1 2019 STRATEGIC CAPITAL ALLOCATION PLAN Investor Presentation – June 26, 2019

2 DISCLOSURES Forward-Looking Statements Certain statements in this press release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Such statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Washington REIT to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to the risks associated with the ownership of real estate in general and our real estate assets in particular; the risk that any of the assumptions on which our pro formas is based are incorrect, risk of failure to enter into and/or complete contemplated acquisitions and dispositions at all, within the price ranges anticipated and on the terms and timing anticipated; the economic health of the greater Washington Metro region; fluctuations in interest rates; reductions in or actual or threatened changes to the timing of federal government spending; the risks related to use of third-party providers and joint venture partners; the ability to control our operating expenses; the economic health of our tenants; the supply of competing properties; shifts away from brick and mortar stores to ecommerce; the availability and terms of financing and capital and the general volatility of securities markets; compliance with applicable laws, including those concerning the environment and access by persons with disabilities; terrorist attacks or actions and/or cyber attacks; weather conditions and natural disasters; ability to maintain key personnel; failure to qualify and maintain our qualification as a REIT and the risks of changes in laws affecting REITs; and other risks and uncertainties detailed from time to time in our filings with the SEC, including our 2018 Form 10-K and subsequent Quarterly Reports on Form 10-Q. While forward- looking statements reflect our good faith beliefs, they are not guarantees of future performance. We undertake no obligation to update our forward-looking statements or risk factors to reflect new information, future events, or otherwise. Use of Non-GAAP Financial Measures and other Definitions This presentation contains certain non-GAAP financial measures and other terms that have particular definitions when used by us. The definitions and calculations of these non-GAAP financial measures and other terms may differ from those used by other REITs and, accordingly, may not be comparable. Please refer to the definitions and calculations of these terms and the reasons for their use, and reconciliations to the most directly comparable GAAP measures included later in this investor presentation.

3 Basis of presentation This presentation assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. Except with respect to those transactions that have actually closed (the acquisition of the five Virginia assets in the seven-property Assembly portfolio and the sale of Quantico Corporate Center), no assurance can be given as to the timing, final transaction terms or ultimate completion of these transactions. In the event that any or all of the transactions or proposed transactions that have not yet closed do not eventually close or do not close on the timing and for the values anticipated, the anticipated results presented in this investor presentation may not be achieved. Additionally, even in the event that all of the transactions under contract close and the proposed transactions become under contract and subsequently close, on time and for the values anticipated, in each case, we can give no assurance that the potential results presented in this investor presentation will be achieved. Reconciliation This presentation also includes certain forward-looking non-GAAP information. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these estimates, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable efforts.

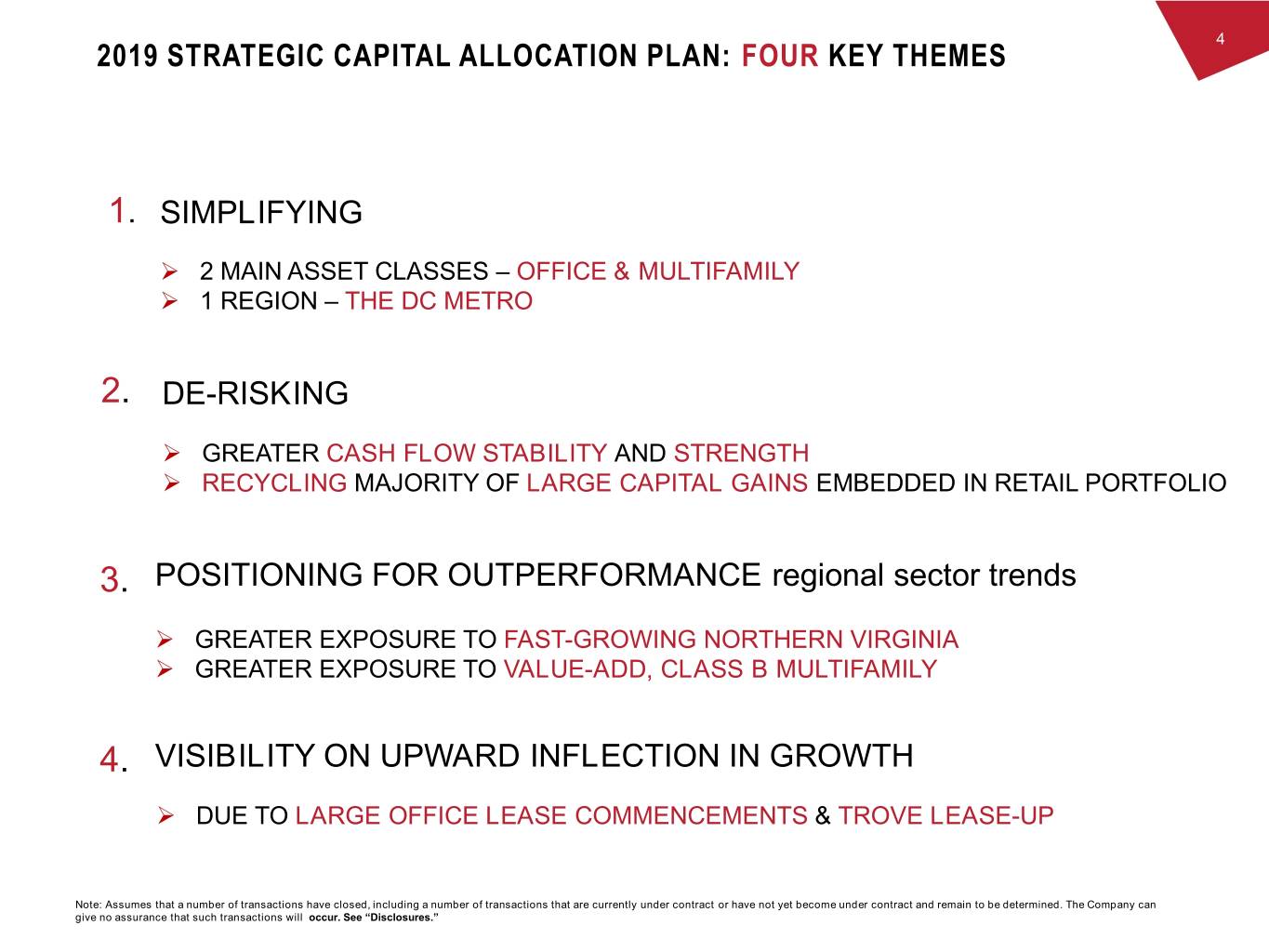

4 2019 STRATEGIC CAPITAL ALLOCATION PLAN: FOUR KEY THEMES 1. SIMPLIFYING 2 MAIN ASSET CLASSES – OFFICE & MULTIFAMILY 1 REGION – THE DC METRO 2. DE-RISKING GREATER CASH FLOW STABILITY AND STRENGTH RECYCLING MAJORITY OF LARGE CAPITAL GAINS EMBEDDED IN RETAIL PORTFOLIO 3. POSITIONING FOR OUTPERFORMANCE regional sector trends GREATER EXPOSURE TO FAST-GROWING NORTHERN VIRGINIA GREATER EXPOSURE TO VALUE-ADD, CLASS B MULTIFAMILY 4. VISIBILITY ON UPWARD INFLECTION IN GROWTH DUE TO LARGE OFFICE LEASE COMMENCEMENTS & TROVE LEASE-UP Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

