PURCHASE AND SALE AGREEMENT

by and among

WASHREIT BRADLEE SHOPPING CENTER LLC,

a Delaware limited liability company,

as Bradlee Seller,

WASHREIT SHOPPES AT FOXCHASE LLC,

a Delaware limited liability company,

as Foxchase Seller,

WRIT GATEWAY OVERLOOK LLC,

a Delaware limited liability company,

as Gateway Seller,

WRIT OLNEY VILLAGE CENTER LLC,

a Delaware limited liability company,

as Olney Seller,

WASHREIT WHEATON PARK SHOPPING CENTER LLC,

a Delaware limited liability company,

as Wheaton Seller

and

GLOBAL RETAIL INVESTORS, LLC,

a Delaware limited liability company, as Buyer

* * * * * *

Date: June 26, 2019

PROPERTIES:

Bradlee Shopping Center - 3600 King Street, Alexandria, VA 22302

Shoppes at Foxchase - 4500-4600 Duke Street, Alexandria, VA 22304

Gateway Overlook - Little Patuxent Pkwy/Rte 175 & Waterloo Rd/Rte 108, Columbia, MD 21075

Olney Village Shopping Center - 18100 - 18330 Village Center Drive, Olney, MD 20832

Wheaton Park Shopping Center - Georgia Avenue and Shorefield Road, Wheaton, MD 20902

TABLE OF CONTENTS

|

| | | |

| - 1 - |

| 1.1 | Real Property | - 1 - |

| 1.2 | Personal Property | - 1 - |

| 1.3 | Other Property Rights | - 1 - |

| 1.4 | Individual Properties | - 2 - |

| 1.5 | Seller Relationships. | - 2 - |

| 1.6 | “All or Nothing Basis”. | - 2 - |

| - 2 - |

| 2.1 | Earnest Money Deposit; Payment of Deposit | - 3 - |

| 2.2 | Cash at Closing | - 3 - |

| 2.3 | Independent Consideration | - 3 - |

| 2.4 | Allocation of Purchase Price | - 3 - |

| - 3 - |

| 3.1 | Title to Real Property | - 3 - |

| 3.2 | Title Defects | - 4 - |

| 3.3 | Additional Title Objections | - 5 - |

| 3.4 | Title Insurance | - 6 - |

| - 6 - |

| 4.1 | Buyer’s Due Diligence | - 6 - |

| 4.2 | As-Is Sale | - 10 - |

| - 10 - |

| 5.1 | Lease Rentals and Expenses | - 10 - |

| 5.2 | Real Estate and Personal Property Taxes | - 11 - |

| 5.3 | Other Property Operating Expenses | - 12 - |

| 5.4 | Closing Costs | - 12 - |

| 5.5 | Security Deposits | - 13 - |

| 5.6 | Leasing Commissions and Tenant Improvements. | - 13 - |

| 5.7 | Apportionment Credit | - 13 - |

| 5.8 | Post-Closing Adjustment | - 13 - |

|

| | | |

| 5.9 | Customary Prorations. | - 14 - |

| 5.10 | Survival of Provisions | - 14 - |

| - 15 - |

| 6.1 | Closing Date | - 15 - |

| 6.2 | Title Transfer and Payment of Purchase Price | - 15 - |

| 6.3 | Seller’s Closing Deliveries | - 15 - |

| 6.4 | Buyer Closing Deliveries | - 18 - |

| 6.5 | Delivery of Deed | - 18 - |

| - 18 - |

| 7.1 | Seller’s Obligations | - 18 - |

| 7.2 | Buyer’s Obligations | - 19 - |

| 7.3 | Failure of Conditions Precedent | - 19 - |

| 7.4 | No Financing Contingency | - 20 - |

| - 20 - |

| 8.1 | Buyer’s Representations | - 20 - |

| 8.2 | Seller’s Representations | - 21 - |

| 8.3 | General Provisions | - 24 - |

| - 25 - |

| 9.1 | Buyer’s Covenants | - 25 - |

| 9.2 | Seller’s Covenants | - 25 - |

| 9.2.4 | Changes in Representations. | - 28 - |

| 9.2.5 | Survival. The provisions of Section 9.2 shall survive Closing. | - 28 - |

| 9.3 | Mutual Covenants | - 28 - |

| - 30 - |

| 10.1 | Condemnation | - 30 - |

| 10.2 | Destruction or Damage | - 30 - |

| 10.3 | Insurance | - 31 - |

| 10.4 | Effect of Termination | - 31 - |

| 10.5 | Waiver | - 32 - |

| - 32 - |

| 11.1 | Default Remedies | - 32 - |

| 11.2 | Surviving Obligations. | - 33 - |

| - 33 - |

|

| | | |

| 12.1 | Investment of Deposit | - 33 - |

| 12.2 | Delivery of Deposit Upon Closing | - 33 - |

| 12.3 | Disbursement Following Termination | - 33 - |

| 12.4 | Release and Indemnity | - 33 - |

| 12.5 | Taxpayer Identification | - 34 - |

| 12.7 | Escrow Fee | - 34 - |

| - 34 - |

| 13.1 | Buyer’s Assignment | - 34 - |

| 13.2 | Designation Agreement | - 34 - |

| 13.3 | Survival/Merger | - 35 - |

| 13.4 | Integration; Waiver | - 35 - |

| 13.5 | Governing Law | - 35 - |

| 13.6 | Captions Not Binding; Schedules and Exhibits | - 35 - |

| 13.7 | Binding Effect | - 36 - |

| 13.8 | Severability | - 36 - |

| 13.9 | Notices | - 36 - |

| 13.10 | Counterparts | - 37 - |

| 13.11 | No Recordation | - 37 - |

| 13.12 | Additional Agreements; Further Assurances | - 37 - |

| 13.13 | Time of the Essence | - 37 - |

| 13.14 | Construction | - 37 - |

| 13.15 | Business Day | - 38 - |

| 13.16 | Sellers’ Maximum Aggregate Liability | - 38 - |

| 13.17 | Relationship of the Parties | - 38 - |

| 13.18 | Incorporation By Reference | - 38 - |

| 13.19 | Captions | - 39 - |

| 13.20 | Waiver of Trial By Jury; Venue and Jurisdiction; Certain Costs | - 39 - |

| 13.21 | Intentionally Omitted | - 39 - |

| 13.22 | No Third Party Beneficiary | - 39 - |

| 13.23 | Exculpation | - 39 - |

| 13.24 | 1031 Exchange | - 40 - |

| 13.25 | Maryland Statutory Disclosures. | - 41 - |

LIST OF EXHIBITS AND SCHEDULES

Exhibit A Sellers and Individual Properties

Exhibit B-1 Bradlee Legal Description

Exhibit B-2 Foxchase Legal Description

Exhibit B-3 Gateway Legal Description

Exhibit B-4 Olney Legal Description

Exhibit B-5 Wheaton Legal Description

Exhibit C As-Is Provisions

Exhibit D-1 Maryland Form of Deed

Exhibit D-2 Virginia Form of Deed

Exhibit D-3 Assignment of Ground Lease

Exhibit E Form of Bill of Sale

Exhibit F Form of Assignment of Leases

Exhibit G Form of Assignment of Licenses and Permits

Exhibit H Form of Notice to Tenants

Exhibit I Form of Seller’s FIRPTA Affidavit

Exhibit J Form of Owner’s Affidavit

Exhibit K Form of Rent Roll

Exhibit L Litigation, Condemnation Notices and Governmental Violations

Exhibit M List of Leases

Exhibit N Form of Tenant Estoppel Certificate

Exhibit N -1 Form of Seller Estoppel Certificate

Exhibit N-2 Required Tenant Estoppels

Exhibit O-1 Declaration Estoppel Certificate (Gateway Seller)

Exhibit O-2 Declaration Estoppel Certificate (Third-Party)

Exhibit O-3 Declaration Estoppel Certificate (Third-Party)

