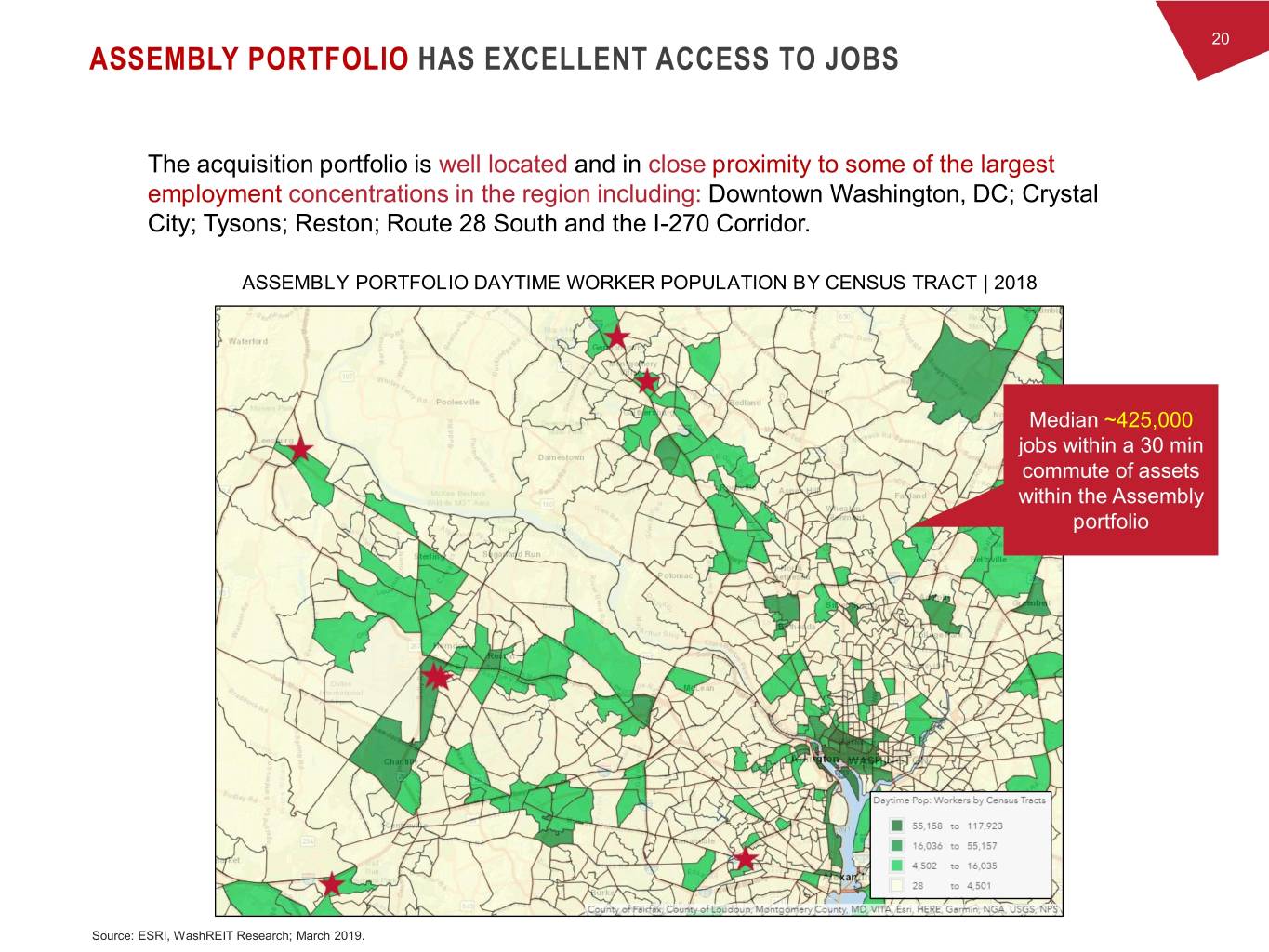

20 ASSEMBLY PORTFOLIO HAS EXCELLENT ACCESS TO JOBS The acquisition portfolio is well located and in close proximity to some of the largest employment concentrations in the region including: Downtown Washington, DC; Crystal City; Tysons; Reston; Route 28 South and the I-270 Corridor. ASSEMBLY PORTFOLIO DAYTIME WORKER POPULATION BY CENSUS TRACT | 2018 Median ~425,000 jobs within a 30 min commute of assets within the Assembly portfolio Source: ESRI, WashREIT Research; March 2019.

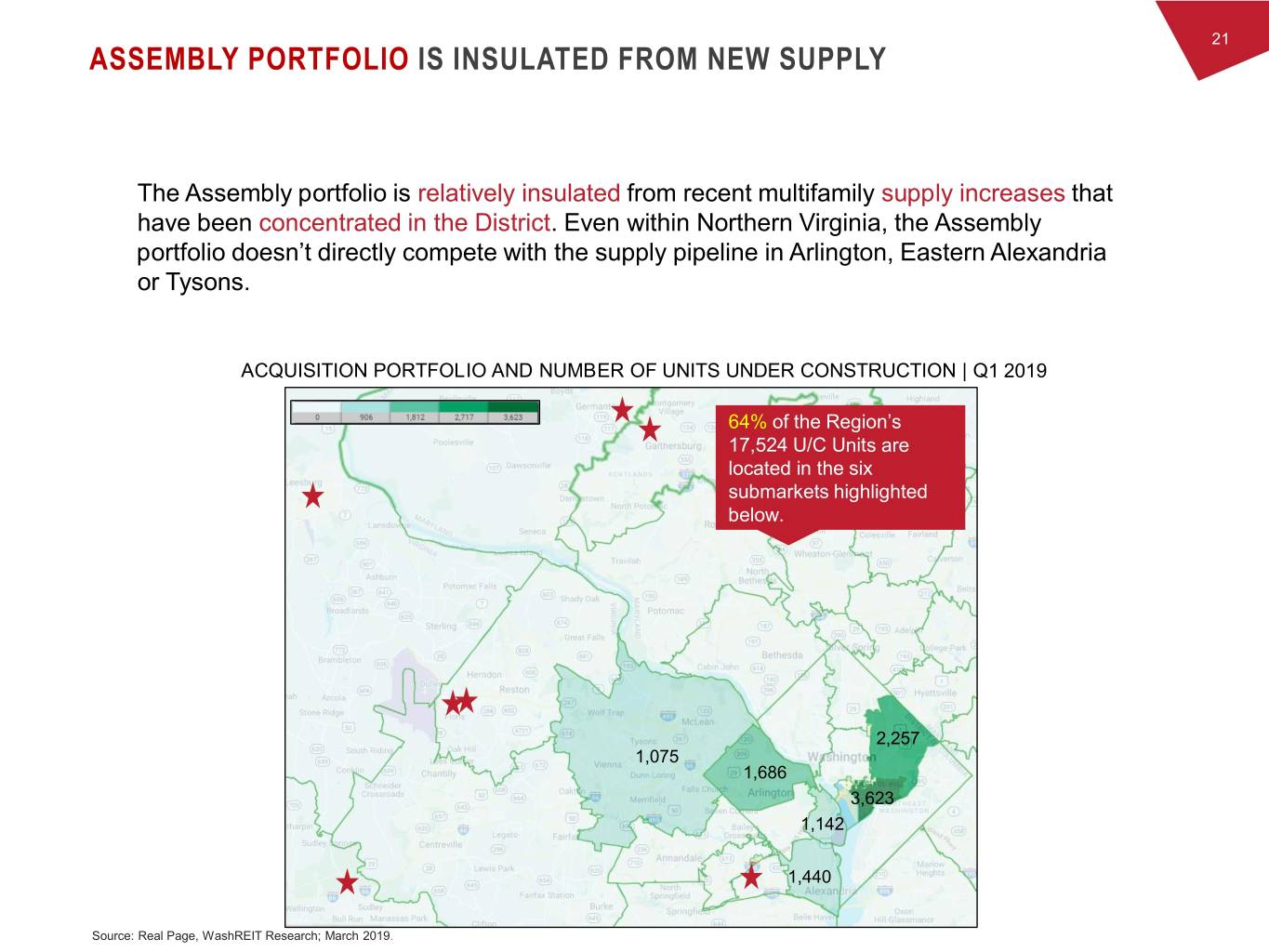

21 ASSEMBLY PORTFOLIO IS INSULATED FROM NEW SUPPLY The Assembly portfolio is relatively insulated from recent multifamily supply increases that have been concentrated in the District. Even within Northern Virginia, the Assembly portfolio doesn’t directly compete with the supply pipeline in Arlington, Eastern Alexandria or Tysons. ACQUISITION PORTFOLIO AND NUMBER OF UNITS UNDER CONSTRUCTION | Q1 2019 64% of the Region’s 17,524 U/C Units are located in the six submarkets highlighted below. 2,257 1,075 1,686 3,623 1,142 1,440 Source: Real Page, WashREIT Research; March 2019.

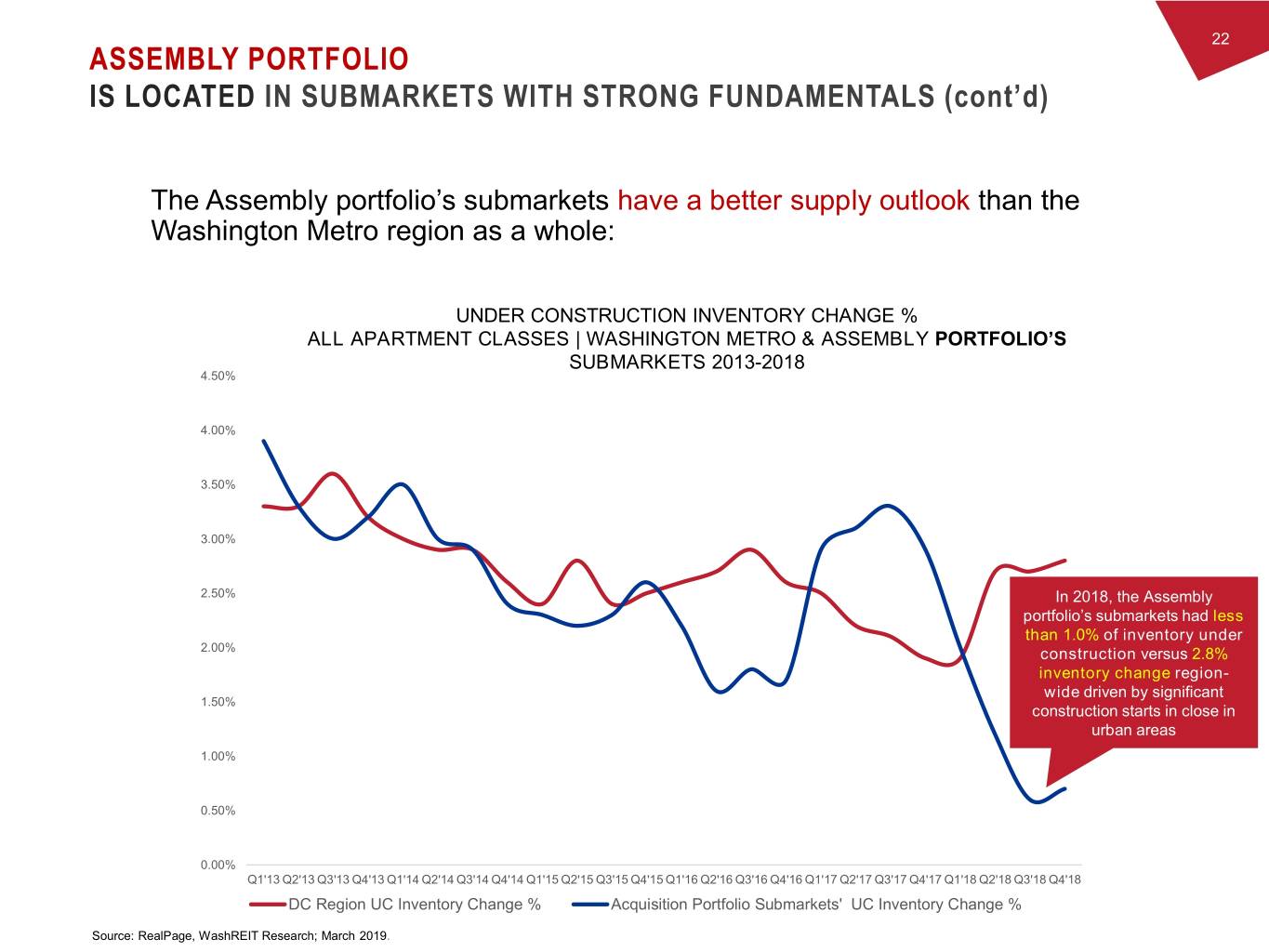

22 ASSEMBLY PORTFOLIO IS LOCATED IN SUBMARKETS WITH STRONG FUNDAMENTALS (cont’d) The Assembly portfolio’s submarkets have a better supply outlook than the Washington Metro region as a whole: UNDER CONSTRUCTION INVENTORY CHANGE % ALL APARTMENT CLASSES | WASHINGTON METRO & ASSEMBLY PORTFOLIO’S SUBMARKETS 2013-2018 4.50% 4.00% 3.50% 3.00% 2.50% In 2018, the Assembly portfolio’s submarkets had less than 1.0% of inventory under 2.00% construction versus 2.8% inventory change region- wide driven by significant 1.50% construction starts in close in urban areas 1.00% 0.50% 0.00% Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 DC Region UC Inventory Change % Acquisition Portfolio Submarkets' UC Inventory Change % Source: RealPage, WashREIT Research; March 2019.

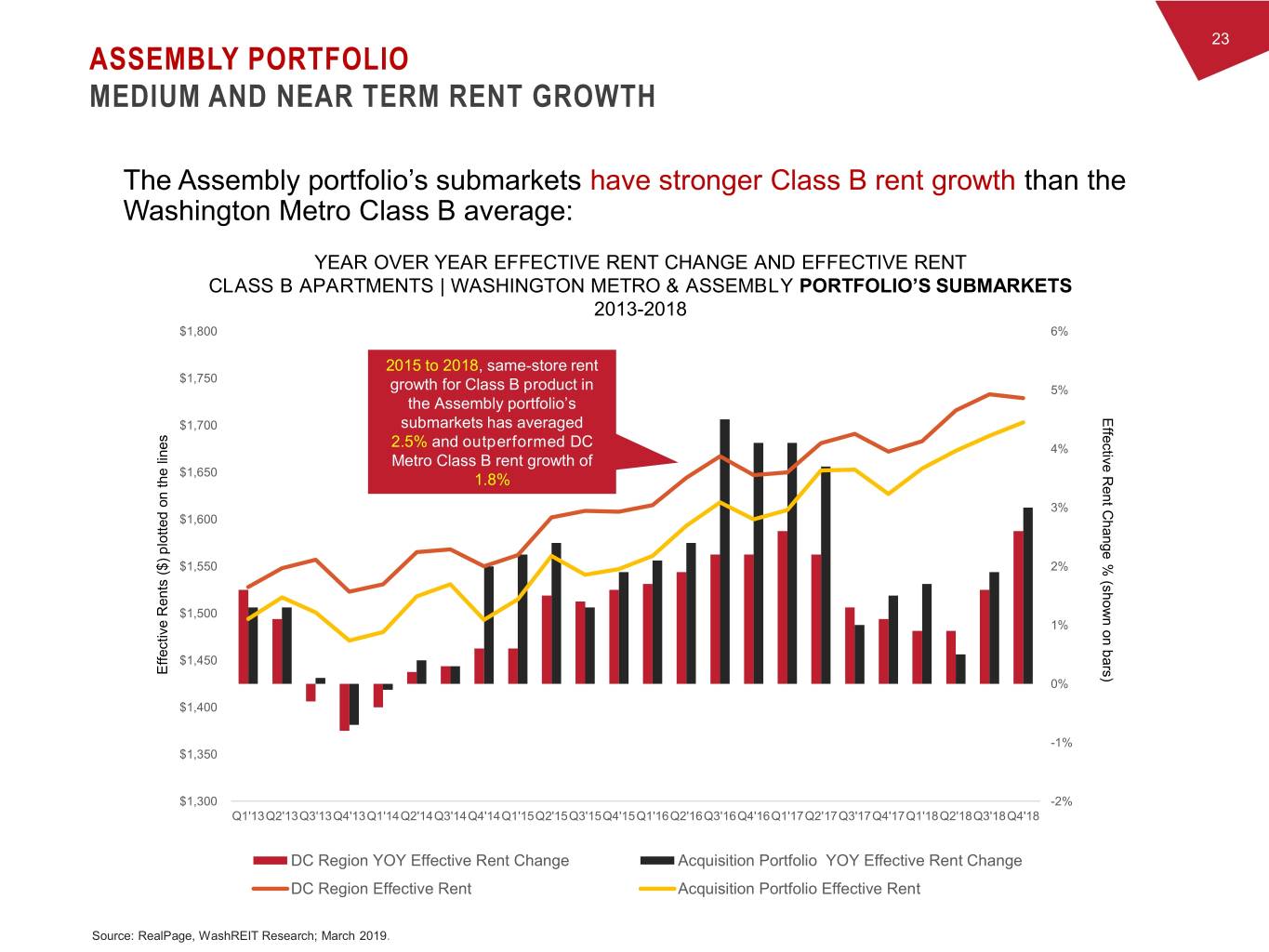

23 ASSEMBLY PORTFOLIO MEDIUM AND NEAR TERM RENT GROWTH The Assembly portfolio’s submarkets have stronger Class B rent growth than the Washington Metro Class B average: YEAR OVER YEAR EFFECTIVE RENT CHANGE AND EFFECTIVE RENT CLASS B APARTMENTS | WASHINGTON METRO & ASSEMBLY PORTFOLIO’S SUBMARKETS 2013-2018 $1,800 6% 2015 to 2018, same-store rent $1,750 growth for Class B product in 5% the Assembly portfolio’s Effective RentEffective Change $1,700 submarkets has averaged 2.5% and outperformed DC 4% Metro Class B rent growth of $1,650 1.8% 3% $1,600 $1,550 2% % bars)(shown on Rents ($) plotted Rents ($) the on lines $1,500 1% $1,450 Effective 0% $1,400 -1% $1,350 $1,300 -2% Q1'13Q2'13Q3'13Q4'13Q1'14Q2'14Q3'14Q4'14Q1'15Q2'15Q3'15Q4'15Q1'16Q2'16Q3'16Q4'16Q1'17Q2'17Q3'17Q4'17Q1'18Q2'18Q3'18Q4'18 DC Region YOY Effective Rent Change Acquisition Portfolio YOY Effective Rent Change DC Region Effective Rent Acquisition Portfolio Effective Rent Source: RealPage, WashREIT Research; March 2019.

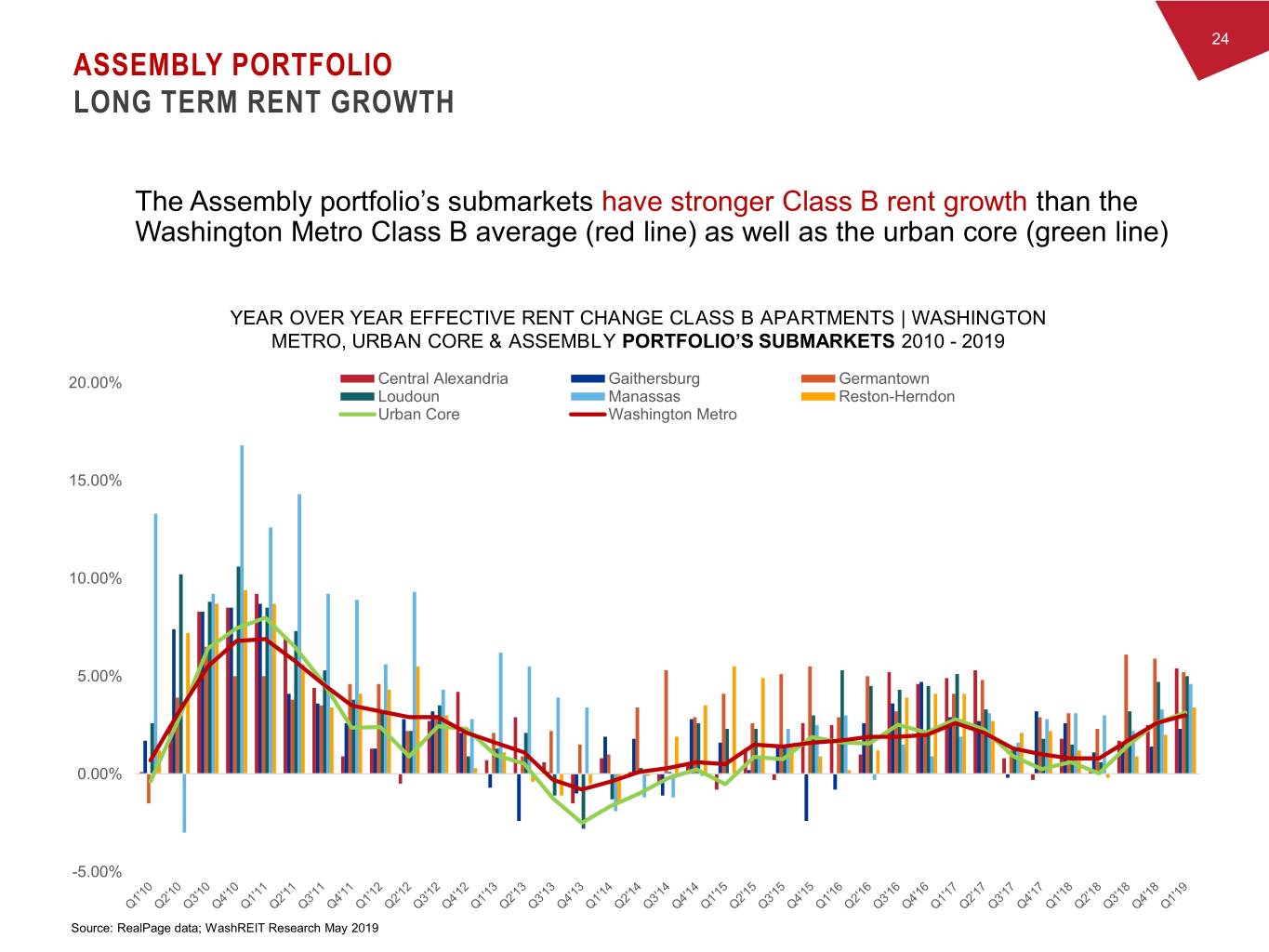

24 ASSEMBLY PORTFOLIO LONG TERM RENT GROWTH The Assembly portfolio’s submarkets have stronger Class B rent growth than the Washington Metro Class B average (red line) as well as the urban core (green line) YEAR OVER YEAR EFFECTIVE RENT CHANGE CLASS B APARTMENTS | WASHINGTON METRO, URBAN CORE & ASSEMBLY PORTFOLIO’S SUBMARKETS 2010 - 2019 20.00% Central Alexandria Gaithersburg Germantown Loudoun Manassas Reston-Herndon Urban Core Washington Metro 15.00% 10.00% 5.00% 0.00% -5.00% Source: RealPage data; WashREIT Research May 2019

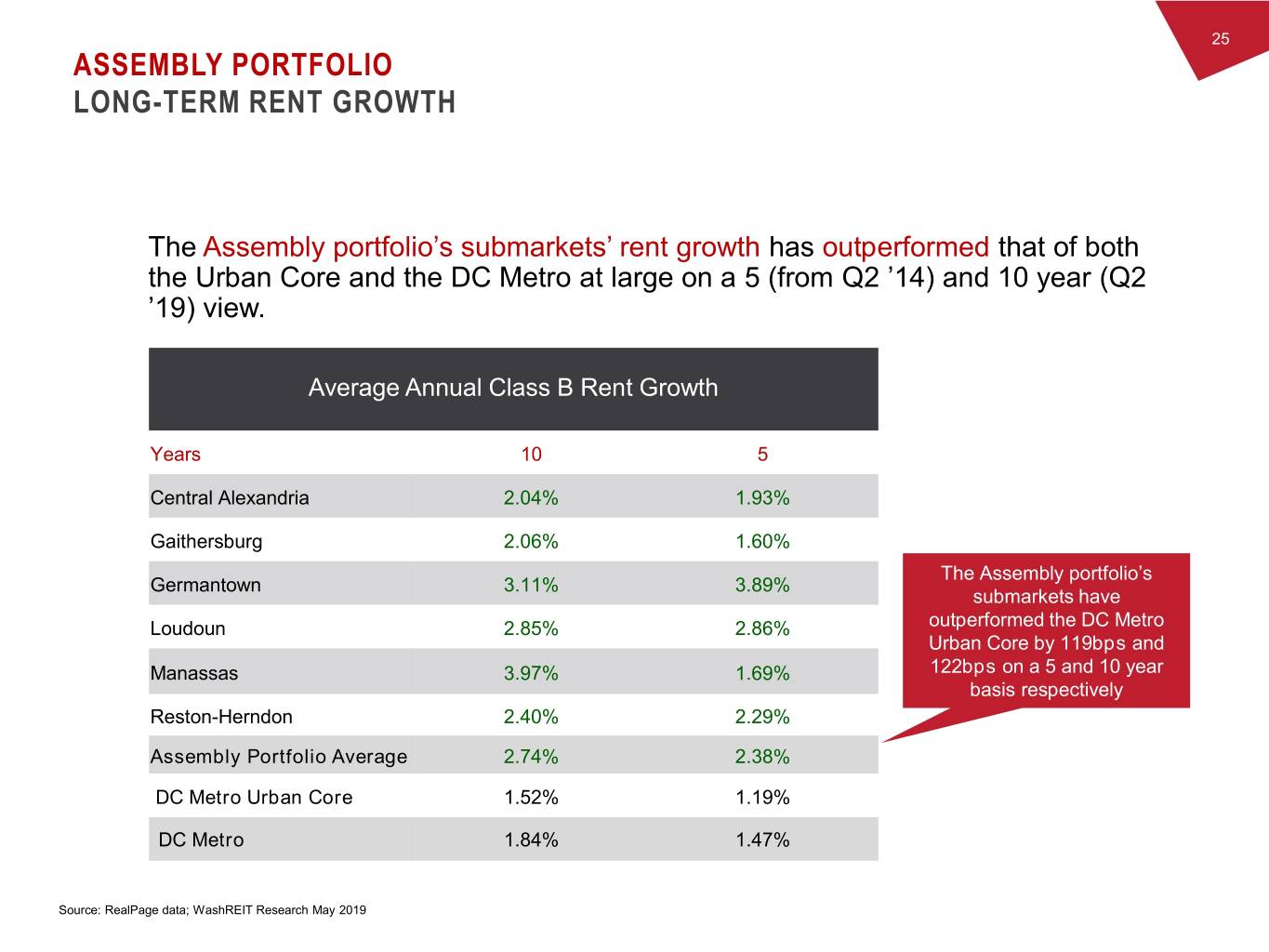

25 ASSEMBLY PORTFOLIO LONG-TERM RENT GROWTH The Assembly portfolio’s submarkets’ rent growth has outperformed that of both the Urban Core and the DC Metro at large on a 5 (from Q2 ’14) and 10 year (Q2 ’19) view. Average Annual Class B Rent Growth Years 10 5 Central Alexandria 2.04% 1.93% Gaithersburg 2.06% 1.60% The Assembly portfolio’s Germantown 3.11% 3.89% submarkets have Loudoun 2.85% 2.86% outperformed the DC Metro Urban Core by 119bps and Manassas 3.97% 1.69% 122bps on a 5 and 10 year basis respectively Reston-Herndon 2.40% 2.29% Assembly Portfolio Average 2.74% 2.38% DC Metro Urban Core 1.52% 1.19% DC Metro 1.84% 1.47% Source: RealPage data; WashREIT Research May 2019

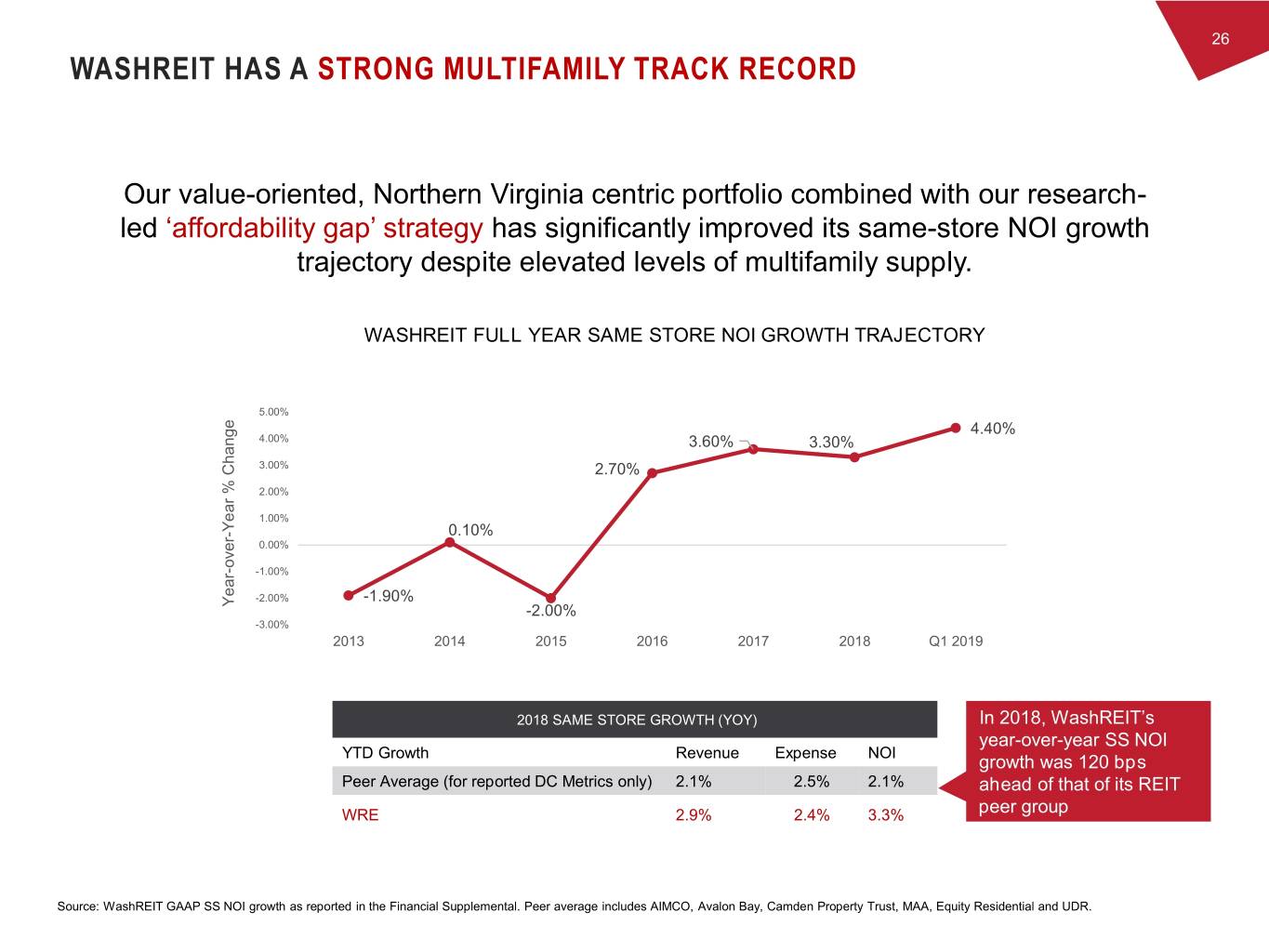

26 WASHREIT HAS A STRONG MULTIFAMILY TRACK RECORD Our value-oriented, Northern Virginia centric portfolio combined with our research- led ‘affordability gap’ strategy has significantly improved its same-store NOI growth trajectory despite elevated levels of multifamily supply. WASHREIT FULL YEAR SAME STORE NOI GROWTH TRAJECTORY 5.00% 4.40% 4.00% 3.60% 3.30% 3.00% 2.70% 2.00% 1.00% Year % Change Year - 0.10% 0.00% over - -1.00% -2.00% -1.90% Year -2.00% -3.00% 2013 2014 2015 2016 2017 2018 Q1 2019 2018 SAME STORE GROWTH (YOY) In 2018, WashREIT’s year-over-year SS NOI YTD Growth Revenue Expense NOI growth was 120 bps Peer Average (for reported DC Metrics only) 2.1% 2.5% 2.1% ahead of that of its REIT WRE 2.9% 2.4% 3.3% peer group Source: WashREIT GAAP SS NOI growth as reported in the Financial Supplemental. Peer average includes AIMCO, Avalon Bay, Camden Property Trust, MAA, Equity Residential and UDR.