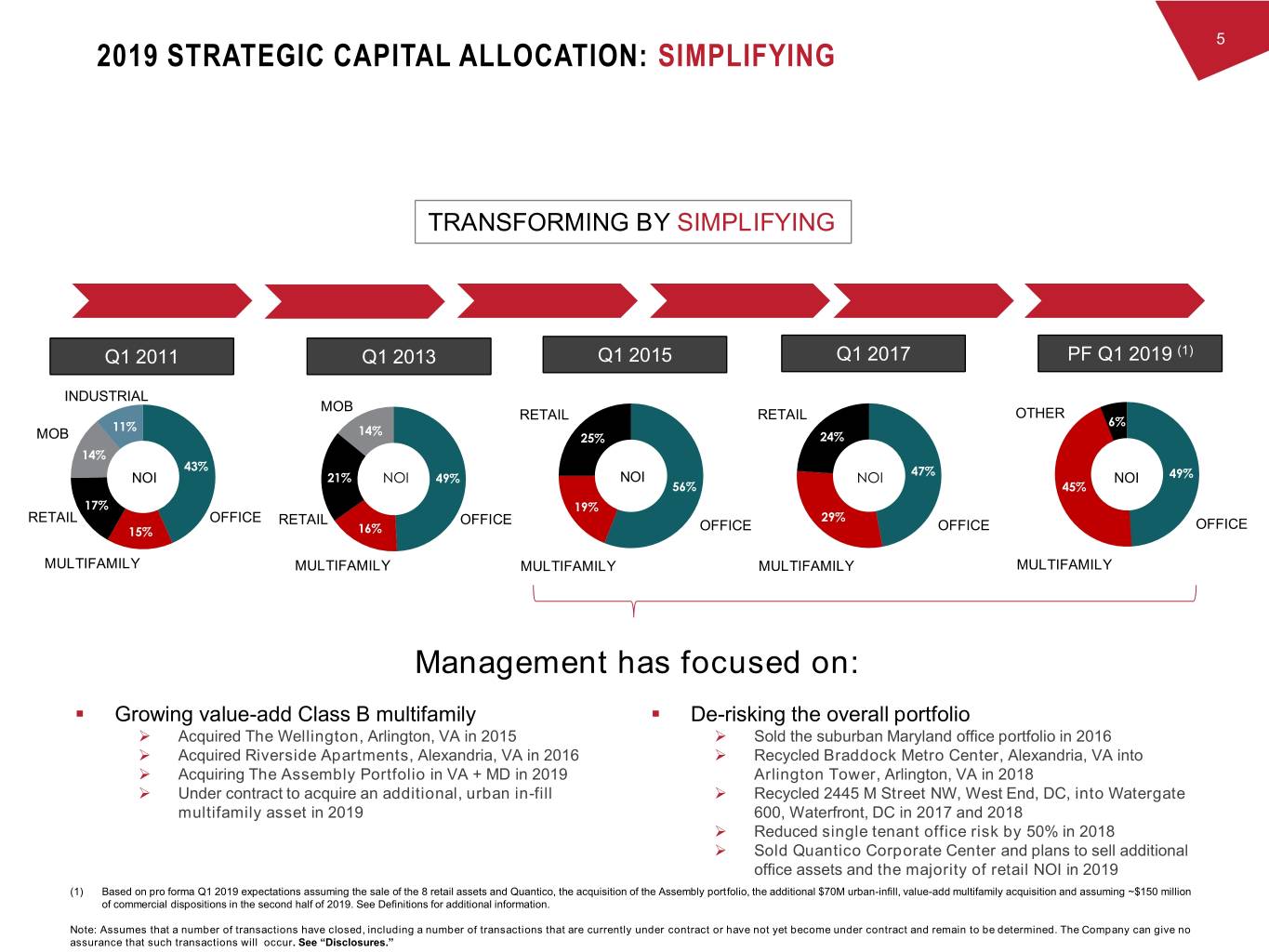

5 2019 STRATEGIC CAPITAL ALLOCATION: SIMPLIFYING TRANSFORMING BY SIMPLIFYING Q1 2011 Q1 2013 Q1 2015 Q1 2017 PF Q1 2019 (1) INDUSTRIAL MOB RETAIL OTHER RETAIL 6% 11% 14% MOB 25% 24% 14% 43% 47% NOI 21% NOI 49% NOI NOI NOI 49% 56% 45% 17% 19% RETAIL OFFICE RETAIL OFFICE 29% OFFICE 15% 16% OFFICE OFFICE MULTIFAMILY MULTIFAMILY MULTIFAMILY MULTIFAMILY MULTIFAMILY Management has focused on: . Growing value-add Class B multifamily . De-risking the overall portfolio Acquired The Wellington, Arlington, VA in 2015 Sold the suburban Maryland office portfolio in 2016 Acquired Riverside Apartments, Alexandria, VA in 2016 Recycled Braddock Metro Center, Alexandria, VA into Acquiring The Assembly Portfolio in VA + MD in 2019 Arlington Tower, Arlington, VA in 2018 Under contract to acquire an additional, urban in-fill Recycled 2445 M Street NW, West End, DC, into Watergate multifamily asset in 2019 600, Waterfront, DC in 2017 and 2018 Reduced single tenant office risk by 50% in 2018 Sold Quantico Corporate Center and plans to sell additional office assets and the majority of retail NOI in 2019 (1) Based on pro forma Q1 2019 expectations assuming the sale of the 8 retail assets and Quantico, the acquisition of the Assembly portfolio, the additional $70M urban-infill, value-add multifamily acquisition and assuming ~$150 million of commercial dispositions in the second half of 2019. See Definitions for additional information. Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

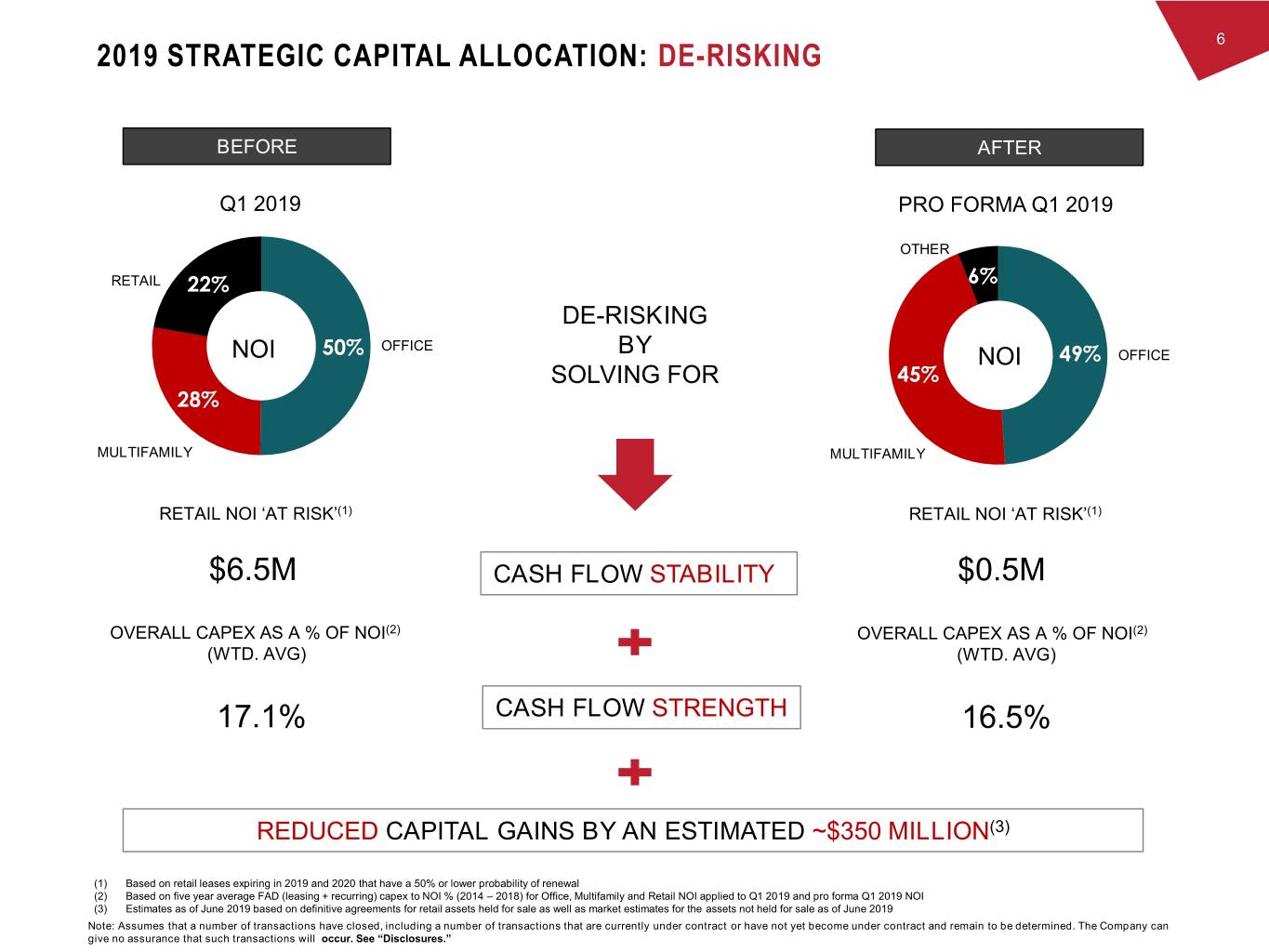

6 2019 STRATEGIC CAPITAL ALLOCATION: DE-RISKING BEFORE AFTER Q1 2019 PRO FORMA Q1 2019 OTHER RETAIL 22% 6% DE-RISKING 50% OFFICE BY NOI NOI 49% OFFICE SOLVING FOR 45% 28% MULTIFAMILY MULTIFAMILY RETAIL NOI ‘AT RISK’(1) RETAIL NOI ‘AT RISK’(1) $6.5M CASH FLOW STABILITY $0.5M OVERALL CAPEX AS A % OF NOI(2) OVERALL CAPEX AS A % OF NOI(2) (WTD. AVG) (WTD. AVG) 17.1% CASH FLOW STRENGTH 16.5% REDUCED CAPITAL GAINS BY AN ESTIMATED ~$350 MILLION(3) (1) Based on retail leases expiring in 2019 and 2020 that have a 50% or lower probability of renewal (2) Based on five year average FAD (leasing + recurring) capex to NOI % (2014 – 2018) for Office, Multifamily and Retail NOI applied to Q1 2019 and pro forma Q1 2019 NOI (3) Estimates as of June 2019 based on definitive agreements for retail assets held for sale as well as market estimates for the assets not held for sale as of June 2019 Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