Schedule 2.4 Allocation of Purchase Price & Deposit

Schedule 5.2 Tax Appeals

Schedule 5.6 Sellers’ Leasing Costs

Schedule 8.2.2(b) Contracts

Schedule 8.2.2(g) Environmental Disclosures

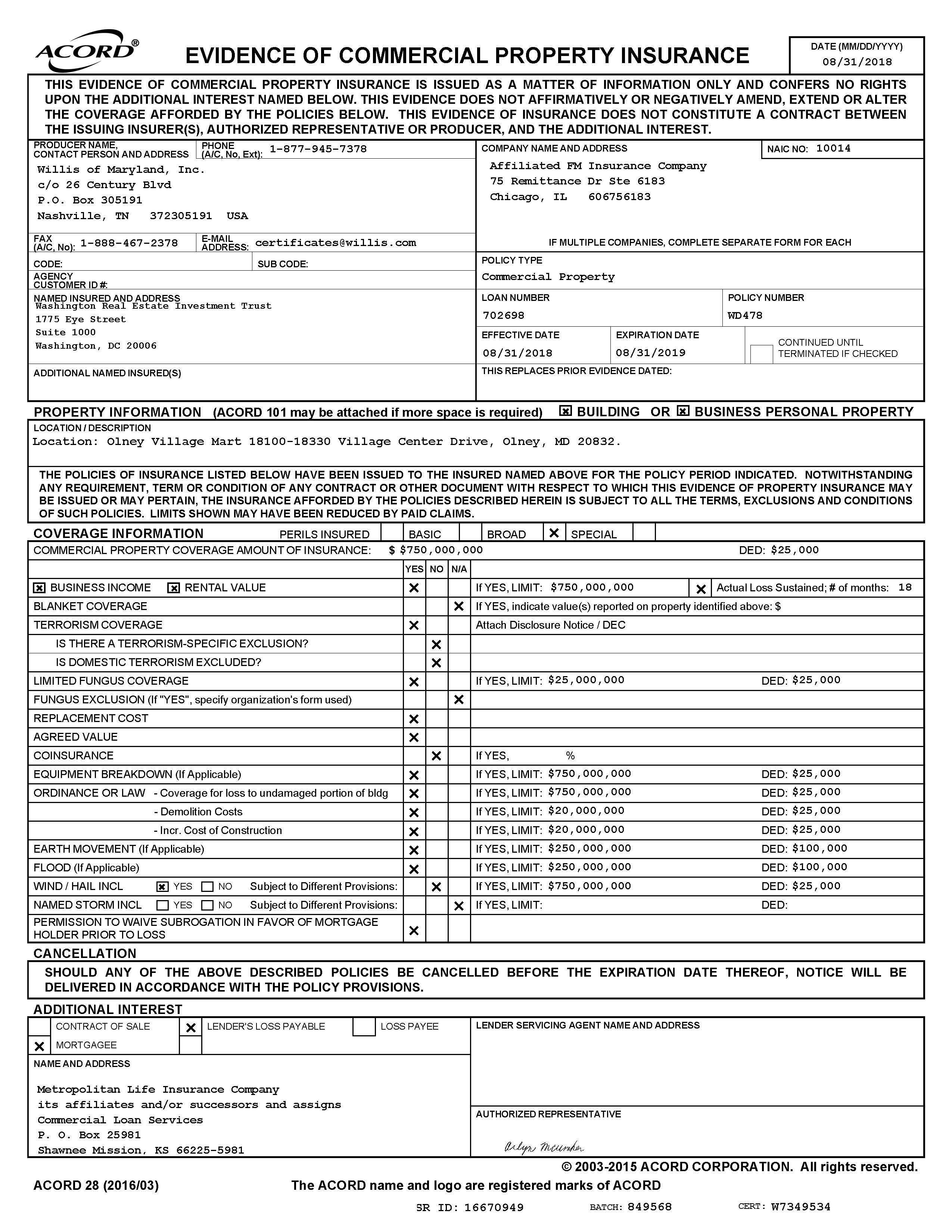

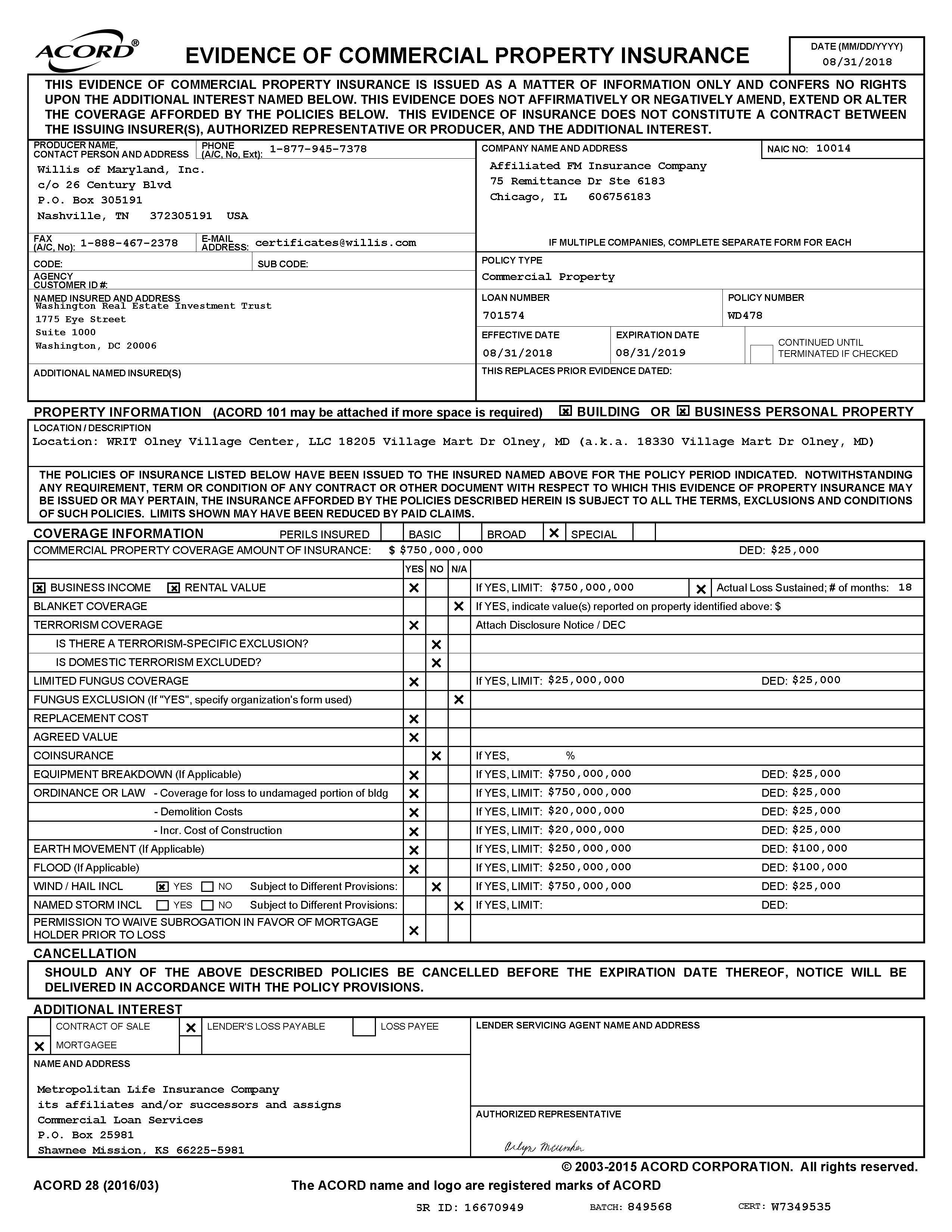

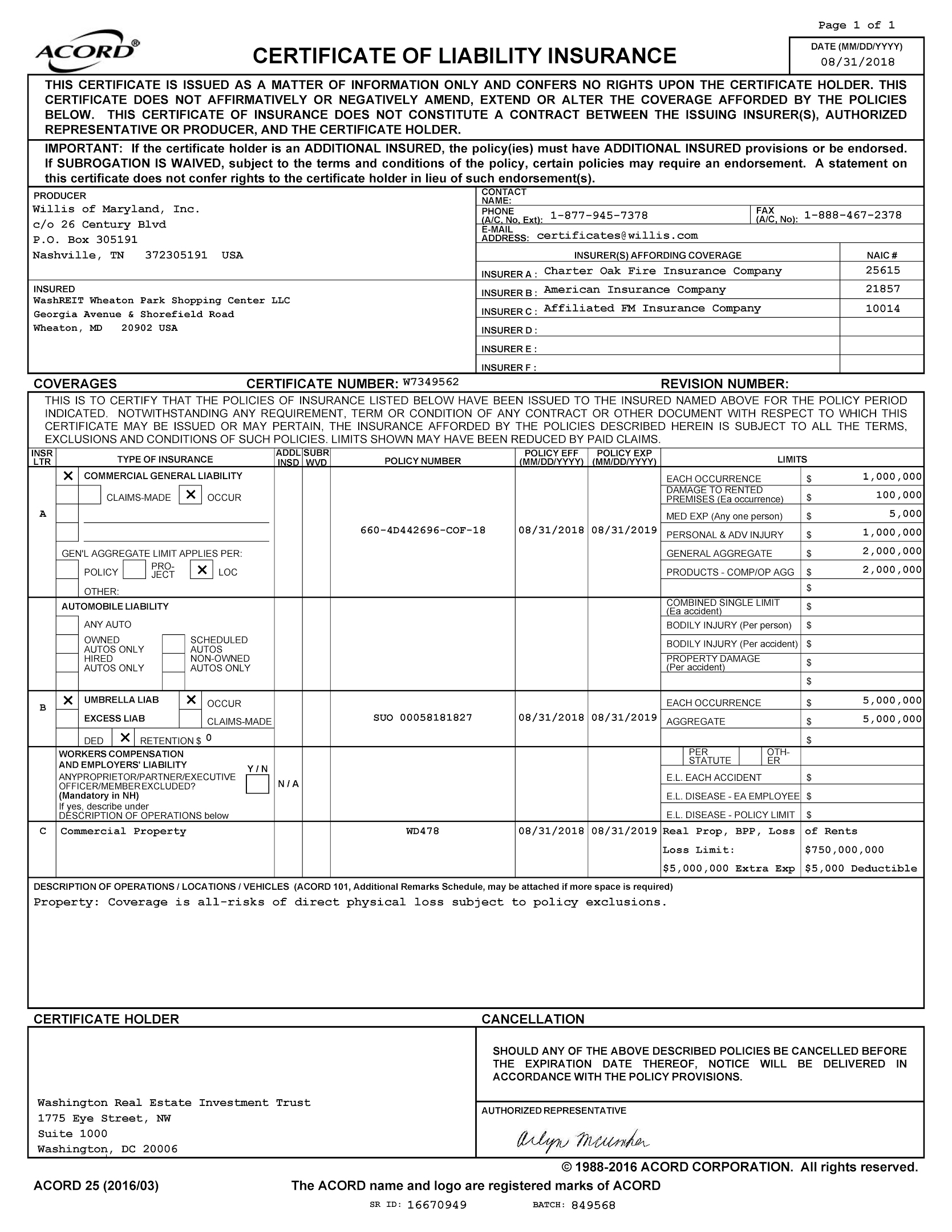

Schedule 10.3 Sellers’ Property Insurance Certificates

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”) is made as of June 26, 2019 (the “Effective Date”), by and among the sellers identified on Exhibit A (each, a “Seller” and collectively, the “Sellers”), and GLOBAL RETAIL INVESTORS, LLC, a Delaware limited liability company (“Buyer”).

W I T N E S S E T H:

In consideration of the mutual covenants and agreements set forth in this Agreement the parties hereto do hereby agree as follows:

ARTICLE 1– SALE OF PROPERTY

Each Seller agrees to sell, transfer and assign, as applicable, and Buyer agrees to purchase, accept and assume, subject to the terms and conditions stated herein, all of the following (herein collectively called the “Property”):

1.1 Real Property. Fee simple (and the Ground Leasehold (as defined below) held by the Gateway Seller, as the ground lessee) title to all those certain parcels of real estate legally described in Exhibit B-1 through Exhibit B-5 attached hereto and incorporated herein by this reference (“Land”), together with any and all buildings, improvements, and structures located on the Land (collectively with the appurtenant improvements and fixtures located thereon (the “Improvements”)) and all easements, rights, privileges and appurtenances pertaining thereto including all of each Seller’s right, title and interest, if any, in and to all rights-of-way, open or proposed streets, alleys, easements, strips or gores of land adjacent thereto (herein collectively called the “Real Property”);

1.2 Personal Property. All of Seller’s right, title and interest in and to all tangible personal property and equipment owned by each Seller, now or hereafter located on such Seller’s Real Property, and used in the ownership, operation or maintenance of such Seller’s Real Property (herein collectively called the “Personal Property”) but expressly excluding commercial vehicles that may be located onsite at any Individual Property and used by Sellers, or any of their agents, employees or representatives (collectively, the “Excluded Personal Property”). The term Personal Property shall not include: any (i) Excluded Personal Property, or (ii) software owned by any Seller or any Seller’s property manager, appraisals, brokers’ analyses, purchase offers, budgets, any Seller’s strategic plans for the Property, internal analyses, financial projections, property condition reports, refinancing offers and analysis, marketing information, submissions relating to each Seller’s obtaining of corporate authorization, attorney and accountant work product, or other information in the possession or control of any Seller or any Seller’s property manager that any such Seller deems confidential or proprietary (collectively the “Proprietary Documents”); and

1.3 Other Property Rights. Each Seller’s interest (a) as landlord in all leases with tenants and any amendments, guarantees, and other documents relating thereto and lease security and other deposits held thereunder, as well as all licenses and other occupancy agreements, for all or any

portion of such Seller’s Individual Property (as defined below) (herein collectively called the “Leases”); (b) to the extent assignable by each Seller without material liability or material expense for such Seller’s Individual Property: (i) all certificates of occupancy then in place for the Improvements and all other licenses, permits, approvals and other written authorizations necessary for the use, operation or ownership of the Real Property or Personal Property of such Seller’s Individual Property (the “Licenses and Permits”); and (ii) all guaranties and warranties relating to the Real Property that remain in effect on the Closing Date (the “Warranties and Guaranties”) on each Seller’s Individual Property (it being agreed that Seller shall reasonably cooperate with Buyer in seeking any required third party consents with respect to such Warranties and Guaranties), (c) all rights to use the trade names and property names for the shopping centers listed on Exhibit A to this Agreement, (the rights and interests of Sellers described in Sections 1.3(a), 1.3(b) and 1.3(c) hereinabove being herein collectively called the “Other Property Rights”).

1.4 Individual Properties. The portion of the Property associated with each of the parcels of Land described in Exhibits B-1 through B-5 is referred to in this Agreement as an “Individual Property.” The portion of the Property associated with each respective parcel of land is as described on Exhibit A. By its execution of this Agreement, each Seller is agreeing to convey the Individual Property set forth opposite such Seller’s name on Exhibit A to this Agreement (a “Seller’s Individual Property”) upon the terms and conditions set forth in this Agreement.

1.5 Seller Relationships. Notwithstanding anything contained in this Agreement to the contrary, the representations, covenants and obligations of each individual Seller under this Agreement shall be limited to the representations, covenants and obligations of the Sellers set forth in this Agreement, as applicable to such Seller and such Seller’s Individual Property only. The obligations of the Sellers under this Agreement are not joint and several. No Seller shall be responsible for the obligations of any other Seller under this Agreement. Except as set forth in this Agreement, no Seller shall be subject to claims, damages or remedies attributable to the breach by any other Seller.

1.6 “All or Nothing Basis”. Subject to the terms and conditions of this Agreement, Sellers agree to sell to Buyer, and Buyer agrees to purchase from Sellers, all of the property comprising the Property at Closing in consideration for the Purchase Price set forth in this Agreement. The parties acknowledge and agree that, except as otherwise set forth in this Agreement, (a) the sale of the Property shall be on an “all or nothing” basis; (b) Buyer shall have no right, and Sellers shall have no right or obligation, to exclude any portion of the Property from the Transactions (as defined below), and (c) any termination of this Agreement shall constitute a termination of this Agreement as to Buyer, all Sellers, and all of the Property.

ARTICLE 2 – PURCHASE PRICE

The total purchase price to be paid by Buyer for the purchase of the Property is the sum of Four Hundred Eighty Five Million Two Hundred Fifty Thousand and No/100 Dollars ($485,250,000.00) (the “Purchase Price”). The Purchase Price, subject to the prorations and adjustments set forth in Article 5 or as otherwise provided under this Agreement, plus any other amounts required to be paid by Buyer at Closing, shall be paid by Buyer at Closing in immediately available funds by wire transfer as more particularly set forth in Section 6.2; provided, however, that if this Agreement is terminated with respect to one or more Individual Properties (but not all

of the Property) as provided in Sections 10.1.1, 10.2 or 11.1.1(iv) hereof, then the term “Purchase Price” shall be adjusted to reduce the total Purchase Price by the amount allocated to such Individual Property(ies) (as set forth in Section 2.4 hereof) that will not be conveyed to Buyer as part of the Closing of the Transactions (as defined below).

