1 WASHREIT washreit.com Investor Presentation Accelerating Our Transformation into a Multifamily REIT June 15, 2021

2 WASHREIT washreit.com This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of WashREIT, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification of such securities under the securities law of any such jurisdiction. If WashREIT were to conduct an offering of securities in the future, it will be made under an effective registration statement filed with the Securities and Exchange Commission and only by means of a prospectus supplement and accompanying prospectus. In such an event, a copy of the prospectus and the applicable preliminary prospectus supplement and final prospectus supplement, as well as the final term sheet, if applicable, relating to such transaction will be able to be obtained from the Securities and Exchange Commission at www.sec.gov, from any underwriters in that offering, or by contacting WashREIT at 202-774-3200. Before you invest in any such offering, you should read the applicable prospectus supplement related to such offering, the accompanying prospectus and the information incorporated by reference therein and other documents WashREIT has then filed with the Securities and Exchange Commission for more complete information about WashREIT and any such offering. Forward-Looking Statements Certain statements in this presentation are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and involve risks and uncertainties. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” "assumed," "pro forma," "target," “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Such statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of WashREIT to be materially different from future results, performance or achievements expressed or implied by such forward looking statements. Currently, one of the most significant factors continues to be adverse effect of the COVID-19 virus, including any variants and mutations thereof, the actions taken to contain the pandemic or mitigate the impact of COVID-19, and the direct and indirect economic effects of the pandemic and containment measures. The extent to which COVID-19 continues to impact WashREIT and its tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, the continued speed and success of the vaccine rollout, effectiveness and willingness of people to take COVID-19 vaccines, and the duration of associated immunity and their efficacy against emerging variants of COVID-19, among others. Moreover, investors are cautioned to interpret many of the risks identified in the risk factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2020 filed on February 16, 2021, as being heightened as a result of the ongoing and numerous adverse impacts of COVID-19. Additional factors which may cause the actual results, performance, or achievements of WashREIT to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements include, but are not limited to the risks associated with the failure to enter into and/or complete contemplated acquisitions or dispositions (including the announced office portfolio sale transaction and assumed retail asset sales) within the price ranges anticipated and on the terms and timing anticipated, or at all; our ability to execute on our strategies, including new strategies with respect to our operations and our portfolio, including the acquisition of multifamily properties and the repayment of debt, and to realize any anticipated benefits, including the performance of any acquired multifamily properties at the levels anticipated; whether our Actual NOI for 2021 will be consistent with our Estimated 2021 NOI; whether our actual Net Leverage (including its components of Net Debt and Adjusted EBITDA) will be consistent with our targeted Net Leverage range (including its components of Net Debt and Adjusted EBITDA); whether Actual 2021 and 2022 NOI for Trove will be consistent with Annualized Estimated 2021 NOI and our Estimated Stabilized NOI for Trove for Q2 2022; whether actual 2021 NOI for Watergate 600 will be consistent with Estimated 2021 NOI for Watergate 600; our assumptions regarding capitalization rates; the ownership of real estate in general and our real estate assets in particular; the economic health of the greater Washington, DC metro region and the larger Southeastern region; changes in the composition and geographic location of our portfolio; fluctuations in interest rates; reductions in or actual or threatened changes to the timing of federal government spending; the risks related to use of third-party providers and joint venture partners; the ability to control our operating expenses; the economic health of our tenants; shifts away from brick and mortar stores to ecommerce; the availability and terms of financing and capital and the general volatility of securities markets; compliance with applicable laws, including those concerning the environment and access by persons with disabilities; the risks related to not having adequate insurance to cover potential losses; the risks related to our organizational structure and limitations of stock ownership; changes in the market value of securities; terrorist attacks or actions and/or cyber-attacks; failure to qualify and maintain our qualification as a REIT and the risks of changes in laws affecting REITs; and other risks and uncertainties detailed from time to time in our filings with the SEC, including our 2020 Form 10-K filed on February 16, 2021 and the additional assumptions included on slide 45 of this presentation. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We undertake no obligation to update our forward-looking statements or risk factors to reflect new information, future events, or otherwise. Use of Non-GAAP Financial Measures and other Definitions This presentation contains certain non-GAAP financial measures and other terms that have particular definitions when used by us. The definitions and calculations of these non-GAAP financial measures and other terms may differ from those used by other REITs and, accordingly, may not be comparable. Please refer to the definitions and calculations of these terms and the reasons for their use, and reconciliations to the most directly comparable GAAP measures included later in this investor presentation. See pages 45 - 58 for certain definitions and reconciliations of non-GAAP information. Definitions and Reconciliation of Certain Forward-Looking Non-GAAP information This presentation also includes certain forward-looking non-GAAP information. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these estimates, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable efforts. Strategic Transactions As discussed in greater detail under the "Forward-Looking Statements" above, there is no assurance that we will execute the transactions and strategies described in this presentation, including the expected dispositions, repayment of debt and redeployment of proceeds into additional multifamily assets, on the terms and timing anticipated, or at all. Market Data Market data and industry forecasts are used in this presentation, including data obtained from publicly available sources. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but the accuracy and completeness of the information is not assured. The Company has not independently verified any such information. DISCLOSURES

3 WASHREIT washreit.com Our Foundation for Growth02 01 Strategic Transactions Overview TOPICS OF DISCUSSION Multifamily Expansion Strategy03