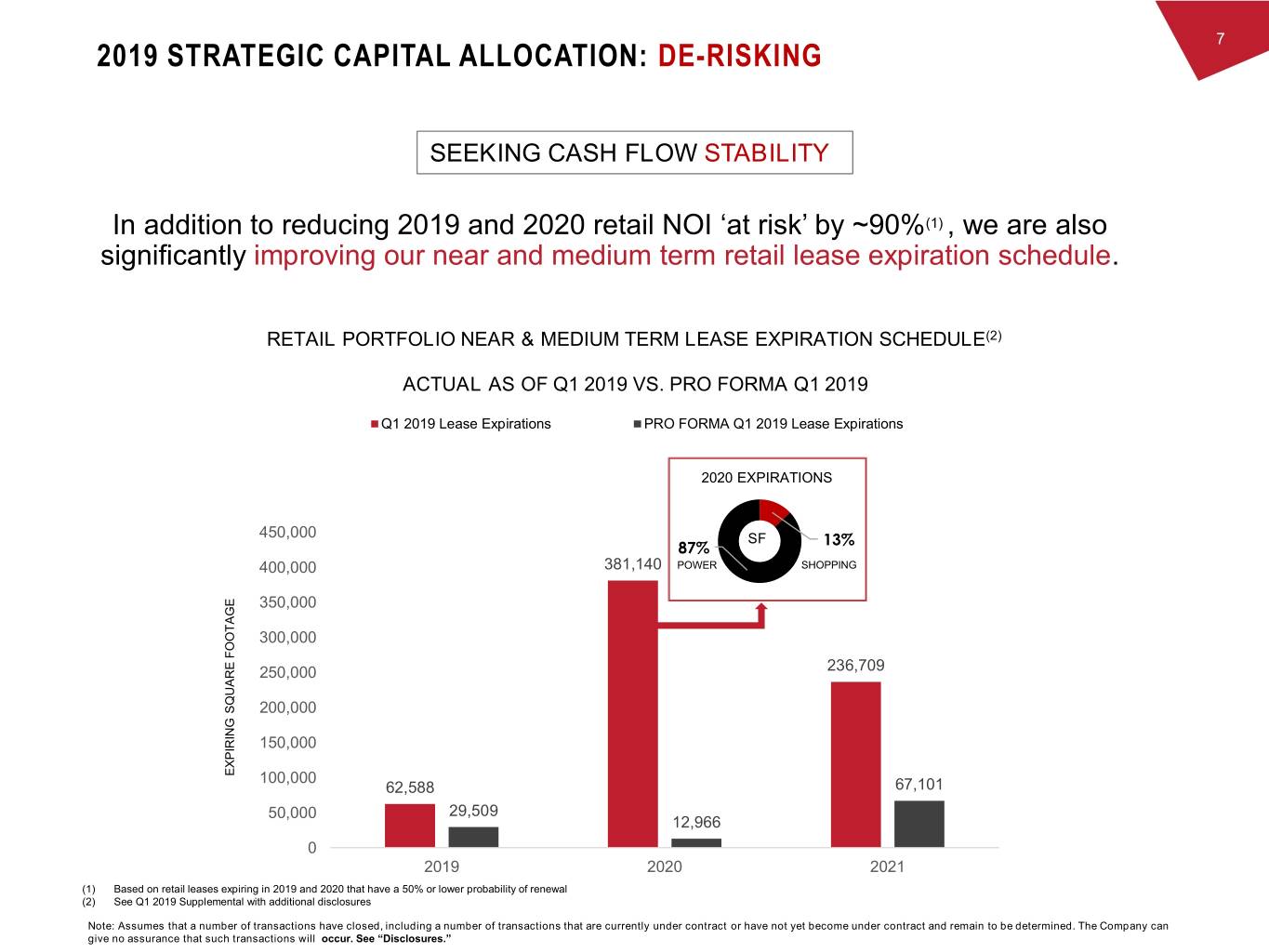

7 2019 STRATEGIC CAPITAL ALLOCATION: DE-RISKING SEEKING CASH FLOW STABILITY In addition to reducing 2019 and 2020 retail NOI ‘at risk’ by ~90%(1) , we are also significantly improving our near and medium term retail lease expiration schedule. RETAIL PORTFOLIO NEAR & MEDIUM TERM LEASE EXPIRATION SCHEDULE(2) ACTUAL AS OF Q1 2019 VS. PRO FORMA Q1 2019 Q1 2019 Lease Expirations PRO FORMA Q1 2019 Lease Expirations 2020 EXPIRATIONS 450,000 SF 13% 87% 400,000 381,140 POWER SHOPPING 350,000 300,000 250,000 236,709 200,000 150,000 EXPIRING EXPIRING FOOTAGE SQUARE 100,000 62,588 67,101 50,000 29,509 12,966 0 2019 2020 2021 (1) Based on retail leases expiring in 2019 and 2020 that have a 50% or lower probability of renewal (2) See Q1 2019 Supplemental with additional disclosures Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

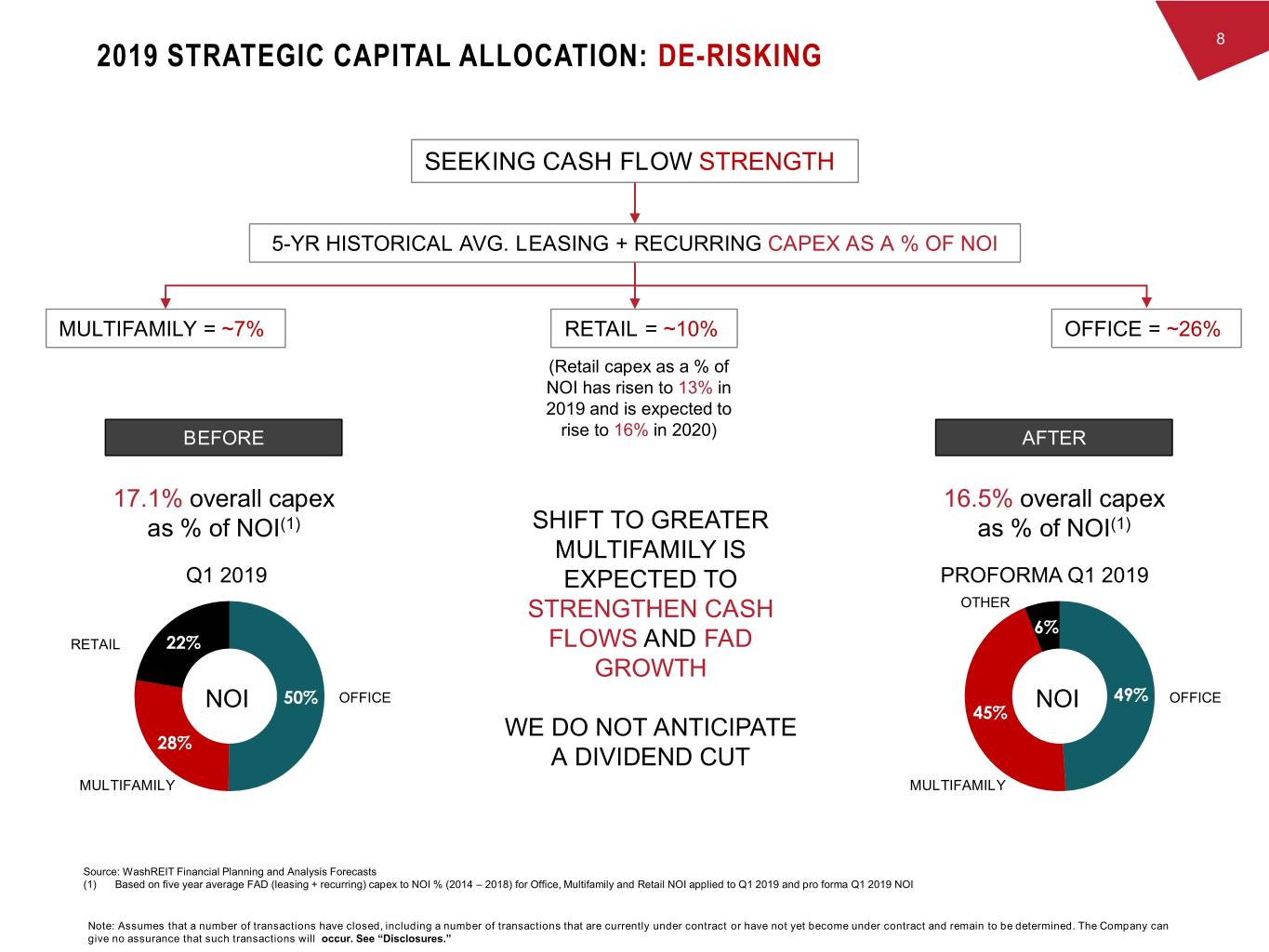

8 2019 STRATEGIC CAPITAL ALLOCATION: DE-RISKING SEEKING CASH FLOW STRENGTH 5-YR HISTORICAL AVG. LEASING + RECURRING CAPEX AS A % OF NOI MULTIFAMILY = ~7% RETAIL = ~10% OFFICE = ~26% (Retail capex as a % of NOI has risen to 13% in 2019 and is expected to BEFORE rise to 16% in 2020) AFTER 17.1% overall capex 16.5% overall capex as % of NOI(1) SHIFT TO GREATER as % of NOI(1) MULTIFAMILY IS Q1 2019 EXPECTED TO PROFORMA Q1 2019 STRENGTHEN CASH OTHER 6% RETAIL 22% FLOWS AND FAD GROWTH NOI 50% OFFICE NOI 49% OFFICE 45% WE DO NOT ANTICIPATE 28% A DIVIDEND CUT MULTIFAMILY MULTIFAMILY Source: WashREIT Financial Planning and Analysis Forecasts (1) Based on five year average FAD (leasing + recurring) capex to NOI % (2014 – 2018) for Office, Multifamily and Retail NOI applied to Q1 2019 and pro forma Q1 2019 NOI Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