2.1 Earnest Money Deposit; Payment of Deposit. No later than one (1) Business Day (as defined below) after execution of this Agreement (with all Exhibits and Schedules attached) and as a condition precedent to the effectiveness of this Agreement as to each Seller, Buyer shall deposit the sum of Seven Million Five Hundred Thousand and No/100 Dollars ($7,500,000.00) (“Initial Deposit”) with Chicago Title Insurance Company (“Escrow Agent”), with an address of 1620 L Street, NW, 4th Floor, Washington, DC 20036, Attn: Mark Badanowski. The Initial Deposit and the Second Deposit (if made pursuant to Section 4.1 below) (i.e., the total amount of up to $15,000,000) shall be collectively referred to as the “Deposit” and shall be non-refundable except as provided in this Agreement and shall be held and delivered by Escrow Agent in accordance with the provisions of Article 12. Any interest earned on the Initial Deposit and, if applicable, the Second Deposit, shall be added to, and form part of, the Deposit. Except as otherwise expressly set forth in this Agreement, the Deposit shall be paid to Sellers and applied against the Purchase Price on the Closing Date.

2.2 Cash at Closing. On the Closing Date, Buyer shall pay to Sellers an amount equal to the difference between (a) the Purchase Price, and (b) the amount of the Deposit as of the Closing Date (such difference, the “Balance”), subject to the prorations and adjustments set forth in Article 5 or as otherwise provided under this Agreement, plus any other amounts required to be paid by Buyer at Closing, in immediately available funds by wire transfer as more particularly set forth in Section 6.2.

2.3 Independent Consideration. Contemporaneously with the execution of this Agreement, Buyer hereby delivers to each Seller and each Seller hereby acknowledges the delivery of a check in the amount of One Hundred and No/100 Dollars ($100.00) (“Independent Contract Consideration”), which amount the parties bargained for and agreed to as consideration for each Seller’s grant to Buyer of the terms hereof and for each Seller’s execution, delivery and performance of this Agreement. This Independent Contract Consideration is in addition to and independent of any other consideration or payment provided in this Agreement, is non-refundable under any circumstances, and shall be retained by each Seller notwithstanding any other provisions of this Agreement, but will be applied to the cash portion of the Purchase Price at the Closing, if same occurs.

2.4 Allocation of Purchase Price and Deposit. Sellers and Buyer agree that the allocation of the Purchase Price, the Initial Deposit and the Second Deposit among the Individual Properties shall be as set forth on Schedule 2.4.

ARTICLE 3 – TITLE MATTERS

3.1 Title to Real Property. Buyer has ordered a commitment for an Owner’s Policy of Title Insurance with respect to such Seller’s Individual Property (each, a “Title Commitment”, and collectively, the “Title Commitments”) from the Escrow Agent (“Title Company”), and hyperlinks

within the Title Commitments to copies of all recorded documents referred to on Schedule B of each Title Commitment as exceptions to coverage (the “Title Documents”). Buyer acknowledges and agrees that at Closing title to each Individual Property shall be subject to (i) applicable zoning and building ordinances and land use regulations; (ii) all valid and enforceable easements, conditions and restrictions of record as of the Effective Date, including those shown in the Title Commitment (excluding the Mandatory Cure Items (as defined below), and Title Defects (as defined below) to which Buyer timely objects, and as to which the applicable Seller agrees to cure in accordance with Sections 3.2 and 3.3 hereof) (collectively, the “Title Exceptions”); (iii) such state of facts disclosed by (or which would be disclosed by) a current and accurate ALTA survey of the Real Property for each Individual Property obtained by Buyer prior to the end of the Due Diligence Period (the “Current Survey”) to which Buyer has not objected in accordance with Sections 3.2 and 3.3 hereof; (iv) the lien of real estate taxes not yet due and payable; (v) any exceptions to title caused by Buyer, its authorized agents, representatives or employees; (vi) any Title Defects that are waived or deemed waived by Buyer pursuant to the terms of Section 3.2; and (vii) subject to Section 9.2.2(b) hereof, the Leases for such Individual Property (the foregoing exceptions described in clauses (i) through (vii) being herein collectively called the “Permitted Exceptions”).

3.2 Title Defects. No later than five (5) days prior to the expiration of the Due Diligence Period, Buyer shall deliver a notice to each Seller, as applicable, of the existence of any exceptions in each Title Commitment (other than Permitted Exceptions) that are unsatisfactory to Buyer (such exceptions being called “Title Defects”). Notwithstanding the foregoing, Buyer need not provide Seller with written notice under this Section 3.2 or Section 3.3 of its objection to any mortgages or deeds of trust that are created by a Seller or its predecessors in title, and related financing documentation recorded against the Property, Mechanic’s Liens (as defined below), tax liens encumbering the Property, and all other monetary liens encumbering the Property (collectively, “Mandatory Cure Items”), all of which, to the extent that they are reflected in the Title Commitments, shall be deemed Title Defects that Seller is obligated hereunder to remove at or prior to Closing. If Buyer timely notifies a Seller of the existence of any Title Defects for a Seller’s Individual Property, then such Seller shall have five (5) days within which to notify Buyer whether such Seller intends to cure such Title Defects, and the failure by such Seller to notify Buyer within such 5-day period shall be deemed conclusively to be such Seller’s notice to Buyer of such Seller’s decision not to cure the Title Defects. If Buyer does not deliver such notice of Title Defects or does not do so timely, or does not list any particular title objection, in each instance other than Mandatory Cure Items that Seller is obligated to remove at or prior to Closing, then Buyer shall be deemed to have waived any and all objections to the state of title identified in such Title Commitment relating to such Individual Property not expressly identified as a Title Defect in any such notice (and all such matters not so expressly identified, other than Mandatory Cure Items, shall become Permitted Exceptions). If a Seller notifies, or is deemed to have notified, Buyer of its intention not to cure any Title Defects with respect to such Seller’s Individual Property, then Buyer shall have five (5) days from the date of such Seller’s notification (or the date such Seller is deemed to have notified Buyer) to notify Sellers of its decision whether to (a) take title to the Individual Property as such Seller may give (i.e., waive the Title Defect), without abatement of the Purchase Price, or (b) terminate this Agreement with respect to all of the Property and all Sellers, and in the latter event, the Deposit shall be promptly returned to Buyer and this Agreement shall terminate. If a Seller agrees to cure any Title Defects with respect to such Seller’s Individual Property and such Title

Defects (including any Mandatory Cure Items) remain uncured at Closing then such failure shall constitute a default by Seller under this Agreement and Buyer shall have the remedies set forth in Section 11.1 of this Agreement. Other than the removal of the Mandatory Cure Items, in no event shall Sellers be required to expend amounts in excess of $500,000, in the aggregate, to cure or correct any or all other monetary liens; provided, however, that if Sellers elect not to discharge such other monetary liens, Sellers shall pay to Buyer the Buyer’s Diligence Costs (as defined below). Subject to Section 9.2.2(b), each Seller shall not voluntarily sell, transfer, mortgage, pledge or subject its Individual Property or any portion thereof to a lien or other encumbrance and shall not cause to be recorded any document, including easements, affecting title thereto during the term of this Agreement (other than the Closing Documents, as defined in Exhibit C). At Closing, each Seller shall deliver title to such Seller’s Real Property subject only to the Permitted Exceptions. As used in this Agreement, the term “Mechanic’s Liens” means any mechanic’s liens encumbering the Property other than mechanic’s liens (y) relating to work commissioned by any party (other than Sellers and their respective affiliates) and filed against a tenant’s interest in the Property but not any Seller’s reversionary interest in the Property, or (z) that arise from Buyer’s or Inspector Parties’ (as defined below) activities concerning the Property.

3.3 Additional Title Objections. Notwithstanding the foregoing, if after the expiration of the Due Diligence Period, the Title Company shall raise any title or survey exceptions (other than Permitted Exceptions and Mandatory Cure Items) with respect to any Seller’s Individual Property and first arising after the date of the Title Commitment, Buyer shall have the right to send a “Notice of Title Objection” to such Seller, as applicable, within five (5) days of Buyer’s receipt thereof (but in no event after the Closing Date) objecting to such additional title exceptions, each of which items raised in a Notice of Title Objection shall be deemed to be Title Defects, and such Seller shall have five (5) days from receipt of such statement(s) to respond thereto. Closing shall be adjourned as necessary to accommodate such periods of time. Notwithstanding the foregoing, any additional title or survey matters identified by the Title Company in an updated Title Commitment that are not specifically identified in a Notice of Title Objection within such five (5) day period other than a Mandatory Cure Item shall also be deemed to be a Permitted Exception. If Buyer delivers a Notice of Title Objection within the applicable time periods referred to this Section 3.3 to a Seller with respect to such Seller’s Individual Property, such Seller shall have the right, but not the obligation, to attempt to cure any such Title Defect. Within five (5) days after receipt of a Notice of Title Objection, such Seller shall notify Buyer in writing whether such Seller elects to attempt to cure any such additional Title Defects. If a Seller elects to attempt to cure any such additional Title Defects, such Seller shall have until the Closing Date to attempt to remove, satisfy or cure the same and for this purpose such Seller shall be entitled to a reasonable adjournment of the Closing, but in no event shall the adjournment exceed sixty (60) days. If a Seller elects not to cure any additional Title Defects, does not respond to a Notice of Title Objection, or if a Seller is unable to effect a cure of such additional Title Defects prior to the Closing Date and such Title Defect does not constitute a default by a Seller under this Agreement, then Buyer shall elect, within five (5) Business Days after (a) receipt of written notice from the applicable Seller that such Seller has elected not to cure any such additional Title Defects; (b) such 5-day period if the applicable Seller does not respond to a Notice of Title Objection, or (c) receipt of written notice from the applicable Seller that such Seller is unable to effect a cure of such additional Title Defects, as the case may be, one of the following options: (i) to accept a conveyance of such Seller’s Individual Property subject to the

Permitted Exceptions and any additional Title Defects that such Seller is unwilling or unable to cure, and without reduction of the Purchase Price, in which case, such additional Title Defects shall be deemed to be a Permitted Exception; or (ii) to terminate this Agreement with respect to all of the Property and all Sellers by sending written notice thereof to Sellers, and upon delivery of such notice of termination, this Agreement shall terminate and the Deposit shall promptly be returned to Buyer by Escrow Agent, and thereafter no party hereto shall have any further rights, duties, obligations and/or liabilities under this Agreement except for those rights, duties, obligations and/or liabilities that expressly survive the termination of this Agreement. Closing shall be adjourned to accommodate Buyer’s five (5) Business Day election period. If Buyer shall fail to notify Sellers in writing of Buyer’s election under the preceding sentence within such five (5) Business Day period, Buyer shall be deemed to have elected to accept the conveyance of the Property under clause (i) above. If such Title Defect constitutes a default by a Seller under this Agreement, then the provisions of Section 11.1.1 shall govern.

3.4 Title Insurance. At Closing, Buyer may, at Buyer’s sole cost and expense, obtain an ALTA Owner’s form of title insurance policy for each Individual Property (each, a “Title Policy”, and collectively, the “Title Policies”) providing coverage in the aggregate amount of the Purchase Price, and insuring that fee simple title to the Real Property for each Individual Property is vested in Buyer subject only to the Permitted Exceptions applicable to such Individual Property. Buyer shall be entitled to request that the Title Company provide, at Buyer’s sole cost and expense, such endorsements (or amendments) to each Title Policy as Buyer may reasonably require, provided that (a) Buyer’s obligations under this Agreement shall not be conditioned upon Buyer’s ability to obtain any endorsements and, if Buyer is unable to obtain any endorsements (unless Buyer timely terminates this Agreement in accordance with an express right provided in Section 4.1), Buyer shall nevertheless be obligated to proceed to close the transactions with respect to all of the Property and all of the Sellers contemplated by this Agreement (the “Transactions”) without reduction of or set off against the Purchase Price, and (b) the Closing shall not be delayed as a result of Buyer’s request.