4 WASHREIT washreit.com STRATEGIC TRANSACTIONS OVERVIEW Trove Arlington, Virginia

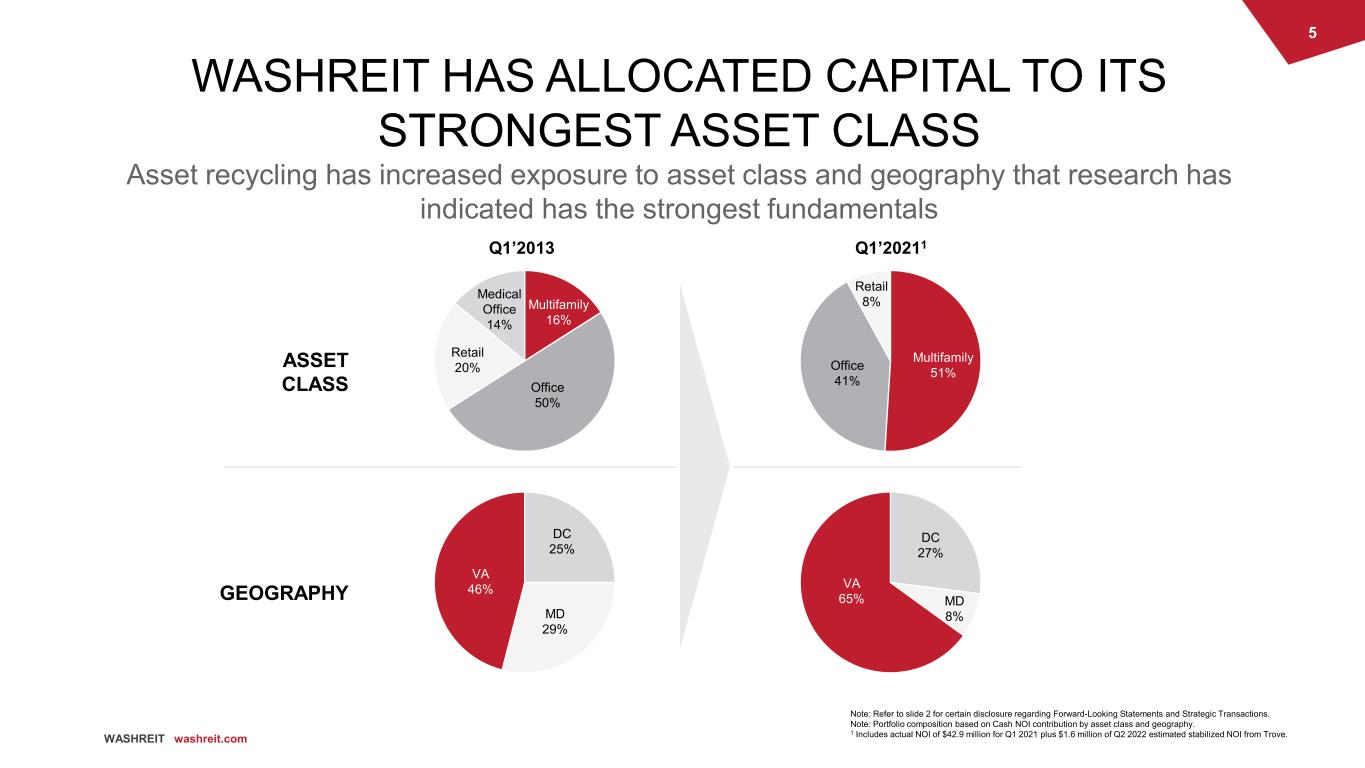

5 WASHREIT washreit.com Multifamily 51%Office 41% Retail 8% Q1’20211Q1’2013 Note: Refer to slide 2 for certain disclosure regarding Forward-Looking Statements and Strategic Transactions. Note: Portfolio composition based on Cash NOI contribution by asset class and geography. 1 Includes actual NOI of $42.9 million for Q1 2021 plus $1.6 million of Q2 2022 estimated stabilized NOI from Trove. WASHREIT HAS ALLOCATED CAPITAL TO ITS STRONGEST ASSET CLASS Asset recycling has increased exposure to asset class and geography that research has indicated has the strongest fundamentals ASSET CLASS GEOGRAPHY Medical Office 14% Multifamily 16% Office 50% Retail 20% DC 25% MD 29% VA 46% DC 27% MD 8% VA 65%

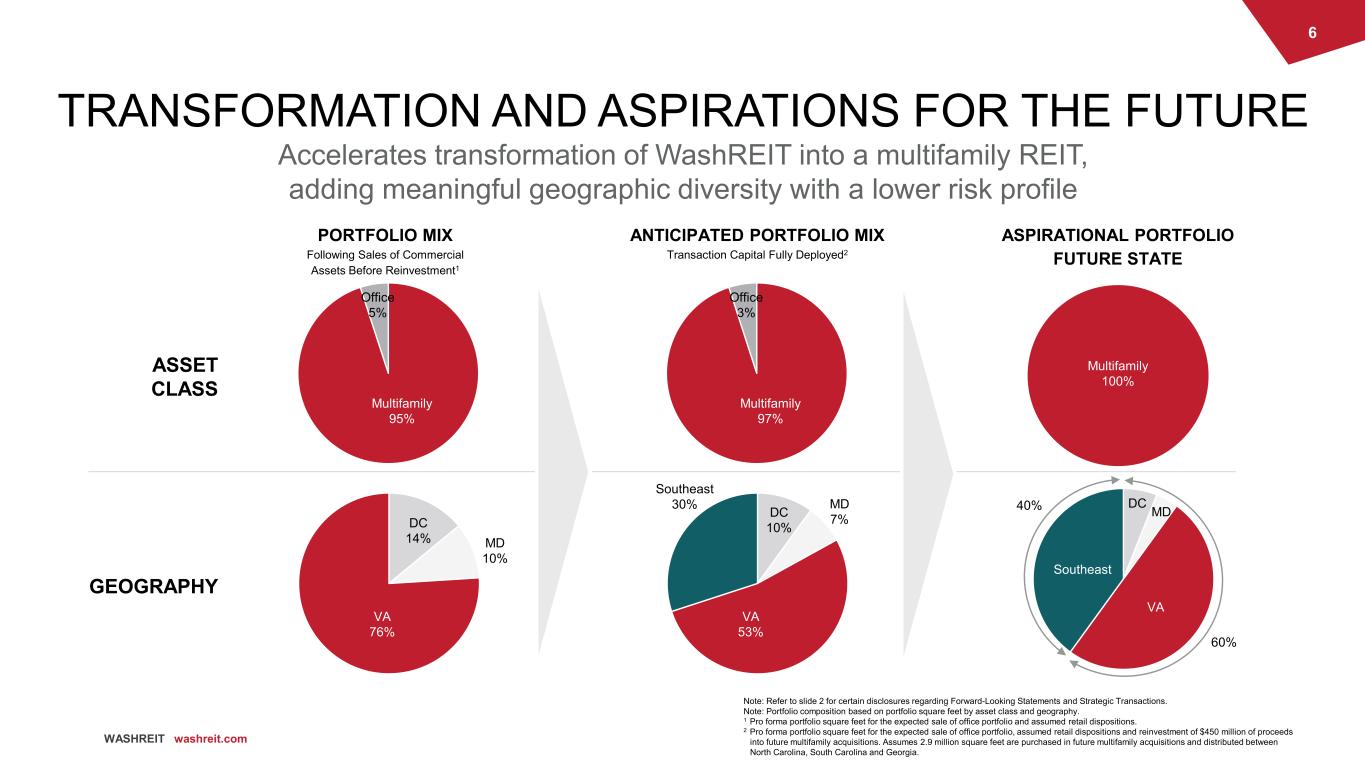

6 WASHREIT washreit.com Office 5% Multifamily 95% DC 14% MD 10% VA 76% PORTFOLIO MIX Following Sales of Commercial Assets Before Reinvestment1 Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. Note: Portfolio composition based on portfolio square feet by asset class and geography. 1 Pro forma portfolio square feet for the expected sale of office portfolio and assumed retail dispositions. 2 Pro forma portfolio square feet for the expected sale of office portfolio, assumed retail dispositions and reinvestment of $450 million of proceeds into future multifamily acquisitions. Assumes 2.9 million square feet are purchased in future multifamily acquisitions and distributed between North Carolina, South Carolina and Georgia. TRANSFORMATION AND ASPIRATIONS FOR THE FUTURE Accelerates transformation of WashREIT into a multifamily REIT, adding meaningful geographic diversity with a lower risk profile ASPIRATIONAL PORTFOLIO FUTURE STATE Multifamily 100% ASSET CLASS GEOGRAPHY DC MD VA Southeast 40% 60% Office 3% Multifamily 97% DC 10% MD 7% VA 53% Southeast 30% ANTICIPATED PORTFOLIO MIX Transaction Capital Fully Deployed2