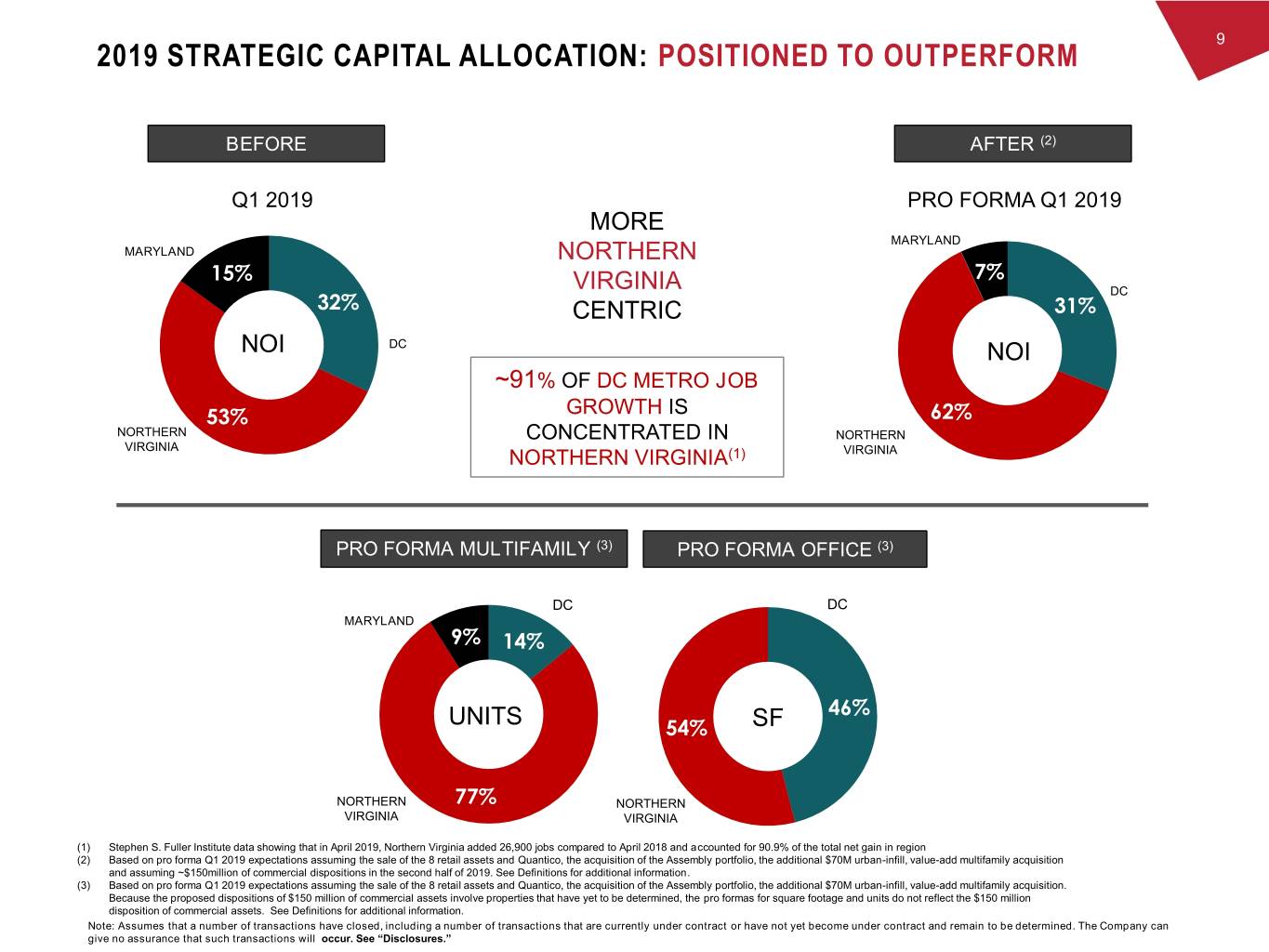

9 2019 STRATEGIC CAPITAL ALLOCATION: POSITIONED TO OUTPERFORM BEFORE AFTER (2) Q1 2019 PRO FORMA Q1 2019 MORE MARYLAND MARYLAND NORTHERN 15% 7% VIRGINIA DC 32% CENTRIC 31% NOI DC NOI ~91% OF DC METRO JOB 53% GROWTH IS 62% NORTHERN CONCENTRATED IN NORTHERN VIRGINIA NORTHERN VIRGINIA(1) VIRGINIA PRO FORMA MULTIFAMILY (3) PRO FORMA OFFICE (3) DC DC MARYLAND 9% 14% 46% UNITS 54% SF NORTHERN 77% NORTHERN VIRGINIA VIRGINIA (1) Stephen S. Fuller Institute data showing that in April 2019, Northern Virginia added 26,900 jobs compared to April 2018 and accounted for 90.9% of the total net gain in region (2) Based on pro forma Q1 2019 expectations assuming the sale of the 8 retail assets and Quantico, the acquisition of the Assembly portfolio, the additional $70M urban-infill, value-add multifamily acquisition and assuming ~$150million of commercial dispositions in the second half of 2019. See Definitions for additional information. (3) Based on pro forma Q1 2019 expectations assuming the sale of the 8 retail assets and Quantico, the acquisition of the Assembly portfolio, the additional $70M urban-infill, value-add multifamily acquisition. Because the proposed dispositions of $150 million of commercial assets involve properties that have yet to be determined, the pro formas for square footage and units do not reflect the $150 million disposition of commercial assets. See Definitions for additional information. Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

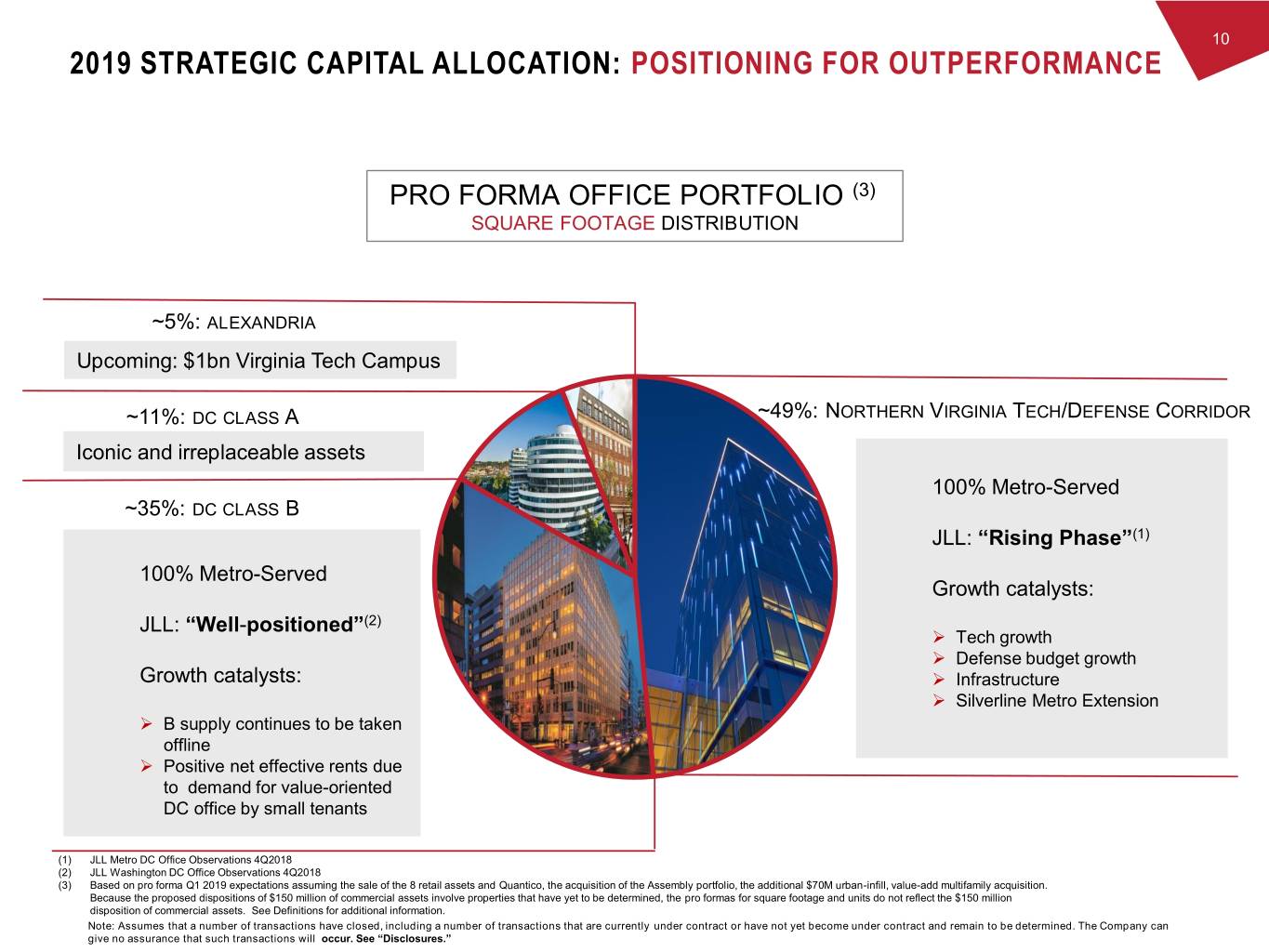

10 2019 STRATEGIC CAPITAL ALLOCATION: POSITIONING FOR OUTPERFORMANCE PRO FORMA OFFICE PORTFOLIO (3) SQUARE FOOTAGE DISTRIBUTION ~5%: ALEXANDRIA Upcoming: $1bn Virginia Tech Campus ~11%: DC CLASS A ~49%: NORTHERN VIRGINIA TECH/DEFENSE CORRIDOR Iconic and irreplaceable assets 100% Metro-Served ~35%: DC CLASS B JLL: “Rising Phase”(1) 100% Metro-Served Growth catalysts: JLL: “Well-positioned”(2) Tech growth Defense budget growth Growth catalysts: Infrastructure Silverline Metro Extension B supply continues to be taken offline Positive net effective rents due to demand for value-oriented DC office by small tenants (1) JLL Metro DC Office Observations 4Q2018 (2) JLL Washington DC Office Observations 4Q2018 (3) Based on pro forma Q1 2019 expectations assuming the sale of the 8 retail assets and Quantico, the acquisition of the Assembly portfolio, the additional $70M urban-infill, value-add multifamily acquisition. Because the proposed dispositions of $150 million of commercial assets involve properties that have yet to be determined, the pro formas for square footage and units do not reflect the $150 million disposition of commercial assets. See Definitions for additional information. Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