ARTICLE 4 – BUYER’S DUE DILIGENCE

4.1 Buyer’s Due Diligence. The “Due Diligence Period” shall be defined as the period continuing until the earlier of: (a) 5:00 p.m. Eastern Time on June 21, 2019, or (b) the date on which this Agreement is terminated by Buyer pursuant to this Section 4.1. Buyer shall have the right to conduct, its examinations, inspections, testing, studies and/or investigations in accordance with and subject to the terms and conditions of this Agreement (herein collectively called the “Due Diligence”) of each Seller’s Individual Property and information regarding each Seller’s Individual Property until the date this Agreement is terminated or Closing occurs. If Buyer is not satisfied with the results of its Due Diligence (including its review of the Title Documents) for all of the Property, or if Buyer elects otherwise not to proceed with the Transactions in Buyer’s sole and absolute discretion, for no reason or any reason, Buyer may elect at any time prior to 5:00 p.m. Eastern Time on the last day of the Due Diligence Period to (i) terminate this Agreement with respect to all of the Property and all Sellers by written notice thereof to Sellers given in accordance with the provisions of Section 13.9 hereof, and, if there is such a termination, neither Sellers nor Buyer shall have any liability hereunder except for those obligations that expressly survive the termination of this Agreement, and Buyer shall be entitled to the prompt return of the Deposit, or (ii) proceed with the

Transactions pursuant to the terms and conditions of this Agreement, whereupon the Deposit shall be deemed non-refundable to Buyer (except as expressly set forth elsewhere in this Agreement) but applicable to the Purchase Price at Closing. If Buyer does not notify Sellers in writing of its election to terminate this Agreement prior to the end of the Due Diligence Period, (A) Buyer shall no longer have any right to terminate this Agreement under this Section 4.1; (B) Buyer shall deposit in immediately available funds by wire transfer the amount of Seven Million Five Hundred Thousand and No/100 Dollars ($7,500,000.00) (the “Second Deposit”) with Escrow Agent not later than 5:00 p.m. (Eastern time) on the next Business Day following the expiration of the Due Diligence Period pursuant to Section 2.1 hereof, and (C) except as otherwise expressly provided in this Agreement, the Deposit shall be non-refundable. Buyer acknowledges and agrees that Buyer shall have no right after the expiration of the Due Diligence Period to terminate this Agreement pursuant to this Section 4.1. Buyer acknowledges that, as of the Effective Date, Buyer has no other right pursuant to this Section 4.1 to terminate the Agreement.

4.1.1 Access to Property. Buyer, and Buyer’s agents, employees, representatives, consultants, inspectors, appraisers, engineers and contractors (collectively, the “Inspector Parties”), at Buyer’s sole cost and expense, shall have the right during the term of this Agreement to have access to the Property for the purpose of conducting such non-invasive investigations, inspections, audits, analyses, surveys, tests, examinations, and studies of the Property as Buyer has deemed necessary or desirable to determine whether the Property is suitable for Buyer’s purposes. As of the Effective Date, that certain Access and Confidentiality Agreement dated as of May 20, 2019 (the “Access Agreement”) shall no longer apply and is of no further force or effect. Concurrently with the execution of this Agreement, Buyer’s access to the Property shall be governed by the terms of this Agreement. Buyer and Inspector Parties shall not perform any destructive or invasive testing of the Property without each Seller’s consent (which consent may be withheld in such Seller’s sole discretion), and shall not otherwise alter or damage the Property in any manner or permit any mechanic’s liens to be filed against all or any part of the Property that arise from Buyer’s or Inspector Parties’ activities concerning the Property.

(a) In exercising its right of access to, or inspection of, the Property, Buyer shall give Seller’s representative, Dan Chappell (email: dchappell@washreit.com), at least twenty-four (24) hours’ prior written notice to any proposed access to the Property during normal business hours to perform inspections and tests of the Property, including surveys, environmental studies and examinations. All such inspections and tests undertaken by or on behalf of Buyer shall be conducted in strict accordance with all applicable laws and regulations and in a manner reasonably acceptable to Sellers.

(b) Buyer (and the Inspector Parties) shall not contact any Protected Party (hereinafter defined), whether directly or indirectly, by e-mail, telephone or personal contact, or through any intermediaries, without each respective Seller’s prior written consent (which may be by email from Andrew Leahy). Each respective Seller shall have the absolute right to participate in any discussions between Buyer (or the Inspector Parties, or both) and any Protected Party except with respect to the authorities described in the last sentence of this subsection (b). Buyer shall provide copies of all material correspondence sent to or received from any Protected Party within two (2) Business Days after receipt or dispatch, as the case may be. Buyer shall not have the right

to make any commitments to any Protected Party that are in any way binding on any Seller or the Property or any part thereof. As used herein, the term “Protected Party” shall mean any of the following: (i) any tenant or subtenant of the Property; (ii) any person or entity currently engaged by any Seller to provide design, engineering, construction, management, leasing or other services (except survey and title services) for all or any portion of the Property, and (iii) except as provided in the next sentence, any governmental or quasi-governmental authority with jurisdiction over the Property. Notwithstanding anything to the contrary herein, Buyer (and the Inspector Parties) may communicate with any governmental or quasi-governmental authority regarding (y) the preparation of a “Phase I” environmental report with respect to the Property, and (z) the existence, validity and effect of any existing licenses, permits and approvals, and for the purposes of performing routine records searches and obtaining a customary zoning compliance letter or other zoning/land use information that is generally available to the public with respect to the Property (which may include building file reviews and customary zoning compliance letters with respect to the Property)); provided, however, that Buyer shall provide copies of all material correspondence sent to or received from such governmental or quasi-governmental authority within two (2) Business Days after receipt or dispatch, as the case may be.

(c) Buyer and the Inspector Parties shall schedule and coordinate all inspections, including, without limitation, any environmental tests, and such other access with each Seller and shall provide Seller with at least twenty-four (24) hours’ prior written notice (it being understood that Buyer’s access to the leased areas of the Property shall at all times be subject to the applicable tenant’s consent pursuant to the applicable terms of its Lease and occur during normal business hours). Sellers shall use commercially reasonable efforts to obtain such consents, if required. None of Buyer nor any Inspector Party shall enter onto any Individual Property unless such party is accompanied by a representative of the Seller of such Individual Property, unless such Seller otherwise waives such requirement in writing. Sellers agree to reasonably cooperate with Buyer and the Inspector Parties to schedule any such entry onto the Property at mutually convenient times. At no time shall Buyer or the Inspector Parties unreasonably interfere with any business conducted by any Seller at the Property or unreasonably disturb the use and occupancy of any tenant (or any user or occupant of the Property) under the Leases. Buyer and the Inspector Parties shall at all times comply with (i) all laws and regulations of all applicable governmental authorities, and (ii) the terms and conditions of the Leases. Buyer shall not conduct or allow any physically intrusive testing of, on or under the Property without first obtaining such respective Seller’s written consent as to the timing and scope of the work to be performed, which consent shall be given or withheld in such Seller’s sole and absolute discretion. Without limiting the generality of the foregoing, a Seller’s written approval shall be required prior to conducting any Phase II environmental survey or any testing or sampling of surface or subsurface soils, surface water, groundwater or any materials in or about the Property in connection with Buyer’s environmental due diligence. If any testing is approved by any Seller, Buyer agrees to cooperate with any reasonable request by such Seller in connection with the timing of any such inspection or test. Buyer shall deliver to Seller, within five (5) days of such Seller’s request, copies of the final versions of any written environmental inspection or test report or environmental summary prepared by any unrelated third party (excluding attorneys), and copies of all test results, in each case to the extent such third party consents thereto and at no material cost to Buyer. Buyer agrees that any inspection,

test or other study or analysis of any Individual Property by Buyer shall be performed at Buyer’s expense and in accordance with applicable law.

(d) If any portion of the Property is damaged or altered by any Inspector Party (other than as a result of the presence or discovery of pre-existing conditions (except to the extent exacerbated by such investigations)), the affected Seller may notify Buyer of such alteration or damage and Buyer shall restore, or shall cause the restoration, of the Property to substantially the same condition prior to such investigation within five (5) Business Days of Buyer’s receipt of such notice, so long as access to the Property is provided. If the Property is not restored as provided in this Section 4.1, then any Seller may undertake such restoration and Buyer shall promptly reimburse such Seller for any repair or restoration costs incurred by such Seller as a result thereof (other than as a result of the presence or discovery of pre-existing conditions, except to the extent exacerbated by Buyer’s or Inspector Parties’ investigations).