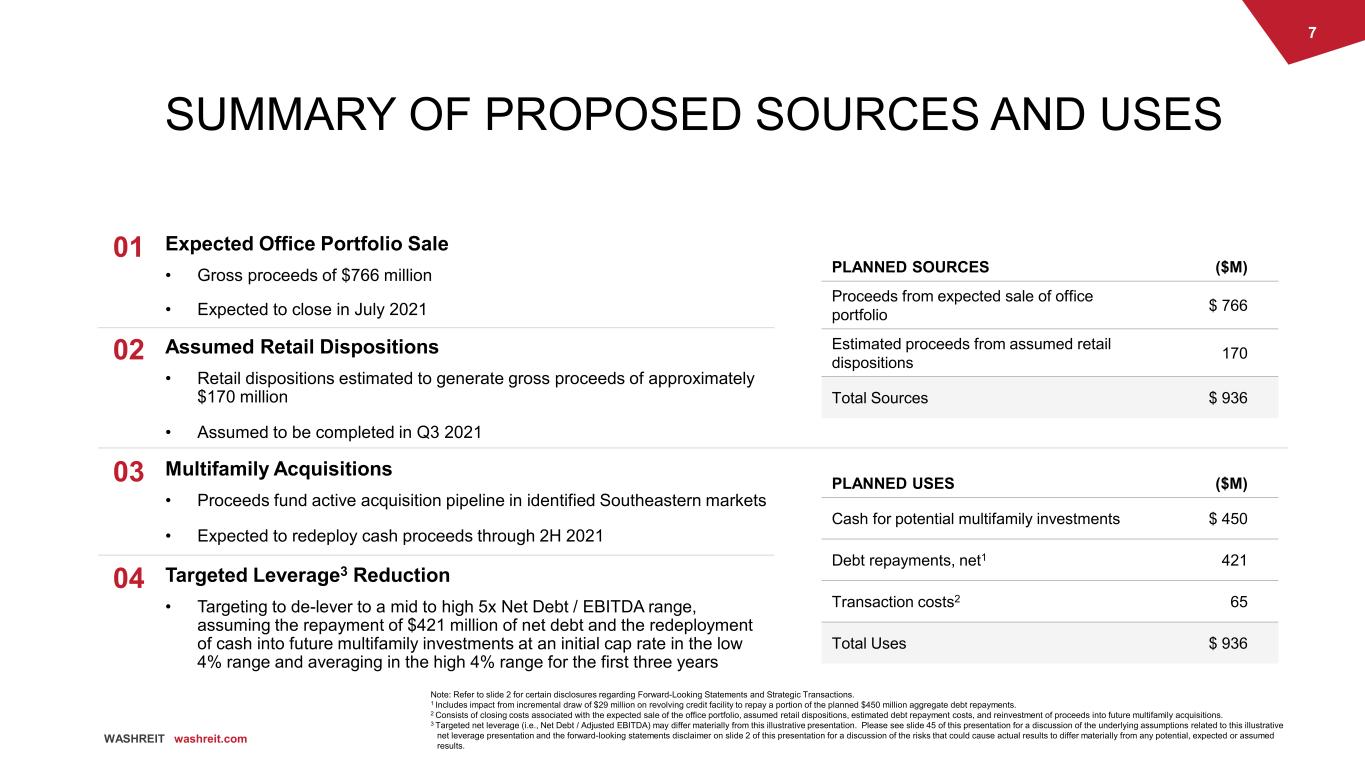

7 WASHREIT washreit.com Expected Office Portfolio Sale • Gross proceeds of $766 million • Expected to close in July 2021 Multifamily Acquisitions • Proceeds fund active acquisition pipeline in identified Southeastern markets • Expected to redeploy cash proceeds through 2H 2021 Targeted Leverage3 Reduction • Targeting to de-lever to a mid to high 5x Net Debt / EBITDA range, assuming the repayment of $421 million of net debt and the redeployment of cash into future multifamily investments at an initial cap rate in the low 4% range and averaging in the high 4% range for the first three years Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Includes impact from incremental draw of $29 million on revolving credit facility to repay a portion of the planned $450 million aggregate debt repayments. 2 Consists of closing costs associated with the expected sale of the office portfolio, assumed retail dispositions, estimated debt repayment costs, and reinvestment of proceeds into future multifamily acquisitions. 3 Targeted net leverage (i.e., Net Debt / Adjusted EBITDA) may differ materially from this illustrative presentation. Please see slide 45 of this presentation for a discussion of the underlying assumptions related to this illustrative net leverage presentation and the forward-looking statements disclaimer on slide 2 of this presentation for a discussion of the risks that could cause actual results to differ materially from any potential, expected or assumed results. SUMMARY OF PROPOSED SOURCES AND USES 01 03 04 PLANNED SOURCES ($M) Proceeds from expected sale of office portfolio $ 766 Estimated proceeds from assumed retail dispositions 170 Total Sources $ 936 PLANNED USES ($M) Cash for potential multifamily investments $ 450 Debt repayments, net1 421 Transaction costs2 65 Total Uses $ 936 Assumed Retail Dispositions • Retail dispositions estimated to generate gross proceeds of approximately $170 million • Assumed to be completed in Q3 2021 02

8 WASHREIT washreit.com Accelerate WashREIT’s transformation into a multifamily REIT operating in the Washington, DC metro and Southeastern markets Provide financial flexibility to prudently invest in high-growth Southeastern region Significantly reset earnings growth profile and enhance geographic diversification Streamline and simplify business model to promote sustainable growth Improve cash flow characteristics – lower volatility, lower capex, and greater growth going forward Reduce net leverage with a target of mid to high 5x range1 TRANSACTIONS HIGHLIGHTS If completed, the strategic transactions would: Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 See footnote 3 on slide 7 for additional information regarding net leverage presentation.