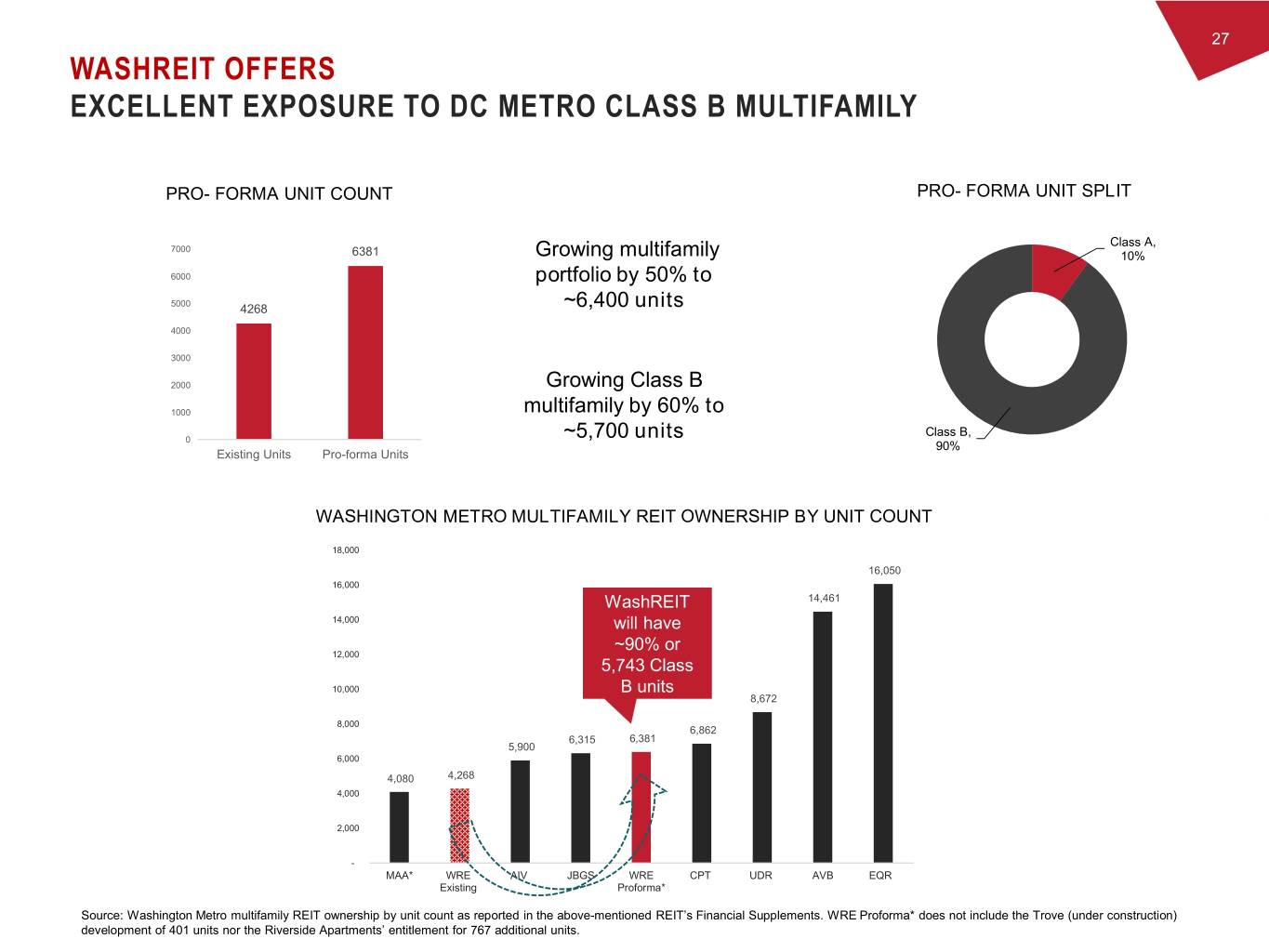

27 WASHREIT OFFERS EXCELLENT EXPOSURE TO DC METRO CLASS B MULTIFAMILY PRO- FORMA UNIT COUNT PRO- FORMA UNIT SPLIT Class A, 7000 6381 Growing multifamily 10% 6000 portfolio by 50% to 5000 4268 ~6,400 units 4000 3000 2000 Growing Class B 1000 multifamily by 60% to Class B, 0 ~5,700 units 90% Existing Units Pro-forma Units WASHINGTON METRO MULTIFAMILY REIT OWNERSHIP BY UNIT COUNT 18,000 16,050 16,000 WashREIT 14,461 14,000 will have ~90% or 12,000 5,743 Class 10,000 B units 8,672 8,000 6,862 6,315 6,381 5,900 6,000 4,080 4,268 4,000 2,000 - MAA* WRE AIV JBGS WRE CPT UDR AVB EQR Existing Proforma* Source: Washington Metro multifamily REIT ownership by unit count as reported in the above-mentioned REIT’s Financial Supplements. WRE Proforma* does not include the Trove (under construction) development of 401 units nor the Riverside Apartments’ entitlement for 767 additional units.

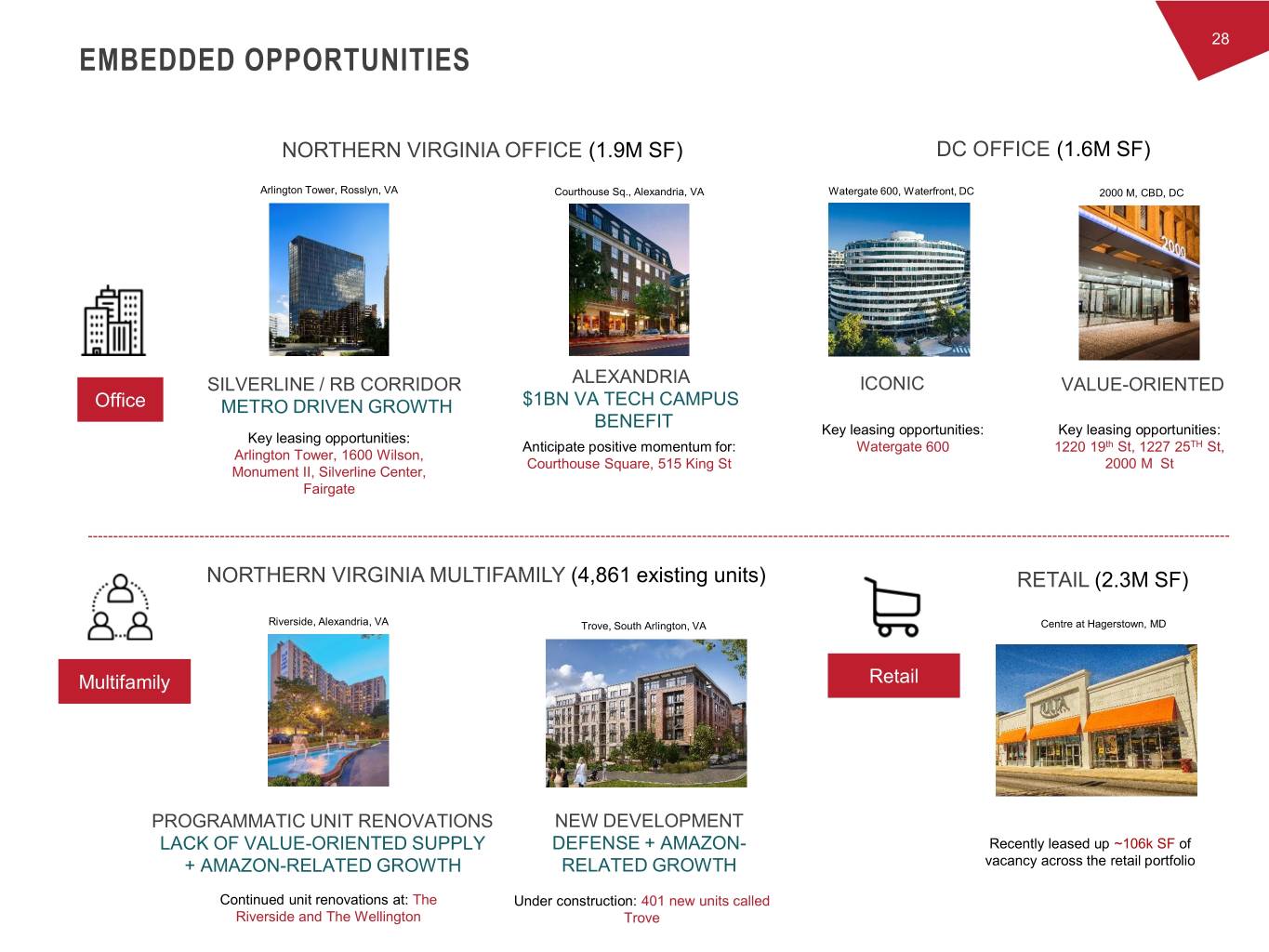

28 EMBEDDED OPPORTUNITIES NORTHERN VIRGINIA OFFICE (1.9M SF) THE DC METRODC OFFICE REGION (1.6M SF) Arlington Tower, Rosslyn, VA Courthouse Sq., Alexandria, VA WhereWatergate to 600,be Waterfront, in DC DC 2000 M, CBD, DC SILVERLINE / RB CORRIDOR ALEXANDRIA ICONIC VALUE-ORIENTED Office METRO DRIVEN GROWTH $1BN VA TECH CAMPUS BENEFIT Key leasing opportunities: Key leasing opportunities: Key leasing opportunities: Anticipate positive momentum for: Watergate 600 1220 19th St, 1227 25TH St, Arlington Tower, 1600 Wilson, Courthouse Square, 515 King St 2000 M St Monument II, Silverline Center, Fairgate NORTHERN VIRGINIA MULTIFAMILY (4,861 existing units) RETAIL (2.3M SF) Riverside, Alexandria, VA Trove, South Arlington, VA Centre at Hagerstown, MD Multifamily Retail PROGRAMMATIC UNIT RENOVATIONS NEW DEVELOPMENT LACK OF VALUE-ORIENTED SUPPLY DEFENSE + AMAZON- Recently leased up ~106k SF of + AMAZON-RELATED GROWTH RELATED GROWTH vacancy across the retail portfolio Continued unit renovations at: The Under construction: 401 new units called Riverside and The Wellington Trove

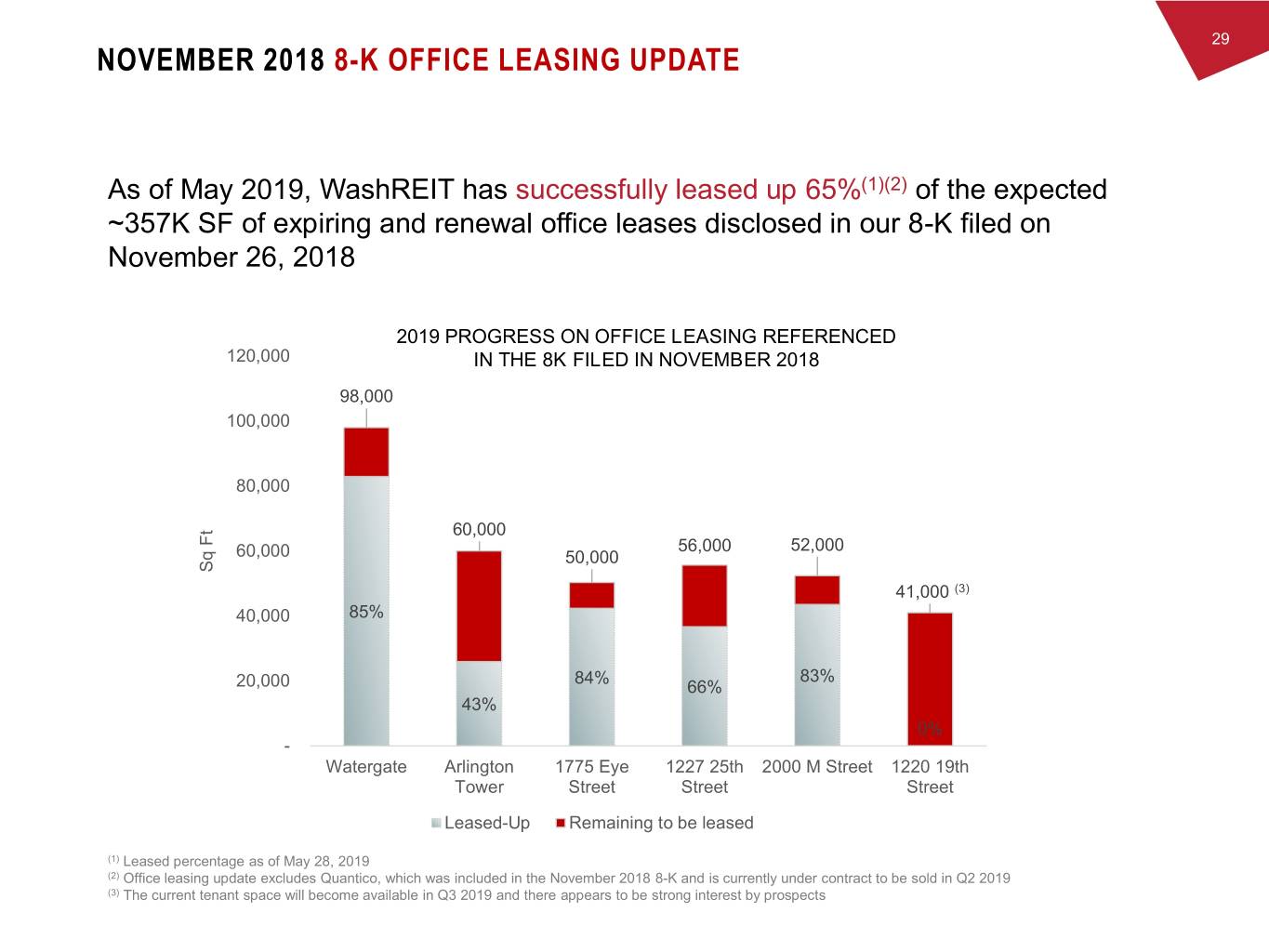

29 NOVEMBER 2018 8-K OFFICE LEASING UPDATE As of May 2019, WashREIT has successfully leased up 65%(1)(2) of the expected ~357K SF of expiring and renewal office leases disclosed in our 8-K filed on November 26, 2018 2019 PROGRESS ON OFFICE LEASING REFERENCED 120,000 IN THE 8K FILED IN NOVEMBER 2018 98,000 100,000 80,000 60,000 56,000 52,000 60,000 50,000 Sq Sq Ft 41,000 (3) 40,000 85% 84% 83% 20,000 66% 43% 0% - Watergate Arlington 1775 Eye 1227 25th 2000 M Street 1220 19th Tower Street Street Street Leased-Up Remaining to be leased (1) Leased percentage as of May 28, 2019 (2) Office leasing update excludes Quantico, which was included in the November 2018 8-K and is currently under contract to be sold in Q2 2019 (3) The current tenant space will become available in Q3 2019 and there appears to be strong interest by prospects

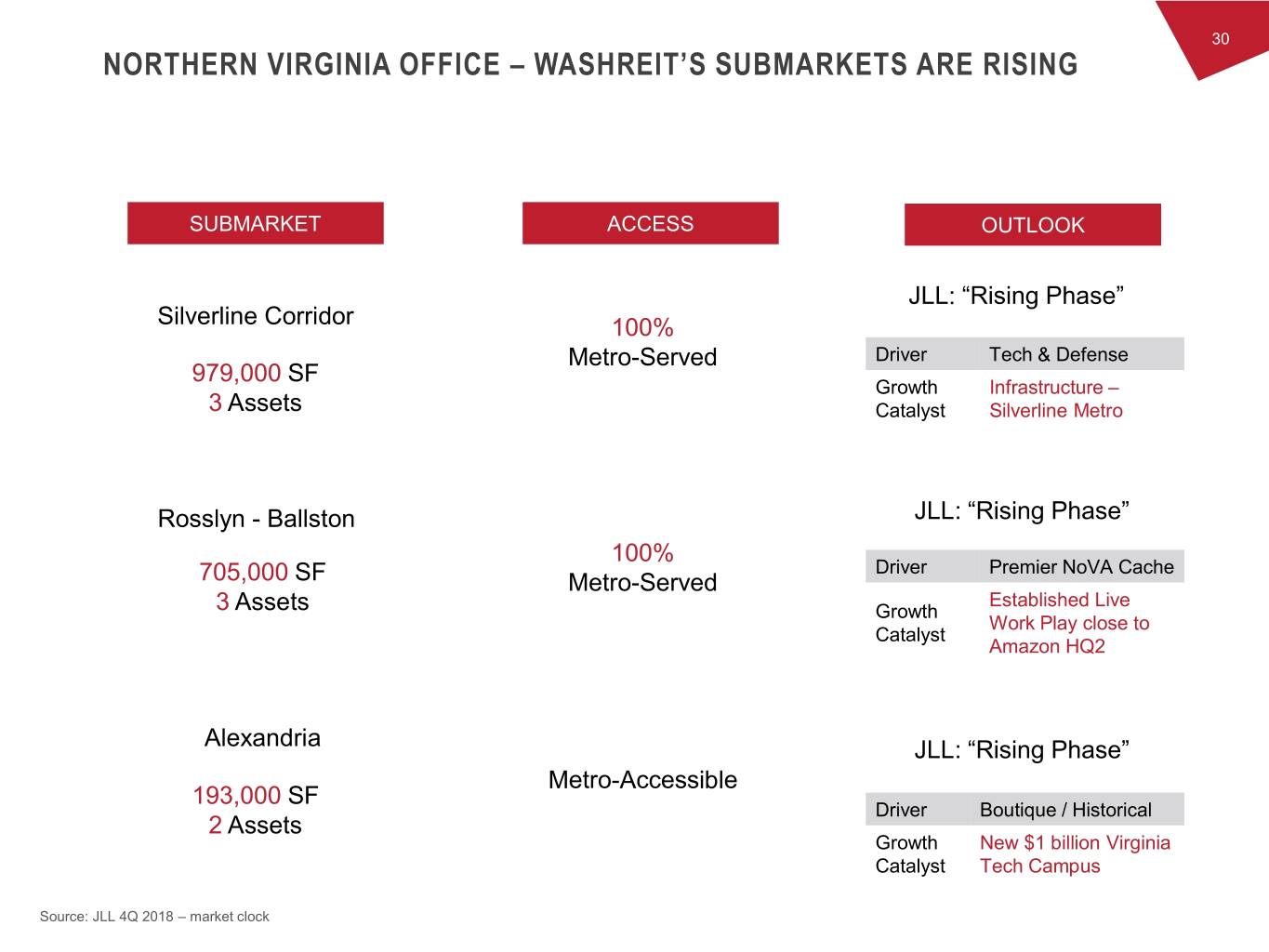

30 NORTHERN VIRGINIA OFFICE – WASHREIT’S SUBMARKETS ARE RISING THE DC METRO REGION Where to be in DC SUBMARKET ACCESS OUTLOOK JLL: “Rising Phase” Silverline Corridor 100% Metro-Served Driver Tech & Defense 979,000 SF Growth Infrastructure – 3 Assets Catalyst Silverline Metro Rosslyn - Ballston JLL: “Rising Phase” 100% Driver Premier NoVA Cache 705,000 SF Metro-Served Established Live 3 Assets Growth Work Play close to Catalyst Amazon HQ2 Alexandria JLL: “Rising Phase” Metro-Accessible 193,000 SF Driver Boutique / Historical 2 Assets Growth New $1 billion Virginia Catalyst Tech Campus Source: JLL 4Q 2018 – market clock

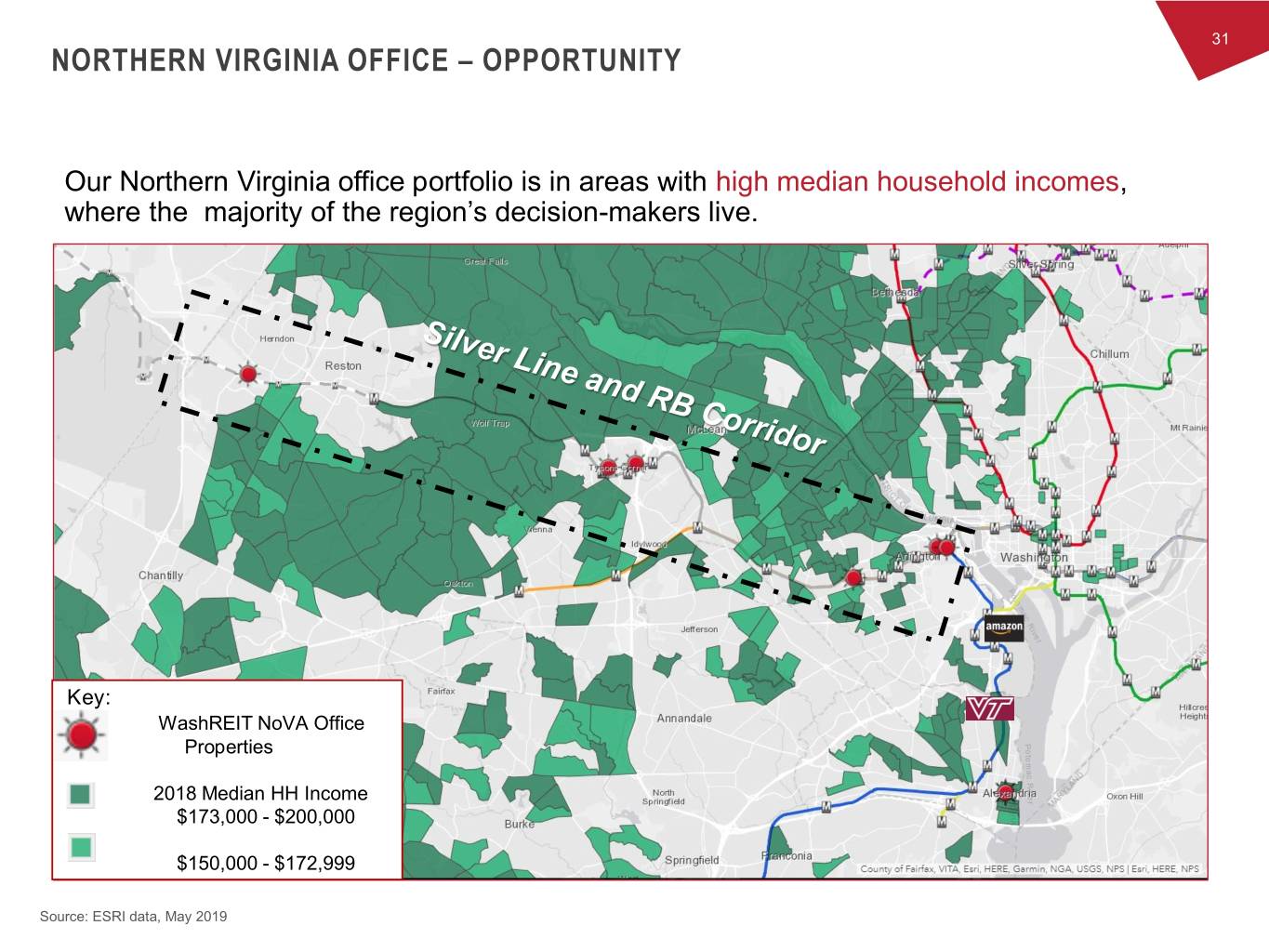

31 NORTHERN VIRGINIA OFFICE – OPPORTUNITY Our Northern Virginia office portfolio is in areas with high median household incomes, where the majority of the region’s decision-makers live. Key: WashREIT NoVA Office Properties 2018 Median HH Income $173,000 - $200,000 $150,000 - $172,999 Source: ESRI data, May 2019

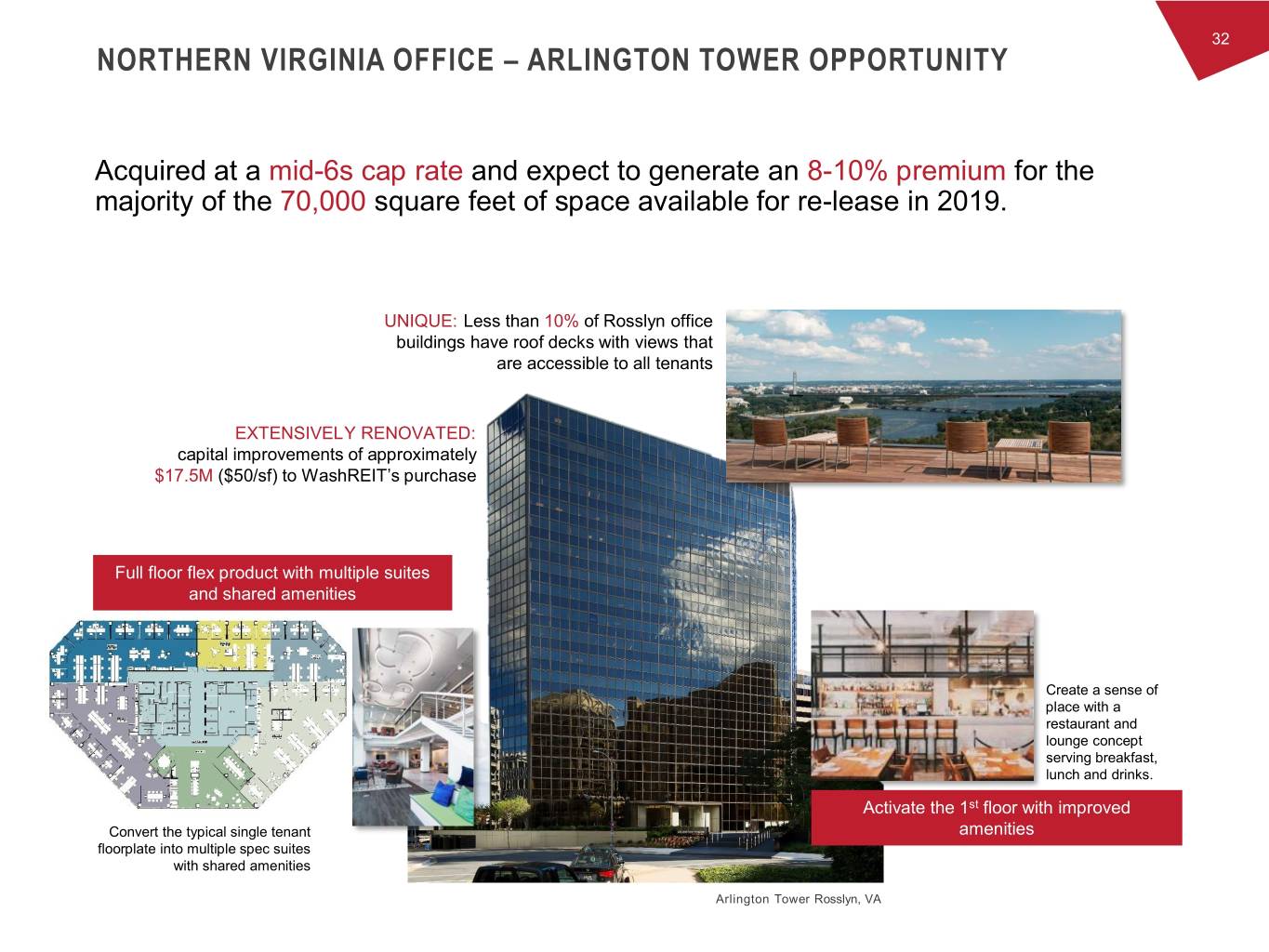

32 NORTHERN VIRGINIA OFFICE – ARLINGTON TOWER OPPORTUNITY Acquired at a mid-6s cap rate and expect to generate an 8-10% premium for the majority of the 70,000 square feet of space available for re-lease in 2019. UNIQUE: Less than 10% of Rosslyn office buildings have roof decks with views that are accessible to all tenants EXTENSIVELY RENOVATED: capital improvements of approximately $17.5M ($50/sf) to WashREIT’s purchase Full floor flex product with multiple suites and shared amenities Create a sense of place with a restaurant and lounge concept serving breakfast, lunch and drinks. Activate the 1st floor with improved Convert the typical single tenant amenities floorplate into multiple spec suites with shared amenities Arlington Tower Rosslyn, VA