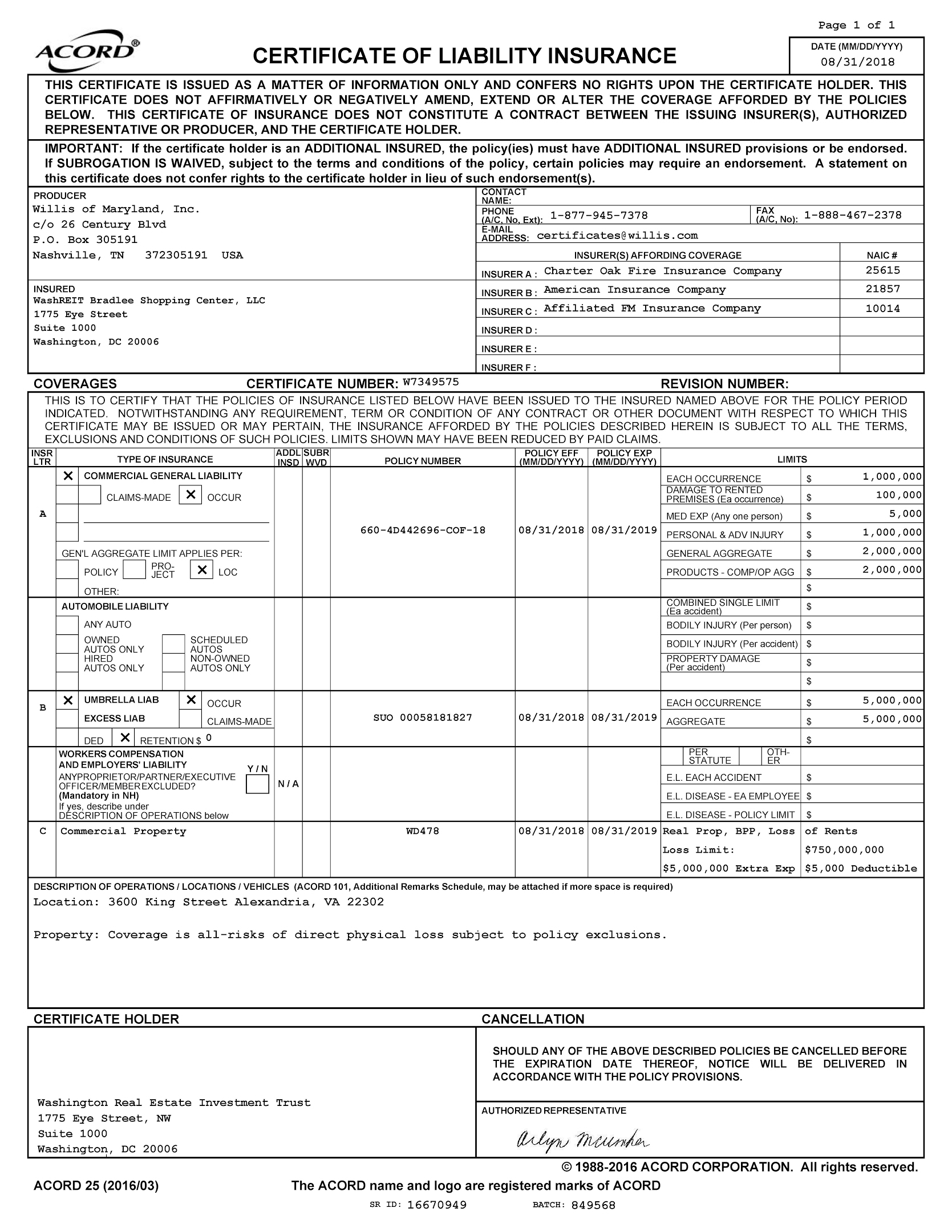

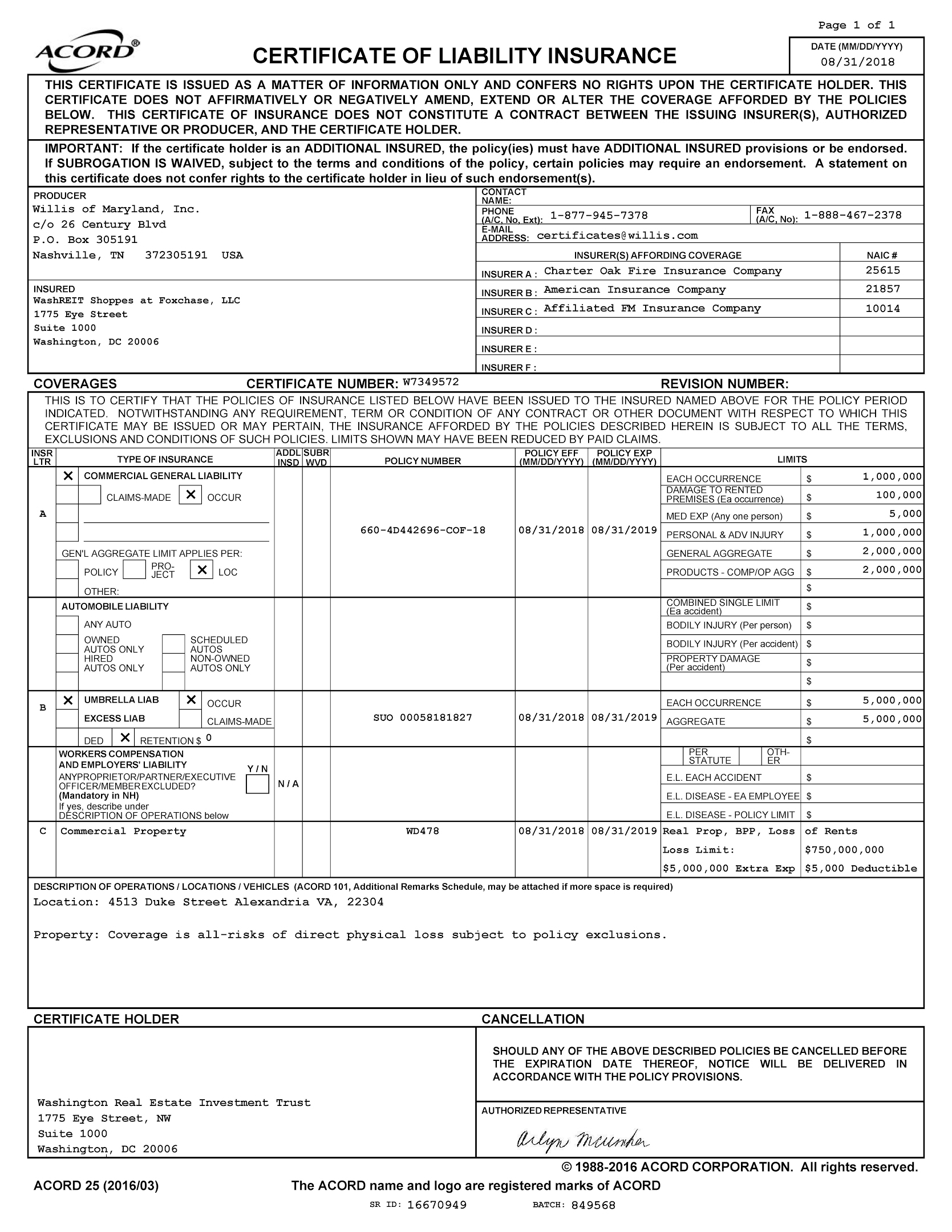

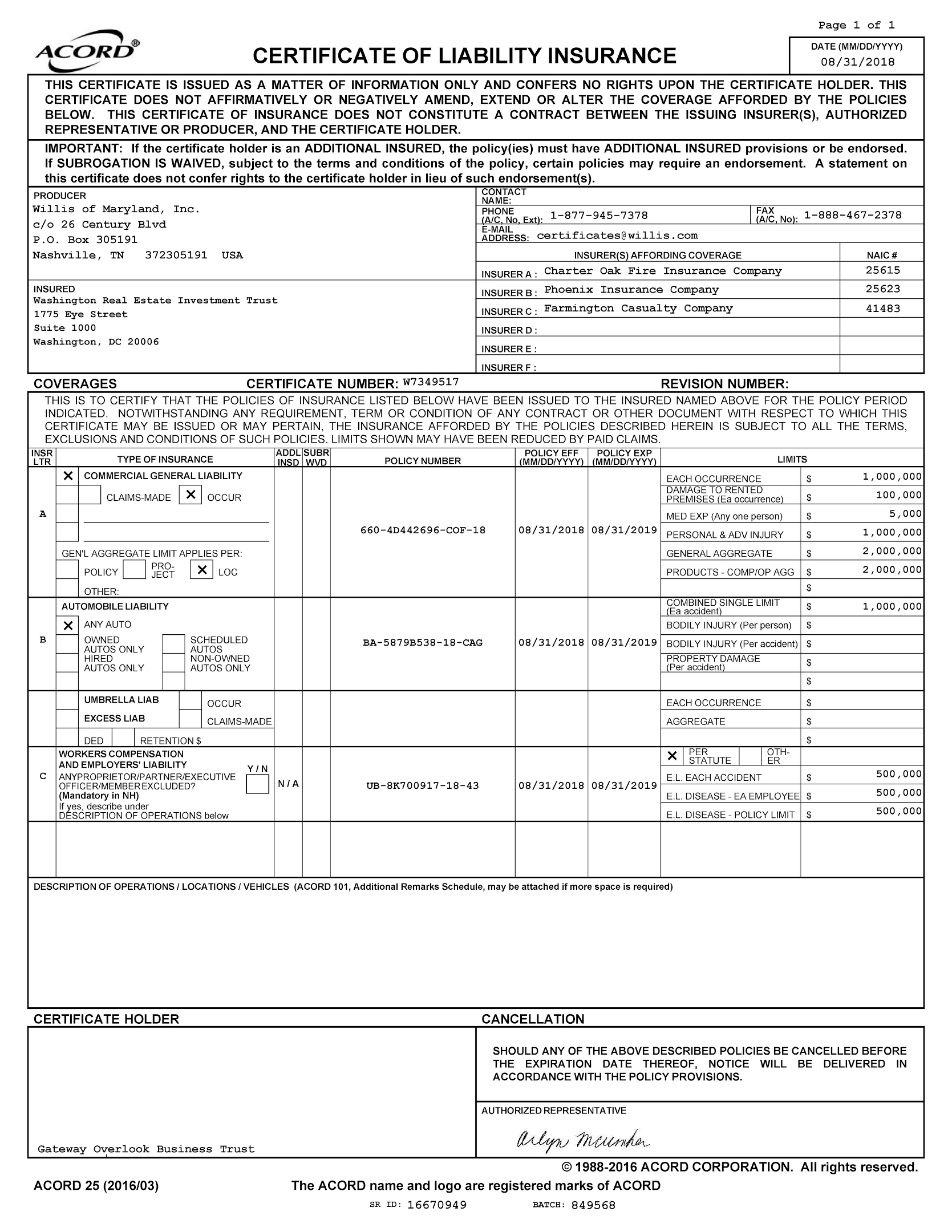

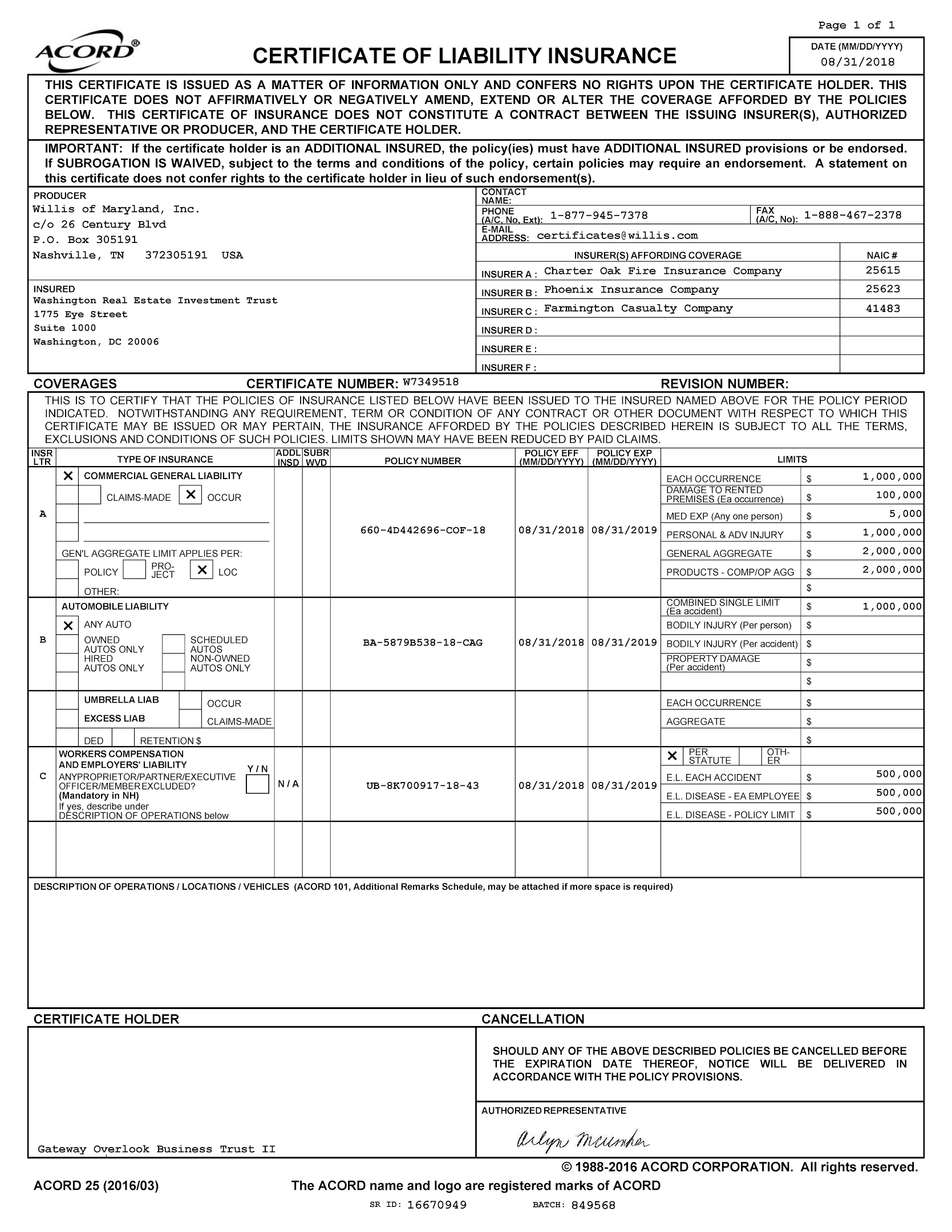

(e) Buyer agrees to indemnify, defend, and hold harmless each Seller and each Seller’s respective partners, members, affiliates, property manager, asset manager, and their respective officers, directors, agents, employees, and representatives (collectively, the “Indemnified Parties”) from and against any and all liens, claims, or damages of any kind or nature (excluding consequential, punitive and/or special damages, except to the extent claimed by a third party), including any demands, actions or causes of action, assessments, losses, costs, expenses, liabilities, interest and penalties, and reasonable attorneys’ fees actually suffered, incurred, or sustained by any of the Indemnified Parties and caused by Buyer or the Inspector Parties with respect to any of their due diligence activities at the Property pursuant to this Agreement. Notwithstanding the foregoing, Buyer shall not be liable for any loss, injury, damage, cause of action, liability, claim, lien, cost or expense incurred by Indemnified Parties arising solely out of (i) the presence of any pre-existing defects or conditions or hazardous materials or Buyer’s discovery of any pre-existing defects or conditions or hazardous materials, or (ii) the gross negligence or willful misconduct of any of the Indemnified Parties. Prior to any entry onto the Property, Buyer and the Inspector Parties shall obtain, and during the period of such inspection or testing shall maintain, at their expense: (A) commercial general liability (“CGL”) insurance, issued on a form at least as broad as Insurance Services Office (“ISO”) Commercial General Liability Coverage “occurrence” form CG 00 01 10 01 or another “occurrence” form providing equivalent coverage, including contractual liability and personal injury liability coverage, with limits of not less than Two Million and 00/100 Dollars ($2,000,000.00) for each occurrence and Three Million Dollars ($3,000,000.00) in the aggregate; (B) comprehensive automobile liability insurance (covering any automobiles owned or operated by Buyer), and (C) workers’ compensation insurance or participation in monopolistic state workers’ compensation fund, if applicable. Each Seller, any Sellers’ property manager, and Washington Real Estate Investment Trust shall be covered as additional insureds on the CGL and automobile liability insurance policies for the Property with respect to liability arising out of the named insured’s acts or omissions relating to the Property. The insurer and the terms and conditions of all the foregoing policies shall be reasonably acceptable to Sellers. Prior to making any entry upon the Property, Buyer shall furnish to each Seller a certificate of insurance evidencing the foregoing coverages, which certificate of insurance shall be in form and substance reasonably satisfactory to each Seller.