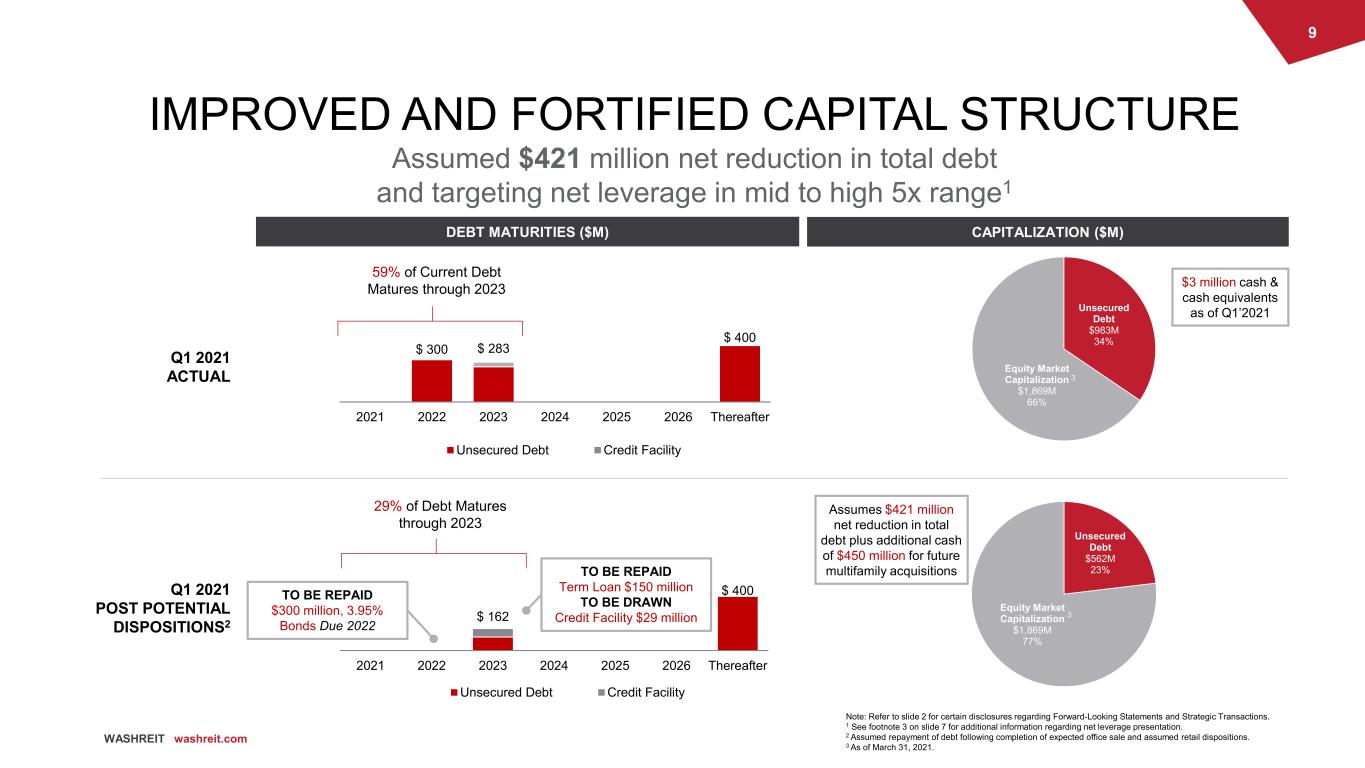

9 WASHREIT washreit.com Equity Market Capitalization $1,869M 77% Unsecured Debt $562M 23% $ 300 $ 283 $ 400 2021 2022 2023 2024 2025 2026 Thereafter IMPROVED AND FORTIFIED CAPITAL STRUCTURE Assumed $421 million net reduction in total debt and targeting net leverage in mid to high 5x range1 DEBT MATURITIES ($M) CAPITALIZATION ($M) Unsecured Debt Credit Facility 59% of Current Debt Matures through 2023 29% of Debt Matures through 2023 Unsecured Debt Credit Facility $3 million cash & cash equivalents as of Q1’2021 Q1 2021 ACTUAL Q1 2021 POST POTENTIAL DISPOSITIONS2 TO BE REPAID Term Loan $150 million TO BE DRAWN Credit Facility $29 million TO BE REPAID $300 million, 3.95% Bonds Due 2022 Assumes $421 million net reduction in total debt plus additional cash of $450 million for future multifamily acquisitions Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 See footnote 3 on slide 7 for additional information regarding net leverage presentation. 2 Assumed repayment of debt following completion of expected office sale and assumed retail dispositions. 3 As of March 31, 2021. Equity Market Capitalization $1,869M 66% Unsecured Debt $983M 34% 3 3 $ 162 $ 400 2021 2022 2023 2024 2025 2026 Thereafter