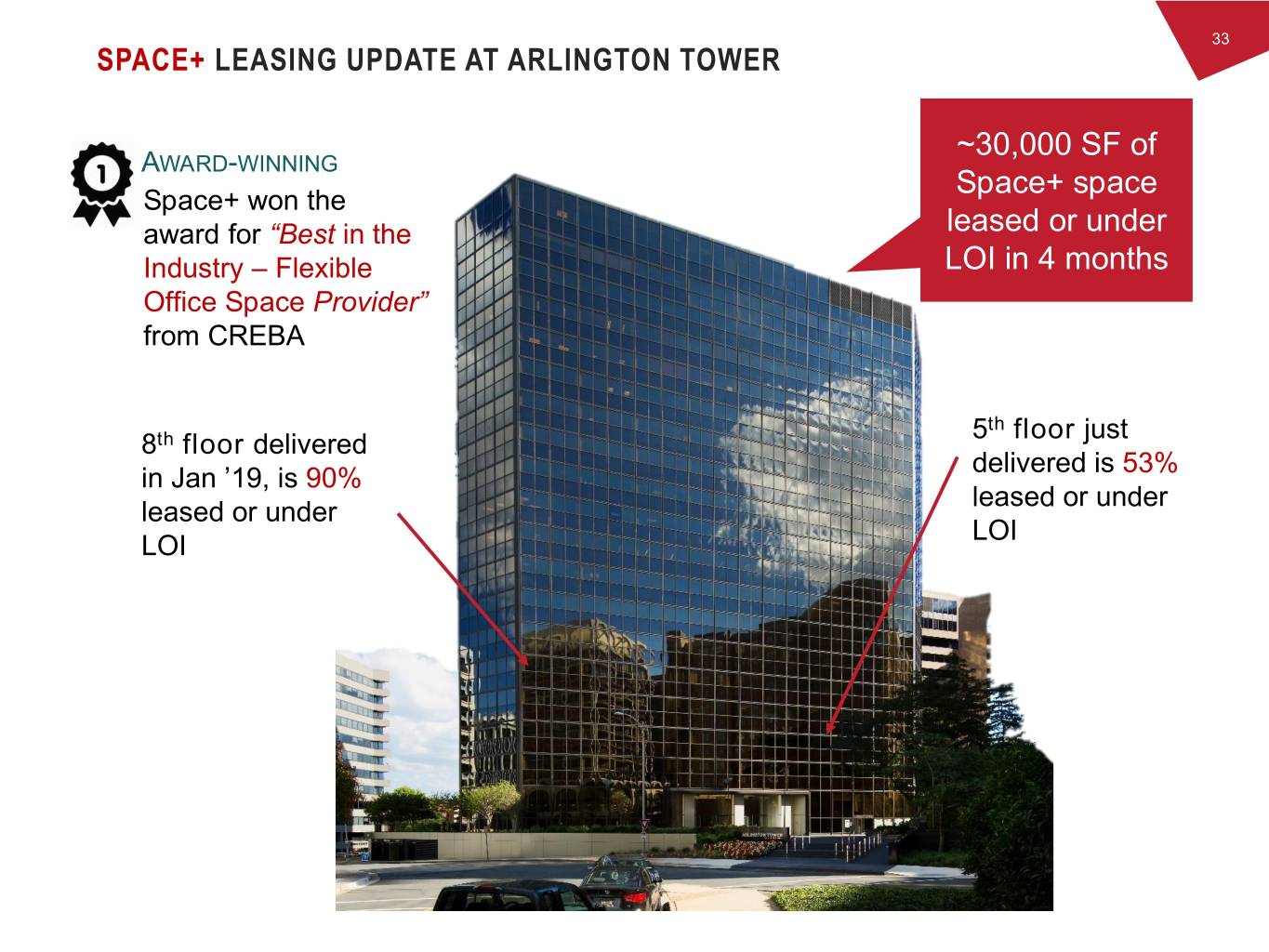

33 SPACE+ LEASING UPDATE AT ARLINGTON TOWER ~30,000 SF of AWARD-WINNING Space+ space Space+ won the award for “Best in the leased or under Industry – Flexible LOI in 4 months Office Space Provider” from CREBA 5th floor just 8th floor delivered delivered is 53% in Jan ’19, is 90% leased or under leased or under LOI LOI

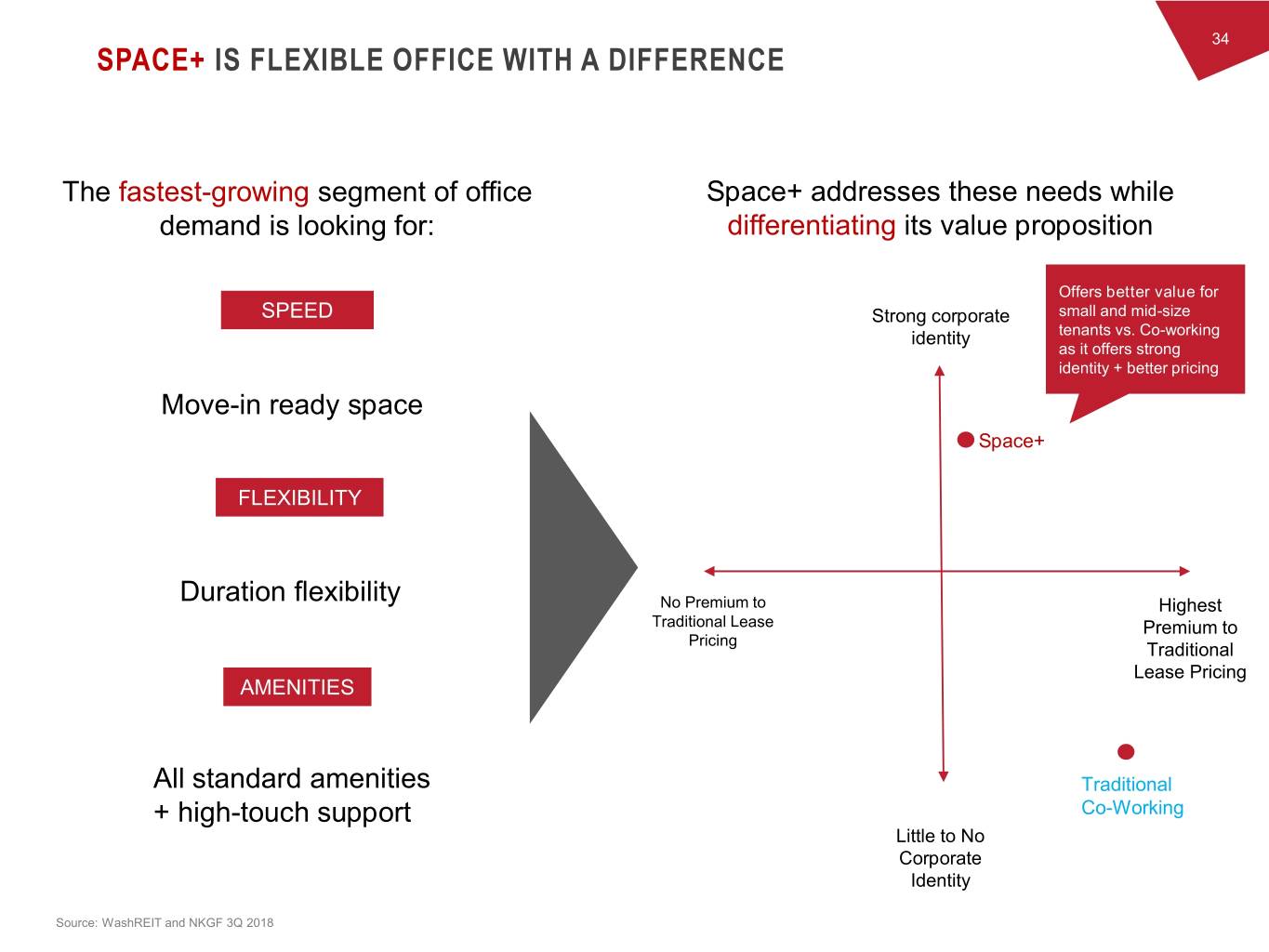

34 SPACE+ IS FLEXIBLE OFFICE WITH A DIFFERENCE The fastest-growing segment of office Space+ addresses these needs while demand is looking for: differentiating its value proposition Offers better value for SPEED Strong corporate small and mid-size identity tenants vs. Co-working as it offers strong identity + better pricing Move-in ready space Space+ FLEXIBILITY Duration flexibility No Premium to Highest Traditional Lease Premium to Pricing Traditional Lease Pricing AMENITIES All standard amenities Traditional + high-touch support Co-Working Little to No Corporate Identity Source: WashREIT and NKGF 3Q 2018

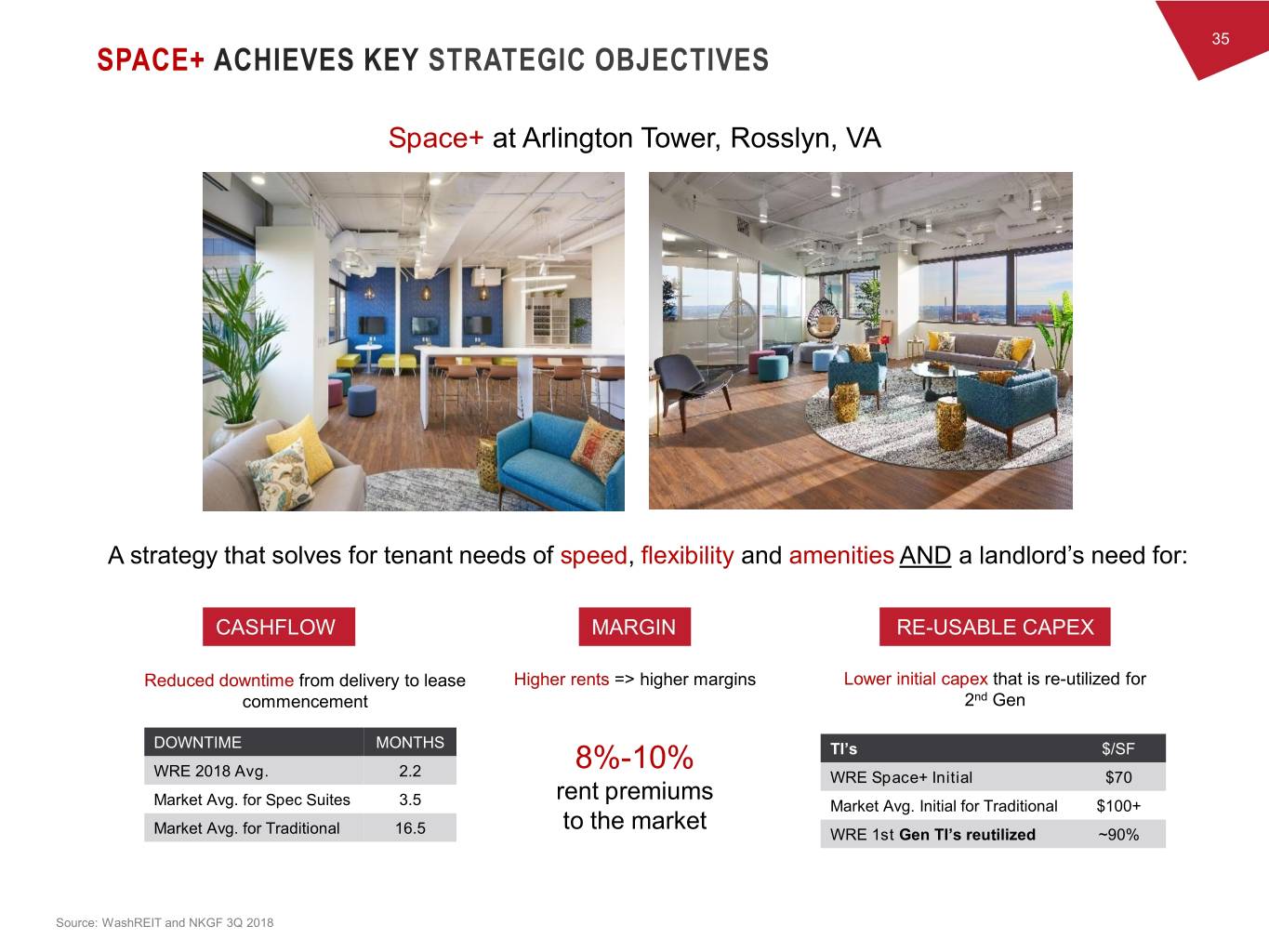

35 SPACE+ ACHIEVES KEY STRATEGIC OBJECTIVES Space+ at Arlington Tower, Rosslyn, VA A strategy that solves for tenant needs of speed, flexibility and amenities AND a landlord’s need for: CASHFLOW MARGIN RE-USABLE CAPEX Reduced downtime from delivery to lease Higher rents => higher margins Lower initial capex that is re-utilized for commencement 2nd Gen DOWNTIME MONTHS 8%-10% TI’s $/SF WRE 2018 Avg. 2.2 WRE Space+ Initial $70 rent premiums Market Avg. for Spec Suites 3.5 Market Avg. Initial for Traditional $100+ to the market Market Avg. for Traditional 16.5 WRE 1st Gen TI’s reutilized ~90% Source: WashREIT and NKGF 3Q 2018

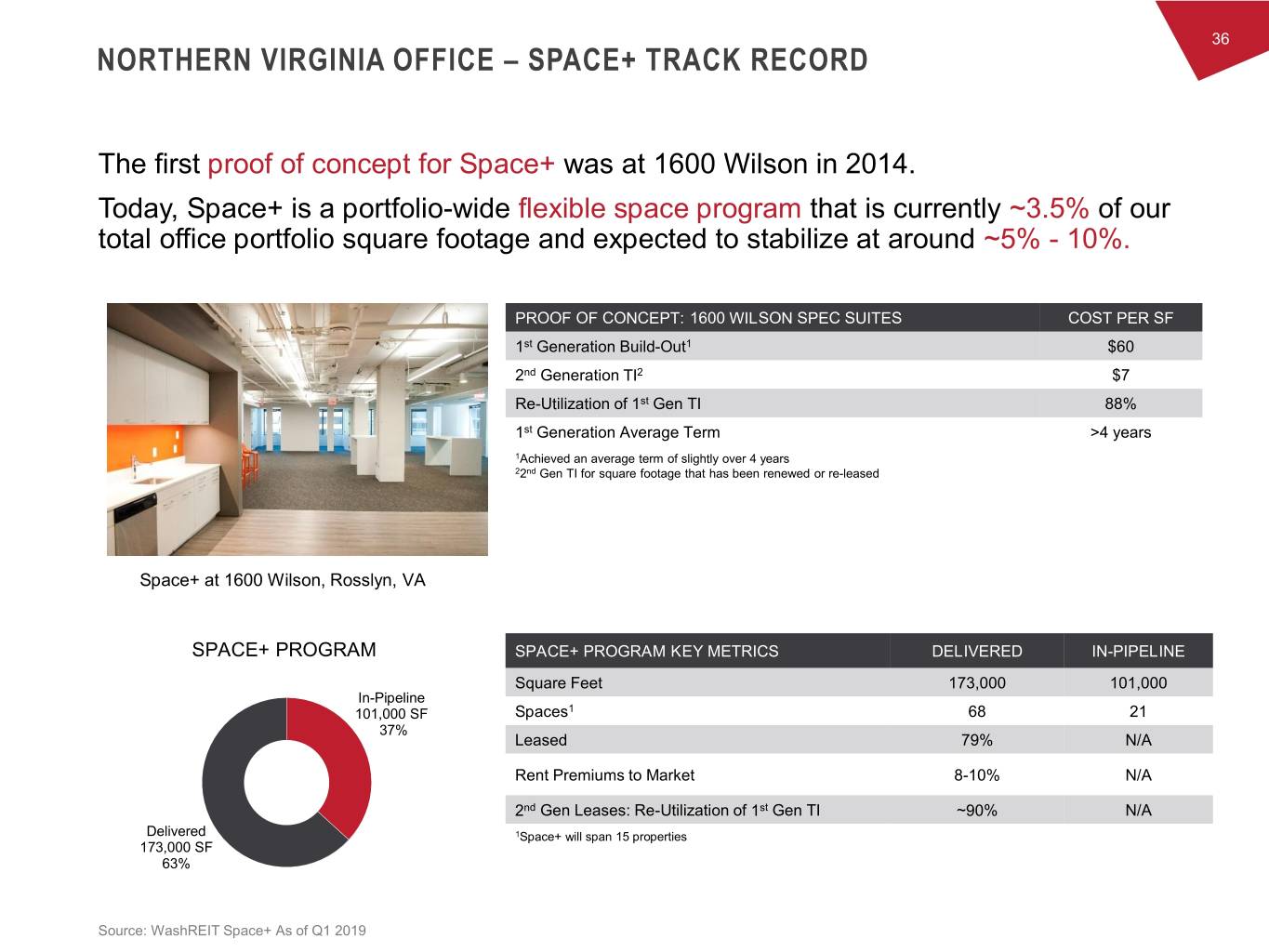

36 NORTHERN VIRGINIA OFFICE – SPACE+ TRACK RECORD The first proof of concept for Space+ was at 1600 Wilson in 2014. Today, Space+ is a portfolio-wide flexible space program that is currently ~3.5% of our total office portfolio square footage and expected to stabilize at around ~5% - 10%. PROOF OF CONCEPT: 1600 WILSON SPEC SUITES COST PER SF 1st Generation Build-Out1 $60 2nd Generation TI2 $7 Re-Utilization of 1st Gen TI 88% 1st Generation Average Term >4 years 1Achieved an average term of slightly over 4 years 22nd Gen TI for square footage that has been renewed or re-leased Space+ at 1600 Wilson, Rosslyn, VA SPACE+ PROGRAM SPACE+ PROGRAM KEY METRICS DELIVERED IN-PIPELINE Square Feet 173,000 101,000 In-Pipeline 101,000 SF Spaces1 68 21 37% Leased 79% N/A Rent Premiums to Market 8-10% N/A 2nd Gen Leases: Re-Utilization of 1st Gen TI ~90% N/A Delivered 1Space+ will span 15 properties 173,000 SF 63% Source: WashREIT Space+ As of Q1 2019

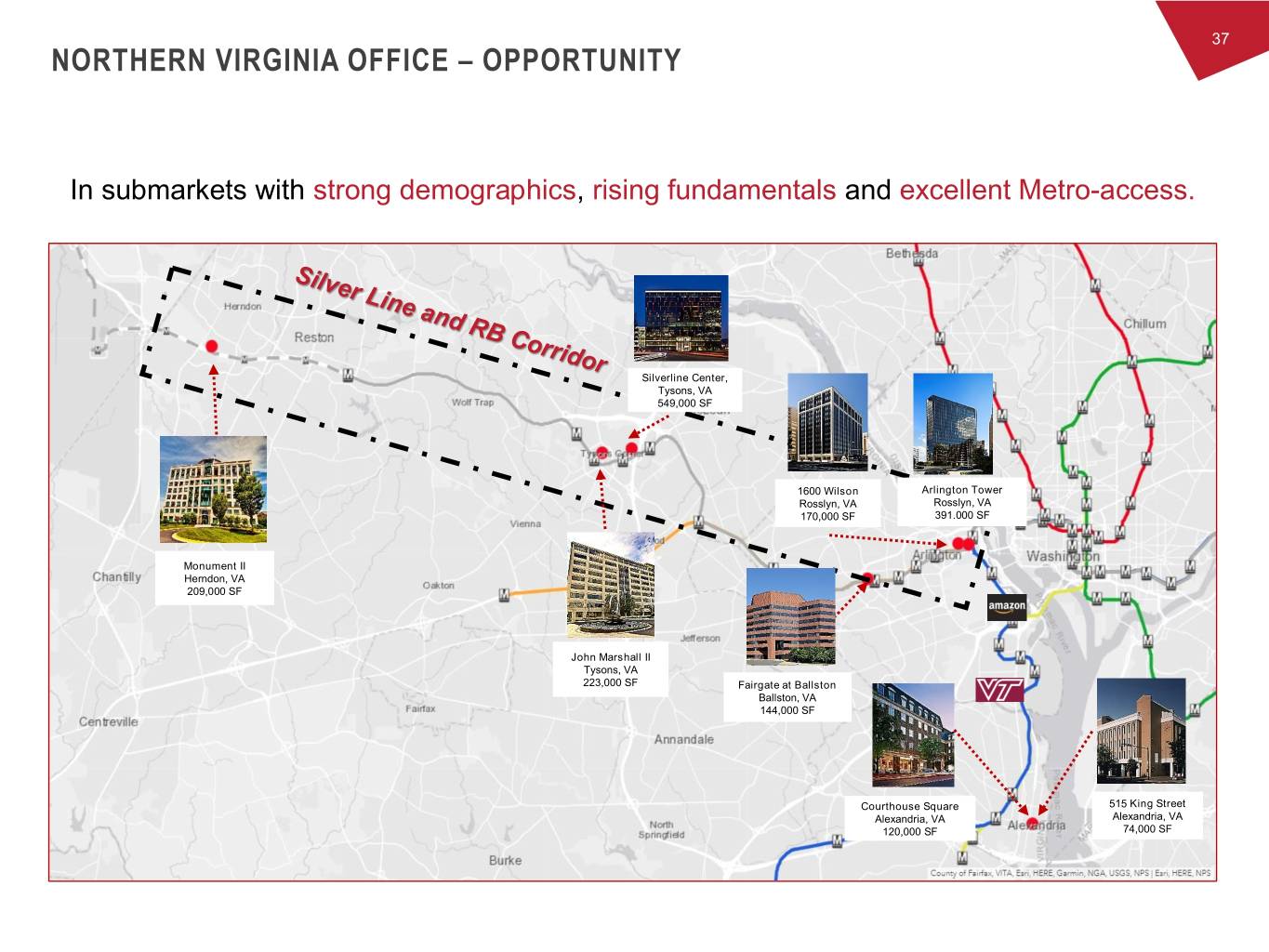

37 NORTHERN VIRGINIA OFFICE – OPPORTUNITY In submarkets with strong demographics, rising fundamentals and excellent Metro-access. Silverline Center, Tysons, VA 549,000 SF 1600 Wilson Arlington Tower Rosslyn, VA Rosslyn, VA 170,000 SF 391.000 SF Monument II Herndon, VA 209,000 SF John Marshall II Tysons, VA 223,000 SF Fairgate at Ballston Ballston, VA 144,000 SF Courthouse Square 515 King Street Alexandria, VA Alexandria, VA 120,000 SF 74,000 SF

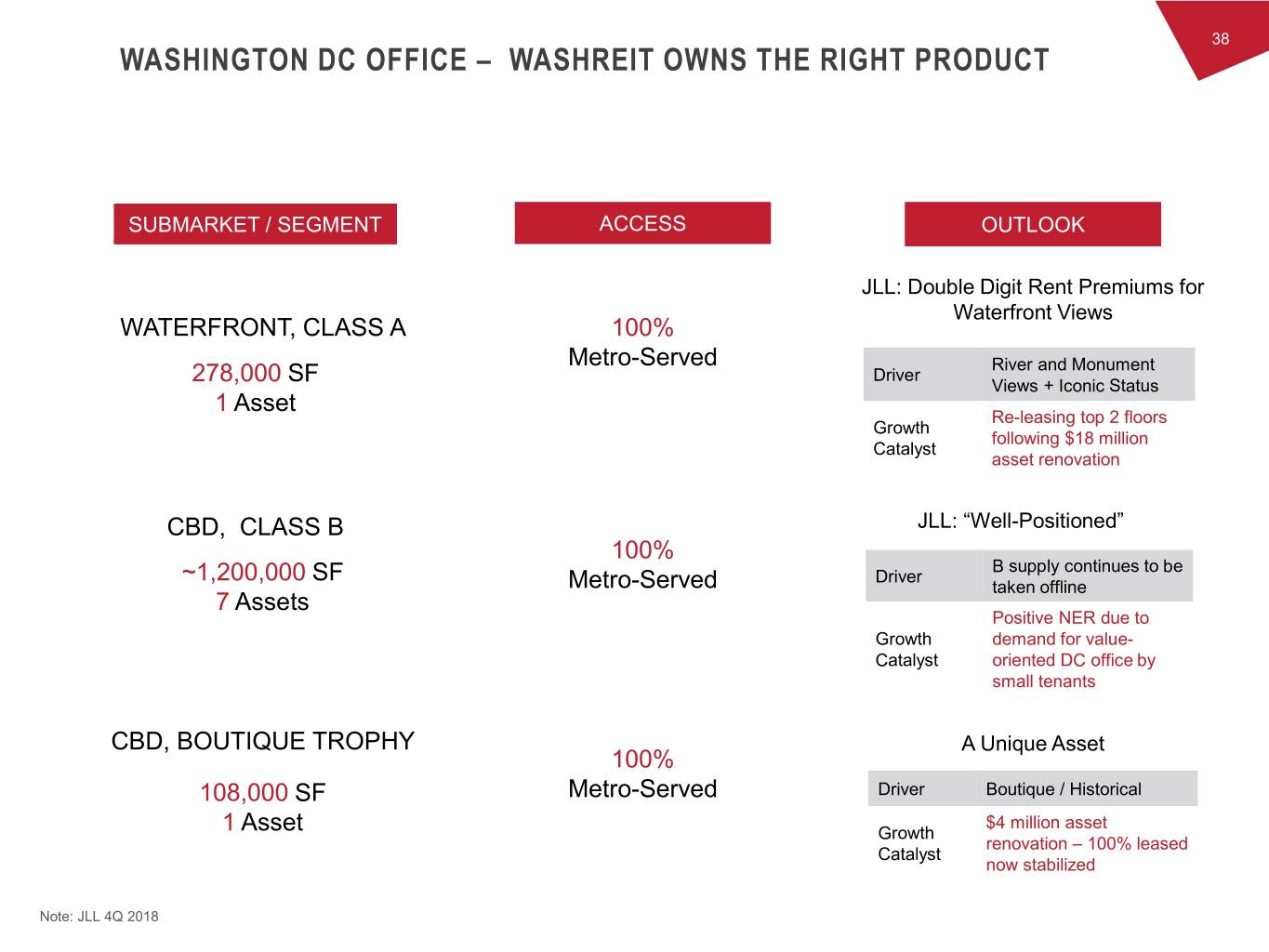

38 WASHINGTON DC OFFICE – WASHREIT OWNS THE RIGHT PRODUCT THE DC METRO REGION Where to be in DC SUBMARKET / SEGMENT ACCESS OUTLOOK JLL: Double Digit Rent Premiums for Waterfront Views WATERFRONT, CLASS A 100% Metro-Served River and Monument Driver 278,000 SF Views + Iconic Status 1 Asset Re-leasing top 2 floors Growth following $18 million Catalyst asset renovation CBD, CLASS B JLL: “Well-Positioned” 100% B supply continues to be ~1,200,000 SF Driver Metro-Served taken offline 7 Assets Positive NER due to Growth demand for value- Catalyst oriented DC office by small tenants CBD, BOUTIQUE TROPHY A Unique Asset 100% 108,000 SF Metro-Served Driver Boutique / Historical $4 million asset 1 Asset Growth renovation – 100% leased Catalyst now stabilized Note: JLL 4Q 2018

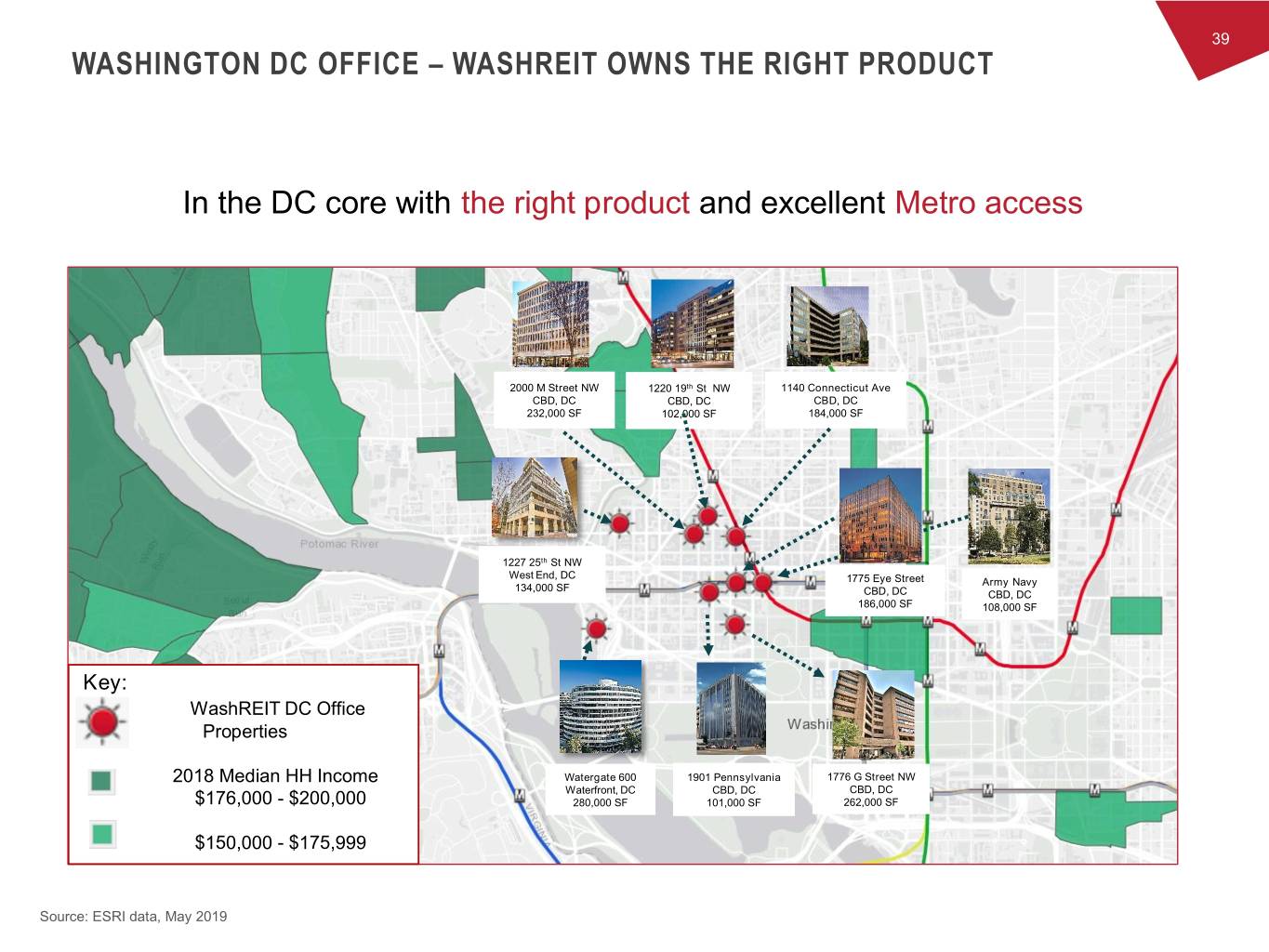

39 WASHINGTON DC OFFICE – WASHREIT OWNS THE RIGHT PRODUCT THE DC METRO REGION Where to be in DC In the DC core with the right product and excellent Metro access 2000 M Street NW 1220 19th St NW 1140 Connecticut Ave CBD, DC CBD, DC CBD, DC 232,000 SF 102,000 SF 184,000 SF 1227 25th St NW West End, DC 1775 Eye Street Army Navy 134,000 SF CBD, DC CBD, DC 186,000 SF 108,000 SF Key: WashREIT DC Office Properties 2018 Median HH Income Watergate 600 1901 Pennsylvania 1776 G Street NW Waterfront, DC CBD, DC CBD, DC $176,000 - $200,000 280,000 SF 101,000 SF 262,000 SF $150,000 - $175,999 Source: ESRI data, May 2019

40 WASHINGTON DC OFFICE – WATERGATE 600 LEASING SUCCESS Watergate 600 Waterfront DC RENOVATION LEASING BEFORE AFTER ~72,000 SF OF EXECUTED LEASES ~50,000 SF IN LEASE-UP (INCL. RENEWALS)

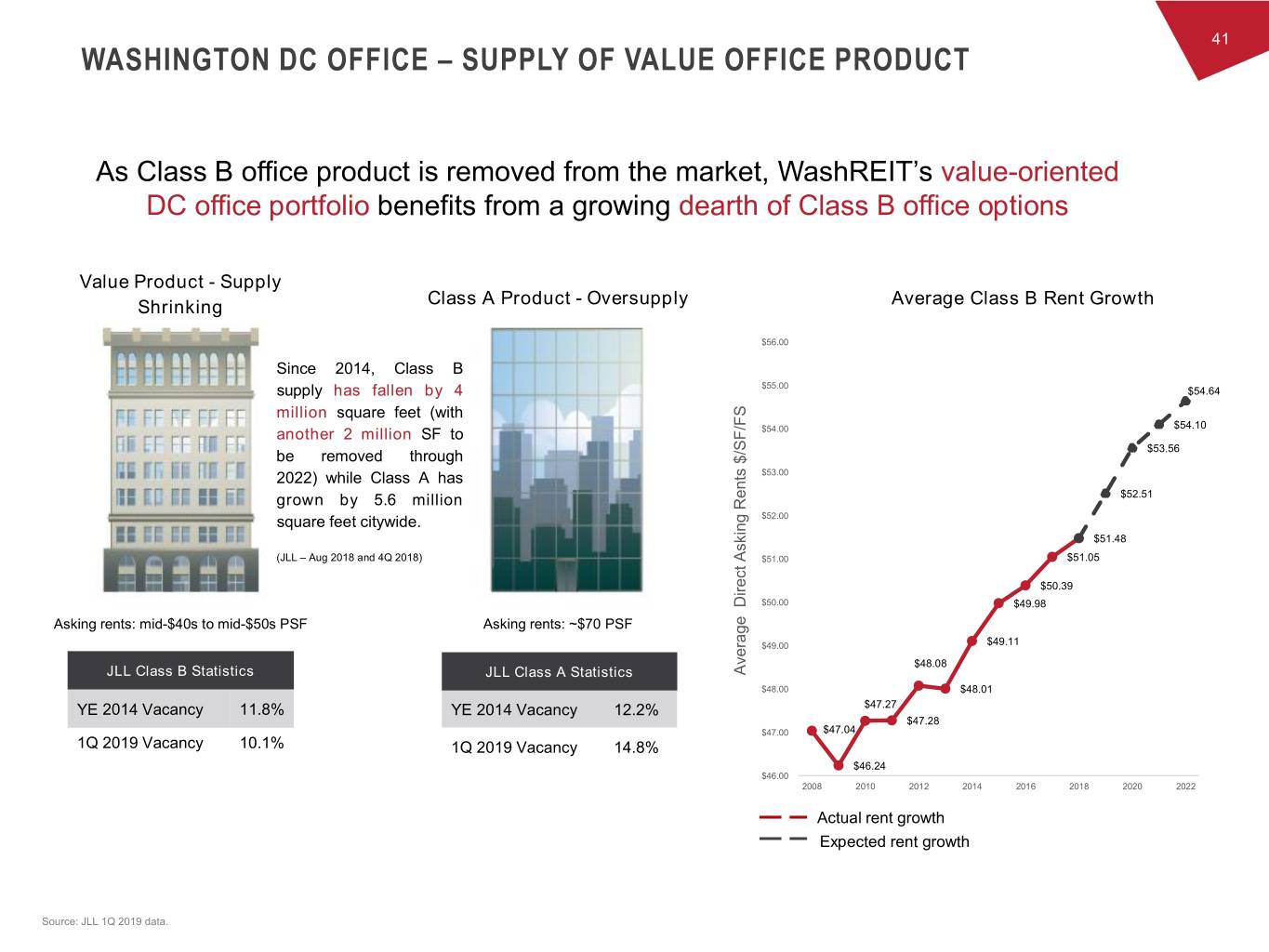

41 WASHINGTON DC OFFICE – SUPPLY OF VALUE OFFICE PRODUCT As Class B office product is removed from the market, WashREIT’s value-oriented DC office portfolio benefits from a growing dearth of Class B office options Value Product - Supply Shrinking Class A Product - Oversupply Average Class B Rent Growth $56.00 Since 2014, Class B $55.00 supply has fallen by 4 $54.64 million square feet (with $54.10 another 2 million SF to $54.00 be removed through $53.56 2022) while Class A has $53.00 grown by 5.6 million $52.51 square feet citywide. $52.00 $51.48 (JLL – Aug 2018 and 4Q 2018) $51.00 $51.05 $50.39 $50.00 $49.98 Asking rents: mid-$40s to mid-$50s PSF Asking rents: ~$70 PSF $49.00 $49.11 $48.08 JLL Class B Statistics JLL Class A Statistics Rents$/SF/FSAsking Direct Average $48.00 $48.01 YE 2014 Vacancy 11.8% YE 2014 Vacancy 12.2% $47.27 $47.28 $47.00 $47.04 1Q 2019 Vacancy 10.1% 1Q 2019 Vacancy 14.8% $46.24 $46.00 2008 2010 2012 2014 2016 2018 2020 2022 Actual rent growth Expected rent growth Source: JLL 1Q 2019 data.