(f) Buyer acknowledges that Sellers have provided to Buyer and all of Buyer’s representatives as aforementioned at Sellers’ office at the Property, or pursuant to a dedicated website, copies of various documents and information regarding the Property, and each Seller will provide such other documents and information (other than Proprietary Documents) requested by Buyer from time-to-time during the term of this Agreement after Buyer’s written request thereof, each to the extent in any Seller’s possession and control and relating to such Seller’s Individual Property (collectively, the “Due Diligence Materials”). “Due Diligence Information” shall mean all Due Diligence Materials and information provided or made available to Buyer (or any Inspector Parties) by any Seller or its representatives pursuant to this Agreement, the Access Agreement, that certain Nondisclosure Agreement dated as of June 28, 2018 (the “NDA” ), and any and all information, studies and tests delivered to Buyer (or any Inspector Parties) by each Seller or its representatives pursuant to this Agreement or the Access Agreement. Buyer acknowledges that except as set forth in this Agreement and in the documents executed by the Sellers at Closing, Sellers have not made any representations or warranties to Buyer with respect to the accuracy or completeness of any of the Due Diligence Information. As of the Effective Date, the NDA shall continue to apply as to the confidential nature of the Due Diligence Information and shall survive the termination of this Agreement subject to the provisions of the Access Agreement. Buyer shall deliver to such Seller, at such Seller’s request, without any representations or warranties and only to the extent in Buyer’s possession or control and if such delivery is not contractually prohibited, true and correct copies of the final versions of any feasibility studies, drawings, plans, property condition and environmental reports prepared by unrelated third parties (excluding attorneys) on behalf of Buyer of which such Seller desires copies.

4.1.2 Document Delivery. Upon termination of this Agreement pursuant to Section 4.1 or otherwise, Buyer shall promptly return (or destroy) all Due Diligence Information in accordance with the terms of the NDA, and provide Sellers with written confirmation that all such Due Diligence Information has been returned (or destroyed) to the extent required under Section 3 of the NDA. Notwithstanding anything to the contrary in this Agreement, Buyer’s obligations under this Section 4.1.2 shall survive any termination of this Agreement.

4.2 As-Is Sale. Buyer acknowledges and agrees as follows:

4.2.1 AS-IS. Subject to each Seller’s Warranties (as defined in Exhibit C), the Property (and each Seller’s Individual Property) shall be sold, and Buyer shall accept possession of the Property (and each Seller’s Individual Property), subject to the terms of this Agreement, on the Closing Date, “AS IS, WHERE IS, WITH ALL FAULTS” as of the Closing Date, with no right of setoff or reduction in the Purchase Price. The terms of Exhibit C attached hereto are expressly incorporated by this reference as if such terms were set forth in their entirety in this Section 4.2.1.

4.2.2 No Verbal or Implied Warranties. With respect to each Seller’s Individual Property, except for Seller’s Warranties, each Seller’s covenants in this Agreement (which shall not survive Closing, except to the extent expressly provided herein), none of the Seller Parties (as defined in Exhibit C) has or shall be deemed to have made any verbal or written representations, warranties, promises or guarantees (whether express, implied, statutory or otherwise) to Buyer with respect to the Property (or any Seller’s Individual Property), any matter set forth, contained or addressed in

any documents provided to Buyer by any Seller or any Seller’s property manager, including, but not limited to, the accuracy and completeness thereof, or the results of Buyer’s Due Diligence.

ARTICLE 5 – ADJUSTMENTS AND PRORATIONS

The following adjustments and prorations shall be made at Closing:

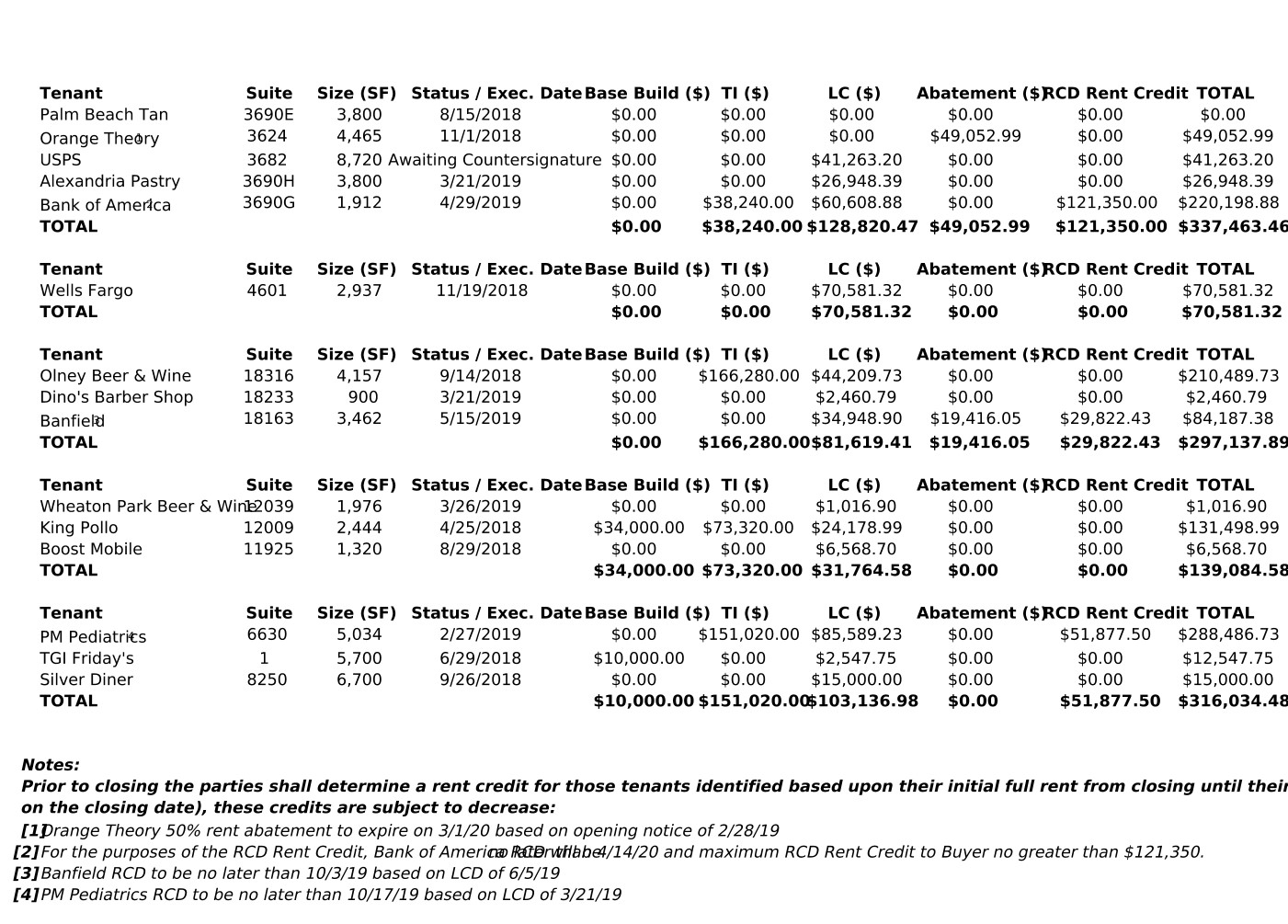

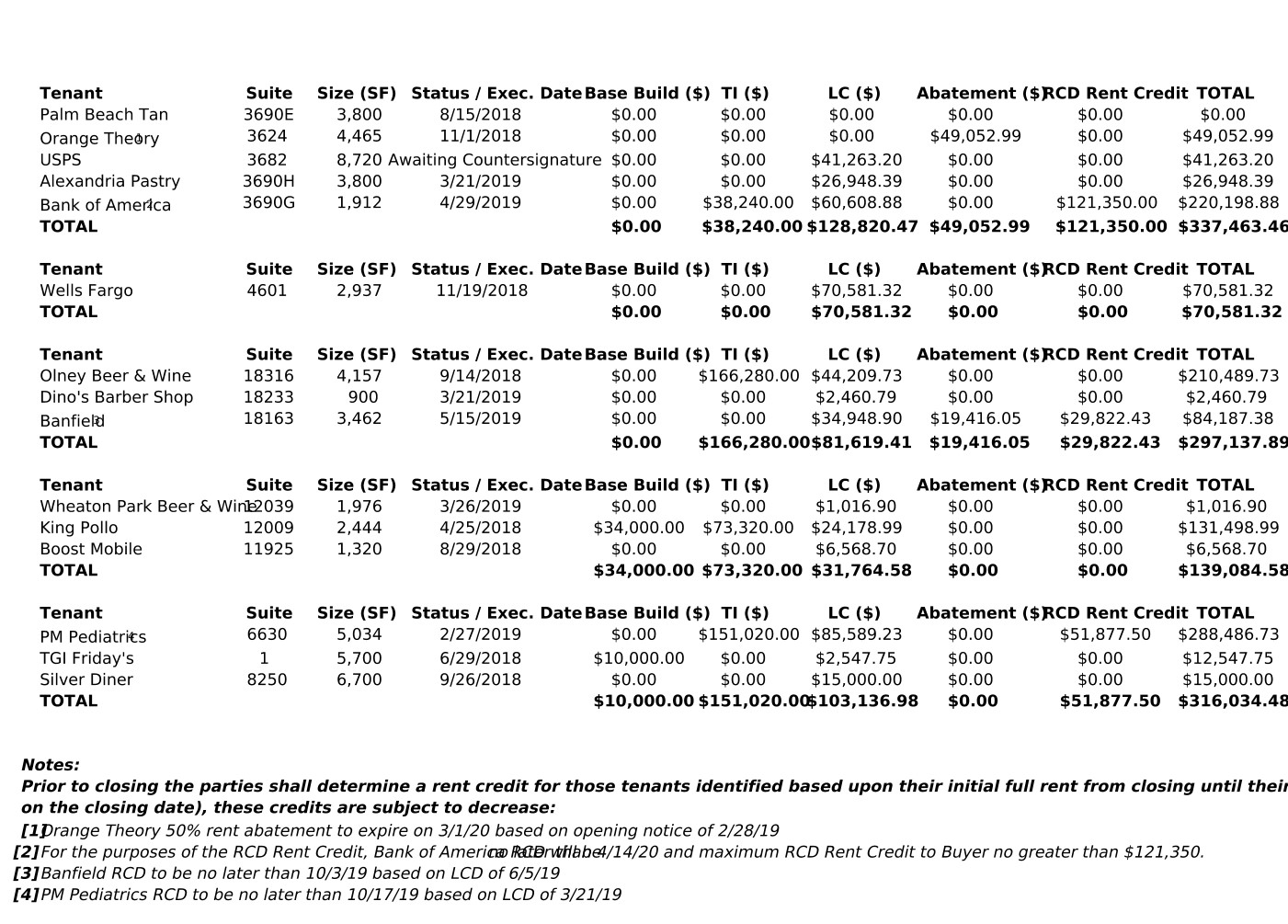

5.1 Lease Rentals . All collected rents, additional rent payments (which, for the purposes of this Agreement, shall include percentage rent and common area maintenance charges), estimated additional rent payments and other collected payments from tenants under the Leases (as hereinafter defined) by each Seller prior to Closing with respect to its Individual Property shall be prorated between such Seller and Buyer as of 11:59 p.m. on the day prior to the Closing Date (the “Apportionment Time”). For purposes of calculating such prorations, if the Closing occurs, with respect to each Seller’s Individual Property, (a) such Seller shall be entitled to all rents, charges, and other revenue of any kind, in each case attributable to any period under the Leases prior to the Apportionment Time, and (b) Buyer shall be entitled to all rents, charges, and other revenue of any kind, in each case attributable to any period under the Leases after the Apportionment Time. The parties agree that (i) as of the Effective Date, the rent commencement dates are not specified in the following Leases: (a) Bank of America at the Bradlee Shopping Center (the “BOA Lease”), (B) Banfield at the Olney Shopping Center (the “Banfield Lease”), and (C) PM Pediatrics at the Gateway Shopping Center (the “PM Pediatrics Lease”); (ii) the Leasing Cost Credit set forth on Schedule 5.6 hereto includes certain rent commencement date credits (the “RCD Rent Credit”) that Buyer will receive at Closing assuming that the rent commencement date for (x) the BOA Lease will be on April 14, 2020, (y) the Banfield Lease will be on October 3, 2019, and (z) the PM Pediatrics Lease will be on October 17, 2019; and (iii) in the event the rent commencement date for any of the BOA Lease, the Banfield Lease or the PM Pediatrics Lease occurs before the date set forth in clause (ii) with respect to such Lease, then the RCD Rent Credit for such Lease set forth on Schedule 5.6 shall be adjusted between such Seller and Buyer as of the actual rent commencement date for such Lease, and Buyer shall deliver to such Seller within thirty (30) days after the actual rent commencement date for such Lease the portion of the RCD Rent Credit for such Lease attributable to the period after the actual rent commencement date, provided that such tenant has commenced paying full rent under such Lease as of the rent commencement date. With respect to each Seller’s Individual Property, rents, additional rent payments, estimated additional rent payments or other reimbursements due landlord under the Leases not collected by such Seller as of the Closing Date shall not be prorated at the time of Closing. Seller shall have the right to seek to collect such amounts directly from such tenants but Seller shall not file suit against any such tenant (while such tenant is in occupancy at any Individual Property) or threaten or seek to evict any such tenant. All rents, escalations and other reimbursements due landlord under the Leases collected by Buyer on or after the Closing Date, less the reasonable costs of collection, shall first be applied to all amounts due under the Leases at the time of collection (i.e., current and other rents and sums due Buyer as the current owner and landlord), for the period from and after Closing, with the balance (if any) payable to such Seller, but only to the extent of amounts delinquent and actually due to such Seller.