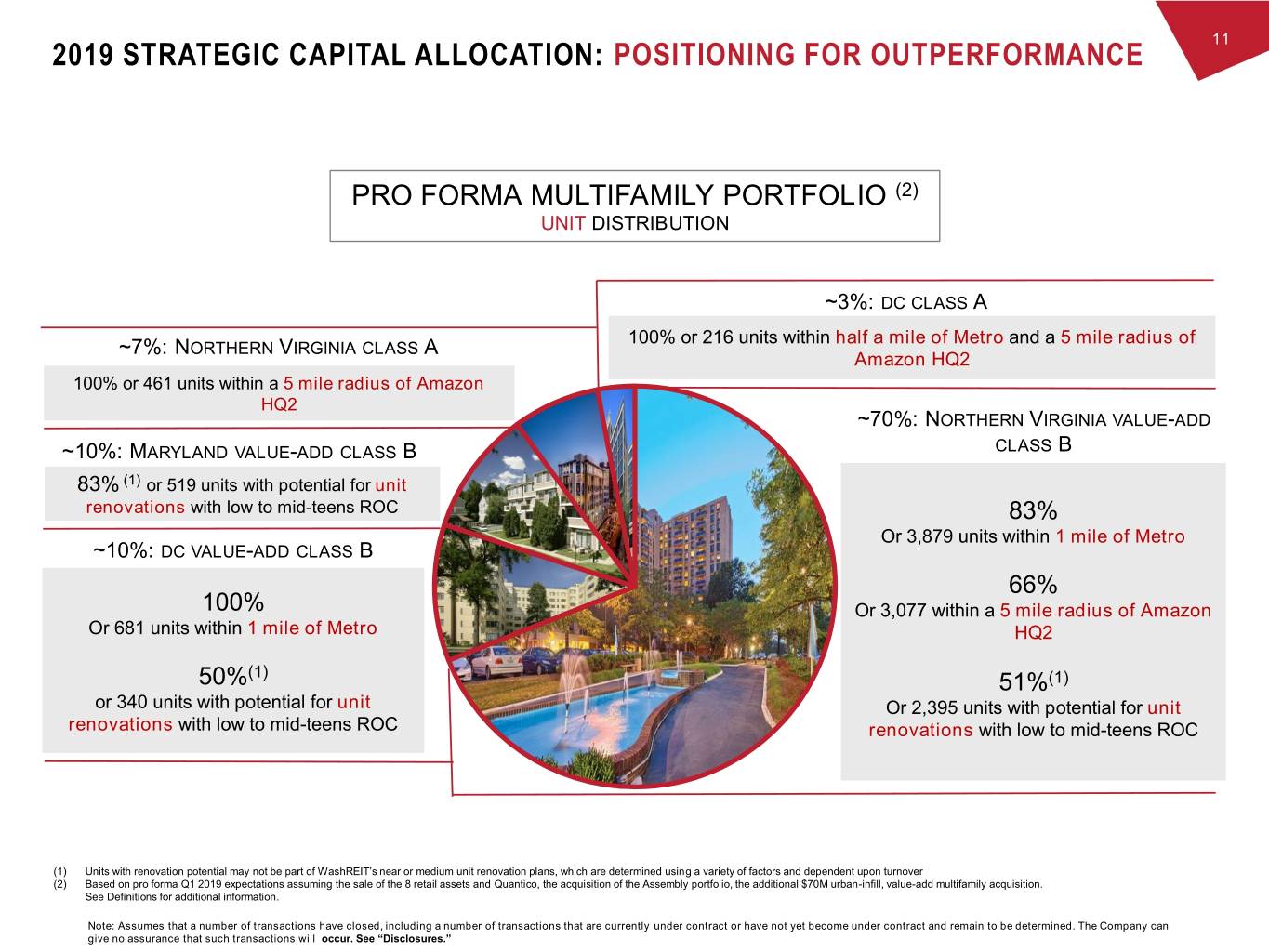

11 2019 STRATEGIC CAPITAL ALLOCATION: POSITIONING FOR OUTPERFORMANCE PRO FORMA MULTIFAMILY PORTFOLIO (2) UNIT DISTRIBUTION ~3%: DC CLASS A 100% or 216 units within half a mile of Metro and a 5 mile radius of ~7%: NORTHERN VIRGINIA CLASS A Amazon HQ2 100% or 461 units within a 5 mile radius of Amazon HQ2 ~70%: NORTHERN VIRGINIA VALUE-ADD ~10%: MARYLAND VALUE-ADD CLASS B CLASS B 83% (1) or 519 units with potential for unit renovations with low to mid-teens ROC 83% Or 3,879 units within 1 mile of Metro ~10%: DC VALUE-ADD CLASS B 66% 100% Or 3,077 within a 5 mile radius of Amazon Or 681 units within 1 mile of Metro HQ2 50%(1) 51%(1) or 340 units with potential for unit Or 2,395 units with potential for unit renovations with low to mid-teens ROC renovations with low to mid-teens ROC (1) Units with renovation potential may not be part of WashREIT’s near or medium unit renovation plans, which are determined using a variety of factors and dependent upon turnover (2) Based on pro forma Q1 2019 expectations assuming the sale of the 8 retail assets and Quantico, the acquisition of the Assembly portfolio, the additional $70M urban-infill, value-add multifamily acquisition. See Definitions for additional information. Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

12 2019 STRATEGIC CAPITAL ALLOCATION: VISIBILITY ON GROWTH KEY DRIVERS 2019 vs. 2018 2020 vs. 2019 2021 vs. 2020 OFFICE Large office lease expirations/known vacates across the office portfolio WATERGATE 600, WATERFRONT, DC ARLINGTON TOWER, ARLINGTON, VA + STREET VIEW OF DC Lease for the top two floors scheduled Large lease commencements expected at Arlington to commence in early 2020 Tower and across the DC B portfolio are anticipated in 2H 2020 expected to positively impact 2021 MULTIFAMILY Trove delivery of units anticipated to commence in fourth quarter 2019 RENDERING OF THE TROVE, ARLINGTON, VA RENDERING OF THE TROVE, ARLINGTON, VA Trove on pace to achieve NOI Trove expected to stabilize in 2021 MULTIFAMILY breakeven in 2H 2020 and keep growing 4.0% - 4.5% same- store NOI Growth Continuing to build on strong, organic multifamily growth Assumption Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

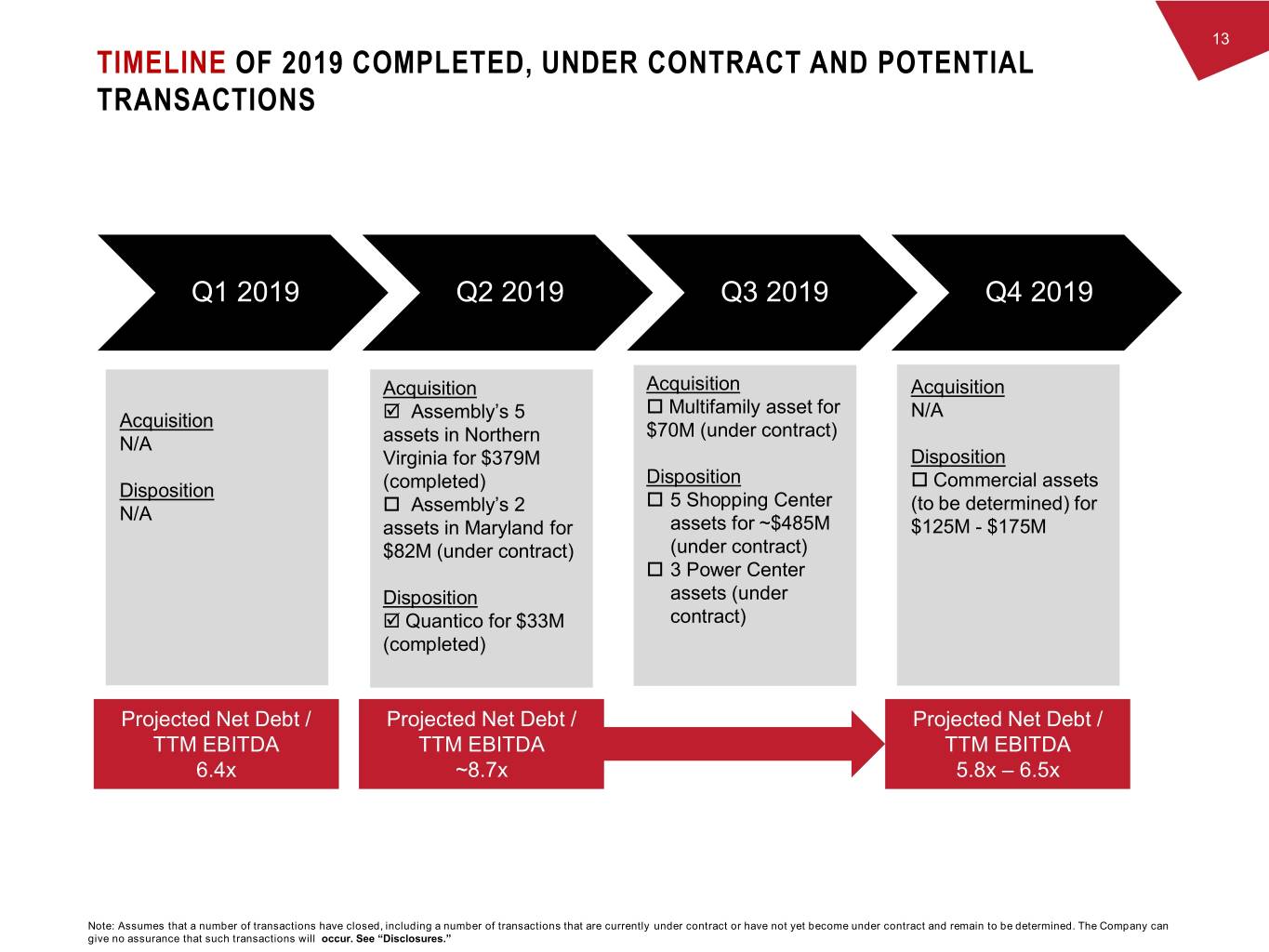

13 TIMELINE OF 2019 COMPLETED, UNDER CONTRACT AND POTENTIAL TRANSACTIONS Q1 2019 Q2 2019 Q3 2019 Q4 2019 Acquisition Acquisition Acquisition Assembly’s 5 Multifamily asset for N/A Acquisition $70M (under contract) N/A assets in Northern Virginia for $379M Disposition Disposition Commercial assets Disposition (completed) 5 Shopping Center (to be determined) for N/A Assembly’s 2 assets in Maryland for assets for ~$485M $125M - $175M $82M (under contract) (under contract) 3 Power Center Disposition assets (under Quantico for $33M contract) (completed) Projected Net Debt / Projected Net Debt / Projected Net Debt / TTM EBITDA TTM EBITDA TTM EBITDA 6.4x ~8.7x 5.8x – 6.5x Note: Assumes that a number of transactions have closed, including a number of transactions that are currently under contract or have not yet become under contract and remain to be determined. The Company can give no assurance that such transactions will occur. See “Disclosures.”