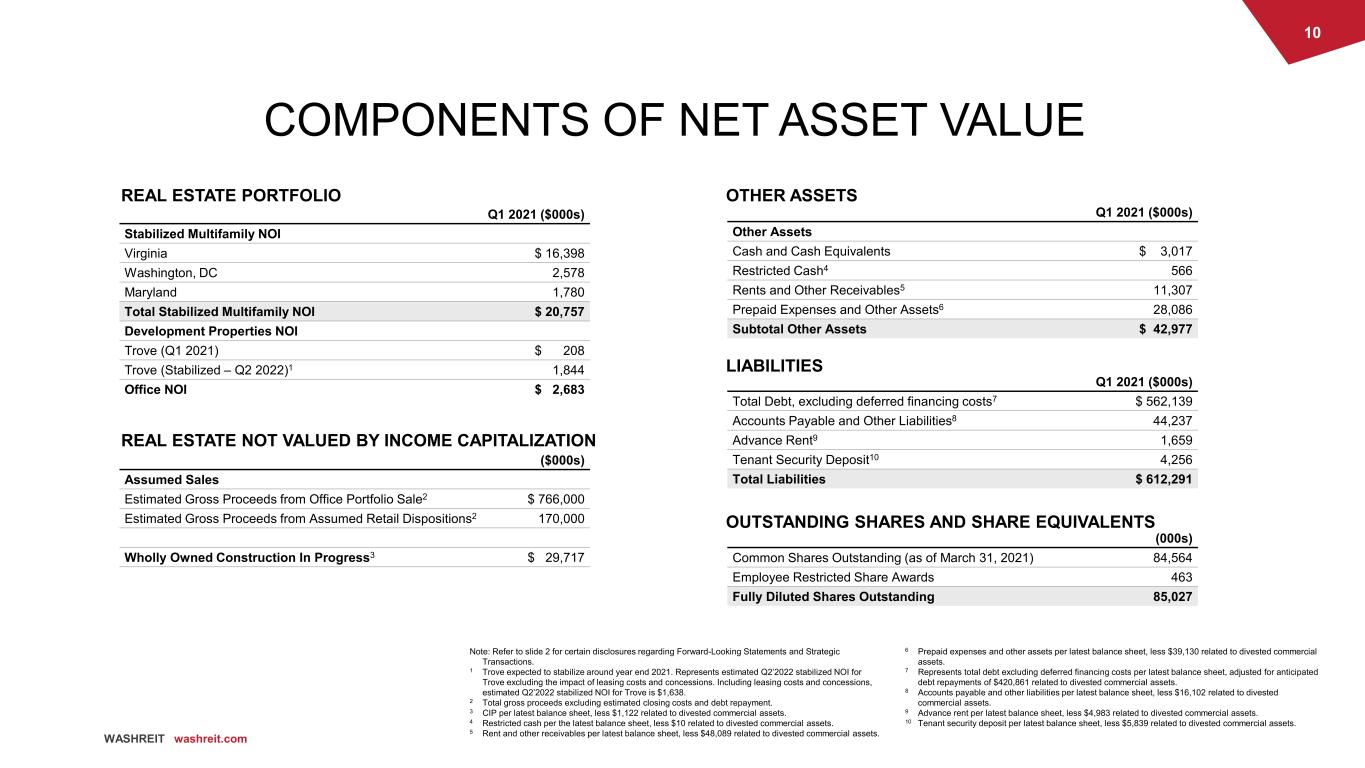

10 WASHREIT washreit.com COMPONENTS OF NET ASSET VALUE Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Trove expected to stabilize around year end 2021. Represents estimated Q2’2022 stabilized NOI for Trove excluding the impact of leasing costs and concessions. Including leasing costs and concessions, estimated Q2’2022 stabilized NOI for Trove is $1,638. 2 Total gross proceeds excluding estimated closing costs and debt repayment. 3 CIP per latest balance sheet, less $1,122 related to divested commercial assets. 4 Restricted cash per the latest balance sheet, less $10 related to divested commercial assets. 5 Rent and other receivables per latest balance sheet, less $48,089 related to divested commercial assets. 6 Prepaid expenses and other assets per latest balance sheet, less $39,130 related to divested commercial assets. commercial assets. 7 Represents total debt excluding deferred financing costs per latest balance sheet, adjusted for anticipated debt repayments of $420,861 related to divested commercial assets. 8 Accounts payable and other liabilities per latest balance sheet, less $16,102 related to divested commercial assets. 9 Advance rent per latest balance sheet, less $4,983 related to divested commercial assets. 10 Tenant security deposit per latest balance sheet, less $5,839 related to divested commercial assets. Q1 2021 ($000s) Stabilized Multifamily NOI Virginia $ 16,398 Washington, DC 2,578 Maryland 1,780 Total Stabilized Multifamily NOI $ 20,757 Development Properties NOI Trove (Q1 2021) $ 208 Trove (Stabilized – Q2 2022)1 1,844 Office NOI $ 2,683 ($000s) Assumed Sales Estimated Gross Proceeds from Office Portfolio Sale2 $ 766,000 Estimated Gross Proceeds from Assumed Retail Dispositions2 170,000 Wholly Owned Construction In Progress3 $ 29,717 REAL ESTATE PORTFOLIO REAL ESTATE NOT VALUED BY INCOME CAPITALIZATION OTHER ASSETS LIABILITIES OUTSTANDING SHARES AND SHARE EQUIVALENTS Q1 2021 ($000s) Other Assets Cash and Cash Equivalents $ 3,017 Restricted Cash4 566 Rents and Other Receivables5 11,307 Prepaid Expenses and Other Assets6 28,086 Subtotal Other Assets $ 42,977 Q1 2021 ($000s) Total Debt, excluding deferred financing costs7 $ 562,139 Accounts Payable and Other Liabilities8 44,237 Advance Rent9 1,659 Tenant Security Deposit10 4,256 Total Liabilities $ 612,291 (000s) Common Shares Outstanding (as of March 31, 2021) 84,564 Employee Restricted Share Awards 463 Fully Diluted Shares Outstanding 85,027