5.2 Real Estate and Personal Property Taxes.

5.2.1 Real estate and personal property taxes shall be prorated between each Seller and Buyer with respect to each Individual Property on an accrual basis for the tax year in which the Closing occurs. Such proration shall be calculated based upon the actual number of days in such tax year, with each Seller being responsible for that portion of such tax year occurring prior to the Apportionment Time and Buyer being responsible for that portion of such tax year occurring thereafter. If the real estate and/or personal property tax rate and assessments have not been set for the tax year in which the Closing occurs, then the proration of such taxes for an Individual Property shall be based upon the rate and assessments for the preceding tax year, and such proration shall be adjusted between each Seller and Buyer upon presentation of written evidence that the actual taxes paid for the tax year in which the Closing occurs differ from the amounts used at Closing and in accordance with the provisions of Section 5.8. Similarly, if the real estate and/or personal property tax rate and/or assessment for an Individual Property are reset after the Closing and such change in rate and/or assessment applies to a period prior to the Closing, then such taxes shall be re-prorated by such applicable Seller and Buyer.

5.2.2 Sellers have advised Buyer that Sellers have previously filed real estate tax assessment appeals as set forth on Schedule 5.2 hereof (collectively, the “Tax Appeals” and each a, “Tax Appeal”). With respect to the Tax Appeal for each of Gateway Shopping Center and Olney Shopping Center (collectively, the “Maryland Tax Appeals”), Gateway Seller and Olney Seller shall each have the right to continue to prosecute its respective Maryland Tax Appeals from and after Closing and Buyer shall have the right to reasonably approve any settlement. With respect to any Individual Property located in Maryland, all rebates or reductions in taxes received subsequent to Closing for tax year 2019 and for tax years preceding tax year 2019, net of any fee payable to Altus Group U.S. Inc. (“Altus”) pursuant to the consulting agreement with Altus dated as of February 10, 2017 (the “Altus Contract”) with respect to such Individual Property, shall be paid to Buyer. Any amounts in excess of amounts refundable to Tenants shall be pro-rated between the parties pro rata based on their respective period of ownership and the tax period to which the rebate or reduction applies. The foregoing obligations with respect to the Tax Appeals shall survive Closing. The terms of this Section 5.2 shall survive Closing.

5.3 Other Property Operating Expenses. Water, sewer charges, and utility charges for the month during which Closing occurs shall be prorated for each Individual Property as of the Apportionment Time. With respect to each Individual Property, each Seller shall pay all water, sewer charges and other utility charges prior to, but not including, the Closing Date (except for those water, sewer charges and other utility charges paid directly to such utility by tenants, if any) and Buyer shall pay all water, sewer charges and other utility charges attributable on or after the Closing Date. For any Individual Property, to the extent that the amount of actual consumption of any utility services is not determined prior to the Closing Date, a proration shall be made at Closing based on the last available reading and post-closing adjustments between Buyer and the applicable Seller shall be made as soon as reasonably possible after the date that actual consumption for such pre-closing period is determined. No Seller shall assign to Buyer any deposits for any of the utility services or companies servicing any Individual Property. With respect to each Individual Property, Buyer shall arrange with such services and companies to have accounts opened in Buyer’s name beginning at 12:01 a.m. on the Closing Date. This Section 5.3 shall survive Closing.

5.4 Closing Costs. Sellers shall pay (a) the commission due HFF (“Broker”); (b) in connection with the recordation of a Deed for any Individual Property located in the State of Maryland, one-half of (i) the recording fees, and (ii) all state, county and local transfer and recording taxes; (c) the Virginia Grantor’s Tax and the Regional WMATA Capital Fee with respect to any Individual Property located in the Commonwealth of Virginia, and (d) one-half of any escrow and/or closing charges. Buyer shall pay (i) all premiums and charges for its title insurance policies and surveys; (ii) in connection with the recordation of a Deed for any Individual Property located in the State of Maryland, one-half of (A) the recording fees, and (B) all state, county and local transfer and recording taxes; (iii) with respect to any Individual Property located in the Commonwealth of Virginia, all state and county recordation taxes in connection with the recordation of a Deed for such Individual Property excluding the Virginia Grantor’s Tax and the WMATA Capital Fee; (iv) [intentionally omitted]; (v) all costs of Buyer’s Due Diligence, and (vi) one-half of any escrow and/or closing charges. Each party shall pay its own attorneys’ fees. The obligations of the parties to pay applicable escrow or closing charges shall survive Closing or the termination of this Agreement.

5.5 Security Deposits. At Closing, each Seller shall give Buyer a credit against the Purchase Price allocated to such Seller’s Individual Property in the aggregate amount of the unapplied refundable deposits, if any, including cash security deposits and other refundable tenant deposits, if any, then held by such Seller under the Leases applicable to such Individual Property and any interest required to be paid thereon and Buyer shall assume the obligation to return to tenants, as and when due under the terms of their Leases, such tenant deposits with respect to which Buyer was given credit at Closing. If any security deposits held by a Seller under any Lease are letters of credit, Seller shall deliver transfer documentation necessary to transfer any such letters of credit from such Seller to Buyer (collectively, the “LOC Transfer Documents”) and pay any fees in connection therewith, except that if any LOC Transfer Document is not available on the Closing Date, such Seller shall deliver such LOC Transfer Document to Buyer promptly after the Closing. The obligations set forth in this Section 5.5 shall survive the Closing.

5.6 Leasing Commissions and Tenant Improvements. The parties agree that as to any new Leases or amendments thereto executed after the Effective Date and prior to Closing in accordance with the terms of this Agreement, all Leasing Costs (as defined below) shall be paid by Buyer. Subject to the foregoing and the provisions of Section 9.2.1, Buyer shall pay all Leasing Costs that become due and payable on or after Closing, and Sellers shall have no obligation to pay any such Leasing Costs; provided, however, that in respect of Buyer’s agreement to pay such Leasing Costs, including, without limitation, those set forth on Schedule 5.6 hereto, Buyer shall receive a credit at Closing in the amount of $1,160,301.72 (the “Leasing Cost Credit”) in respect of the Leasing Costs listed on Schedule 5.6 hereto, subject to reduction as set forth in the penultimate sentence of this Section 5.6. At Closing, Buyer shall assume Seller’s obligation to the applicable tenants to pay any remaining unpaid Leasing Costs for which Buyer is responsible as set forth in this Section 5.6. The Leasing Cost Credit shall be reduced by the amount of any Leasing Costs set forth on Schedule 5.6 that are actually paid by Seller prior to Closing as to which Seller provides reasonable proof of payment to Buyer. As used herein, “Leasing Costs” shall mean any out-of-pocket payments required under a Lease or any Lease amendment to be paid by the landlord thereunder to or for the benefit of the tenant thereunder that is in the nature of a tenant inducement or concession including, without limitation, tenant improvement costs, design, refurbishment and other tenant allowances, lease

buyout costs, moving allowances, any free-rental period provided under the Leases and any brokerage or leasing commissions, finders fees or similar payments and legal expenses relating thereto.

5.7 Apportionment Credit. If the apportionments, adjustments and prorations to be made at Closing, in the aggregate on an Individual Property basis, result in a net balance (a) to Buyer, such sum shall be paid at the Closing by giving Buyer a credit against the Purchase Price in the amount of such credit balance, or (b) to Seller, Buyer shall deposit the amount thereof at the Closing by wire transfer of immediately available funds into the closing escrow established with the Escrow Agent for the payment of the Purchase Price.

5.8 Post-Closing Adjustment.

5.8.1 Reconciliation with Tenants.

(a) 2018 Reconciliation. As soon as reasonably practicable, Sellers will perform a reconciliation of calendar year 2018 pass-throughs for estimated additional rents received for such period from tenants and the underlying operating expenses and real estate taxes to which they relate (the “2018 Reconciliation”) for each Individual Property. Promptly after completion of the 2018 Reconciliation, Sellers will provide the 2018 Reconciliation and appropriate notices to Buyer for Buyer’s information, and Buyer shall send such notices to tenants within five (5) days after receipt. If any amounts are due to tenants on account of the 2018 Reconciliation, then Sellers shall deliver such amounts to Buyer, for distribution to tenants, whereupon Buyer shall remit such amounts to the tenants in accordance with their Leases. In the event any tenants have underpaid such amounts, Seller shall have the right to seek to collect such amounts directly from such tenants but Seller shall not file suit against any such tenant (while such tenant is in occupancy at any Individual Property) or threaten or seek to evict any such tenant.

(b) 2019 Reconciliation. Within sixty (60) days after Closing, Sellers shall provide all information relating to operating expenses and real estate taxes incurred for each Individual Property for the portion of calendar year 2019 prior to Closing. By no later than September 30, 2020, if Closing occurs, Buyer shall perform a reconciliation of calendar year 2019, with respect to estimated additional rents received for such period from tenants and the underlying operating expenses and real estate taxes to which they relate (the “2019 Reconciliation”) for each Individual Property. If any amounts are due to tenants on account of the 2019 Reconciliation that are attributable to the period of time prior to Closing, then Sellers shall promptly deliver such amounts to Buyer, for distribution to tenants, whereupon Buyer shall remit such amounts to the tenants in accordance with their Leases. If any tenants have underpaid such amounts, Buyer shall, promptly after receipt from tenants, deliver to Seller such underpayment (less a proportionate share of any reasonable attorneys’ fees, costs and expenses of collection thereof (if any)). This Section 5.8 shall survive the Closing Date until December 31st of the calendar year following the year in which the Closing occurs.

5.8.2 Errors in Closing Prorations. If the amount of an item listed in any section of this Article 5 shall prove to be incorrect (whether as a result in an error in calculation, a lack of complete and accurate information as of the Closing of such Individual Property or otherwise), the party in

whose favor the error was made shall promptly pay to the other party the sum necessary to correct such error upon receipt of proof of such error; provided, however, that other than for real estate and personal property taxes (which are addressed in Section 5.2 above), such proof is delivered to the party from whom payment is requested. Thereafter, no party shall have the right to contest any adjustments or prorations made pursuant to this Article 5 (except for real estate and personal property taxes, as provided above).

5.9 Customary Prorations. With respect to each Individual Property, any apportionments and prorations that are not expressly provided for in this Article 5 shall be made in accordance with the customary practice in the county in which such Individual Property is located.

5.10 Survival of Provisions. The provisions of Article 5 shall survive the Closing until the later of: (a) twelve (12) months from the Closing as to the Individual Properties that are the subject of the Closing or, (b) in the case of a specific section of Article 5, the time period specifically referenced in that section of this Article 5.

ARTICLE 6 – CLOSING

Buyer and Sellers agree that the Transactions shall be consummated as follows:

6.1 Closing Date. All of the Transactions shall close simultaneously (“Closing”) on July 23, 2019 (the “Closing Date”). Closing shall be conducted through an escrow with the Escrow Agent. Buyer and the Seller of each Individual Property shall use commercially reasonable efforts to conduct a “pre-closing” on the last Business Day prior to the Closing Date with title transfer and payment of the Purchase Price to be completed on the Closing Date as set forth in Section 6.2.