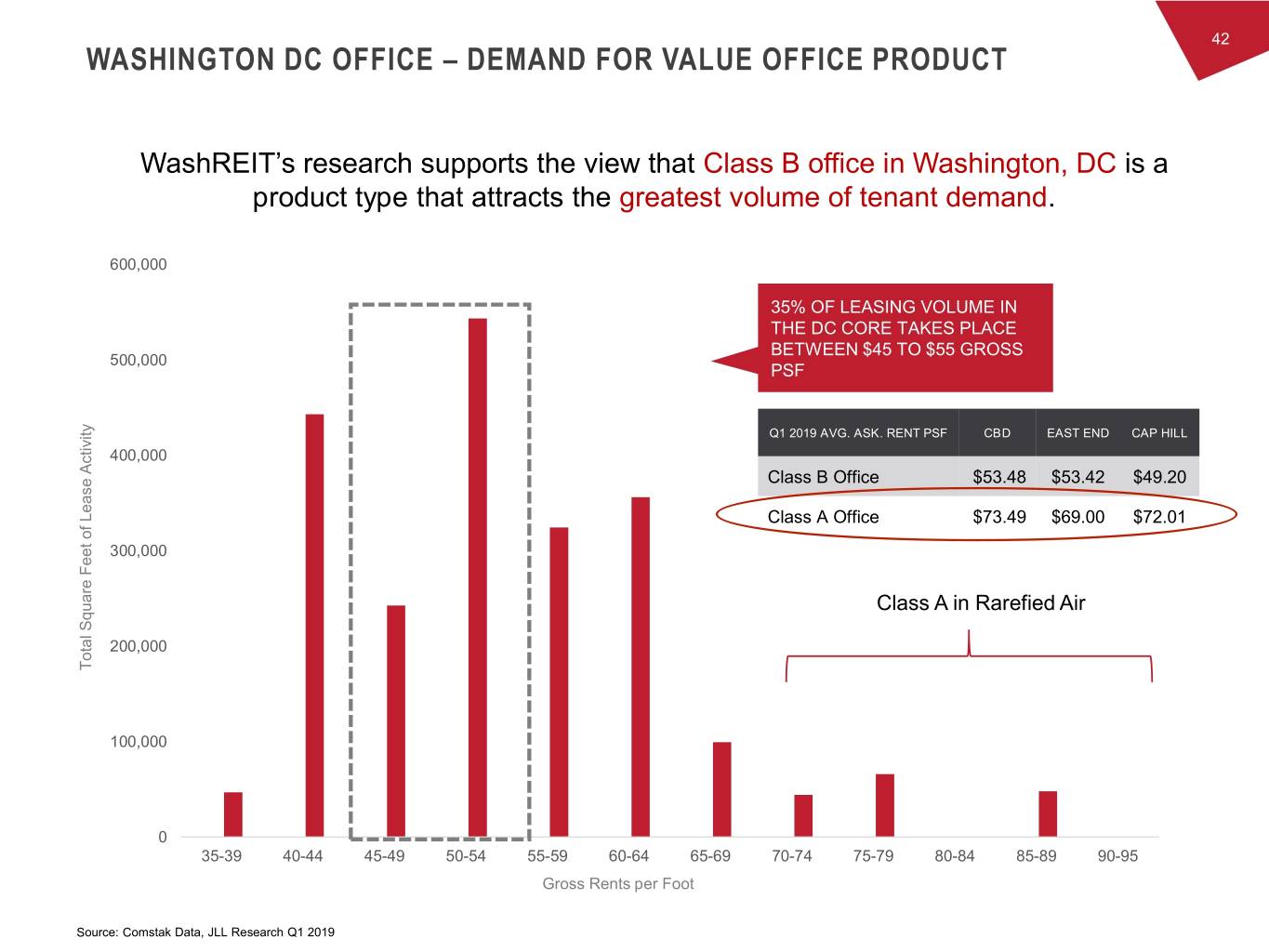

42 WASHINGTON DC OFFICE – DEMAND FOR VALUE OFFICE PRODUCT WashREIT’s research supports the view that Class B office in Washington, DC is a product type that attracts the greatest volume of tenant demand. 600,000 35% OF LEASING VOLUME IN THE DC CORE TAKES PLACE BETWEEN $45 TO $55 GROSS 500,000 PSF Q1 2019 AVG. ASK. RENT PSF CBD EAST END CAP HILL 400,000 Class B Office $53.48 $53.42 $49.20 Class A Office $73.49 $69.00 $72.01 300,000 Class A in Rarefied Air 200,000 Total Square Feet of Lease Activity LeaseofSquareFeet Total 100,000 0 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75-79 80-84 85-89 90-95 Gross Rents per Foot Source: Comstak Data, JLL Research Q1 2019

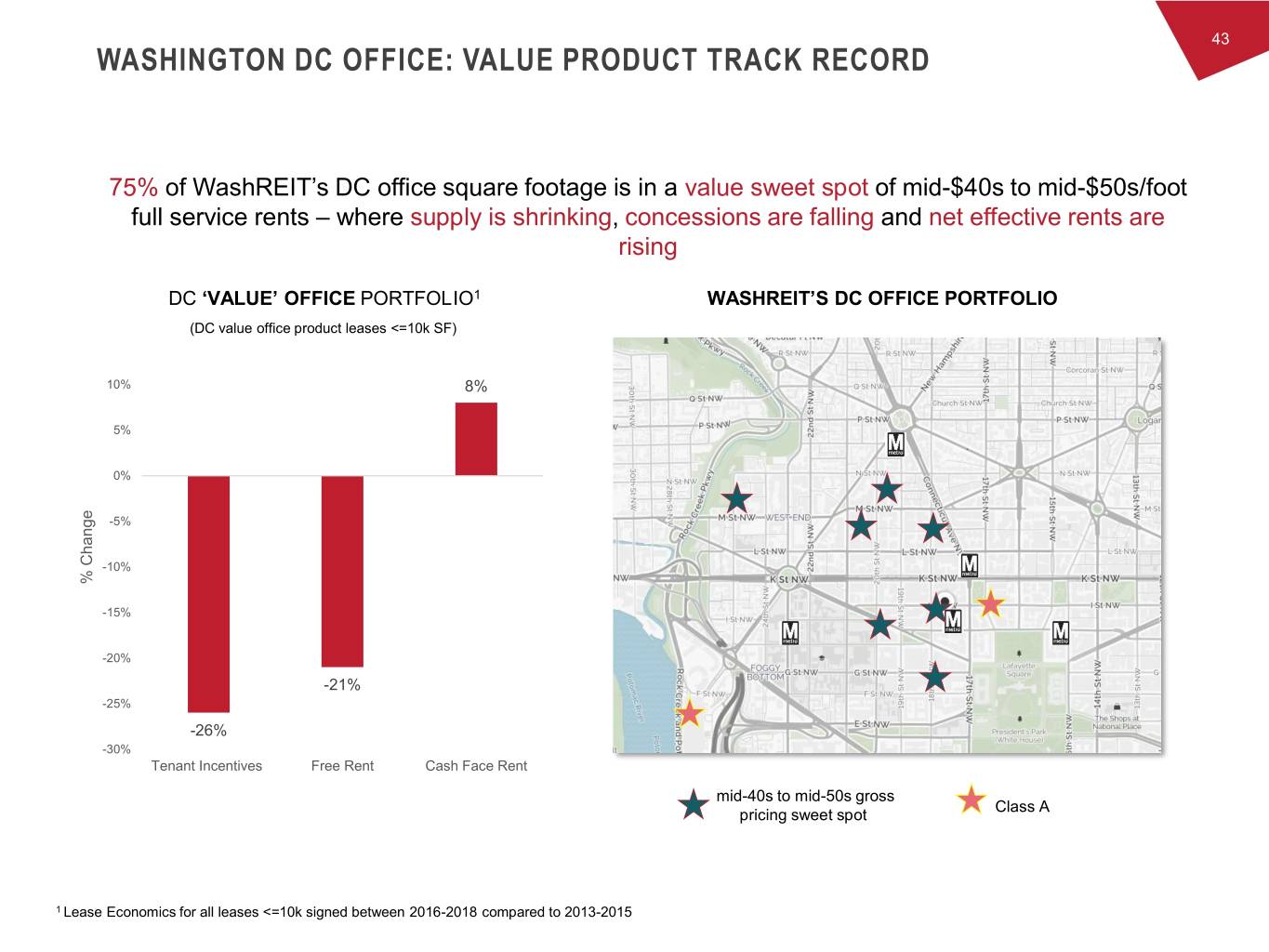

43 WASHINGTON DC OFFICE: VALUE PRODUCT TRACK RECORD 75% of WashREIT’s DC office square footage is in a value sweet spot of mid-$40s to mid-$50s/foot full service rents – where supply is shrinking, concessions are falling and net effective rents are rising DC ‘VALUE’ OFFICE PORTFOLIO1 WASHREIT’S DC OFFICE PORTFOLIO (DC value office product leases <=10k SF) 10% 8% 5% 0% -5% -10% % Change% -15% -20% -21% -25% -26% -30% Tenant Incentives Free Rent Cash Face Rent mid-40s to mid-50s gross Class A pricing sweet spot 1 Lease Economics for all leases <=10k signed between 2016-2018 compared to 2013-2015

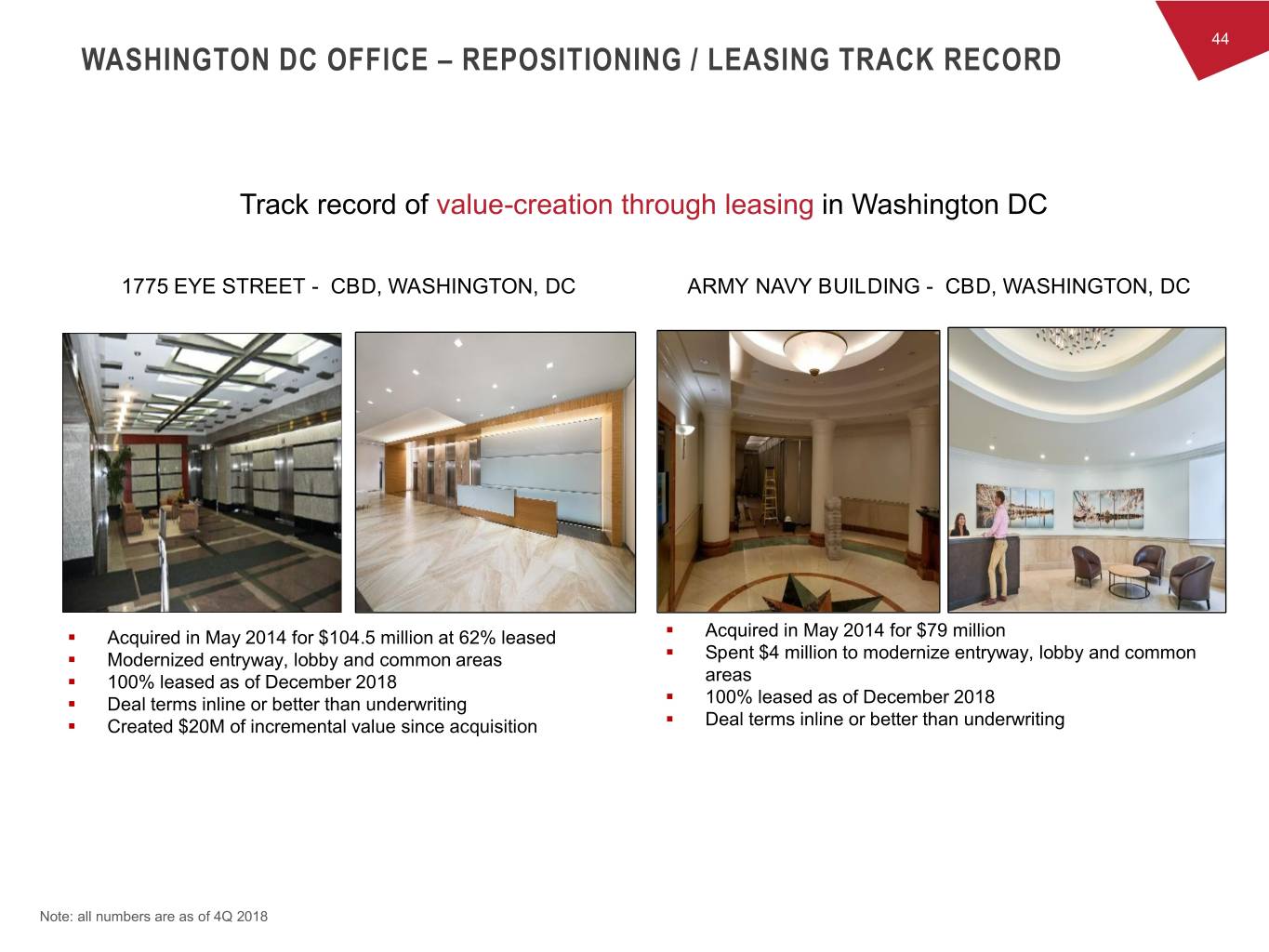

44 WASHINGTON DC OFFICE – REPOSITIONING / LEASING TRACK RECORD THE DC METRO REGION Where to be in DC Track record of value-creation through leasing in Washington DC 1775 EYE STREET - CBD, WASHINGTON, DC ARMY NAVY BUILDING - CBD, WASHINGTON, DC . Acquired in May 2014 for $104.5 million at 62% leased . Acquired in May 2014 for $79 million . Modernized entryway, lobby and common areas . Spent $4 million to modernize entryway, lobby and common . 100% leased as of December 2018 areas . Deal terms inline or better than underwriting . 100% leased as of December 2018 . Created $20M of incremental value since acquisition . Deal terms inline or better than underwriting Note: all numbers are as of 4Q 2018

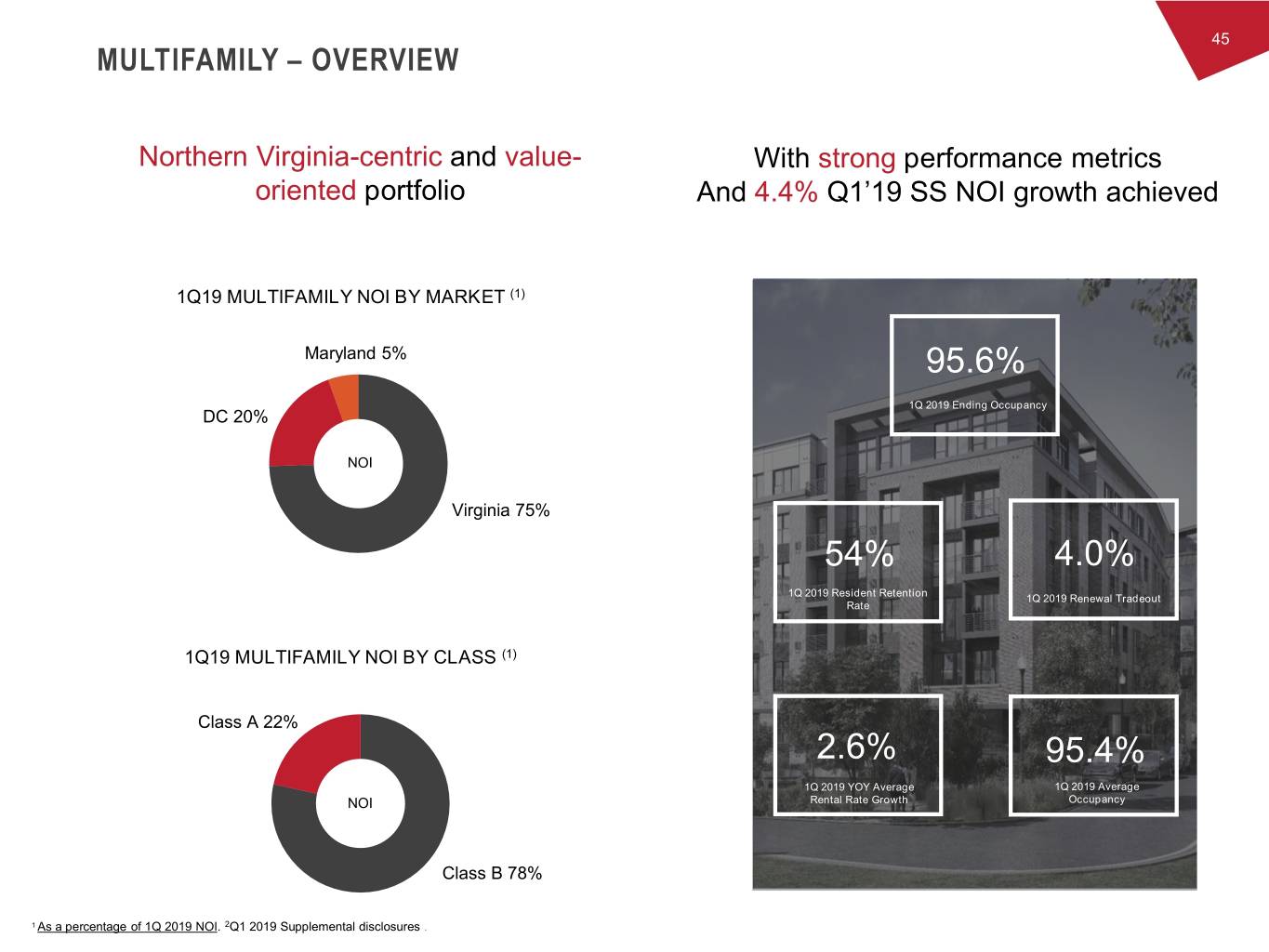

45 MULTIFAMILY – OVERVIEW Northern Virginia-centric and value- With strong performance metrics oriented portfolio And 4.4% Q1’19 SS NOI growth achieved 1Q19 MULTIFAMILY NOI BY MARKET (1) Maryland 5% 95.6% 1Q 2019 Ending Occupancy DC 20% NOI Virginia 75% 54% 4.0% 1Q 2019 Resident Retention 1Q 2019 Renewal Tradeout Rate 1Q19 MULTIFAMILY NOI BY CLASS (1) Class A 22% 2.6% 95.4% 1Q 2019 YOY Average 1Q 2019 Average NOI Rental Rate Growth Occupancy Class B 78% 1 As a percentage of 1Q 2019 NOI. 2Q1 2019 Supplemental disclosures .

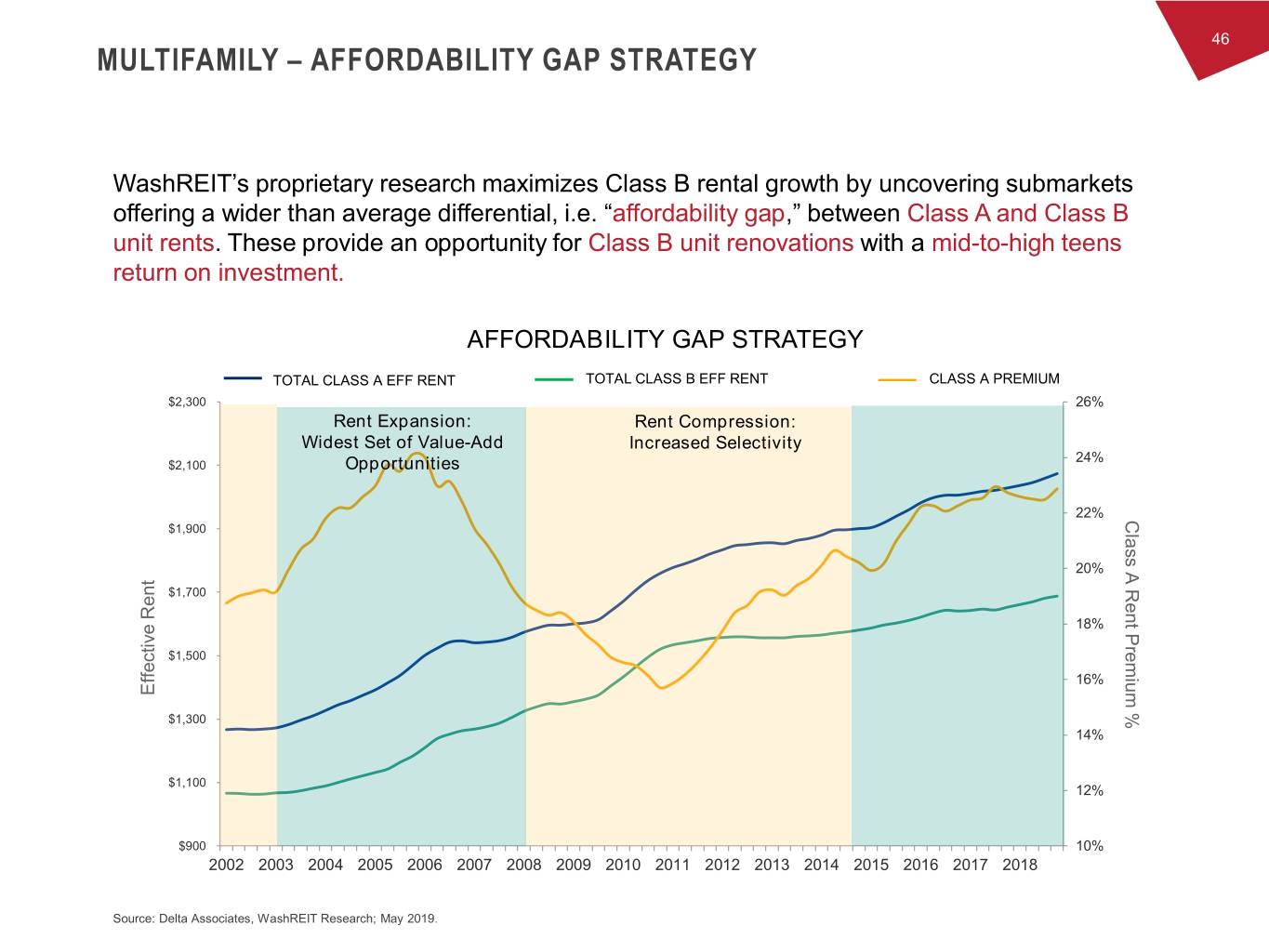

46 MULTIFAMILY – AFFORDABILITY GAP STRATEGY WashREIT’s proprietary research maximizes Class B rental growth by uncovering submarkets offering a wider than average differential, i.e. “affordability gap,” between Class A and Class B unit rents. These provide an opportunity for Class B unit renovations with a mid-to-high teens return on investment. AFFORDABILITY GAP STRATEGY TOTAL CLASS A EFF RENT TOTAL CLASS B EFF RENT CLASS A PREMIUM $2,300 26% Rent Expansion: Rent Compression: Widest Set of Value-Add Increased Selectivity 24% $2,100 Opportunities 22% Class A Rent Premium % $1,900 20% $1,700 18% $1,500 16% Effective Rent Rent Effective $1,300 14% $1,100 12% $900 10% 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: Delta Associates, WashREIT Research; May 2019.

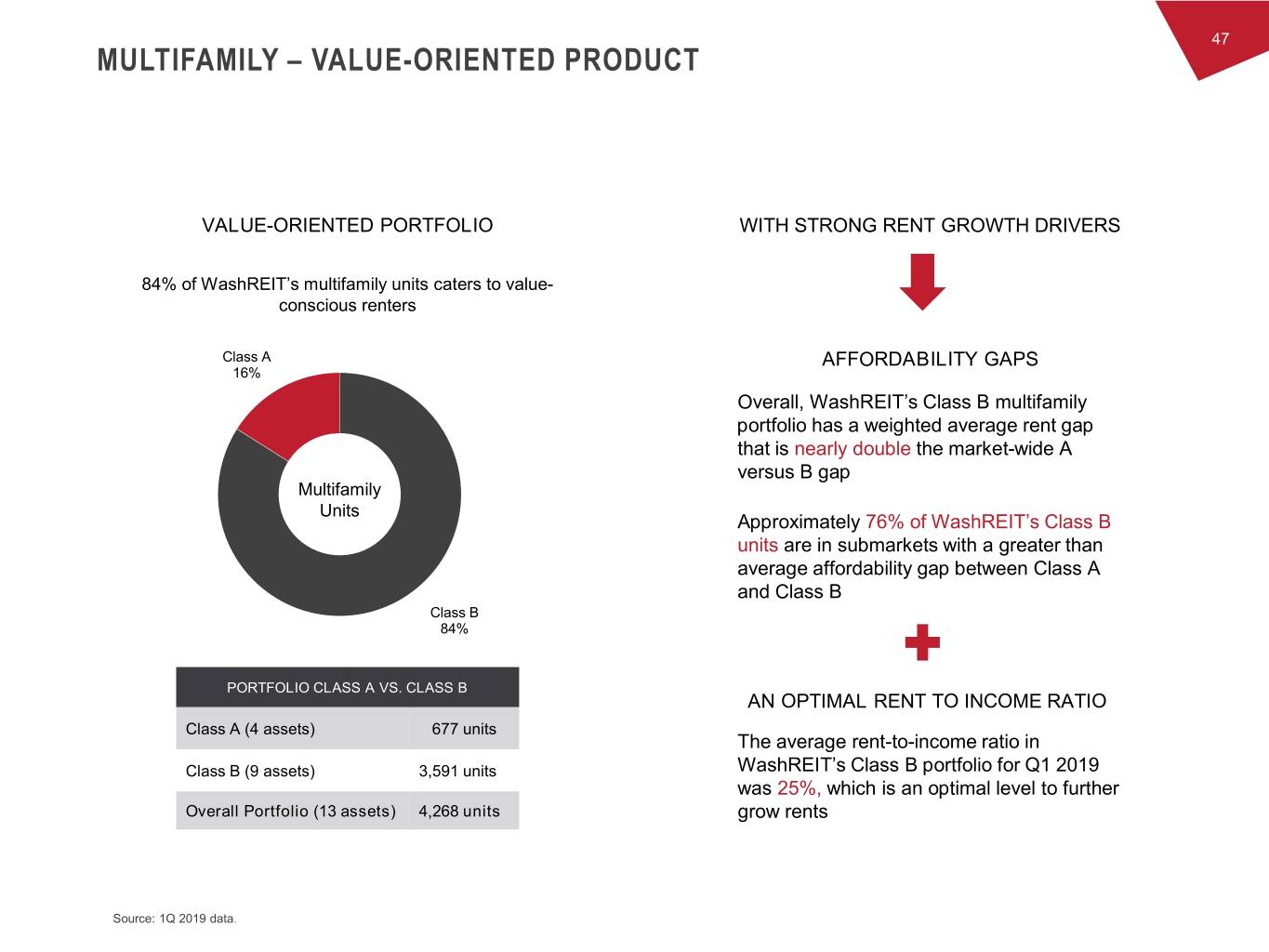

47 MULTIFAMILY – VALUE-ORIENTED PRODUCT VALUE-ORIENTED PORTFOLIO WITH STRONG RENT GROWTH DRIVERS 84% of WashREIT’s multifamily units caters to value- conscious renters Class A AFFORDABILITY GAPS 16% Overall, WashREIT’s Class B multifamily portfolio has a weighted average rent gap that is nearly double the market-wide A versus B gap Multifamily Units Approximately 76% of WashREIT’s Class B units are in submarkets with a greater than average affordability gap between Class A and Class B Class B 84% PORTFOLIO CLASS A VS. CLASS B AN OPTIMAL RENT TO INCOME RATIO Class A (4 assets) 677 units The average rent-to-income ratio in Class B (9 assets) 3,591 units WashREIT’s Class B portfolio for Q1 2019 was 25%, which is an optimal level to further Overall Portfolio (13 assets) 4,268 units grow rents Source: 1Q 2019 data.