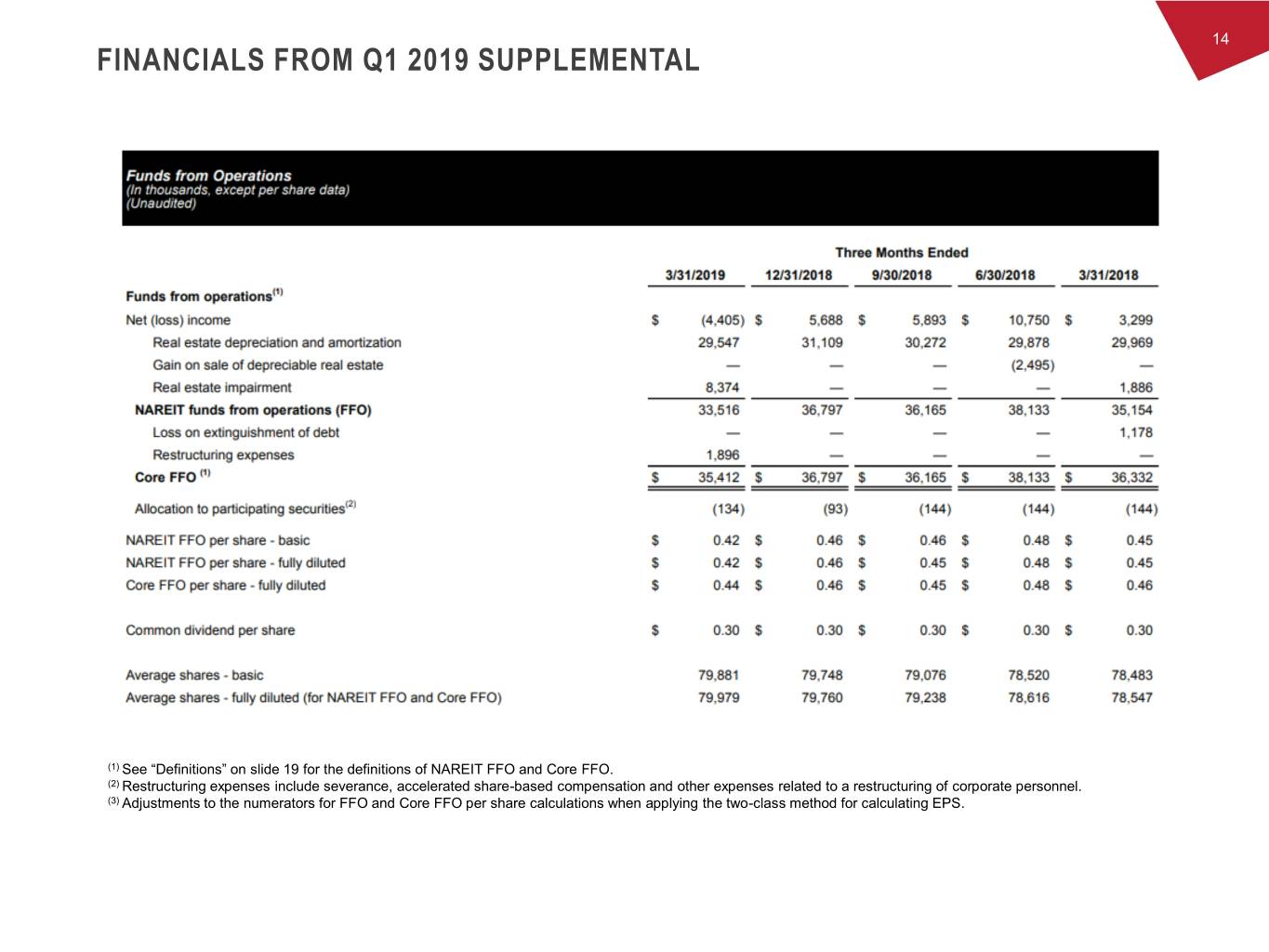

14 FINANCIALS FROM Q1 2019 SUPPLEMENTAL (1) See “Definitions” on slide 19 for the definitions of NAREIT FFO and Core FFO. (2) Restructuring expenses include severance, accelerated share-based compensation and other expenses related to a restructuring of corporate personnel. (3) Adjustments to the numerators for FFO and Core FFO per share calculations when applying the two-class method for calculating EPS.