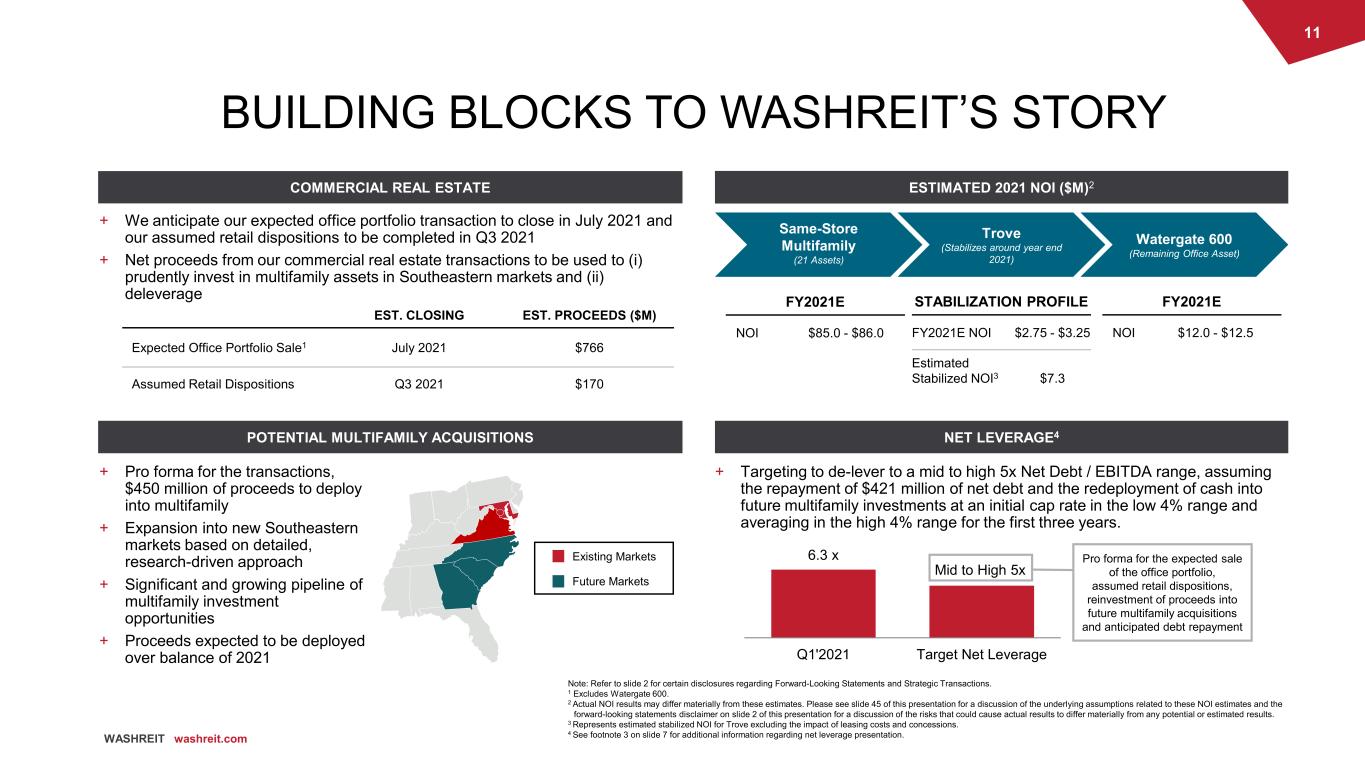

11 WASHREIT washreit.com BUILDING BLOCKS TO WASHREIT’S STORY COMMERCIAL REAL ESTATE ESTIMATED 2021 NOI ($M)2 POTENTIAL MULTIFAMILY ACQUISITIONS NET LEVERAGE4 EST. CLOSING EST. PROCEEDS ($M) Expected Office Portfolio Sale1 July 2021 $766 Assumed Retail Dispositions Q3 2021 $170 + We anticipate our expected office portfolio transaction to close in July 2021 and our assumed retail dispositions to be completed in Q3 2021 + Net proceeds from our commercial real estate transactions to be used to (i) prudently invest in multifamily assets in Southeastern markets and (ii) deleverage Same-Store Multifamily (21 Assets) Trove (Stabilizes around year end 2021) Watergate 600 (Remaining Office Asset) + Pro forma for the transactions, $450 million of proceeds to deploy into multifamily + Expansion into new Southeastern markets based on detailed, research-driven approach + Significant and growing pipeline of multifamily investment opportunities + Proceeds expected to be deployed over balance of 2021 + Targeting to de-lever to a mid to high 5x Net Debt / EBITDA range, assuming the repayment of $421 million of net debt and the redeployment of cash into future multifamily investments at an initial cap rate in the low 4% range and averaging in the high 4% range for the first three years. Existing Markets Future Markets Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Excludes Watergate 600. 2 Actual NOI results may differ materially from these estimates. Please see slide 45 of this presentation for a discussion of the underlying assumptions related to these NOI estimates and the forward-looking statements disclaimer on slide 2 of this presentation for a discussion of the risks that could cause actual results to differ materially from any potential or estimated results. 3 Represents estimated stabilized NOI for Trove excluding the impact of leasing costs and concessions. 4 See footnote 3 on slide 7 for additional information regarding net leverage presentation. FY2021E NOI $85.0 - $86.0 STABILIZATION PROFILE FY2021E NOI $2.75 - $3.25 Estimated Stabilized NOI3 $7.3 FY2021E NOI $12.0 - $12.5 Pro forma for the expected sale of the office portfolio, assumed retail dispositions, reinvestment of proceeds into future multifamily acquisitions and anticipated debt repayment 6.3 x Mid to High 5x Q1'2021 Target Net Leverage

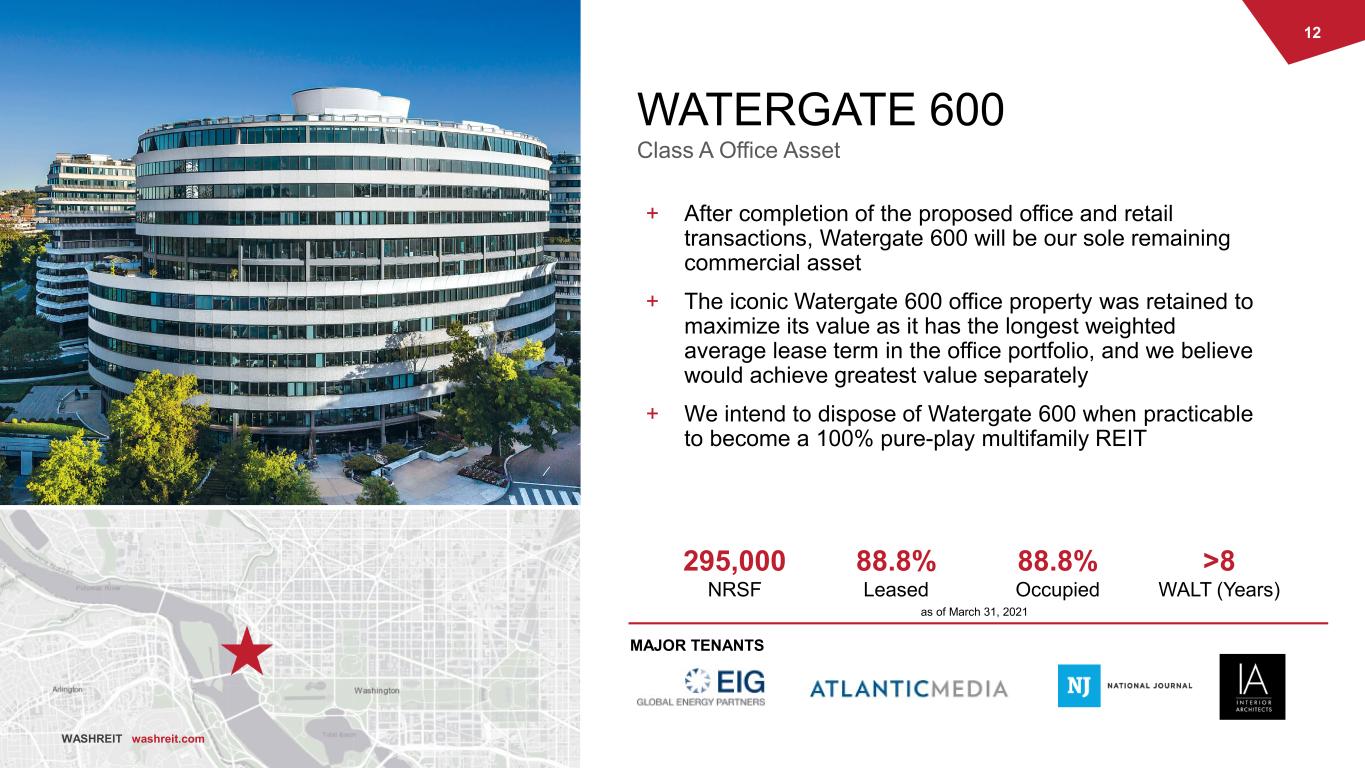

12 WASHREIT washreit.com ACCENT IMAGE Place and image in this space. Resize and use the crop tool to fit on top of this box. WATERGATE 600 Class A Office Asset + After completion of the proposed office and retail transactions, Watergate 600 will be our sole remaining commercial asset + The iconic Watergate 600 office property was retained to maximize its value as it has the longest weighted average lease term in the office portfolio, and we believe would achieve greatest value separately + We intend to dispose of Watergate 600 when practicable to become a 100% pure-play multifamily REIT 295,000 NRSF 88.8% Occupied >8 WALT (Years) 88.8% Leased as of March 31, 2021 MAJOR TENANTS WASHREIT washreit.com