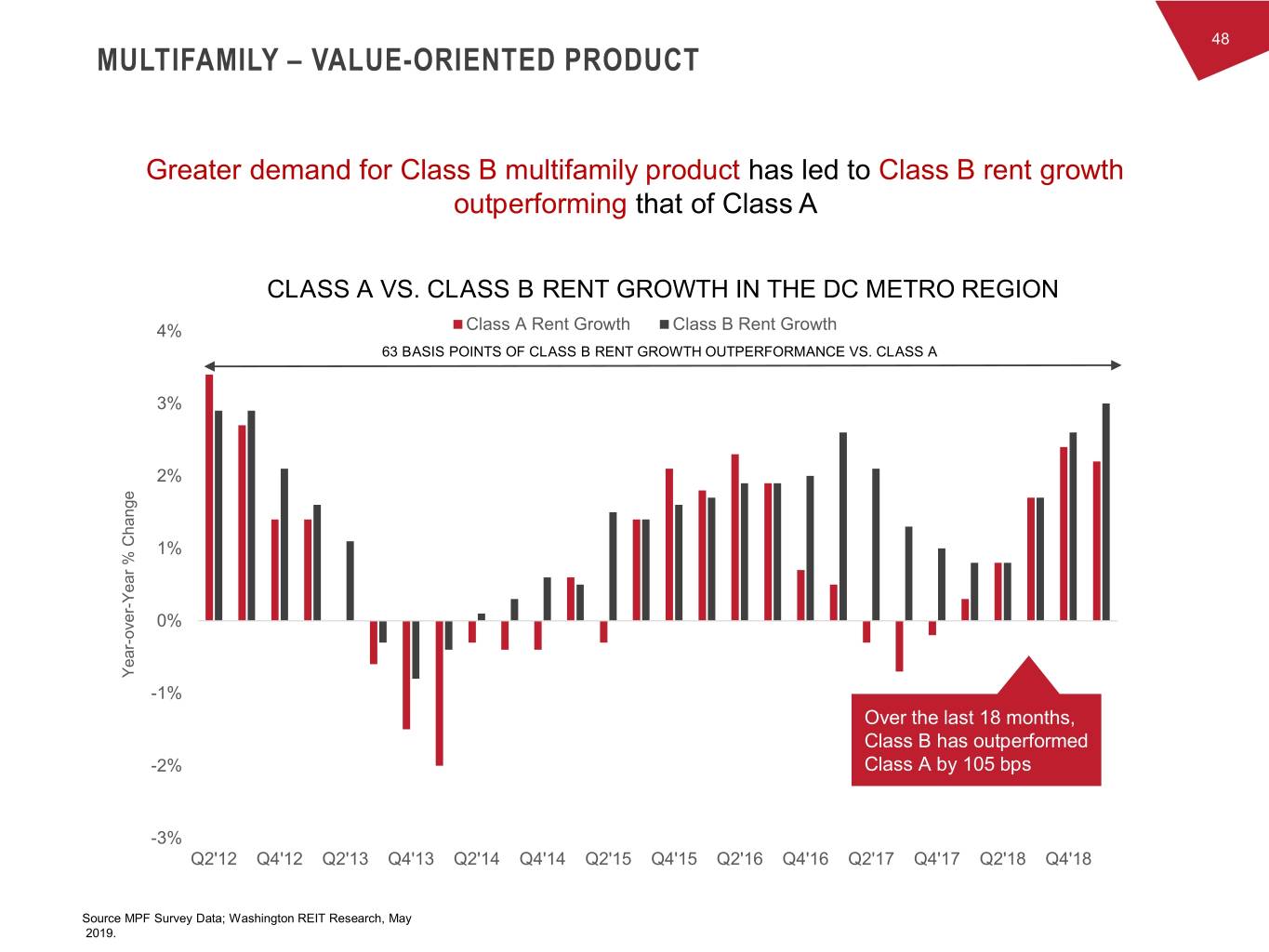

48 MULTIFAMILY – VALUE-ORIENTED PRODUCT Greater demand for Class B multifamily product has led to Class B rent growth outperforming that of Class A CLASS A VS. CLASS B RENT GROWTH IN THE DC METRO REGION 4% Class A Rent Growth Class B Rent Growth 63 BASIS POINTS OF CLASS B RENT GROWTH OUTPERFORMANCE VS. CLASS A 3% 2% 1% Year % Change Year - 0% over - Year -1% Over the last 18 months, Class B has outperformed -2% Class A by 105 bps -3% Q2'12 Q4'12 Q2'13 Q4'13 Q2'14 Q4'14 Q2'15 Q4'15 Q2'16 Q4'16 Q2'17 Q4'17 Q2'18 Q4'18 Source MPF Survey Data; Washington REIT Research, May 2019.

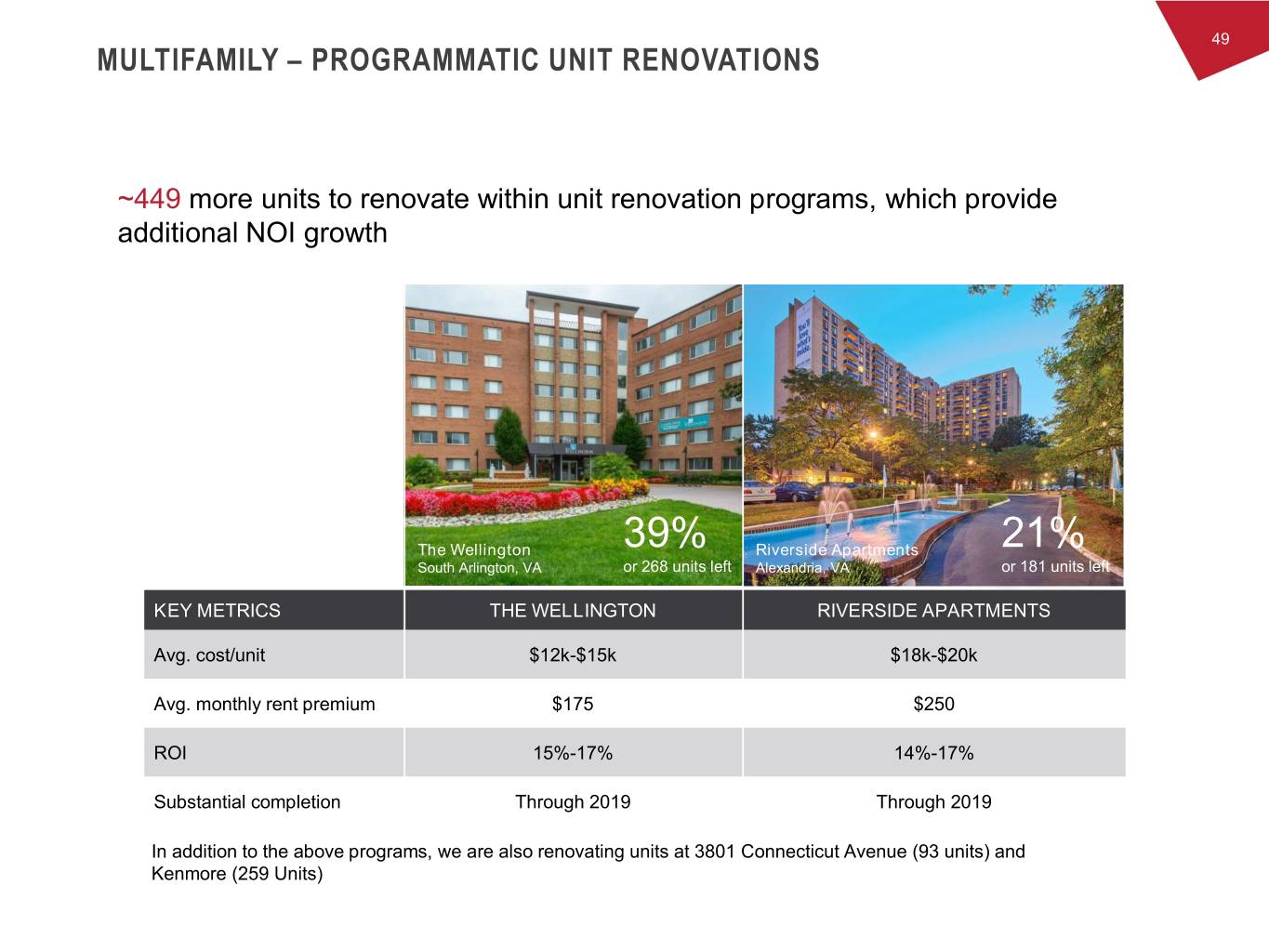

49 MULTIFAMILY – PROGRAMMATIC UNIT RENOVATIONS ~449 more units to renovate within unit renovation programs, which provide additional NOI growth The Wellington 39% Riverside Apartments 21% South Arlington, VA or 268 units left Alexandria, VA or 181 units left KEY METRICS THE WELLINGTON RIVERSIDE APARTMENTS Avg. cost/unit $12k-$15k $18k-$20k Avg. monthly rent premium $175 $250 ROI 15%-17% 14%-17% Substantial completion Through 2019 Through 2019 In addition to the above programs, we are also renovating units at 3801 Connecticut Avenue (93 units) and Kenmore (259 Units)

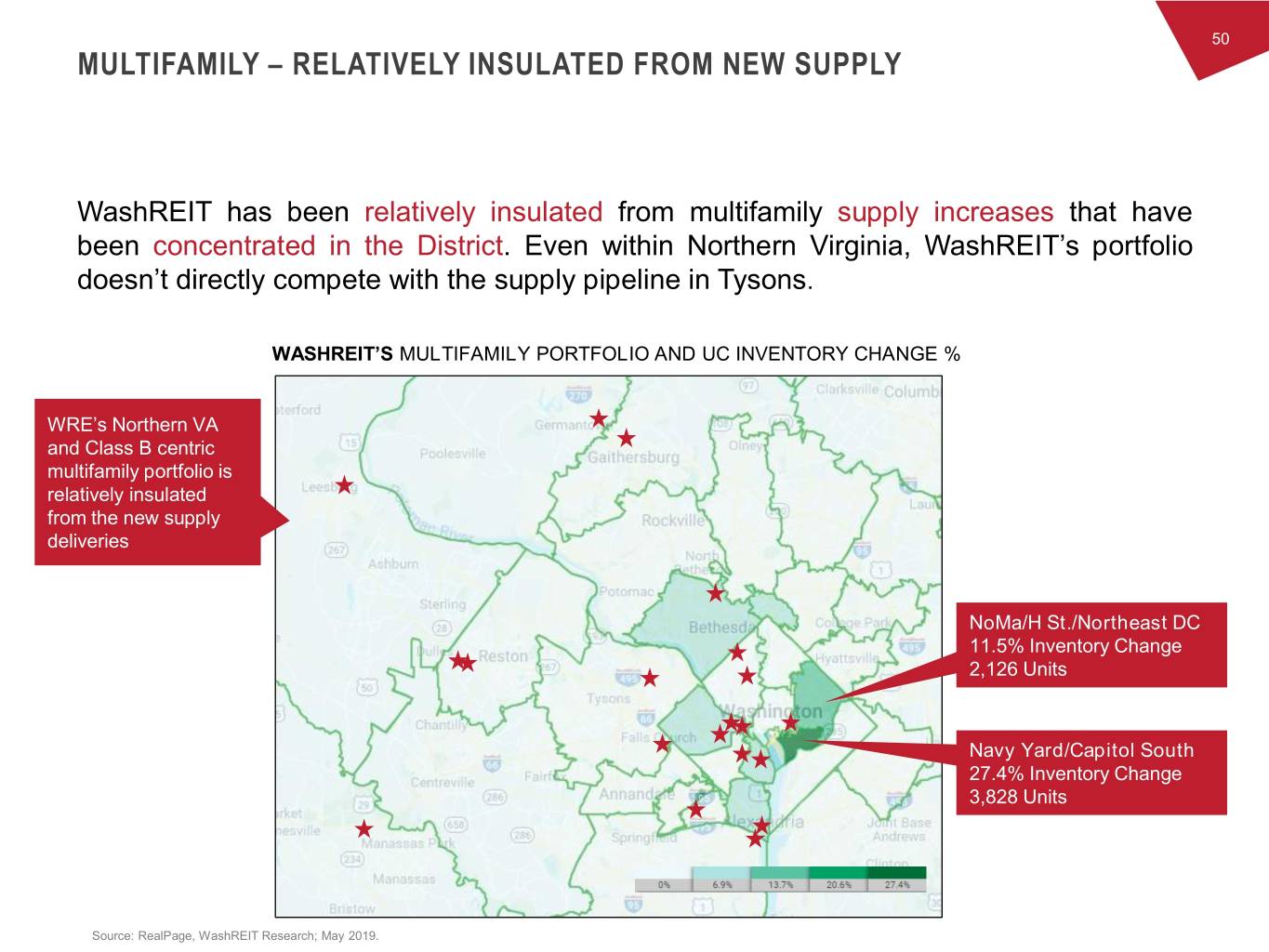

50 MULTIFAMILY – RELATIVELY INSULATED FROM NEW SUPPLY WashREIT has been relatively insulated from multifamily supply increases that have been concentrated in the District. Even within Northern Virginia, WashREIT’s portfolio doesn’t directly compete with the supply pipeline in Tysons. WASHREIT’S MULTIFAMILY PORTFOLIO AND UC INVENTORY CHANGE % WRE’s Northern VA and Class B centric multifamily portfolio is relatively insulated from the new supply deliveries NoMa/H St./Northeast DC 11.5% Inventory Change 2,126 Units Navy Yard/Capitol South 27.4% Inventory Change 3,828 Units Source: RealPage, WashREIT Research; May 2019.

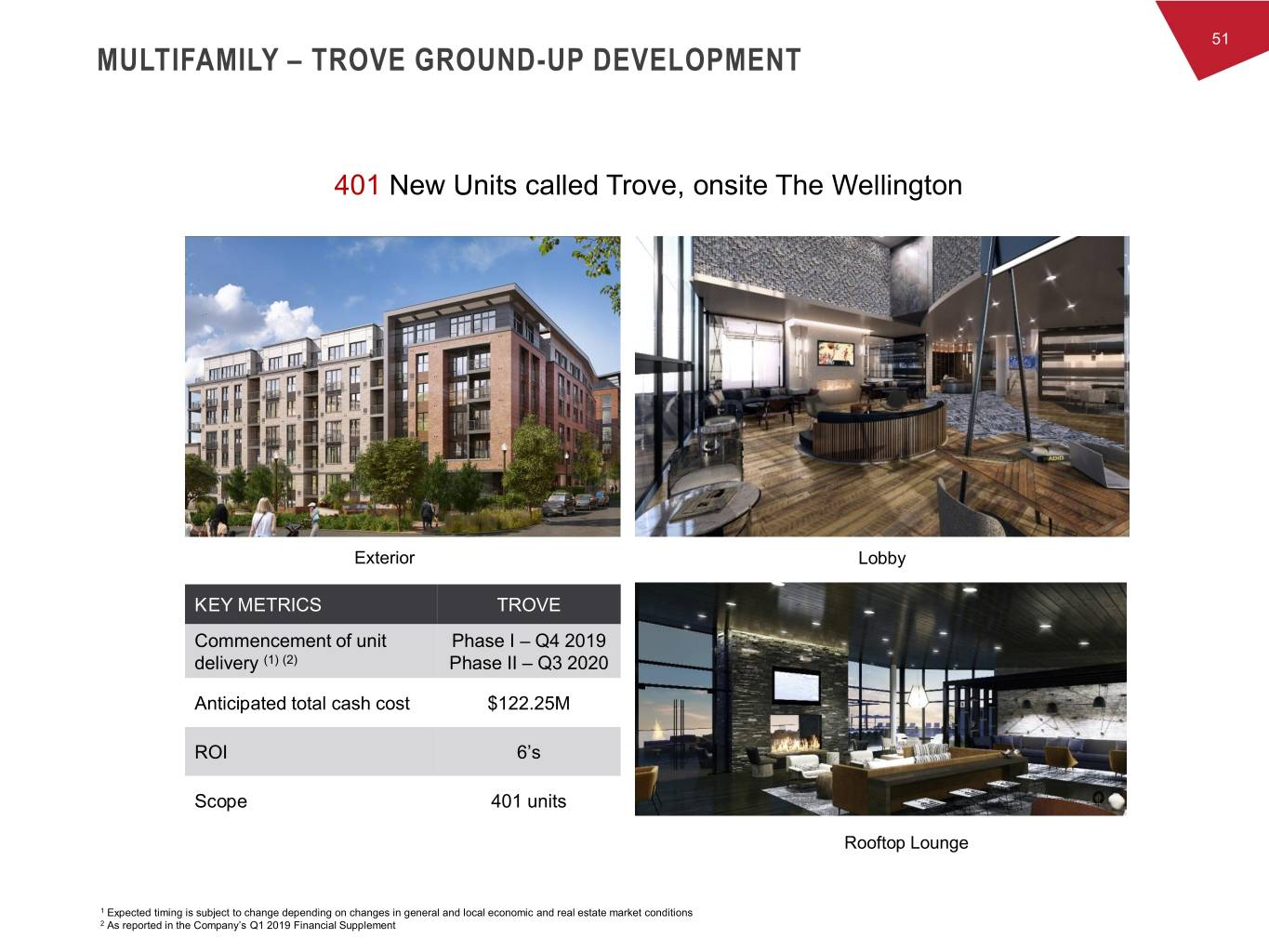

51 MULTIFAMILY – TROVE GROUND-UP DEVELOPMENT 401 New Units called Trove, onsite The Wellington Exterior Lobby KEY METRICS TROVE Commencement of unit Phase I – Q4 2019 delivery (1) (2) Phase II – Q3 2020 Anticipated total cash cost $122.25M ROI 6’s Scope 401 units Rooftop Lounge 1 Expected timing is subject to change depending on changes in general and local economic and real estate market conditions 2 As reported in the Company’s Q1 2019 Financial Supplement

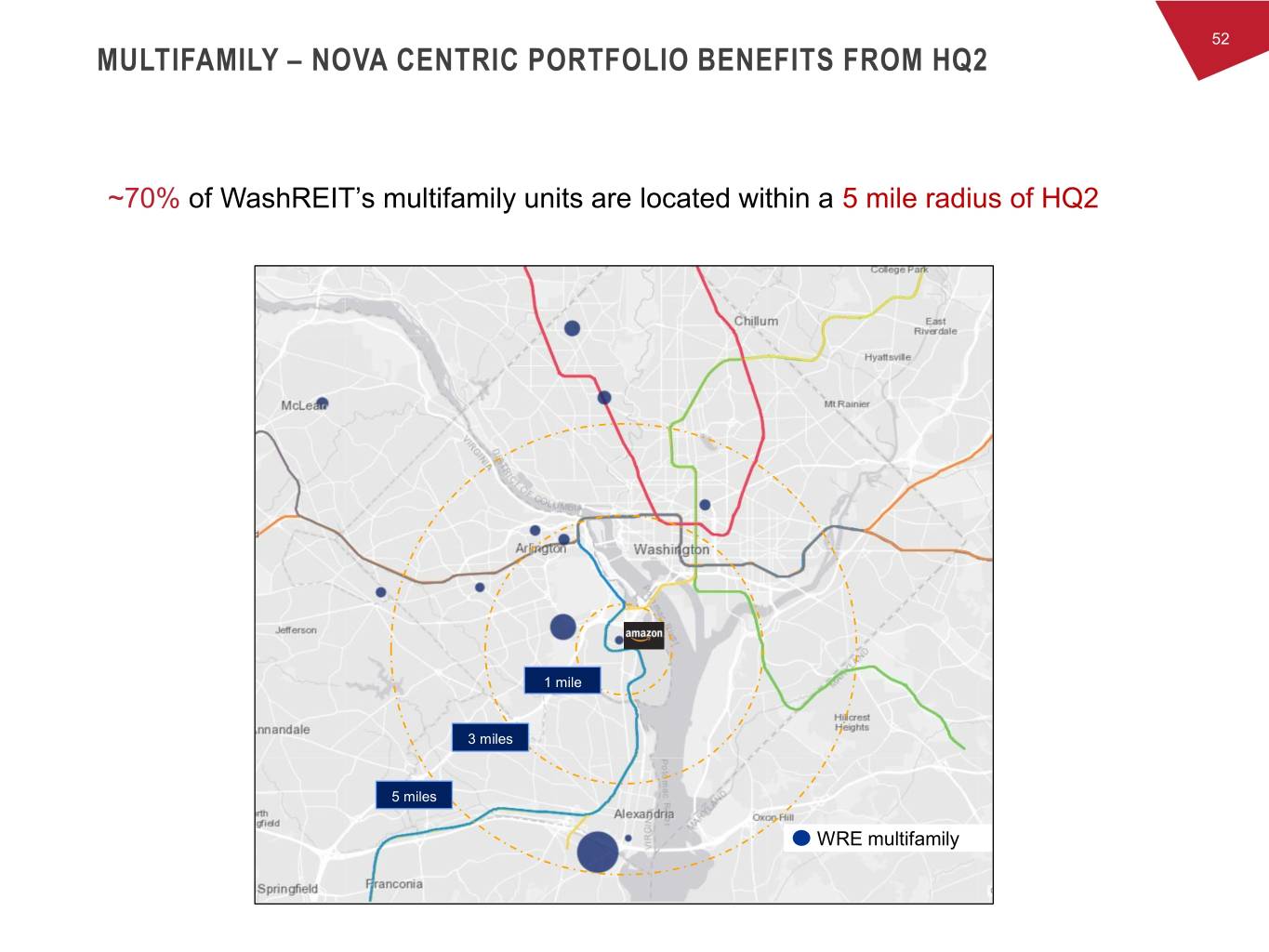

52 MULTIFAMILY – NOVA CENTRIC PORTFOLIO BENEFITS FROM HQ2 ~70% of WashREIT’s multifamily units are located within a 5 mile radius of HQ2 1 mile 3 miles 5 miles WRE multifamily

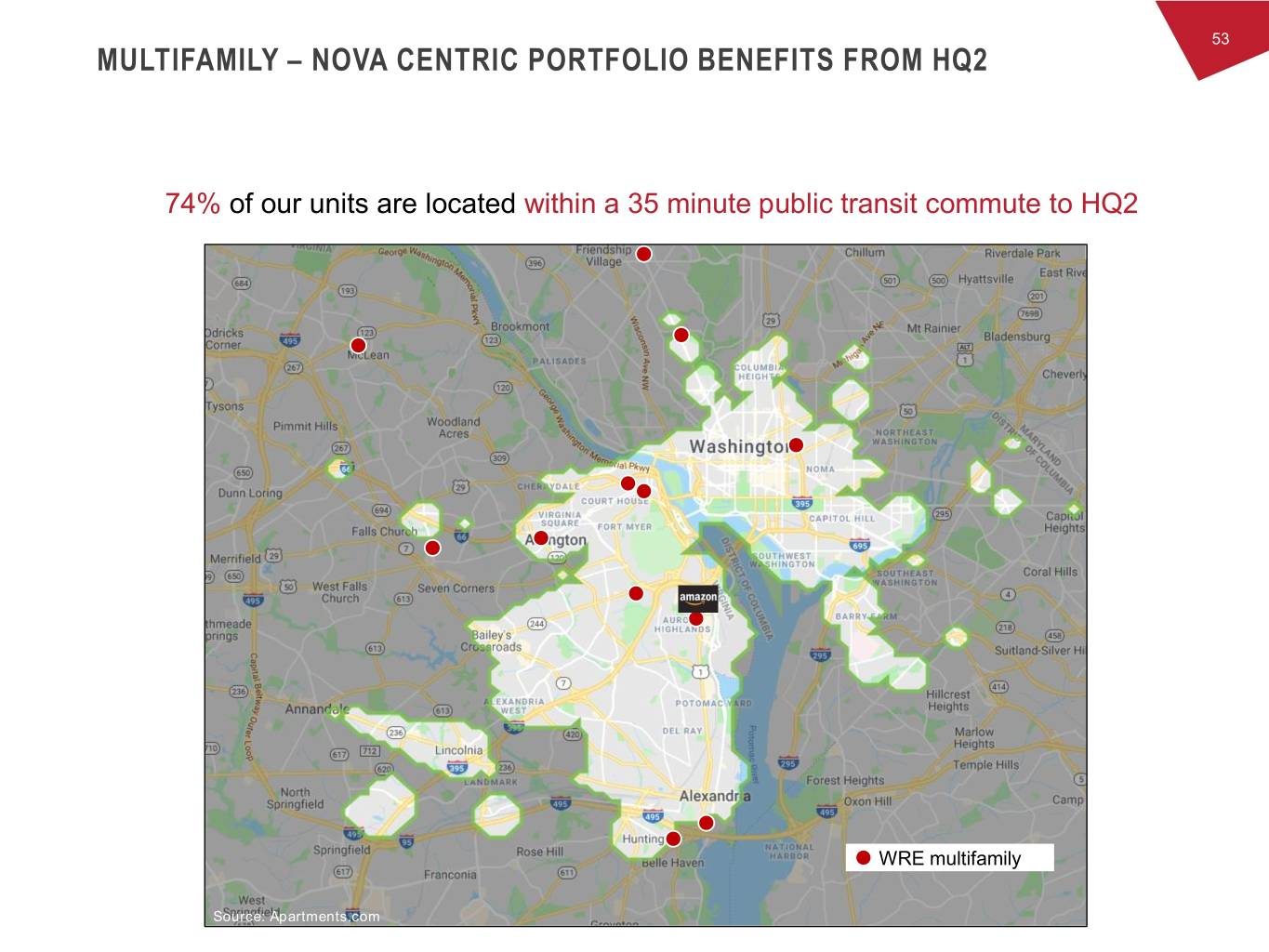

53 MULTIFAMILY – NOVA CENTRIC PORTFOLIO BENEFITS FROM HQ2 74% of our units are located within a 35 minute public transit commute to HQ2 WRE multifamily Source: Apartments.com

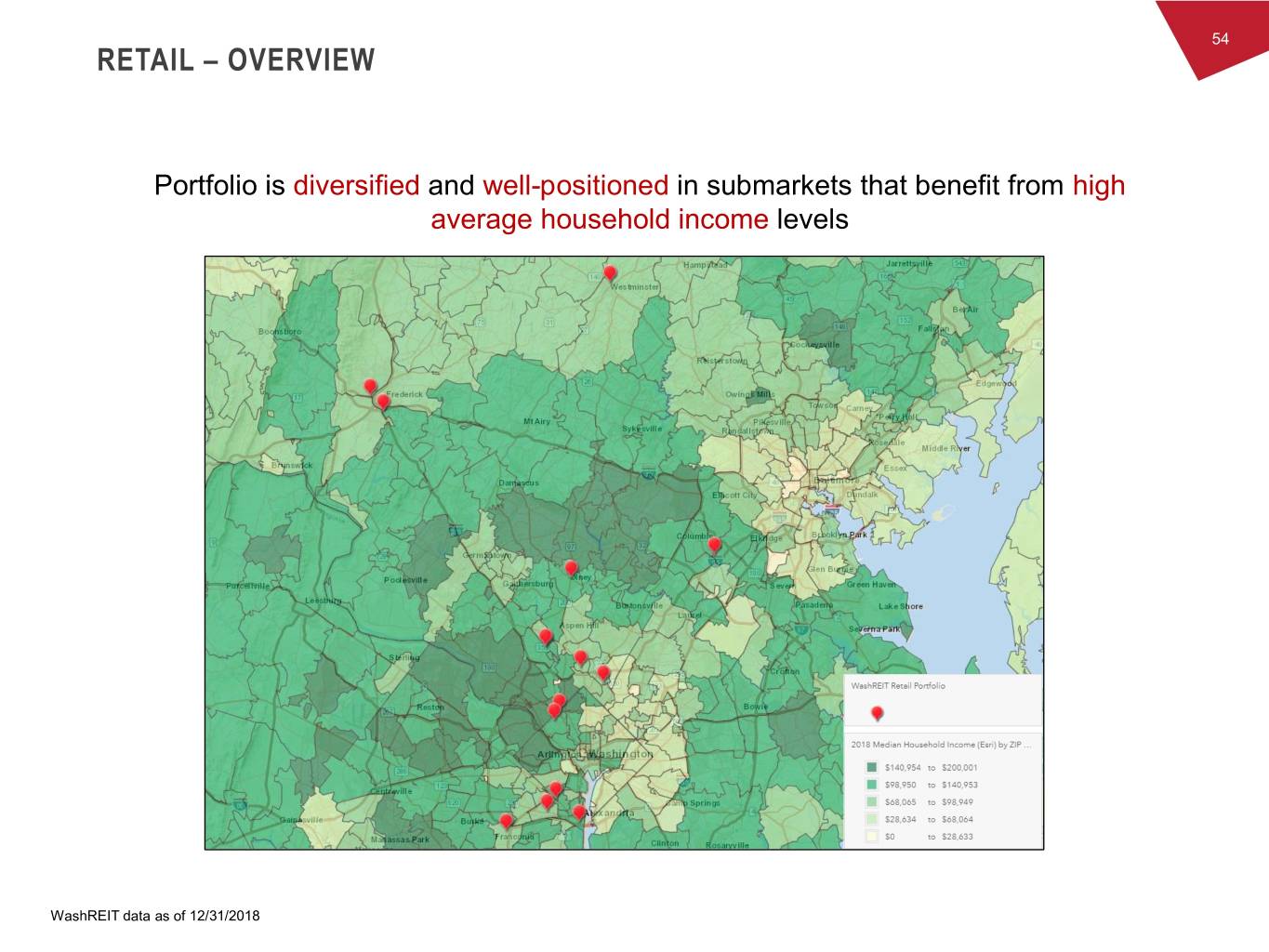

54 RETAIL – OVERVIEW Portfolio is diversified and well-positioned in submarkets that benefit from high average household income levels WashREIT data as of 12/31/2018