6.2 Title Transfer and Payment of Purchase Price. Provided all conditions precedent to Buyer’s obligations under this Agreement have been satisfied, Buyer agrees to deliver the payment specified in Section 2.2 by timely delivering the same to the Escrow Agent no later than 4:00 p.m. Eastern Time on the Closing Date and unconditionally directing the Escrow Agent to wire the same to each Seller’s designated account(s) on the Closing Date. Provided all conditions precedent to Sellers’ obligations under this Agreement have been satisfied, Escrow Agent shall record separate Deeds conveying each Individual Property to Buyer upon confirmation of receipt of the entire Purchase Price for all of the Property, by the Escrow Agent as set forth above. If the events set forth in the preceding sentence are not satisfied within the specified time periods, closing adjustments shall be made as of the date of the actual Closing. Notwithstanding the foregoing and in accordance with Section 11.1.2, each Seller shall have the right to (i) terminate this Agreement with respect to all of the Property and all of the Sellers, and (ii) recover the entire Deposit from Escrow Agent if such payment is not received by the Escrow Agent in strict accordance with this Section 6.2.

6.3 Seller’s Closing Deliveries. At the Closing, each Seller shall cause the items described in Sections 6.3.12 and 6.3.13 with respect to such Seller’s Individual Property to be delivered to Buyer and each Seller shall deliver or cause to be delivered to the Escrow Agent all other items in this Section 6.3 with respect to such Seller’s Individual Property as follows:

6.3.1 Deed. A deed in the form of (i) Exhibit D-1 attached hereto and incorporated herein by this reference with respect to any Individual Property located in the State of Maryland, and (ii) Exhibit D-2 attached hereto and incorporated herein by this reference with respect to any Individual Property located in the Commonwealth of Virginia, each conveying to Buyer the Real Property for such Seller’s Individual Property (the “Deed”), executed by such Seller and duly notarized.

6.3.2 Assignment of Gateway Shopping Center Ground Lease. An assignment of ground lease (the “Assignment of Ground Lease”), in the form of Exhibit D-3, with respect to the ground leasehold estate (the “Ground Leasehold”) created by that certain Ground Lease, dated as of June 1, 2006, by and between The Howard Research and Development Corporation (the predecessor-in-interest to Gateway Seller), and Gateway Overlook Business Trust (the predecessor-in-interest to Gateway Seller), executed by Gateway Seller, as the ground lessor and the ground lessee.

6.3.3 Bill of Sale. A bill of sale in the form of Exhibit E attached hereto and incorporated herein by this reference, conveying to Buyer all of such Seller’s right, title and interest in and to the Personal Property for such Seller’s Individual Property (the “Bill of Sale”), executed by such Seller.

6.3.4 Assignment of Tenant Leases. An assignment and assumption of Leases in the form of Exhibit F attached hereto and incorporated herein by this reference, transferring all of such Seller’s interest in the Leases for such Seller’s Individual Property (the “Assignment of Leases”), executed by such Seller.

6.3.5 Assignment of Licenses and Permits. An assignment and assumption of the Other Property Rights (to the extent the same are not transferred by the Deed, Bill of Sale or Assignment of Leases) in the form of Exhibit G attached hereto and incorporated herein by this reference, assigning all of such Seller’s interest in the Other Property Rights for such Seller’s Individual Property (the “Assignment of Licenses and Permits”), executed by such Seller.

6.3.6 Notices to Tenants. A single form letter, executed by the Seller of each Individual Property, in the form of Exhibit H attached hereto and incorporated herein by this reference, for the tenants under the Leases, duplicate copies of which shall be delivered by Buyer to the tenants notifying each tenant of the sale of the Individual Property to Buyer and advising them that all future payments of rent and other payments due under the Leases for such Individual Property are to be made to Buyer at an address designated by Buyer.

6.3.7 Non-Foreign Status Affidavit. A non-foreign status affidavit in the form of Exhibit I attached hereto and incorporated herein by this reference, as required by Section 1445 of the United States Internal Revenue Code, as amended (the “Code”), executed by each Seller.

6.3.8 Rent Roll. A rent roll in the form of Exhibit K attached hereto and incorporated herein by this reference and an aged receivables report, for each Individual Property dated as of the Closing Date, certified by each Seller with respect to such Seller’s Individual Property.

6.3.9 Transfer and Recordation Tax Returns. With respect to any Individual Property located in the Commonwealth of Virginia, all transfer and recordation tax returns and similar

documents required to be filed with respect to the transfer of such Individual Property to Buyer and recordation of documents pursuant to this Agreement (collectively, the “Transfer/Recordation Tax Returns”), executed by the Seller of such Individual Property.

6.3.10 Settlement Statement. An executed original counterpart of a closing settlement statement with respect to each Individual Property apportioning any prorations and costs as required by this Agreement (the “Settlement Statement”), executed by the Seller of such Individual Property.

6.3.11 Evidence of Authority. Documentation to establish to the Title Company’s reasonable satisfaction the due authorization of each Seller’s (a) sale of such Seller’s Individual Property; (b) delivery of the documents required to be delivered by such Seller pursuant to this Agreement (including, but not limited to, the organizational documents of each Seller, as they may have been amended from time to time, resolutions of each Seller, and incumbency certificates of each Seller), and (c) execution of this Agreement and all documents contemplated by this Agreement and the consummation of the Transactions.

6.3.12 Property Documents. To the extent in each Seller’s possession or control relating to such Seller’s Individual Property, (a) all original (or, if unavailable, copies of) certificates (including certificates of occupancy then in place for such Individual Property), licenses, permits, authorizations and approvals issued for or with respect to such Individual Property by governmental and quasi-governmental authorities having jurisdiction; (b) all original operating manuals for all equipment, systems and machinery used in connection with such Individual Property, and all maintenance, repair and operating records pertaining to such equipment, systems and machinery; (c) all original leasing files and non-cash security deposits, and (d) all original warranties and guaranties (the items described in clauses (a), (b), (c) and (d) being herein collectively called the “Property Documents”).

6.3.13 Keys and Original Documents. Keys and combinations to all locks on the Real Property for each Seller’s Individual Property (in each Seller’s or each Seller’s building manager’s possession) and originals or, if originals are not available, copies, of the Leases for such Seller’s Individual Property (unless otherwise provided during the Due Diligence Period) encumbering such Seller’s Individual Property on the Closing Date.

6.3.14 Owner’s Affidavit. An owner’s affidavit and gap indemnity agreement in the form attached hereto as Exhibit J attached hereto and incorporated herein by this reference for each Seller’s Individual Property.

6.3.15 Maryland Withholding Form. With respect to any Individual Property located in the State of Maryland, an executed original counterpart of the Certification of Exemption from Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence, executed by the Seller of such Individual Property.

6.3.16 Virginia Form. With respect to any Individual Property located in the Commonwealth of Virginia, the Virginia R-5 Non Resident Real Property Owner Registration Form, if required, executed by the Seller of such Individual Property.

6.3.17 IRS 1099. An executed IRS Form 1099 from each Seller.

6.3.18 LOC Transfer Documents. To the extent in each Seller’s possession, the LOC Transfer Documents in accordance with Section 5.5 hereof.

6.3.19 Reaffirmation of Seller’s Representations. An affidavit setting forth that all of Seller’s representations and warranties are true and correct in all material respects as of the Closing Date.

6.3.20 Tenant Estoppel Certificates. Originals of all Seller Estoppels, if applicable, and to the extent in each Seller’s possession, originals of all tenant estoppel certificates.

6.3.21 USPS Certificate of Transfer/Lease Assignment. With respect to that certain Lease dated as of June 3, 2010 (the “USPS Lease”), by and between Washington Real Estate Investment Trust (predecessor-in-interest to Bradlee Seller) and the United States Postal Service (“USPS”) at Bradlee Shopping Center, Bradlee Seller shall execute an original counterpart of the Certificate of Transfer of Title to Leased Property and the Lease Assignment and Assumption (“USPS Certificate of Transfer/Lease Assignment”) provided by the USPS contracting officer (the “Contracting Officer”), as required by Section 4(d) of the “General Conditions to USPS Lease” attached to the USPS Lease.

6.3.22 Declaration Estoppels. The declaration estoppel certificate in substantially the form attached hereto as Exhibit O-1 executed by the Gateway Seller.

6.4 Buyer Closing Deliveries. At the Closing, Buyer shall deliver or cause to be delivered to the Escrow Agent the following with respect to each Seller’s Individual Property:

6.4.1 Purchase Price. The Purchase Price, as adjusted for the prorations and adjustments set forth in Article 5 or as otherwise provided under this Agreement, plus any other amounts required to be paid by Buyer at Closing, in immediately available funds by wire transfer as more particularly set forth in Section 6.2.

6.4.2 Assignment of Leases. Each Assignment of Leases, executed by Buyer.

6.4.3 Assignment of Licenses and Permits. Each Assignment of Licenses and Permits, executed by Buyer.

6.4.4 Settlement Statement. An original counterpart of each Settlement Statement, executed by Buyer.

6.4.5 Evidence of Authority. Documentation to establish to the Title Company’s reasonable satisfaction the due authorization of Buyer’s (a) acquisition of each and every Individual Property; (b) delivery of the documents required to be delivered by Buyer pursuant to this Agreement (including, but not limited to, the organizational documents of Buyer, as they may have been amended from time to time, if required by Title Company), and (c) execution of this Agreement and all documents contemplated by this Agreement and the consummation of the Transactions.

6.4.1 USPS Certificate of Transfer/Lease Assignment. Buyer shall execute an original counterpart of the USPS Certificate of Transfer/Lease Assignment.

6.5 Delivery of Deed. Effective upon delivery of the Deed for each Individual Property, actual and exclusive possession (subject only to the rights of tenants under Leases and any Permitted Exceptions, to the extent such Permitted Exceptions include any possessory rights) and risk of loss to such Individual Property shall pass from the applicable Seller to Buyer.

ARTICLE 7 – CONDITIONS TO CLOSING

7.1 Seller’s Obligations. Sellers’ obligations to proceed with and authorize Closing are conditioned on all of the following (and any other conditions expressly stated in this Agreement as conditions to each Seller’s obligation to proceed with Closing), any or all of which may be waived by the applicable Individual Seller by an express written waiver, at its sole option:

7.1.1 Representations True. All representations and warranties made by Buyer in this Agreement shall be true and correct in all material respects on and as of the Closing Date, as if made on and as of such date except to the extent that they expressly relate to an earlier date;

7.1.2 Buyer’s Financial Condition. No insolvency proceeding has been filed by or against Buyer and Buyer has not admitted in writing an inability to pay its debts as they become due; and

7.1.3 Buyer’s Deliveries Complete. Buyer shall have (a) delivered the funds required hereunder and all of the documents to be executed or delivered by Buyer set forth in Section 6.4, and (b) performed, in all material respects, all other covenants, undertakings and obligations required by this Agreement, to be performed or complied with by Buyer at or prior to the Closing.

7.2 Buyer’s Obligations. Buyer’s obligation to proceed with and authorize Closing is conditioned on all of the following (and any other conditions expressly stated in this Agreement as conditions to Buyer’s obligation to proceed with Closing, in each case, as they pertain to such Individual Property and the Seller of such Individual Property), any or all of which may be expressly waived by Buyer in writing, at its sole option:

7.2.1 Representations True. All representations and warranties made by each Seller with respect to each Seller’s Individual Property in this Agreement, shall be true and correct in all material respects on and as of the Closing Date, as if made on and as of such date except to the extent that they expressly relate to an earlier date (an “Earlier Date Representation”). If any such representation or warranty is an Earlier Date Representation, such Earlier Date Representation shall be true and correct in all material respects on and as of the Closing Date as if made on and as of such date unless such Earlier Date Representation ceased to be true in any material respect as of the Closing Date as the result of an unanticipated change in fact or circumstance occurring after the Effective Date, and before the Closing Date, that is not caused by, or under the reasonable control of, any Seller, or any affiliate or representative of any Seller, and is not the result of a breach of this Agreement by any Seller;

7.2.2 Title Conditions Satisfied. At the time of the Closing (as may be extended pursuant to Article 3), title to each Seller’s Individual Property shall be as provided in Article 3 of this Agreement;

7.2.3 Seller’s Deliveries Complete. Each Seller shall have (a) delivered all the documents and other items required pursuant to Section 6.3; (b) performed, in all material respects, all other covenants, undertakings and obligations with respect to such Seller’s Individual Property to be performed by each Seller (as applicable) at or prior to the Closing, and (c) complied in all material respects with all conditions required by this Agreement, to be complied with by each Seller (as applicable) at or prior to the Closing; and

7.2.4 Estoppel Certificates. At the time of the Closing (as may be extended pursuant to Section 9.2.3), the condition precedent related to Estoppel Certificates set forth in Section 9.2.3 shall have been satisfied.