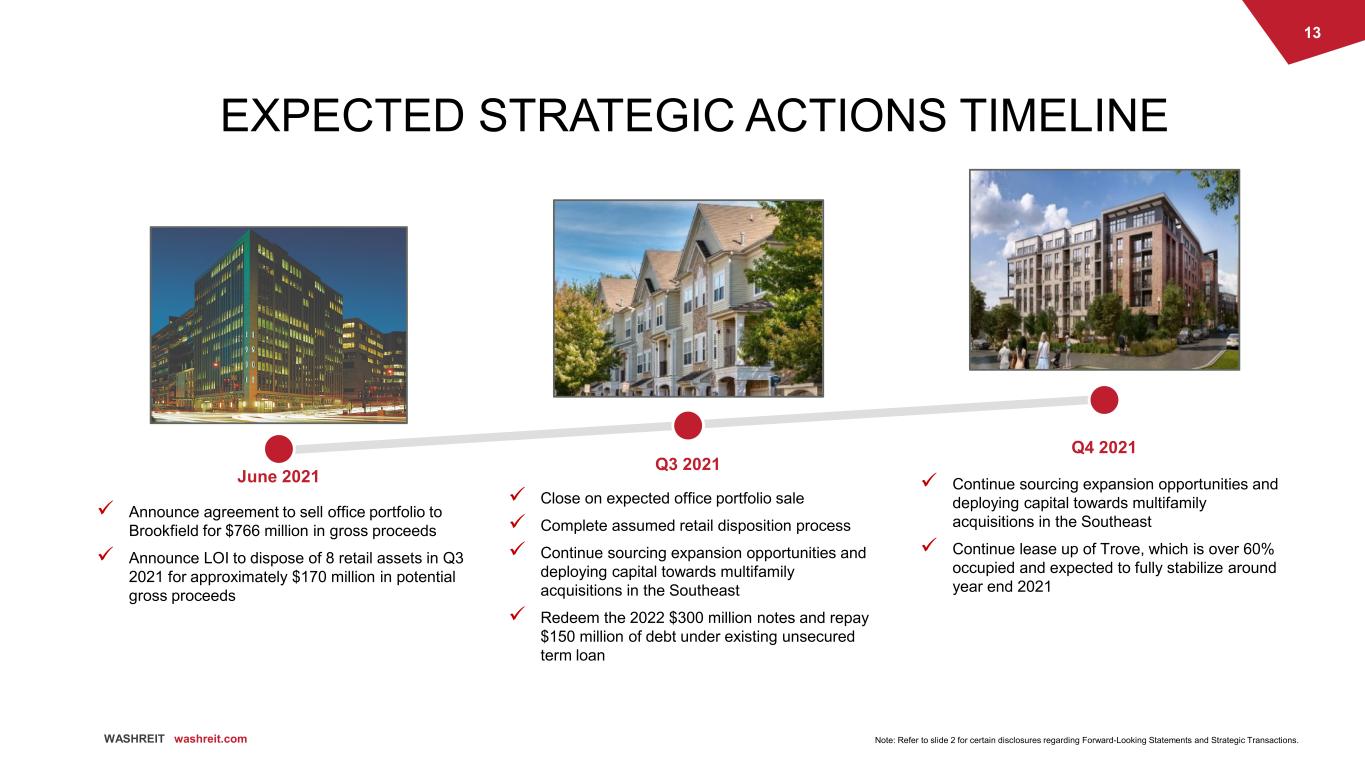

13 WASHREIT washreit.com EXPECTED STRATEGIC ACTIONS TIMELINE June 2021 Announce agreement to sell office portfolio to Brookfield for $766 million in gross proceeds Announce LOI to dispose of 8 retail assets in Q3 2021 for approximately $170 million in potential gross proceeds Close on expected office portfolio sale Complete assumed retail disposition process Continue sourcing expansion opportunities and deploying capital towards multifamily acquisitions in the Southeast Redeem the 2022 $300 million notes and repay $150 million of debt under existing unsecured term loan Q3 2021 Continue sourcing expansion opportunities and deploying capital towards multifamily acquisitions in the Southeast Continue lease up of Trove, which is over 60% occupied and expected to fully stabilize around year end 2021 Q4 2021 Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions.

14 WASHREIT washreit.com OUR FOUNDATION FOR GROWTH

15 WASHREIT washreit.com ~7.1k Multifamily Units4 + Portfolio of value-oriented multifamily properties located in high-growth Washington, DC metro submarkets + Approximately $450 million of cash available1 to capitalize on multifamily acquisition and development opportunities in high-growth Southeastern economies + Improved balance sheet with no upcoming maturities until 20232 + Experienced and proven management team with a combined 100+ years of industry experience that, upon completion of the assumed transactions, will have completed over $5.1 billion of strategic portfolio transactions since 2013 95.4% Ending Occupancy3,4 $1,665 Avg. Effective Monthly Rent 3,4 2,800 unit renovation pipeline4 WASHREIT BEFORE WE START EXPANSION Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Cash available based on estimated gross proceeds of $766 million and $170 million for sale of office and retail portfolios, respectively. 2 Assumes repayment of debt following completion of expected office sale and assumed retail dispositions. See slide 9 for additional information on debt repayment. 3 Excludes Trove development. 4 As of May 31, 2021