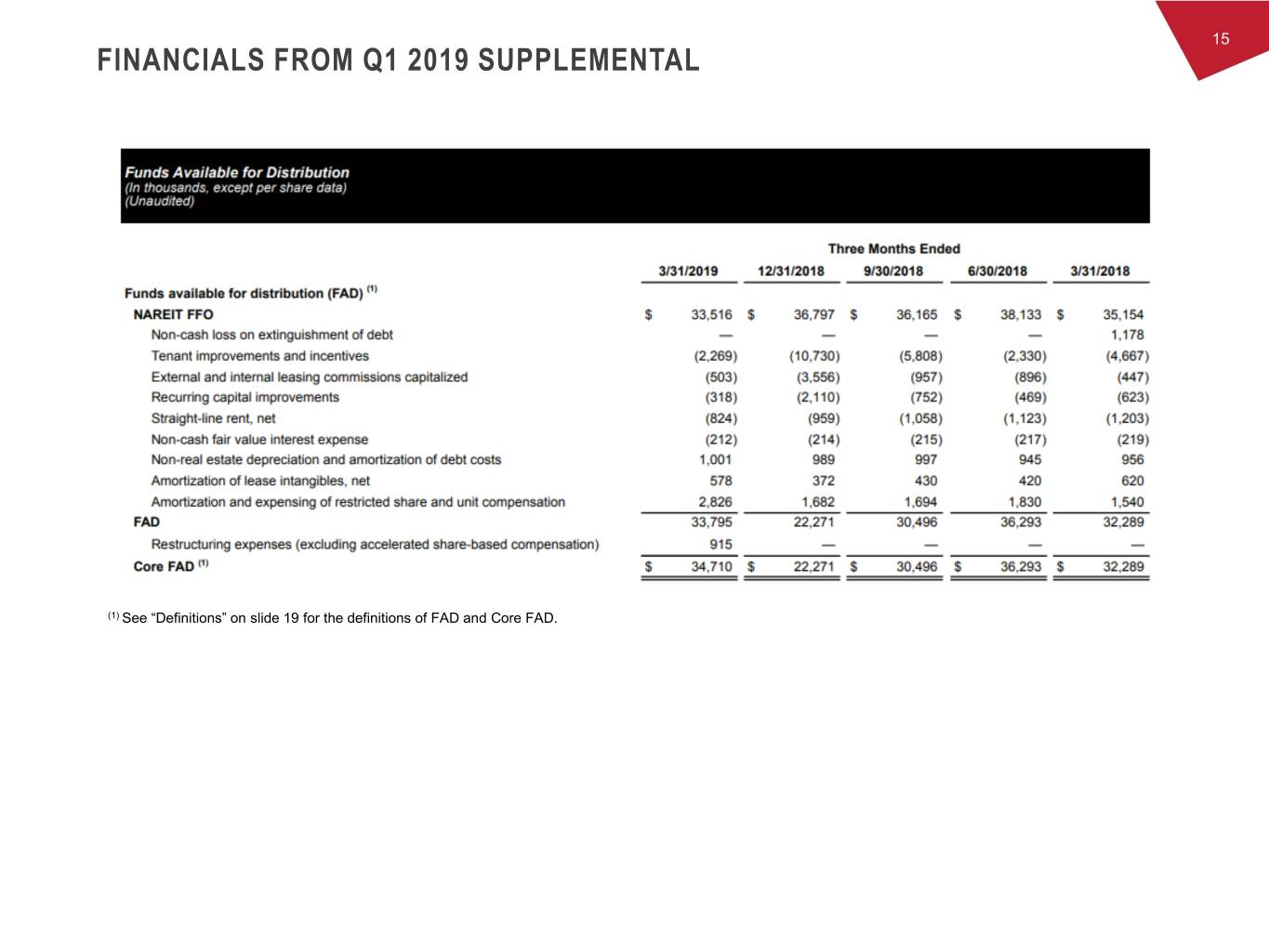

15 FINANCIALS FROM Q1 2019 SUPPLEMENTAL (1) See “Definitions” on slide 19 for the definitions of FAD and Core FAD.

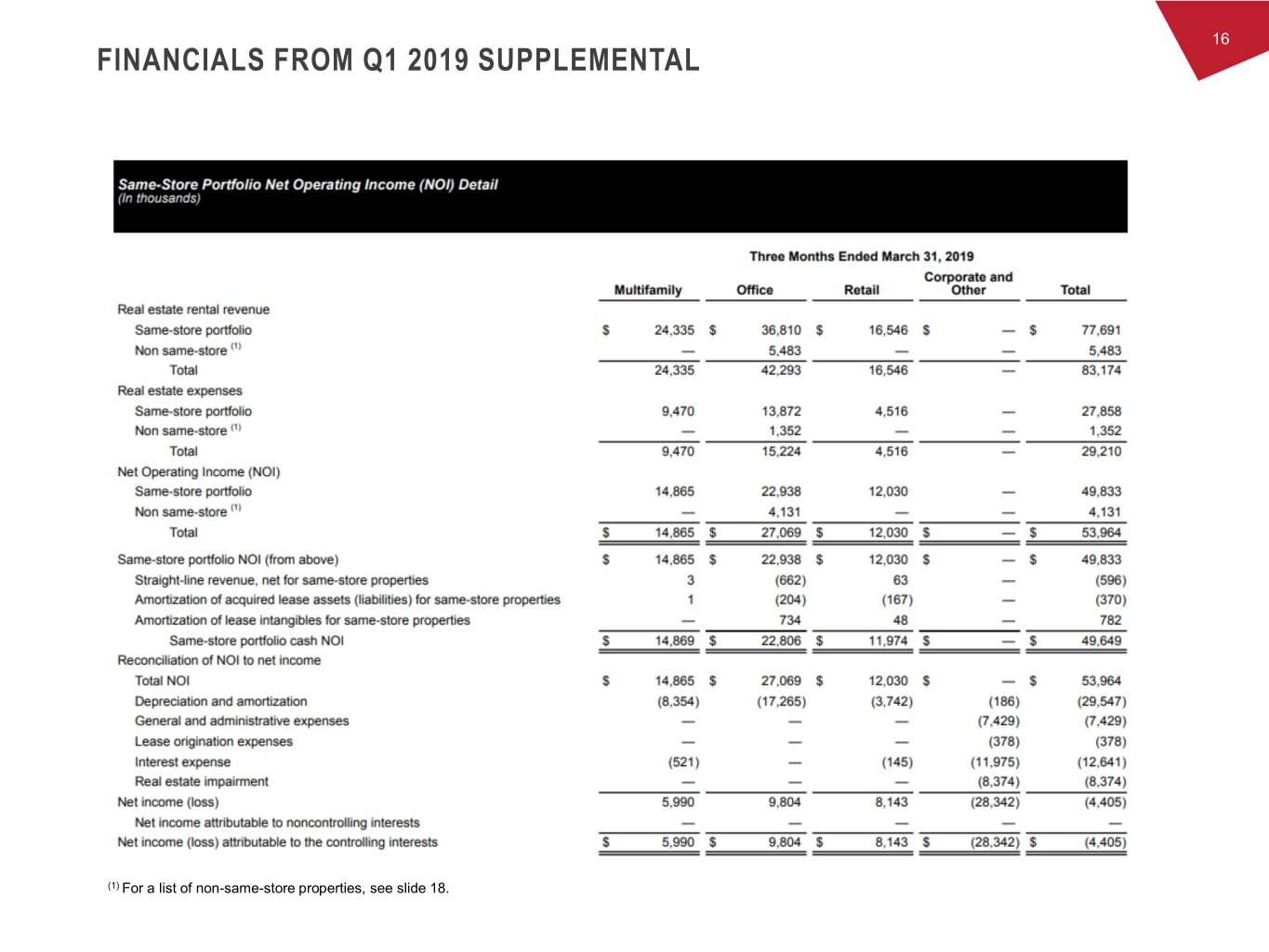

16 FINANCIALS FROM Q1 2019 SUPPLEMENTAL (1) For a list of non-same-store properties, see slide 18.

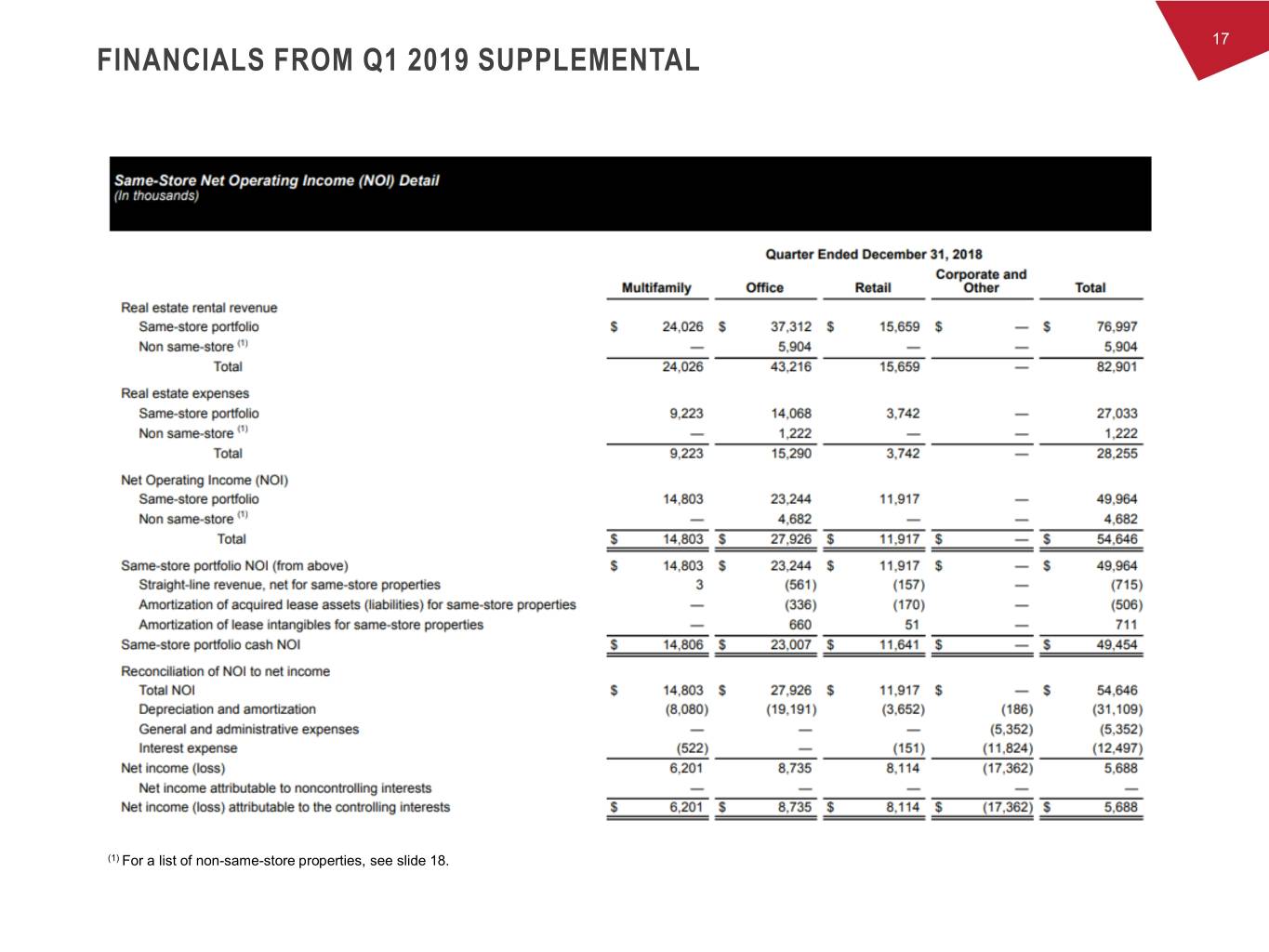

17 FINANCIALS FROM Q1 2019 SUPPLEMENTAL (1) For a list of non-same-store properties, see slide 18.

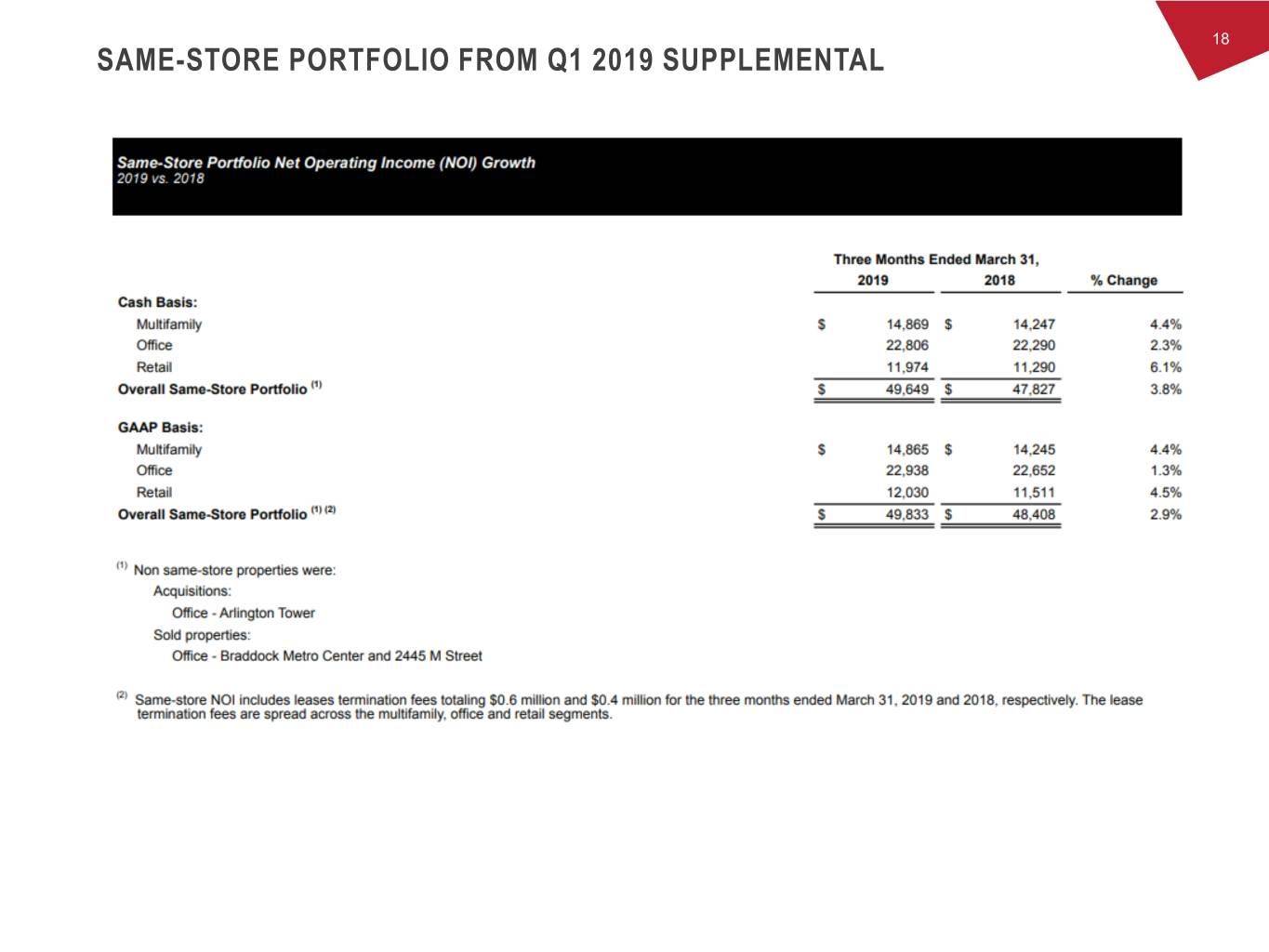

18 SAME-STORE PORTFOLIO FROM Q1 2019 SUPPLEMENTAL

19 DEFINITIONS Adjusted EBITDA (a non-GAAP measure) is earnings before interest expense, taxes, depreciation, amortization, gain/loss on sale of real estate, casualty gain/loss, real estate impairment, gain/loss on extinguishment of debt, restructuring expenses (which include severance, accelerated share-based compensation and other expenses related to a restructuring of corporate personnel), acquisition expenses and gain from non-disposal activities. Annualized base rent ("ABR") is calculated as monthly base rent (cash basis) per the lease, as of the reporting period, multiplied by 12. Average occupancy is based on monthly occupied net rentable square footage as a percentage of total net rentable square footage, except for the rows labeled "Multifamily (calculated on a unit basis)," on which average occupancy is based on average monthly occupied units as a percentage of total units. The square footage for multifamily properties only includes residential space. The occupied square footage for office and retail properties includes temporary lease agreements. Debt service coverage ratio is computed by dividing earnings attributable to the controlling interest before interest expense, taxes, depreciation, amortization, real estate impairment, gain on sale of real estate, gain/loss on extinguishment of debt, severance expense, relocation expense, acquisition and structuring expenses and gain/loss from non-disposal activities by interest expense (including interest expense from discontinued operations) and principal amortization. Debt to total market capitalization is total debt divided by the sum of total debt plus the market value of shares outstanding at the end of the period. Earnings to fixed charges ratio is computed by dividing earnings attributable to the controlling interest by fixed charges. For this purpose, earnings consist of income from continuing operations (or net income if there are no discontinued operations) plus fixed charges, less capitalized interest. Fixed charges consist of interest expense (excluding interest expense from discontinued operations), including amortized costs of debt issuance, plus interest costs capitalized. Ending Occupancy is calculated as occupied square footage as a percentage of total square footage as of the last day of that period. Multifamily unit basis ending occupancy is calculated as occupied units as a percentage of total units as of the last day of that period. NAREIT Funds from operations ("NAREIT FFO") is defined by National Association of Real Estate Investment Trusts, Inc. (“NAREIT”) in its NAREIT FFO White Paper – 2018 Restatement, as net income (computed in accordance with generally accepted accounting principles (“GAAP”) excluding gains (or losses) associated with sales of property, impairment of depreciable real estate and real estate depreciation and amortization. We consider NAREIT FFO to be a standard supplemental measure for equity real estate investment trusts (“REITs”) because it facilitates an understanding of the operating performance of our properties without giving effect to real estate depreciation and amortization, which historically assumes that the value of real estate assets diminishes predictably over time. Since real estate values have instead historically risen or fallen with market conditions, we believe that NAREIT FFO more accurately provides investors an indication of our ability to incur and service debt, make capital expenditures and fund other needs. Our FFO may not be comparable to FFO reported by other real estate investment trusts. These other REITs may not define the term in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently. NAREIT FFO is a non-GAAP measure. Core Funds From Operations ("Core FFO") is calculated by adjusting NAREIT FFO for the following items (which we believe are not indicative of the performance of Washington REIT’s operating portfolio and affect the comparative measurement of Washington REIT’s operating performance over time): (1) gains or losses on extinguishment of debt, (2) expenses related to acquisition and structuring activities, (3) executive transition costs, severance expenses and other expenses related to corporate restructuring and related to executive retirements or resignations, (4) property impairments, casualty gains and losses, and gains or losses on sale not already excluded from NAREIT FFO, as appropriate, and (5) relocation expense. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of Washington REIT’s ability to incur and service debt, and distribute dividends to its shareholders. Core FFO is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. Funds Available for Distribution ("FAD") is calculated by subtracting from NAREIT FFO (1) recurring expenditures, tenant improvements and leasing costs, that are capitalized and amortized and are necessary to maintain our properties and revenue stream (excluding items contemplated prior to acquisition or associated with development / redevelopment of a property) and (2) straight line rents, then adding (3) non-real estate depreciation and amortization, (4) non-cash fair value interest expense and (5) amortization of restricted share compensation, then adding or subtracting the (6) amortization of lease intangibles, (7) real estate impairment and (8) non-cash gain/loss on extinguishment of debt, as appropriate. FAD is included herein, because we consider it to be a performance measure of a REIT’s ability to incur and service debt and to distribute dividends to its shareholders. FAD is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. Core Funds Available for Distribution ("Core FAD") is calculated by adjusting FAD for the following items (which we believe are not indicative of the performance of Washington REIT’s operating portfolio and affect the comparative measurement of Washington REIT’s operating performance over time): (1) gains or losses on extinguishment of debt, (2) costs related to the acquisition of properties, (3) non-share-based executive transition costs, severance expenses and other expenses related to corporate restructuring and related to executive retirements or resignations, (4) property impairments, casualty gains and losses, and gains or losses on sale not already excluded from FAD, as appropriate, and (5) relocation expense. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FAD serves as a useful, supplementary performance measure of Washington REIT’s ability to incur and service debt, and distribute dividends to its shareholders. Core FAD is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs.