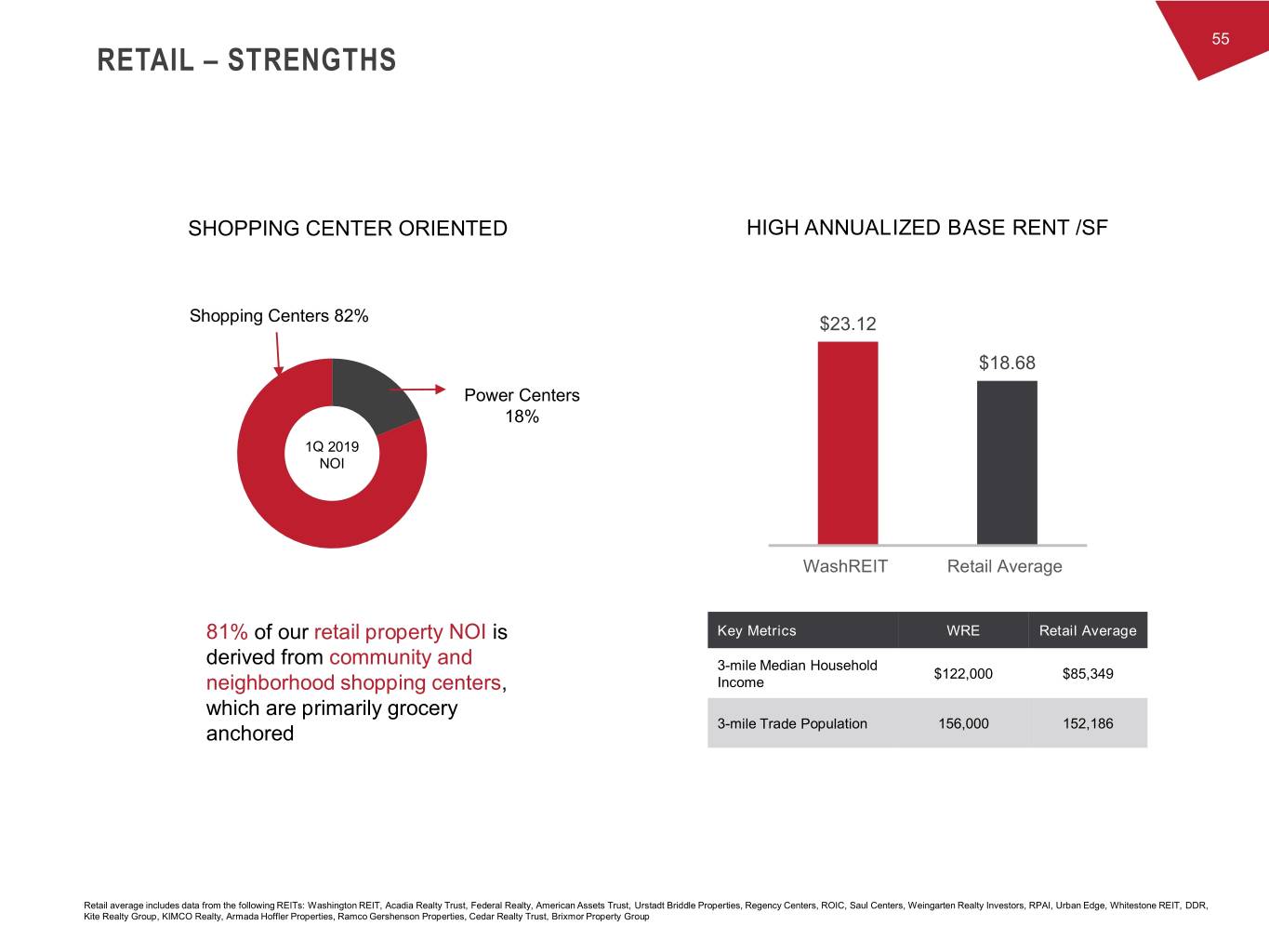

55 RETAIL – STRENGTHS SHOPPING CENTER ORIENTED HIGH ANNUALIZED BASE RENT /SF Shopping Centers 82% $23.12 $18.68 Power Centers 18% 1Q 2019 NOI WashREIT Retail Average 81% of our retail property NOI is Key Metrics WRE Retail Average derived from community and 3-mile Median Household $122,000 $85,349 neighborhood shopping centers, Income which are primarily grocery anchored 3-mile Trade Population 156,000 152,186 Retail average includes data from the following REITs: Washington REIT, Acadia Realty Trust, Federal Realty, American Assets Trust, Urstadt Briddle Properties, Regency Centers, ROIC, Saul Centers, Weingarten Realty Investors, RPAI, Urban Edge, Whitestone REIT, DDR, Kite Realty Group, KIMCO Realty, Armada Hoffler Properties, Ramco Gershenson Properties, Cedar Realty Trust, Brixmor Property Group

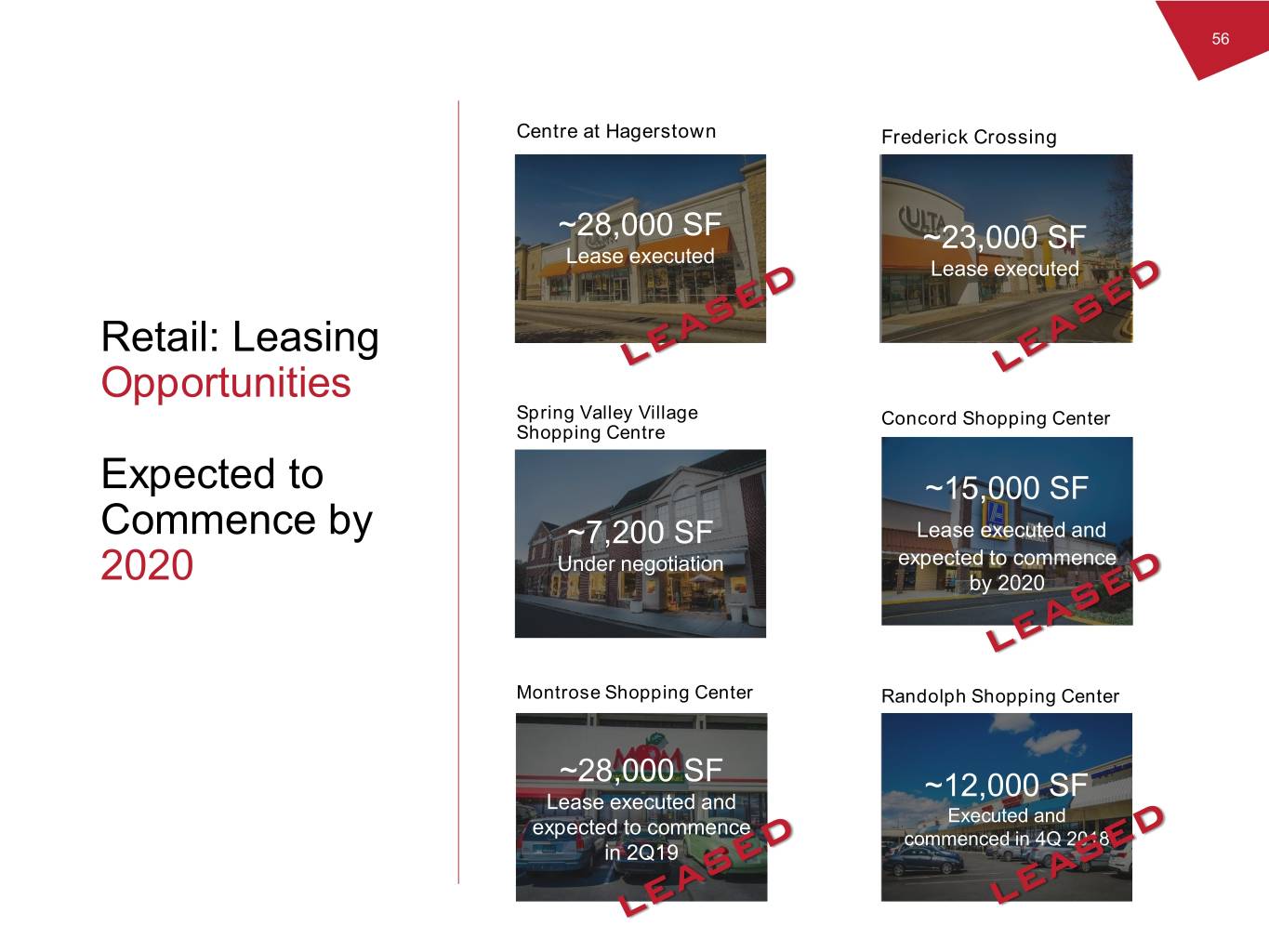

56 Centre at Hagerstown Frederick Crossing ~28,000 SF ~23,000 SF Lease executed Lease executed Retail: Leasing Opportunities Spring Valley Village Concord Shopping Center Shopping Centre Expected to ~15,000 SF Commence by ~7,200 SF Lease executed and Under negotiation expected to commence 2020 by 2020 Montrose Shopping Center Randolph Shopping Center ~28,000 SF ~12,000 SF Lease executed and Executed and expected to commence commenced in 4Q 2018 in 2Q19

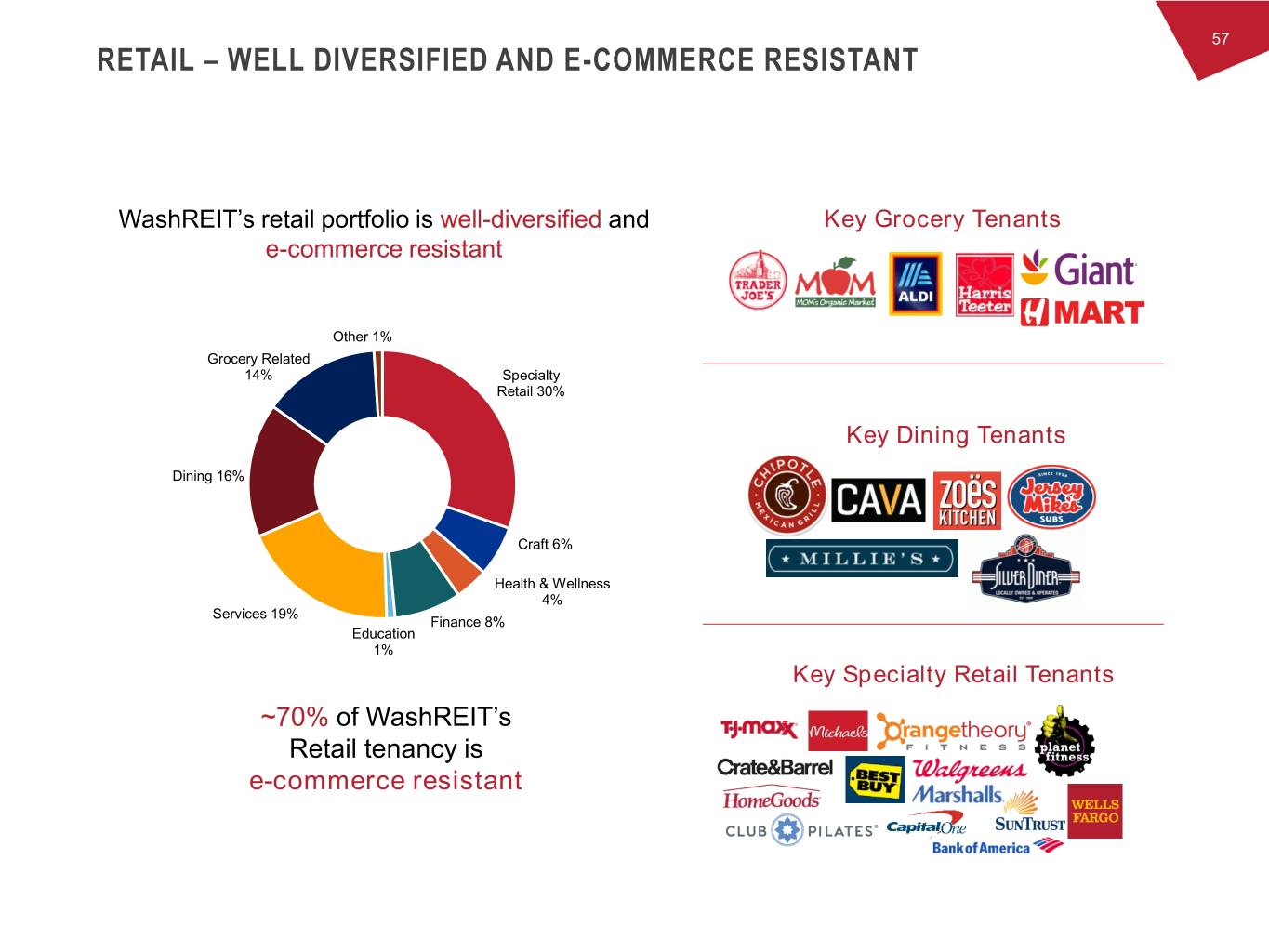

57 RETAIL – WELL DIVERSIFIED AND E-COMMERCE RESISTANT WashREIT’s retail portfolio is well-diversified and Key Grocery Tenants e-commerce resistant Other 1% Grocery Related 14% Specialty Retail 30% Key Dining Tenants Dining 16% Craft 6% Health & Wellness 4% Services 19% Finance 8% Education 1% Key Specialty Retail Tenants ~70% of WashREIT’s Retail tenancy is e-commerce resistant

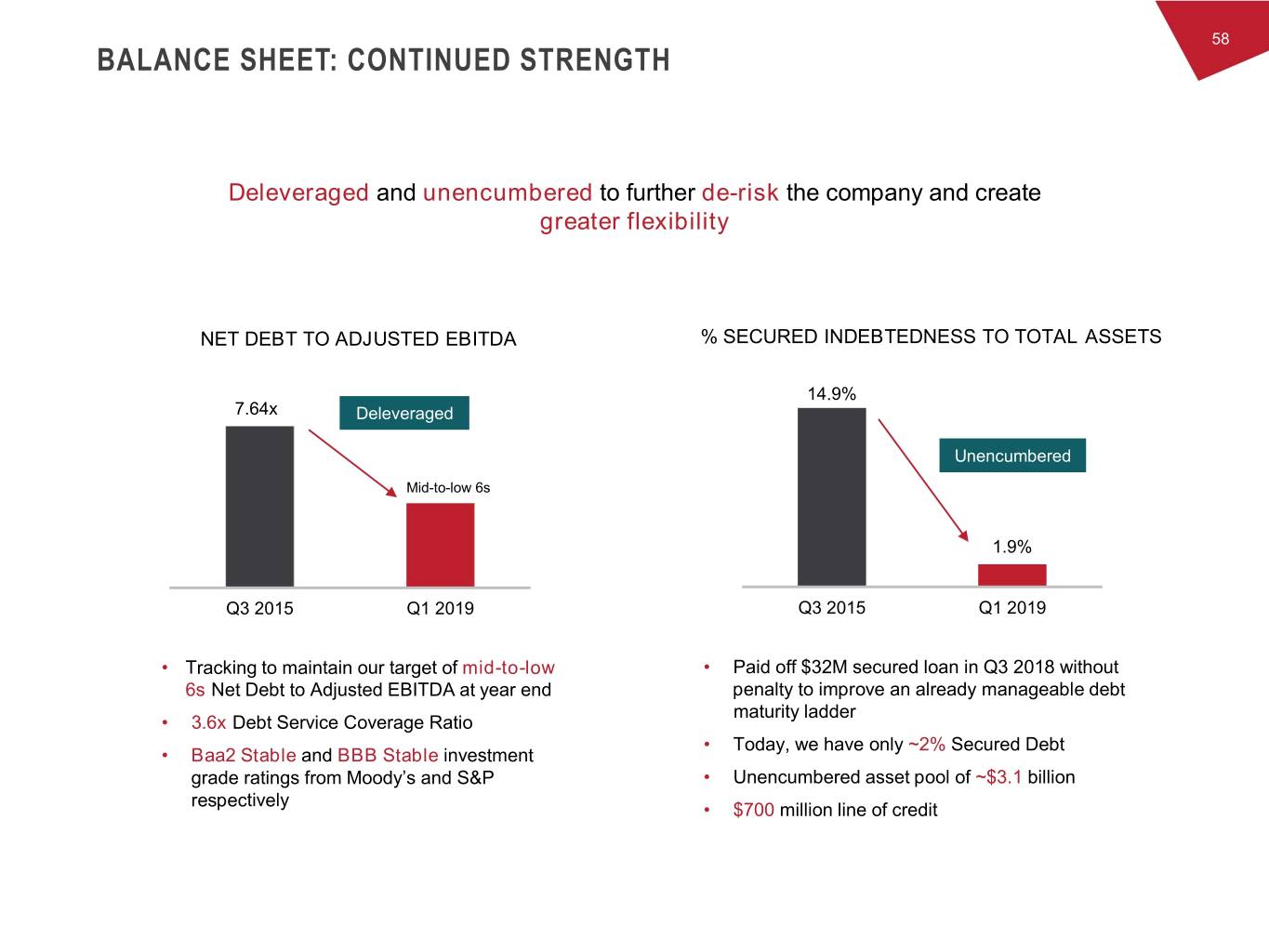

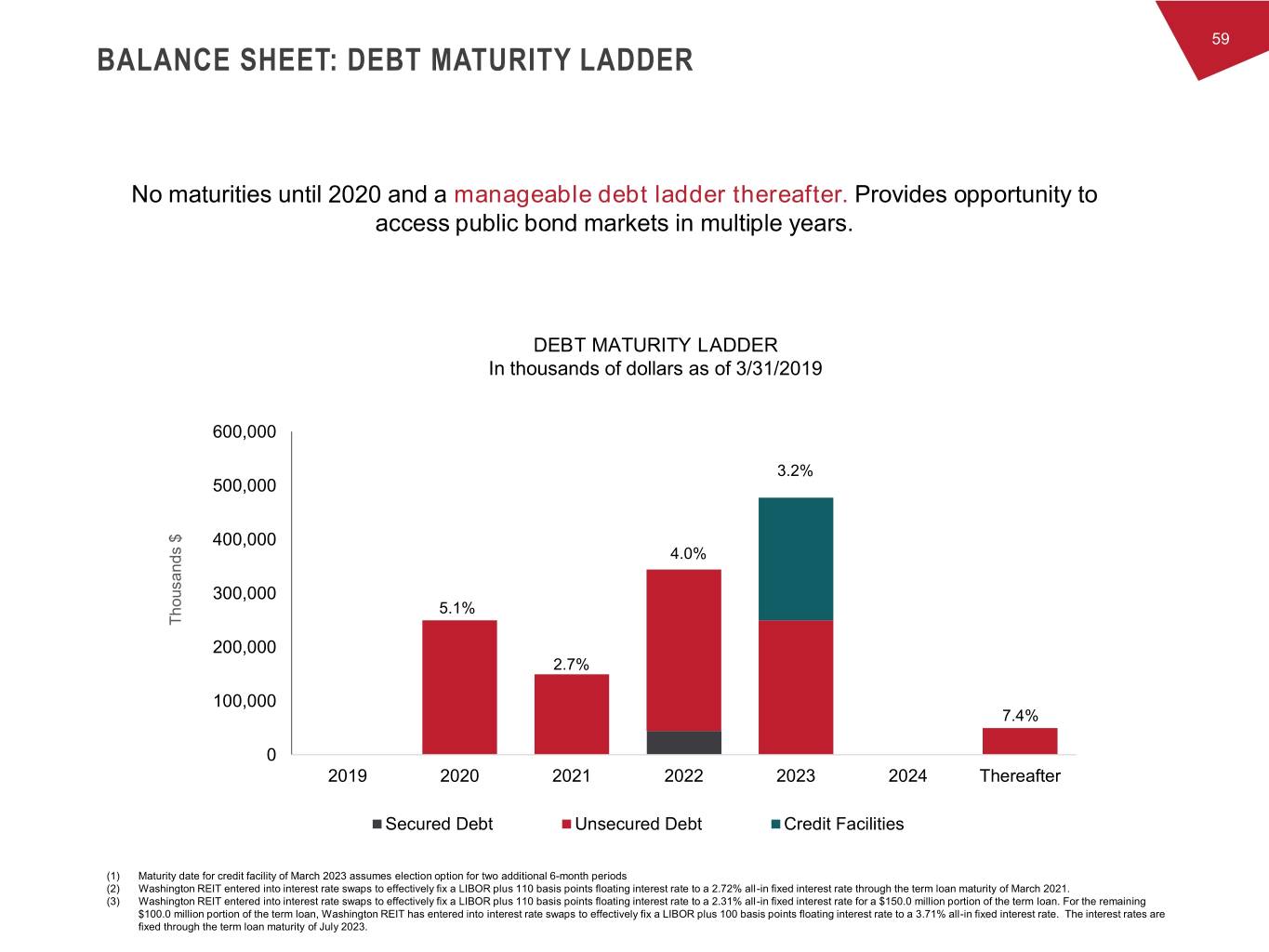

58 BALANCE SHEET: CONTINUED STRENGTH Deleveraged and unencumbered to further de-risk the company and create greater flexibility NET DEBT TO ADJUSTED EBITDA % SECURED INDEBTEDNESS TO TOTAL ASSETS 14.9% 7.64x Deleveraged Unencumbered Mid-to-low 6s 1.9% Q3 2015 Q1 2019 Q3 2015 Q1 2019 • Tracking to maintain our target of mid-to-low • Paid off $32M secured loan in Q3 2018 without 6s Net Debt to Adjusted EBITDA at year end penalty to improve an already manageable debt maturity ladder • 3.6x Debt Service Coverage Ratio • Today, we have only ~2% Secured Debt • Baa2 Stable and BBB Stable investment grade ratings from Moody’s and S&P • Unencumbered asset pool of ~$3.1 billion respectively • $700 million line of credit

59 BALANCE SHEET: DEBT MATURITY LADDER No maturities until 2020 and a manageable debt ladder thereafter. Provides opportunity to access public bond markets in multiple years. DEBT MATURITY LADDER In thousands of dollars as of 3/31/2019 600,000 3.2% 500,000 400,000 4.0% 300,000 5.1% Thousands $ Thousands 200,000 2.7% 100,000 7.4% 0 2019 2020 2021 2022 2023 2024 Thereafter Secured Debt Unsecured Debt Credit Facilities (1) Maturity date for credit facility of March 2023 assumes election option for two additional 6-month periods (2) Washington REIT entered into interest rate swaps to effectively fix a LIBOR plus 110 basis points floating interest rate to a 2.72% all-in fixed interest rate through the term loan maturity of March 2021. (3) Washington REIT entered into interest rate swaps to effectively fix a LIBOR plus 110 basis points floating interest rate to a 2.31% all-in fixed interest rate for a $150.0 million portion of the term loan. For the remaining $100.0 million portion of the term loan, Washington REIT has entered into interest rate swaps to effectively fix a LIBOR plus 100 basis points floating interest rate to a 3.71% all-in fixed interest rate. The interest rates are fixed through the term loan maturity of July 2023.

60 MARKET GROWTH OPPORTUNITIES

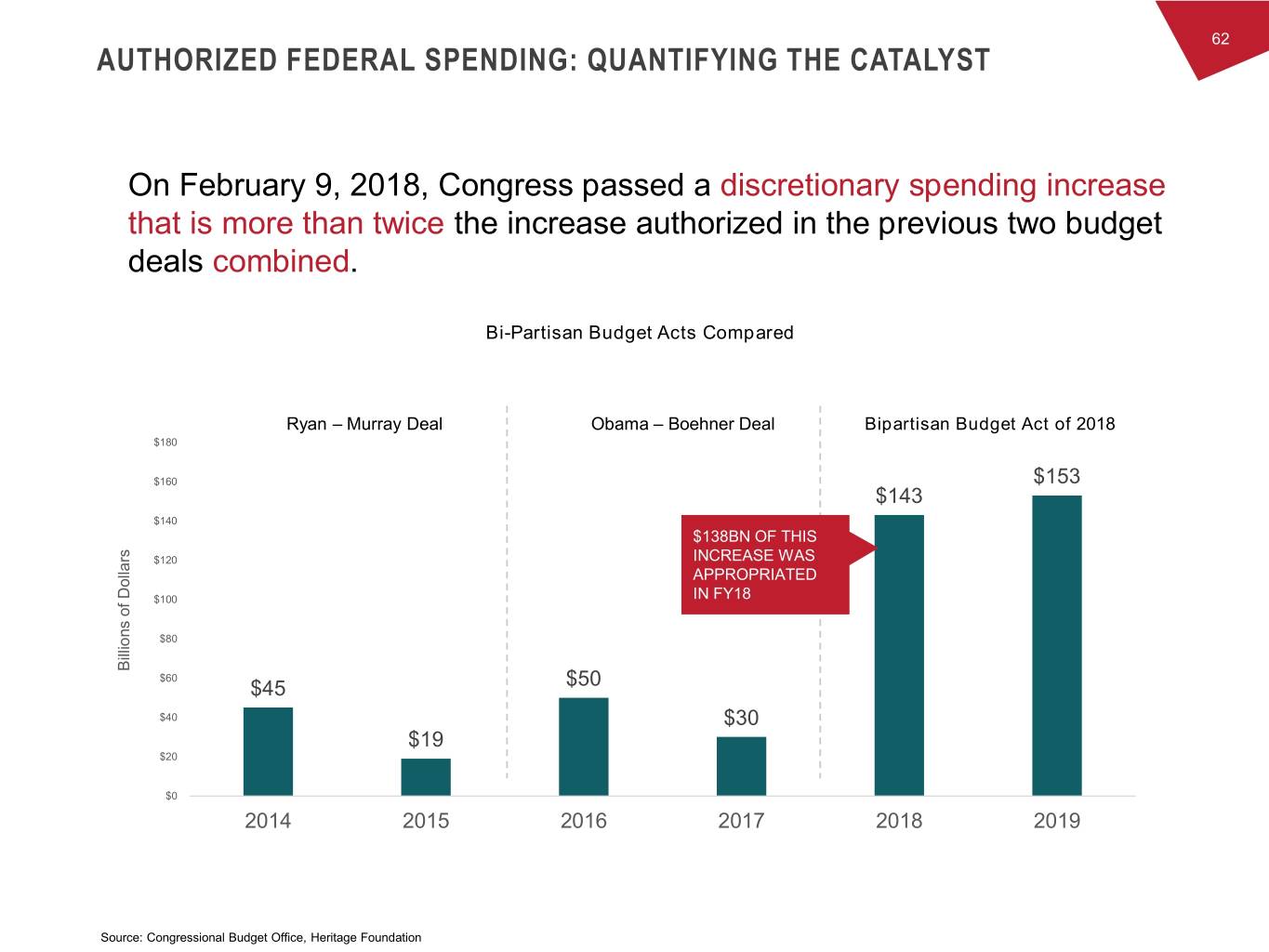

61 MARKET GROWTH: A NEW ERA Following the largest Federal spending increase since 2011 and the Amazon HQ2 win, the DC Metro region has better real estate demand fundamentals today, relative to 2011 – 2017. Moreover, following 5 years of repositioning, WashREIT’s portfolio is well- positioned to capitalize on these new demand drivers.

62 AUTHORIZED FEDERAL SPENDING: QUANTIFYING THE CATALYST On February 9, 2018, Congress passed a discretionary spending increase that is more than twice the increase authorized in the previous two budget deals combined. Bi-Partisan Budget Acts Compared Ryan – Murray Deal Obama – Boehner Deal Bipartisan Budget Act of 2018 $180 $160 $153 $143 $140 $138BN OF THIS $120 INCREASE WAS APPROPRIATED $100 IN FY18 $80 Billions of DollarsBillions $60 $45 $50 $40 $30 $19 $20 $0 2014 2015 2016 2017 2018 2019 Source: Congressional Budget Office, Heritage Foundation

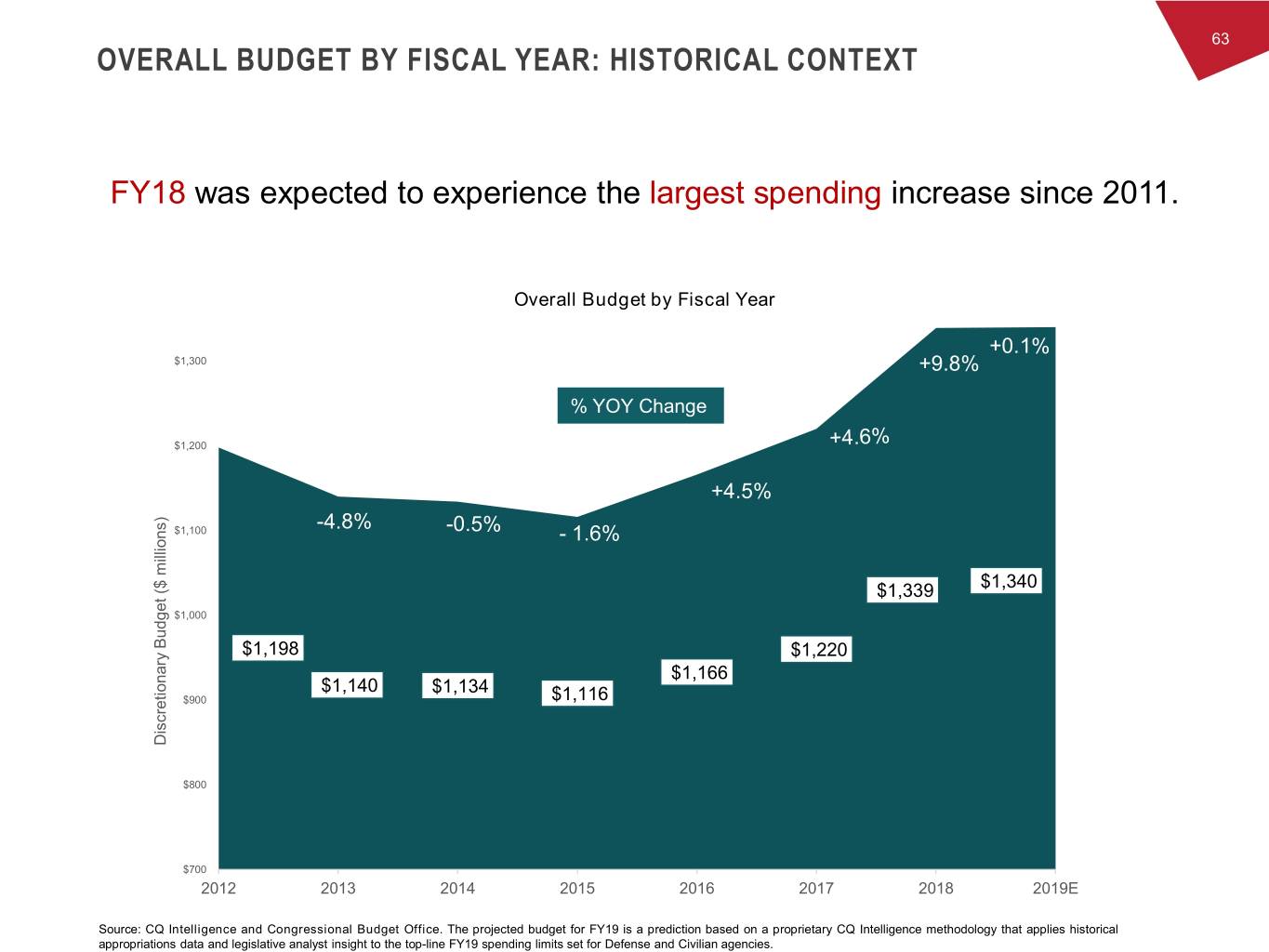

63 OVERALL BUDGET BY FISCAL YEAR: HISTORICAL CONTEXT FY18 was expected to experience the largest spending increase since 2011. Overall Budget by Fiscal Year +0.1% $1,300 +9.8% % YOY Change $1,200 +4.5% -4.8% $1,100 -0.5% - 1.6% $1,339 $1,340 $1,000 $1,198 $1,220 $1,166 $1,140 $1,134 $900 $1,116 Discretionary Budget ($ millions)Budget($ Discretionary $800 $700 2012 2013 2014 2015 2016 2017 2018 2019E Source: CQ Intelligence and Congressional Budget Office. The projected budget for FY19 is a prediction based on a proprietary CQ Intelligence methodology that applies historical appropriations data and legislative analyst insight to the top-line FY19 spending limits set for Defense and Civilian agencies.