20 DEFINITIONS Net Operating Income (“NOI”) is a non-GAAP measure defined as real estate rental revenue less real estate expenses. NOI is calculated as net income, less non-real estate revenue and the results of discontinued operations (including the gain or loss on sale, if any), plus interest expense, depreciation and amortization, general and administrative expenses, acquisition costs, real estate impairment, casualty gains and losses, and gain or loss on extinguishment of debt. We also present NOI on a cash basis ("Cash NOI") which is calculated as NOI less the impact of straightlining of rent and amortization of market intangibles. We provide each of NOI and cash NOI as a supplement to net income calculated in accordance with GAAP. As such, neither should be considered an alternative to net income as an indication of our operating performance. They are the primary performance measures we use to assess the results of our operations at the property level. Recurring capital expenditures represent non-accretive building improvements and leasing costs required to maintain current revenues. Recurring capital expenditures do not include acquisition capital that was taken into consideration when underwriting the purchase of a building or which are incurred to bring a building up to "operating standard." Rent increases on renewals and rollovers are calculated as the difference, weighted by square feet, of the net ABR due the first month after a term commencement date and the net ABR due the last month prior to the termination date of the former tenant's term. Beginning in Q4 2018, in cases where the space has been remeasured in accordance with criteria set by the Building Owners and Managers Association ("BOMA"), the square feet former tenant's space is adjusted to be equivalent to the square feet of the new/renewing tenant's space. Same-store portfolio properties include properties that were owned for the entirety of the years being compared, and exclude properties under redevelopment or development and properties acquired, sold or classified as held for sale during the years being compared. We define development properties as those for which we have planned or ongoing major construction activities on existing or acquired land pursuant to an authorized development plan. We consider a property's development activities to be complete when the property is ready for its intended use. The property is categorized as same-store when it has been ready for its intended use for the entirety of the years being compared. We define redevelopment properties as those for which have planned or ongoing significant development and construction activities on existing or acquired buildings pursuant to an authorized plan, which has an impact on current operating results, occupancy and the ability to lease space with the intended result of a higher economic return on the property. We categorize a redevelopment property as same-store when redevelopment activities have been complete for the majority of each year being compared. Same-store portfolio NOI growth is the change in the NOI of the same-store portfolio properties from the prior reporting period to the current reporting period. Pro forma NOI Certain financial measures and other information have been adjusted to reflect the actual results of WashREIT for the first quarter of 2019 and assuming the sale of 8 retail assets, the sale of Quantico Corporate Center and the estimated financial information for each of: the acquisition of the Assembly portfolio, the acquisition of an additional $70M urban-infill, value add multifamily acquisition, and the disposition of approximately $150 million of to-be-determined commercial assets in the second half of 2019. The acquisition of the five Virginia assets in the seven-property Assembly portfolio and the sale of Quantico Corporate Center are the transactions that have actually closed. These measures and information are presented as of the most recent fiscal quarter, despite that the transactions discussed herein may not close until Q4, if at all. As, discussed elsewhere in this investor presentation, WashREIT can give no assurance that any transaction described or identified herein will close on the timing anticipated, or at all, and can give no assurance that any proposed transaction will result in definitive documentation or will eventually close. When presenting such information, the amounts are identified as “Pro forma Q1 2019 or PF Q1 2019” on a NOI basis. Pro forma for square footage or units Certain financial measures or other information have been adjusted to reflect the actual results of WashREIT for the first quarter of 2019 and assuming the sale of 8 retail assets, the sale of Quantico Corporate Center and the estimated financial information for each of: the acquisition of the Assembly portfolio and the acquisition of an additional $70M urban, in-fill, value-add multifamily acquisition. Because the proposed dispositions of $150 million of commercial assets involve properties that have yet to be determined, the pro formas for square footage and units do not reflect the $150 million disposition of commercial assets. The acquisition of the five Virginia assets in the seven-property Assembly portfolio and the sale of Quantico Corporate Center are the transactions that have actually closed. These measures and information are presented as of the most recent fiscal quarter, despite that transactions discussed herein may not close until Q4, if at all. As discussed elsewhere in this investor presentation, WashREIT can give no assurance that any transaction described or identified herein will close on the timing anticipated or at all and can give no assurance that any proposed transaction will result in definitive documentation or will eventually close. When presenting such information, the amounts are identified as “Pro forma Office” or “Pro forma Multifamily”.