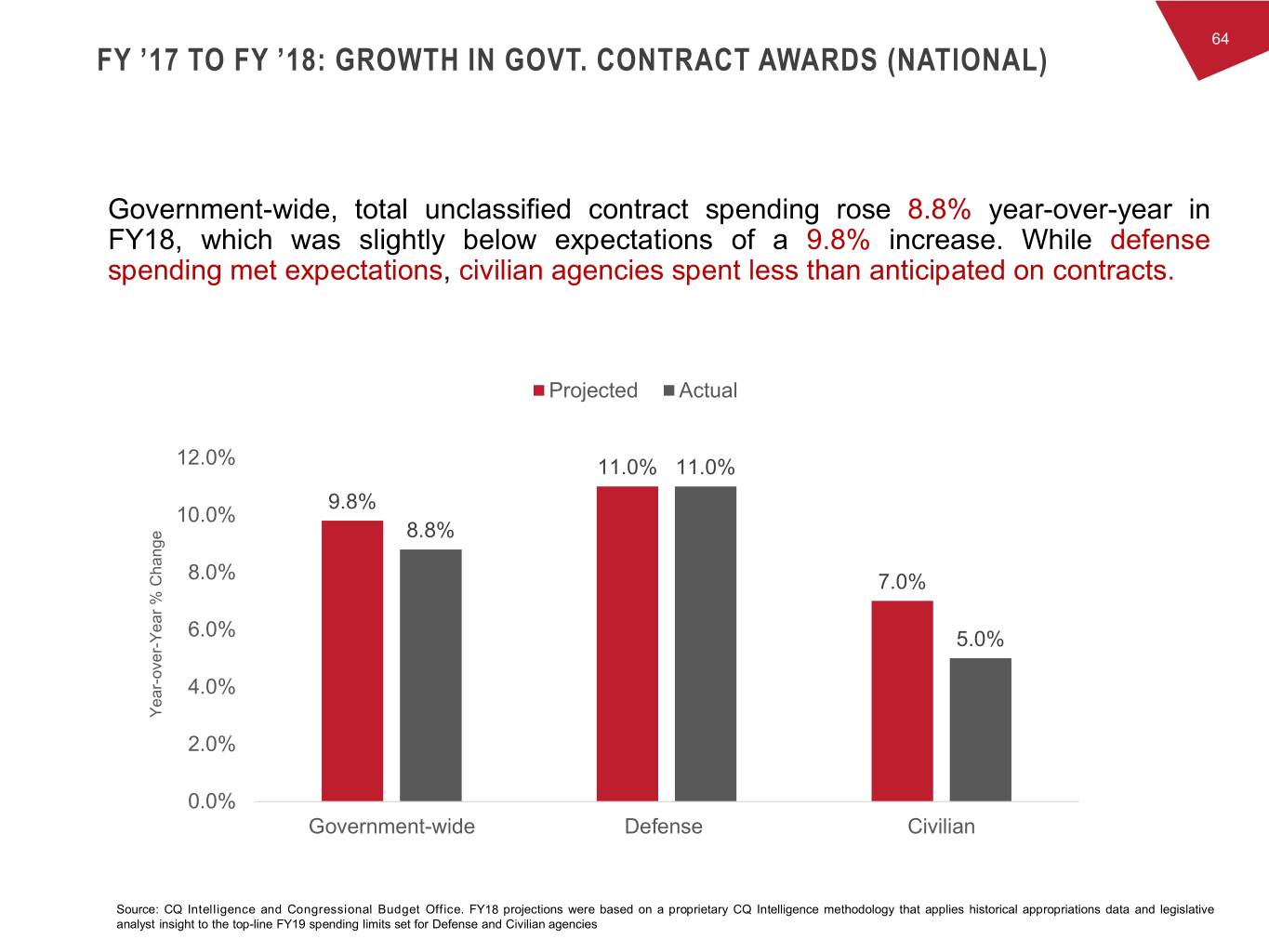

64 FY ’17 TO FY ’18: GROWTH IN GOVT. CONTRACT AWARDS (NATIONAL) Government-wide, total unclassified contract spending rose 8.8% year-over-year in FY18, which was slightly below expectations of a 9.8% increase. While defense spending met expectations, civilian agencies spent less than anticipated on contracts. Projected Actual 12.0% 11.0% 11.0% 9.8% 10.0% 8.8% 8.0% 7.0% 6.0% Year % Change Year - 5.0% over - 4.0% Year 2.0% 0.0% Government-wide Defense Civilian Source: CQ Intelligence and Congressional Budget Office. FY18 projections were based on a proprietary CQ Intelligence methodology that applies historical appropriations data and legislative analyst insight to the top-line FY19 spending limits set for Defense and Civilian agencies

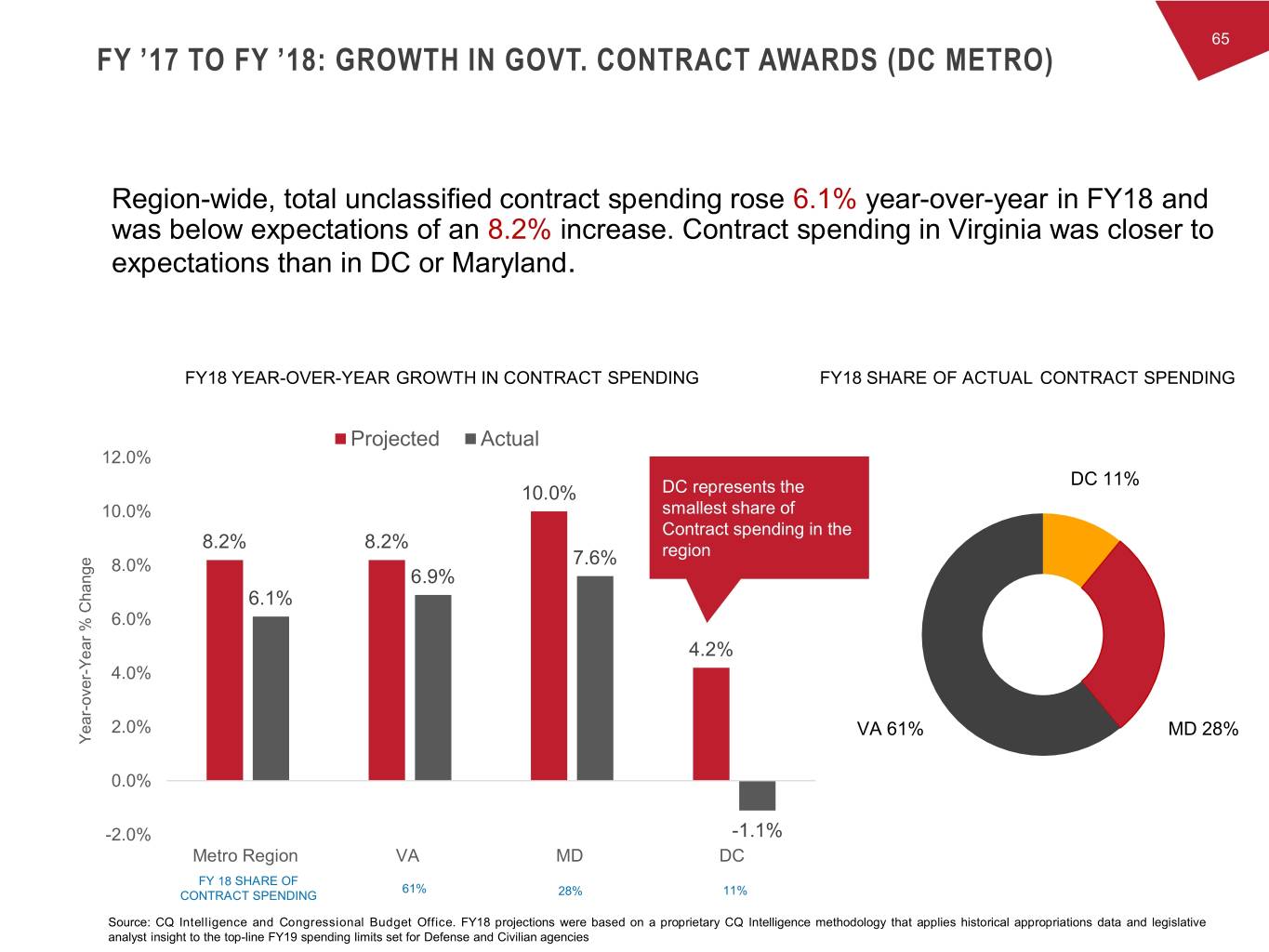

65 FY ’17 TO FY ’18: GROWTH IN GOVT. CONTRACT AWARDS (DC METRO) Region-wide, total unclassified contract spending rose 6.1% year-over-year in FY18 and was below expectations of an 8.2% increase. Contract spending in Virginia was closer to expectations than in DC or Maryland. FY18 YEAR-OVER-YEAR GROWTH IN CONTRACT SPENDING FY18 SHARE OF ACTUAL CONTRACT SPENDING Projected Actual 12.0% DC 11% 10.0% DC represents the 10.0% smallest share of Contract spending in the 8.2% 8.2% region 8.0% 7.6% 6.9% 6.1% 6.0% 4.2% Year % Change Year - 4.0% over - 2.0% VA 61% MD 28% Year 0.0% -2.0% -1.1% Metro Region VA MD DC FY 18 SHARE OF 61% CONTRACT SPENDING 28% 11% Source: CQ Intelligence and Congressional Budget Office. FY18 projections were based on a proprietary CQ Intelligence methodology that applies historical appropriations data and legislative analyst insight to the top-line FY19 spending limits set for Defense and Civilian agencies

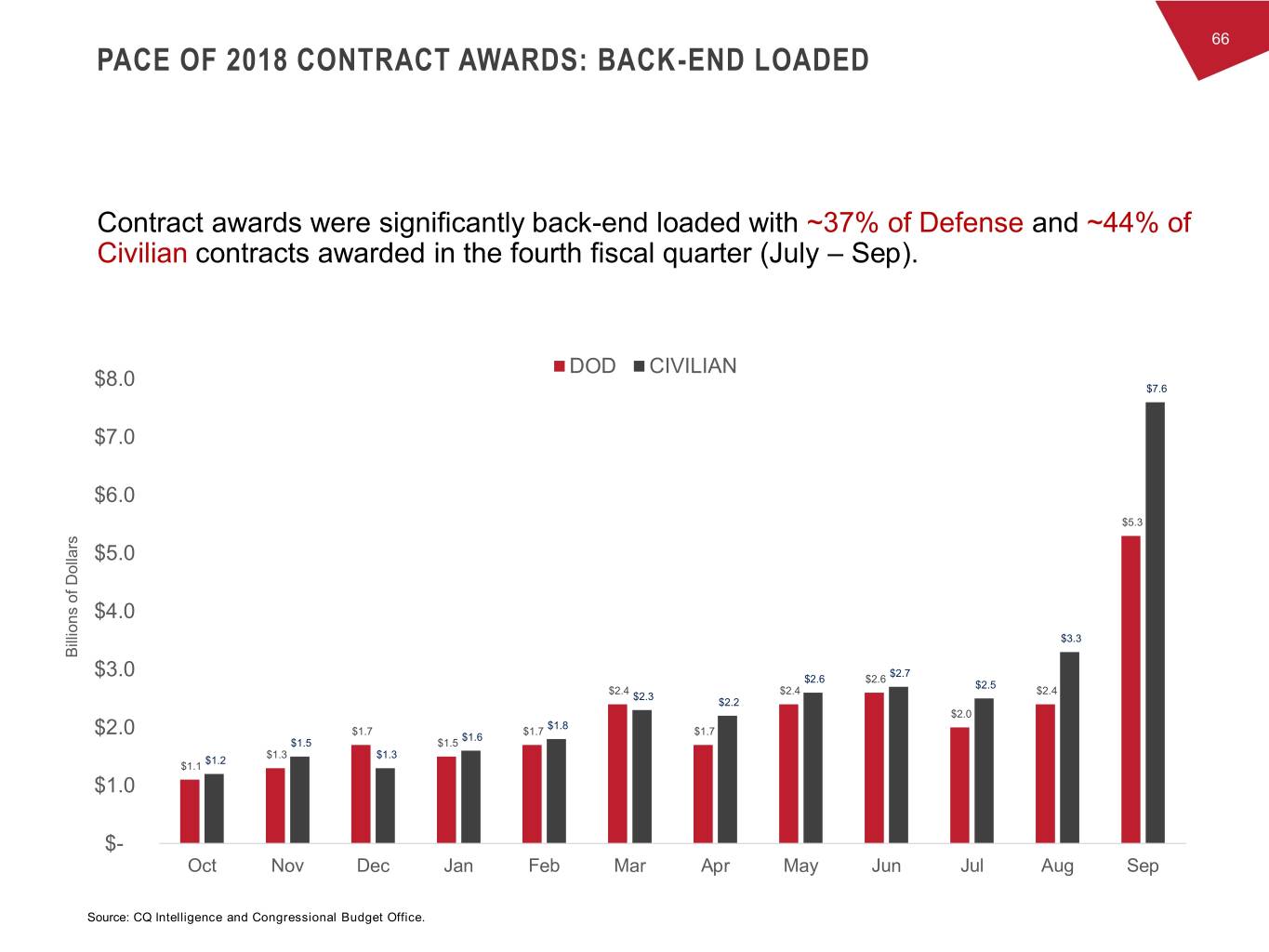

66 PACE OF 2018 CONTRACT AWARDS: BACK-END LOADED Contract awards were significantly back-end loaded with ~37% of Defense and ~44% of Civilian contracts awarded in the fourth fiscal quarter (July – Sep). DOD CIVILIAN $8.0 $7.6 $7.0 $6.0 $5.3 $5.0 $4.0 $3.3 Billions of DollarsBillions $2.7 $3.0 $2.6 $2.6 $2.5 $2.4 $2.4 $2.4 $2.3 $2.2 $2.0 $1.8 $1.7 $1.7 $1.7 $2.0 $1.6 $1.5 $1.5 $1.3 $1.3 $1.2 $1.1 $1.0 $- Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Source: CQ Intelligence and Congressional Budget Office.

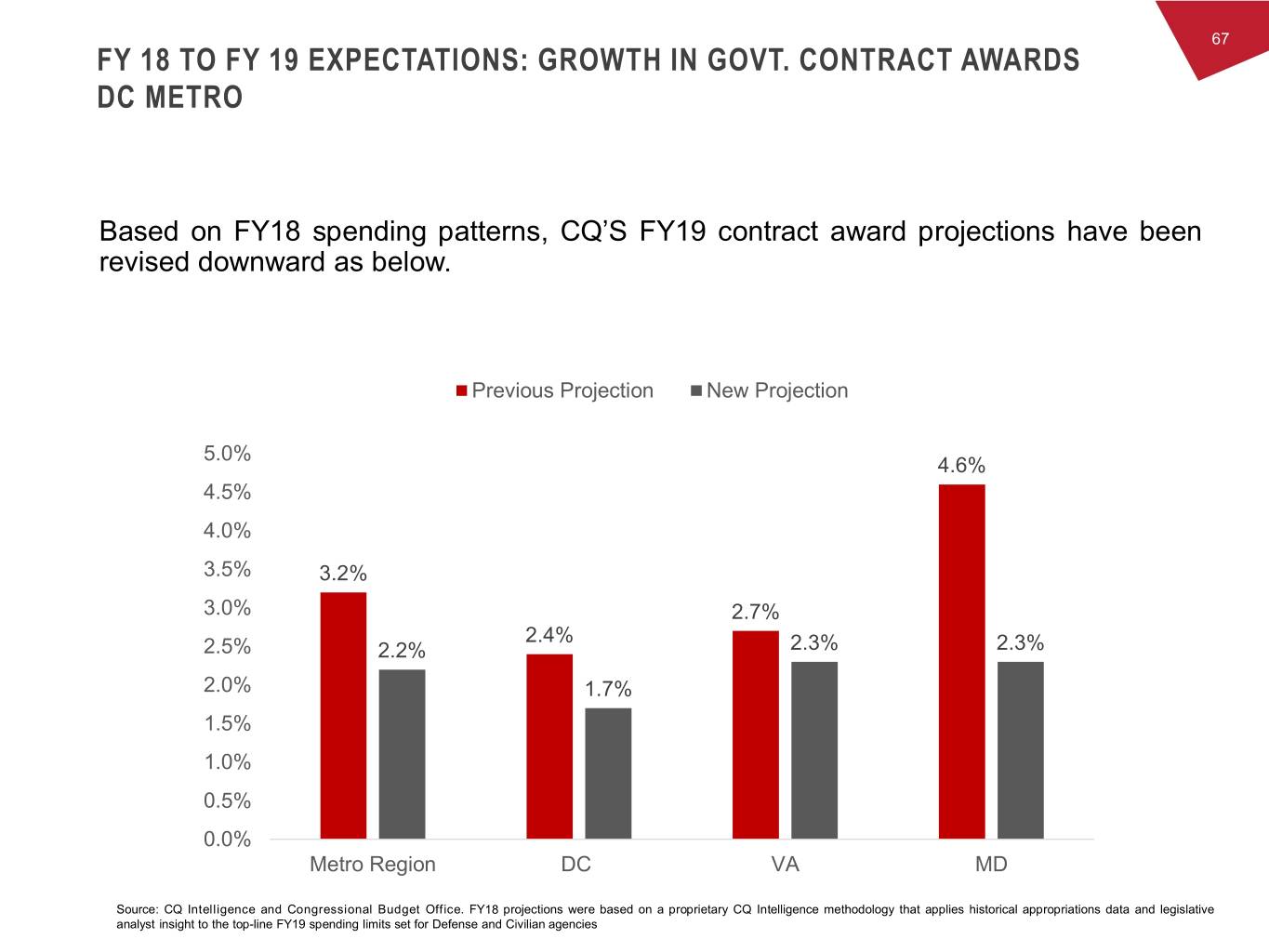

67 FY 18 TO FY 19 EXPECTATIONS: GROWTH IN GOVT. CONTRACT AWARDS DC METRO Based on FY18 spending patterns, CQ’S FY19 contract award projections have been revised downward as below. Previous Projection New Projection 5.0% 4.6% 4.5% 4.0% 3.5% 3.2% 3.0% 2.7% 2.4% 2.5% 2.2% 2.3% 2.3% 2.0% 1.7% 1.5% 1.0% 0.5% 0.0% Metro Region DC VA MD Source: CQ Intelligence and Congressional Budget Office. FY18 projections were based on a proprietary CQ Intelligence methodology that applies historical appropriations data and legislative analyst insight to the top-line FY19 spending limits set for Defense and Civilian agencies

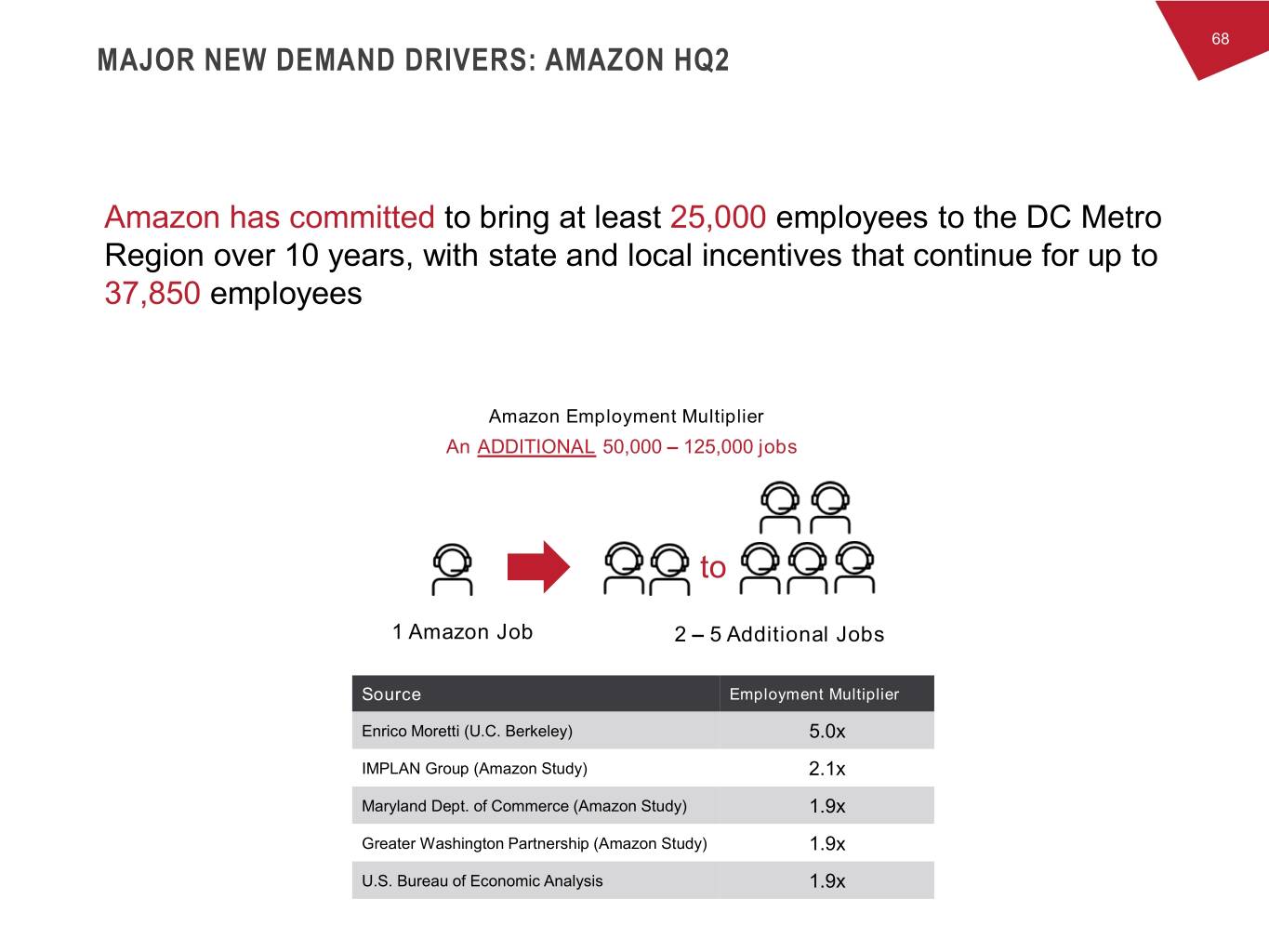

68 MAJOR NEW DEMAND DRIVERS: AMAZON HQ2 Amazon has committed to bring at least 25,000 employees to the DC Metro Region over 10 years, with state and local incentives that continue for up to 37,850 employees Amazon Employment Multiplier An ADDITIONAL 50,000 – 125,000 jobs to 1 Amazon Job 2 – 5 Additional Jobs Source Employment Multiplier Enrico Moretti (U.C. Berkeley) 5.0x IMPLAN Group (Amazon Study) 2.1x Maryland Dept. of Commerce (Amazon Study) 1.9x Greater Washington Partnership (Amazon Study) 1.9x U.S. Bureau of Economic Analysis 1.9x

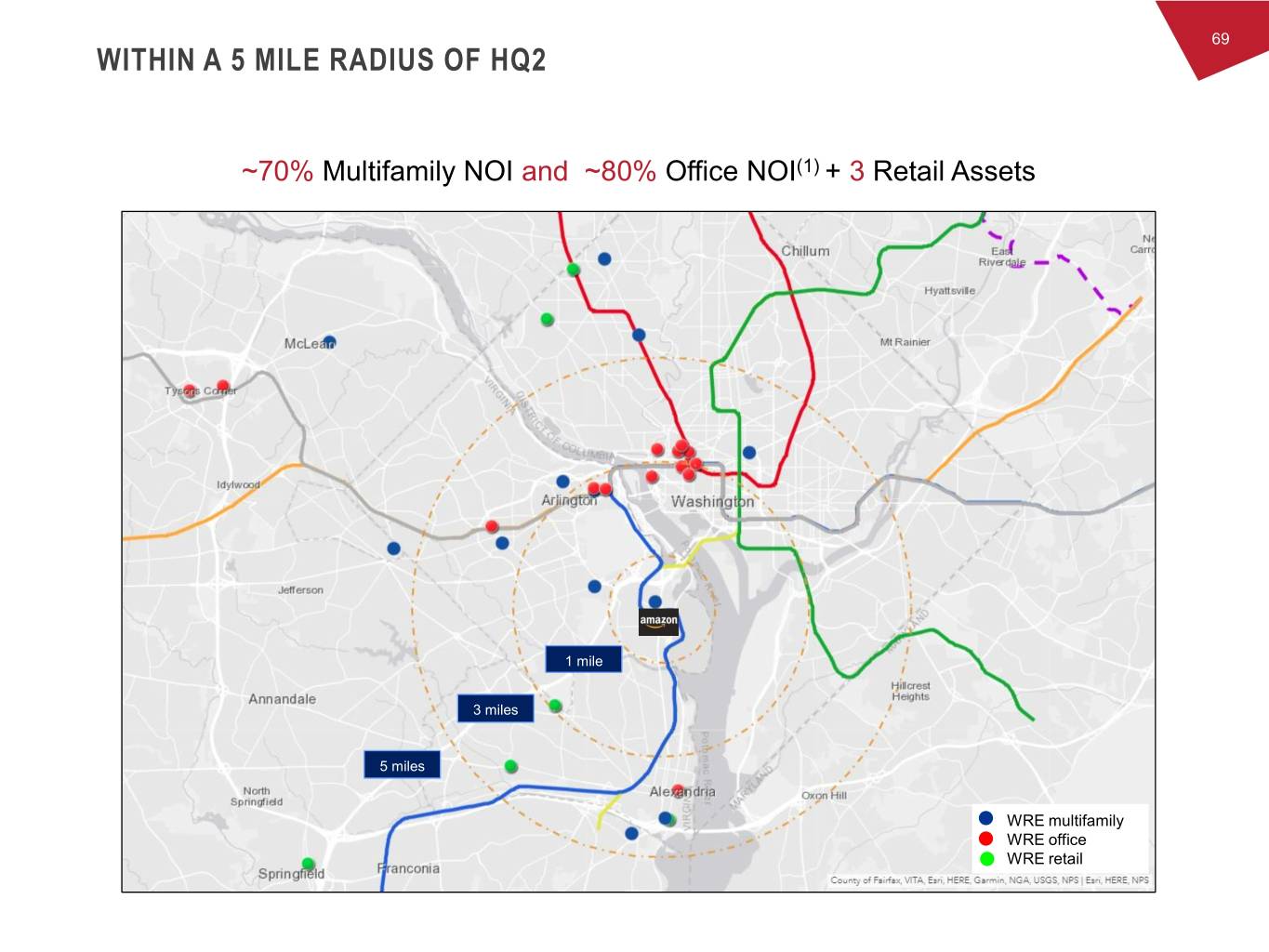

69 WITHIN A 5 MILE RADIUS OF HQ2 ~70% Multifamily NOI and ~80% Office NOI(1) + 3 Retail Assets 1 mile 3 miles 5 miles WRE multifamily WRE office WRE retail

70 STRONG SENIOR LEADERSHIP TEAM PAUL MCDERMOTT STEVE RIFFEE TARYN FIELDER ED MURN CHAIRMAN, PRESIDENT AND EXECUTIVE VICE PRESIDENT SENIOR VICE PRESIDENT MANAGING DIRECTOR CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL GENERAL COUNSEL AND MULTIFAMILY AND >34 Years Real Estate OFFICER CORPORATE SECRETARY DEVELOPMENT DIVISION Experience >23 Years Real Estate >15 Years Real Estate >19 Years Real Estate Experience Experience Experience ANTHONY CHANG MANDI WEDIN ANDREW LEAHY TABITHA BRITTAIN VICE PRESIDENT VICE PRESIDENT VICE PRESIDENT VICE PRESIDENT ASSET MANAGEMENT ASSET MANAGEMENT INVESTMENTS PROPERTY MANAGEMENT >18 Years Real Estate >20 Years Real Estate >16 Years Real Estate >22 Years Real Estate Experience Experience Experience Experience

71 STRONG SENIOR LEADERSHIP TEAM BRIAN GUTTMAN SUSAN GEROCK DREW HAMMOND TEJAL ENGMAN VICE PRESIDENT VICE PRESIDENT VICE PRESIDENT CHIEF VICE PRESIDENT HUMAN RESOURCES INFORMATION TECHNOLOGY ACCOUNTING OFFICER AND INVESTOR RELATIONS >16 Years Real Estate AND CHIEF INFORMATION TREASURER >5 Years Real Estate + >8 Years Experience OFFICER >14 Years Real Estate Finance Experience >19 Years Real Estate Experience Experience DAN CHAPPELL NICOLE MORRILL DEANNA SCHMIDT GRANT MONTGOMERY SENIOR DIRECTOR SENIOR DIRECTOR SENIOR DIRECTOR DIRECTOR RESEARCH INVESTMENTS DEVELOPMENT MARKETING AND CORPORATE >22 Years Real Estate >13 Years Real Estate >18 Years Real Estate COMMUNICATIONS Experience Experience Experience >10 Years Real Estate Experience

72 MULTIFAMILY 01 Deliveries outlook, absorption and occupancy trends 02 DC OFFICE Appendix: 2019 – 2020 supply projections for Glass Box A Everything else you may want to know 03 SUSTAINABILITY Key achievements and Long-term Goals 04 FINANCIAL SUPPLEMENTAL Key pages

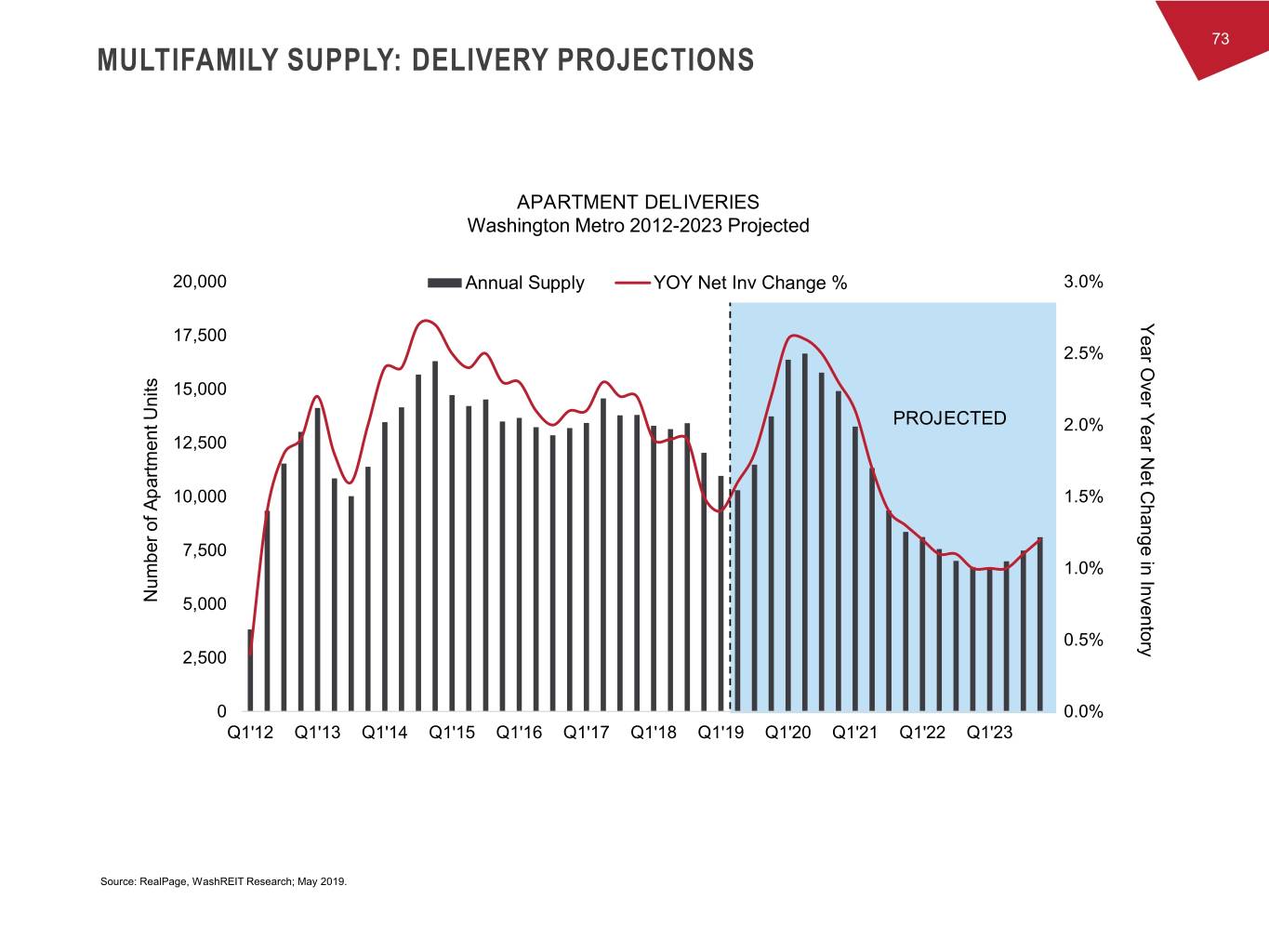

73 MULTIFAMILY SUPPLY: DELIVERY PROJECTIONS APARTMENT DELIVERIES Washington Metro 2012-2023 Projected 20,000 Annual Supply YOY Net Inv Change % 3.0% Year Over 17,500 2.5% 15,000 Year Net Change Inventoryin PROJECTED 2.0% 12,500 10,000 1.5% 7,500 1.0% Number of Apartment Units Apartment of Number 5,000 0.5% 2,500 0 0.0% Q1'12 Q1'13 Q1'14 Q1'15 Q1'16 Q1'17 Q1'18 Q1'19 Q1'20 Q1'21 Q1'22 Q1'23 Source: RealPage, WashREIT Research; May 2019.

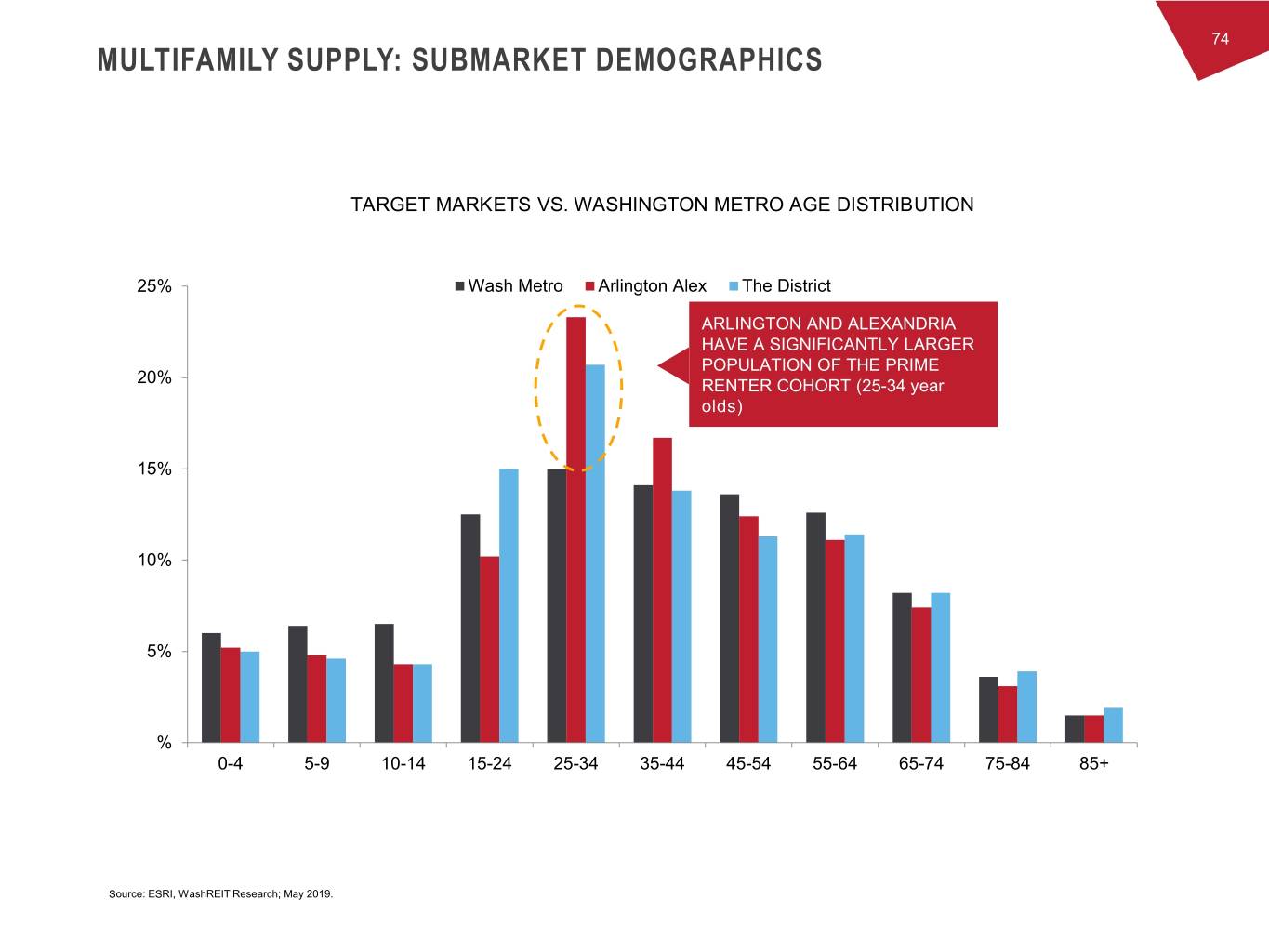

74 MULTIFAMILY SUPPLY: SUBMARKET DEMOGRAPHICS TARGET MARKETS VS. WASHINGTON METRO AGE DISTRIBUTION 25% Wash Metro Arlington Alex The District ARLINGTON AND ALEXANDRIA HAVE A SIGNIFICANTLY LARGER POPULATION OF THE PRIME 20% RENTER COHORT (25-34 year olds) 15% 10% 5% % 0-4 5-9 10-14 15-24 25-34 35-44 45-54 55-64 65-74 75-84 85+ Source: ESRI, WashREIT Research; May 2019.

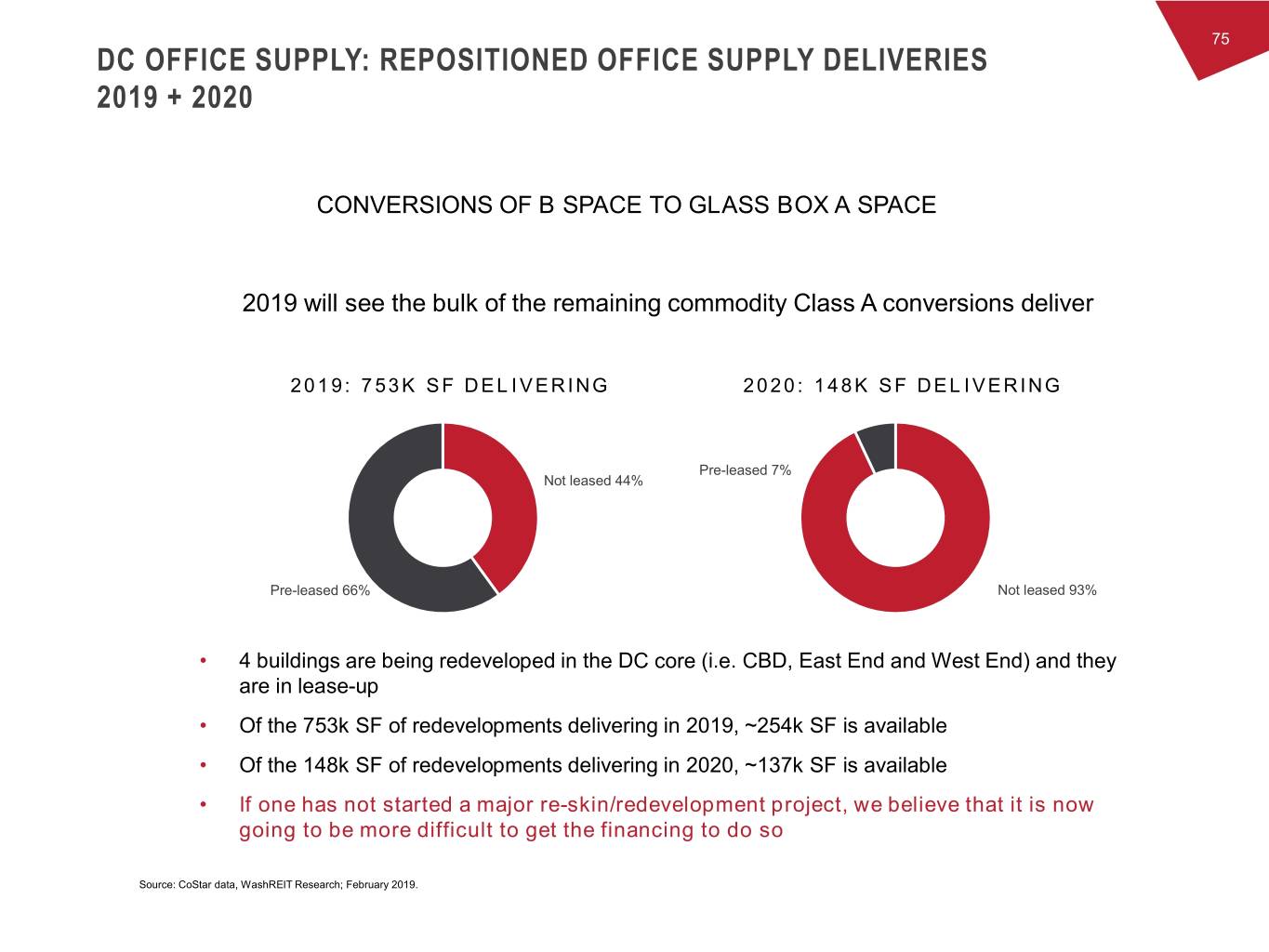

75 DC OFFICE SUPPLY: REPOSITIONED OFFICE SUPPLY DELIVERIES 2019 + 2020 CONVERSIONS OF B SPACE TO GLASS BOX A SPACE 2019 will see the bulk of the remaining commodity Class A conversions deliver 2019: 753K SF DELIVERING 2020: 148K SF DELIVERING Pre-leased 7% Not leased 44% Pre-leased 66% Not leased 93% • 4 buildings are being redeveloped in the DC core (i.e. CBD, East End and West End) and they are in lease-up • Of the 753k SF of redevelopments delivering in 2019, ~254k SF is available • Of the 148k SF of redevelopments delivering in 2020, ~137k SF is available • If one has not started a major re-skin/redevelopment project, we believe that it is now going to be more difficult to get the financing to do so Source: CoStar data, WashREIT Research; February 2019.

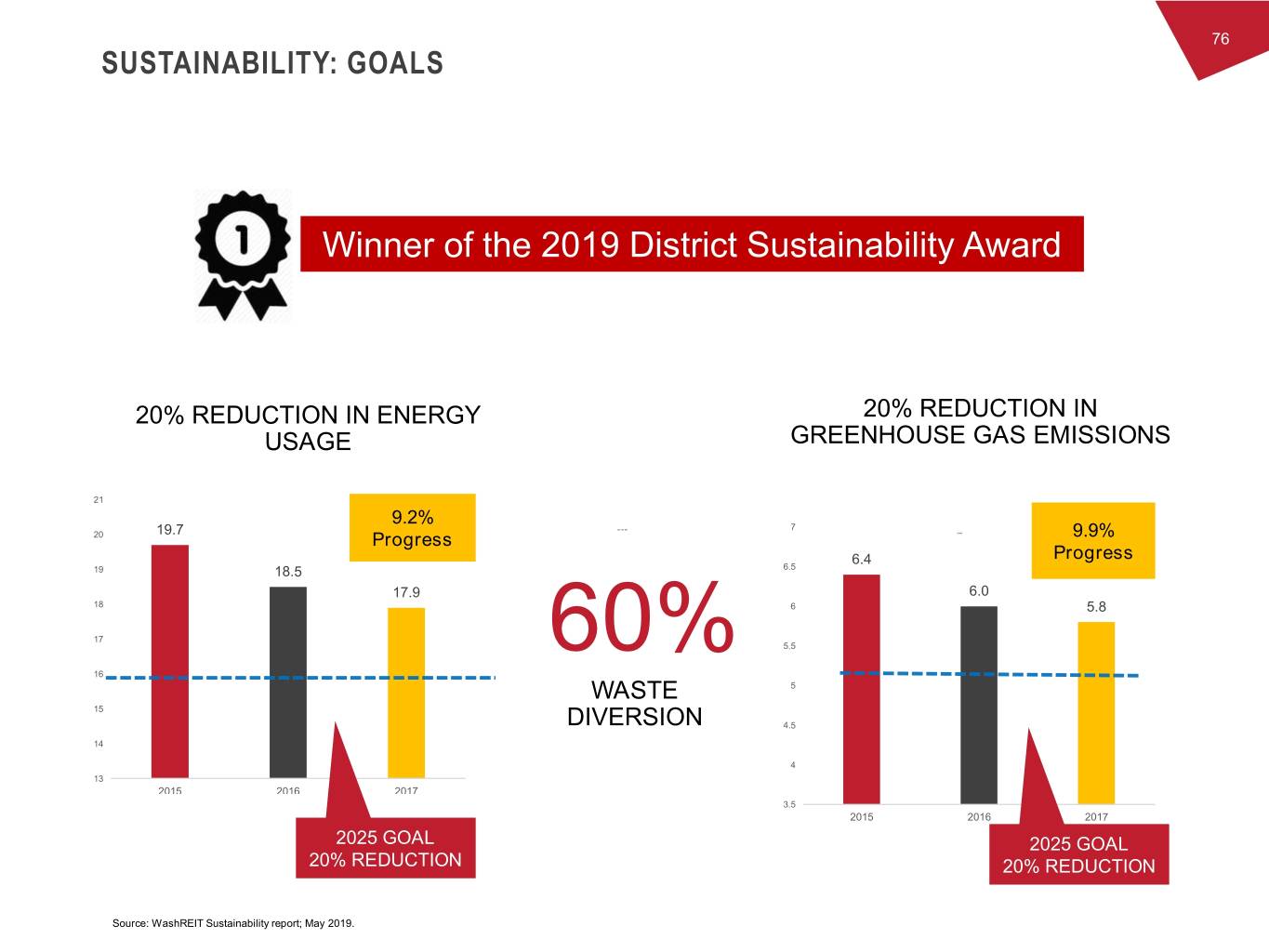

76 SUSTAINABILITY: GOALS Winner of the 2019 District Sustainability Award 20% REDUCTION IN ENERGY 20% REDUCTION IN USAGE GREENHOUSE GAS EMISSIONS 21 9.2% OUT OF 100 7 19.7 YEARS 20 Progress 9.9% 6.4 Progress 19 18.5 6.5 17.9 6.0 18 6 5.8 17 60% 5.5 16 WASTE 5 15 DIVERSION 4.5 14 4 13 2015 2016 2017 3.5 2015 2016 2017 2025 GOAL 2025 GOAL 20% REDUCTION 20% REDUCTION Source: WashREIT Sustainability report; May 2019.

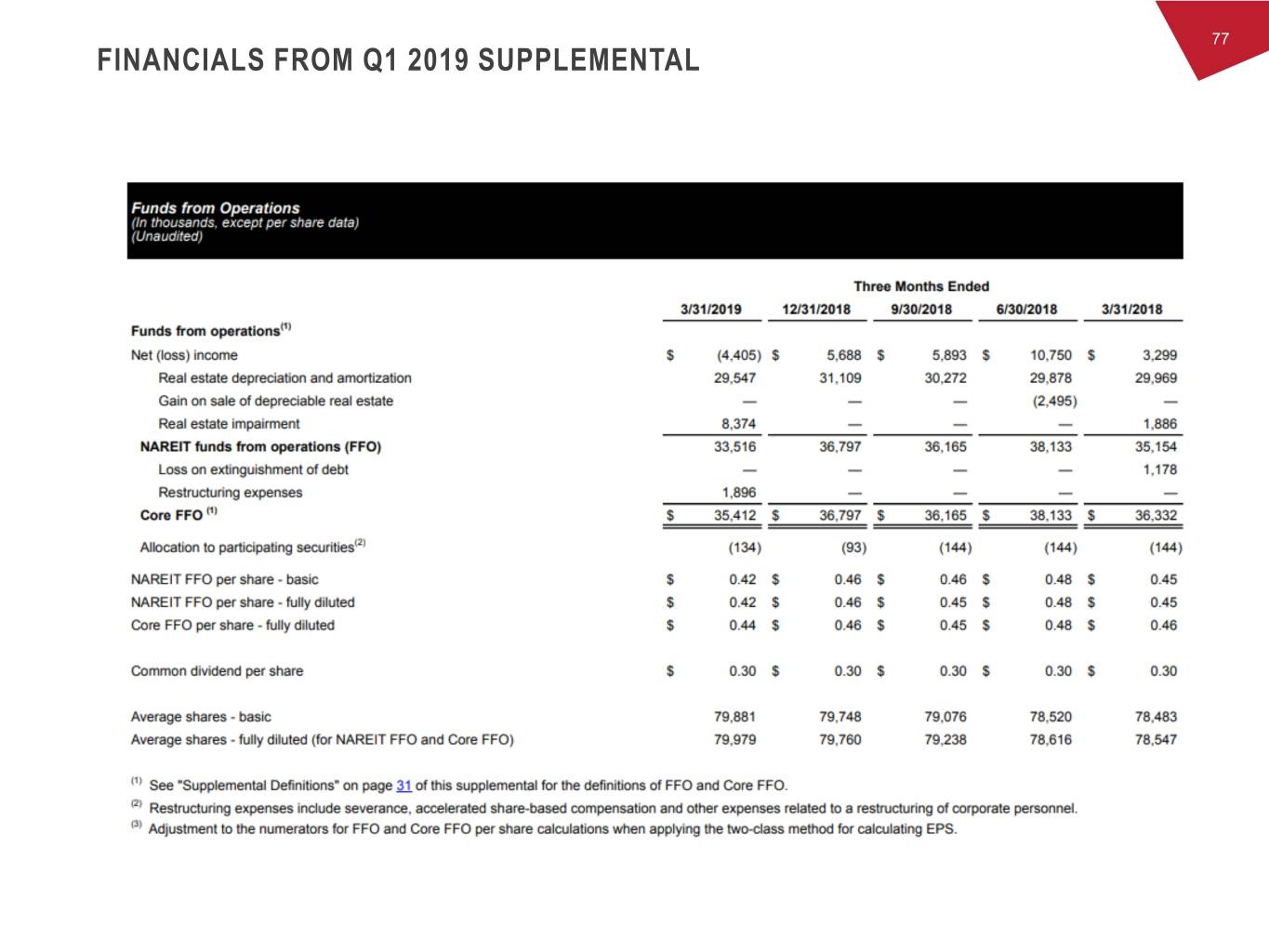

77 FINANCIALS FROM Q1 2019 SUPPLEMENTAL

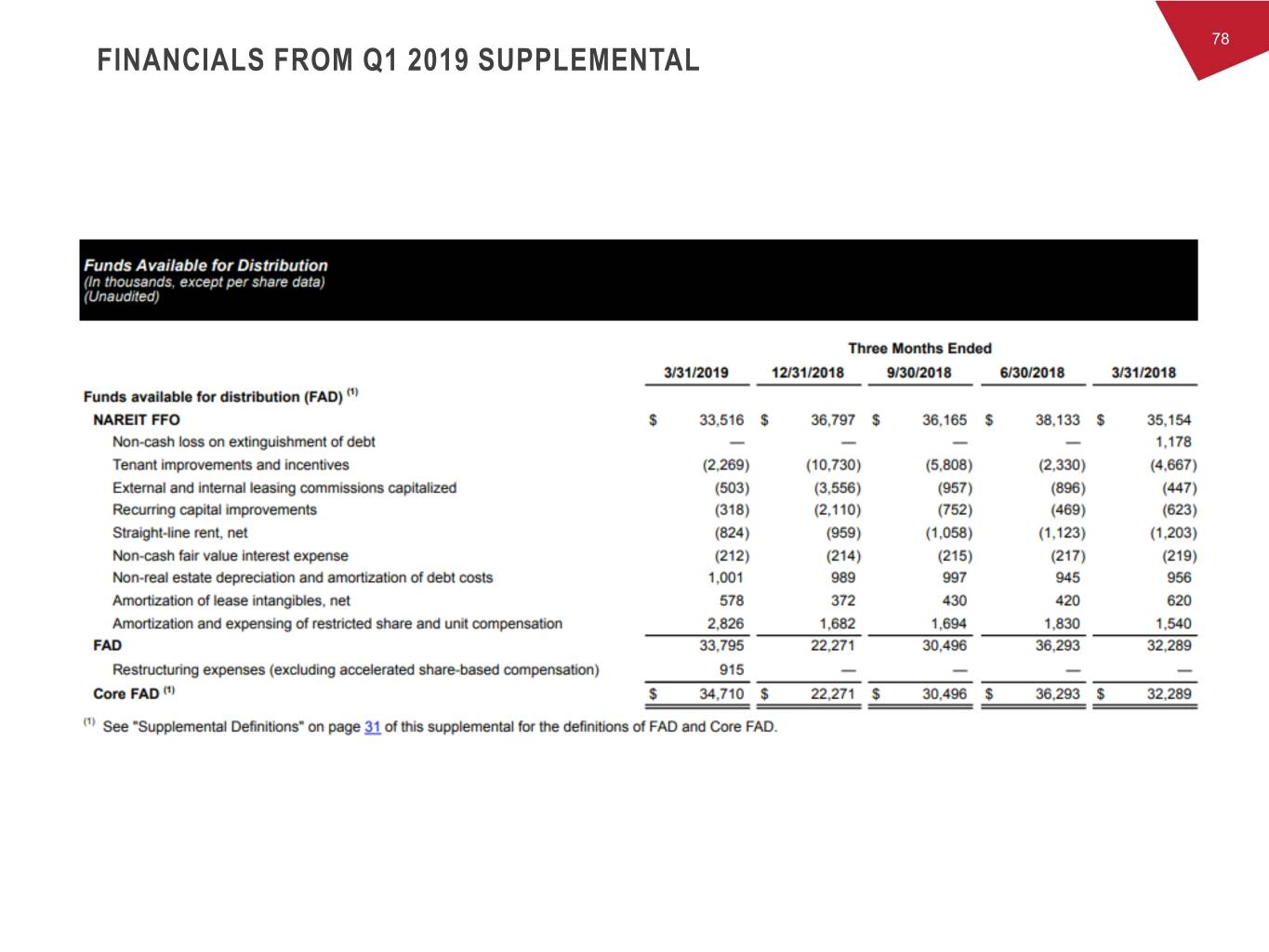

78 FINANCIALS FROM Q1 2019 SUPPLEMENTAL

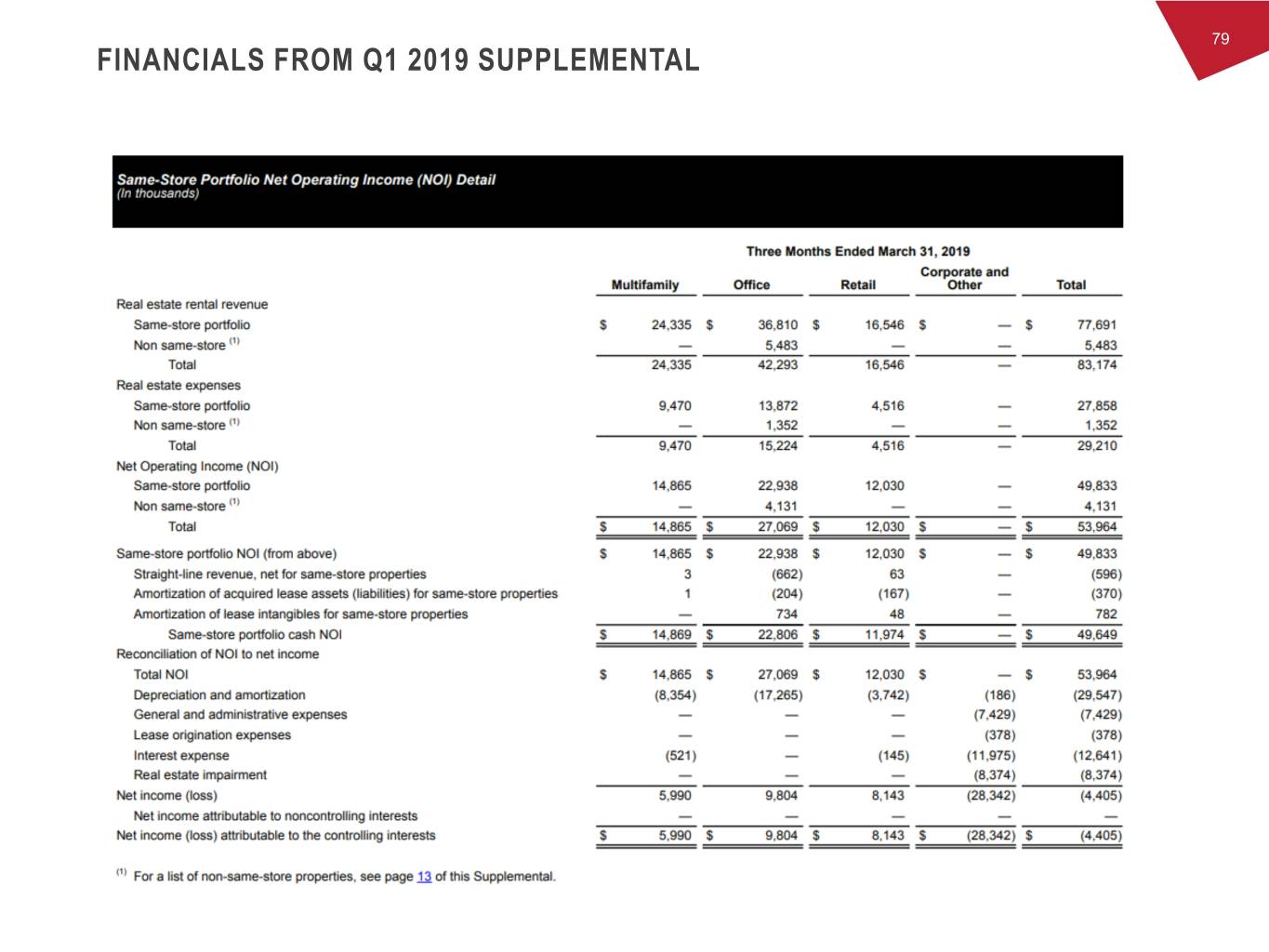

79 FINANCIALS FROM Q1 2019 SUPPLEMENTAL

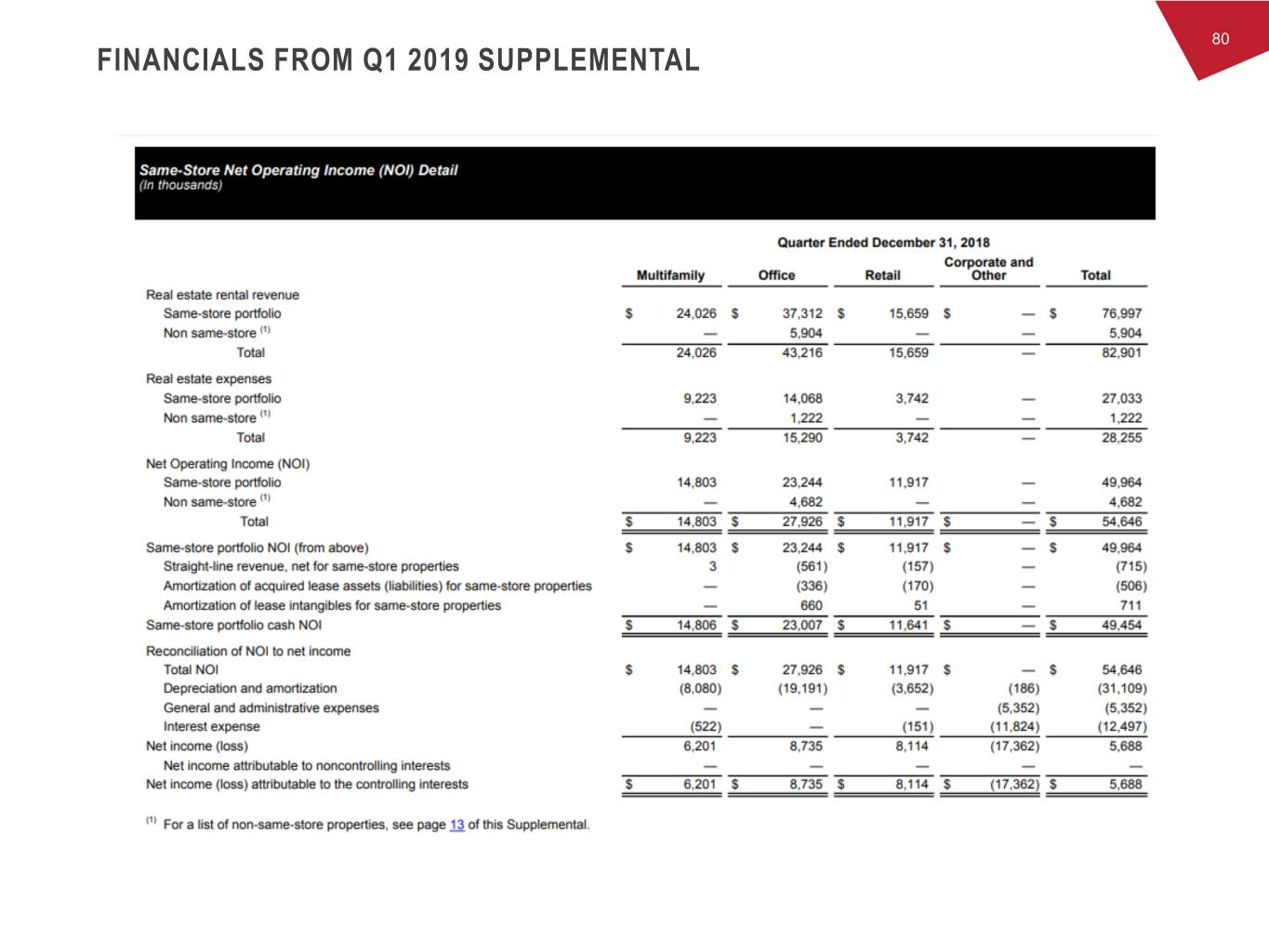

80 FINANCIALS FROM Q1 2019 SUPPLEMENTAL

81 DEFINITIONS FROM Q1 2019 SUPPLEMENTAL

82 DEFINITIONS FROM Q1 2019 SUPPLEMENTAL