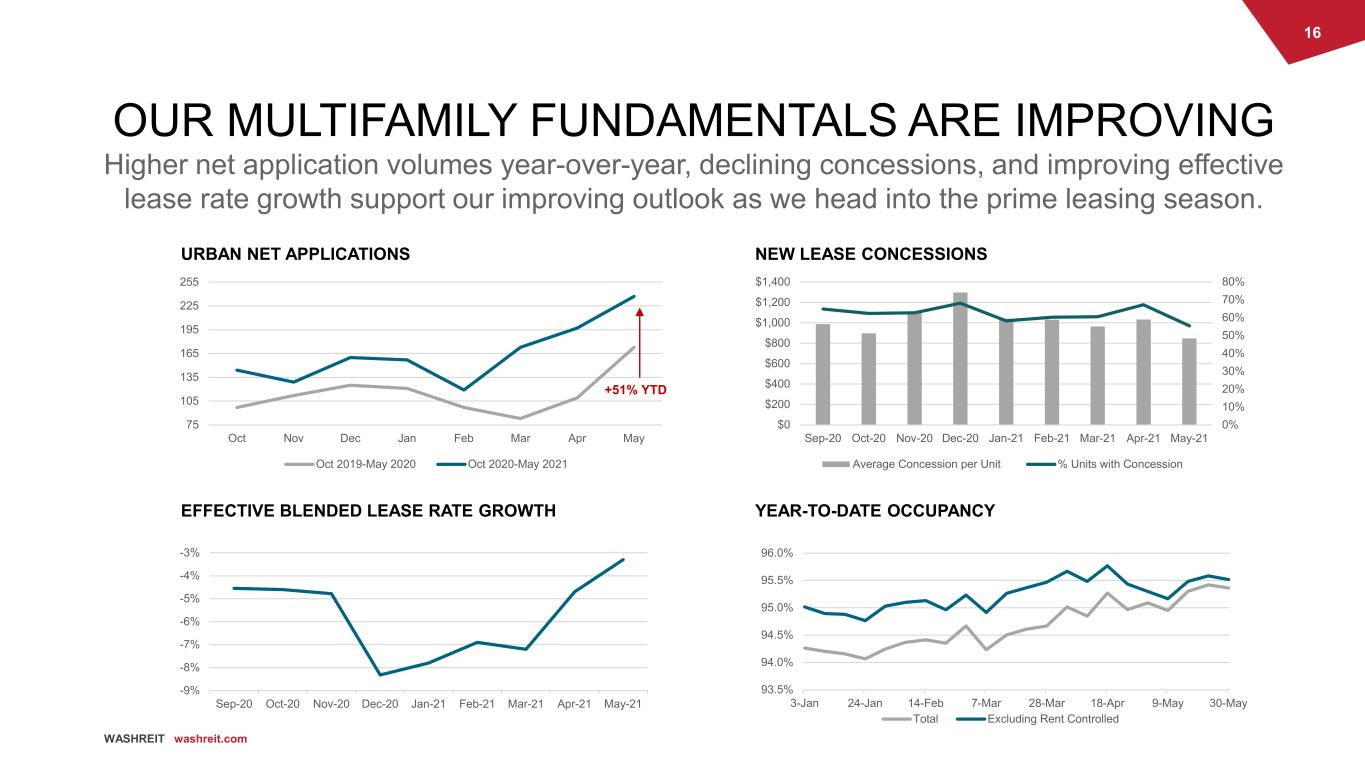

16 WASHREIT washreit.com 75 105 135 165 195 225 255 Oct Nov Dec Jan Feb Mar Apr May Oct 2019-May 2020 Oct 2020-May 2021 -9% -8% -7% -6% -5% -4% -3% Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 93.5% 94.0% 94.5% 95.0% 95.5% 96.0% 3-Jan 24-Jan 14-Feb 7-Mar 28-Mar 18-Apr 9-May 30-May Total Excluding Rent Controlled OUR MULTIFAMILY FUNDAMENTALS ARE IMPROVING Higher net application volumes year-over-year, declining concessions, and improving effective lease rate growth support our improving outlook as we head into the prime leasing season. URBAN NET APPLICATIONS EFFECTIVE BLENDED LEASE RATE GROWTH NEW LEASE CONCESSIONS YEAR-TO-DATE OCCUPANCY 0% 10% 20% 30% 40% 50% 60% 70% 80% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Average Concession per Unit % Units with Concession +51% YTD

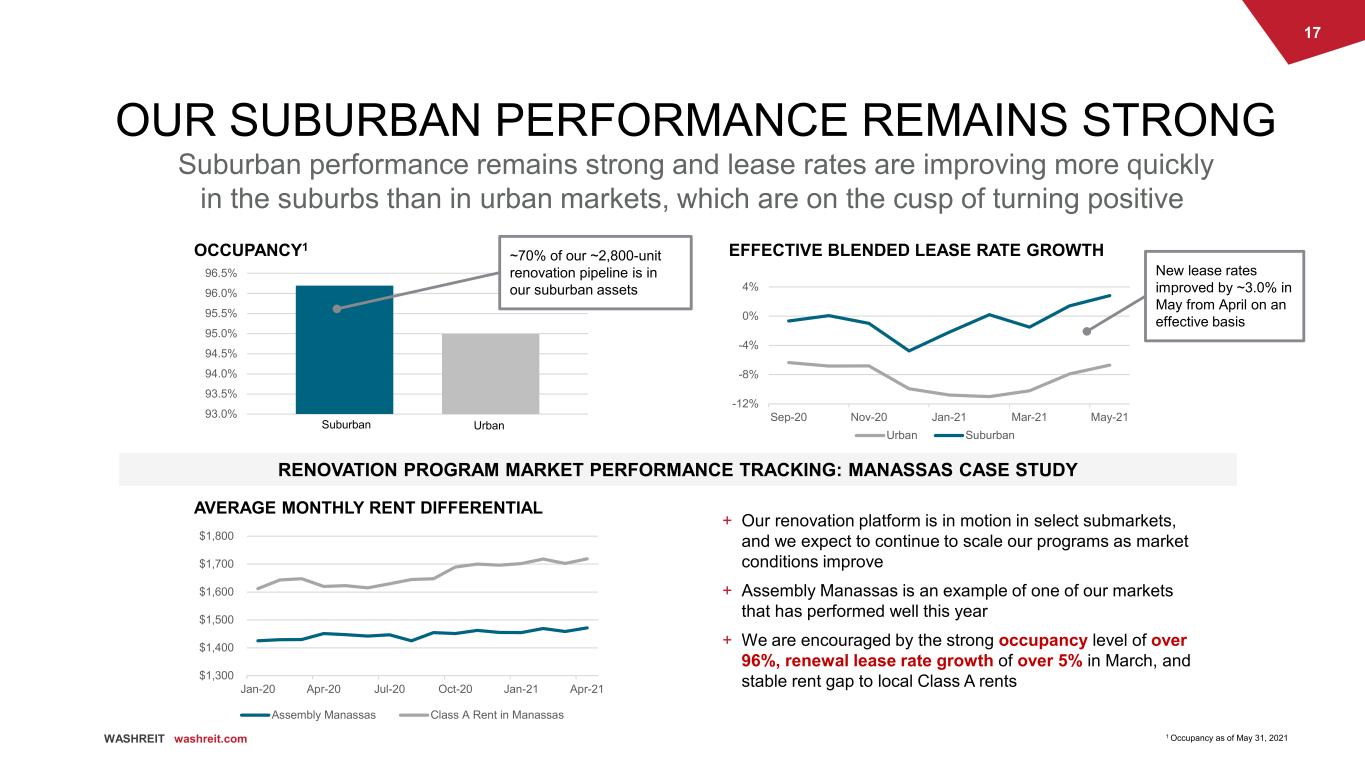

17 WASHREIT washreit.com 93.0% 93.5% 94.0% 94.5% 95.0% 95.5% 96.0% 96.5% + Our renovation platform is in motion in select submarkets, and we expect to continue to scale our programs as market conditions improve + Assembly Manassas is an example of one of our markets that has performed well this year + We are encouraged by the strong occupancy level of over 96%, renewal lease rate growth of over 5% in March, and stable rent gap to local Class A rents RENOVATION PROGRAM MARKET PERFORMANCE TRACKING: MANASSAS CASE STUDY Suburban Urban -12% -8% -4% 0% 4% Sep-20 Nov-20 Jan-21 Mar-21 May-21 Urban Suburban $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Assembly Manassas Class A Rent in Manassas OUR SUBURBAN PERFORMANCE REMAINS STRONG Suburban performance remains strong and lease rates are improving more quickly in the suburbs than in urban markets, which are on the cusp of turning positive AVERAGE MONTHLY RENT DIFFERENTIAL OCCUPANCY1 EFFECTIVE BLENDED LEASE RATE GROWTH New lease rates improved by ~3.0% in May from April on an effective basis ~70% of our ~2,800-unit renovation pipeline is in our suburban assets 1 Occupancy as of May 31, 2021

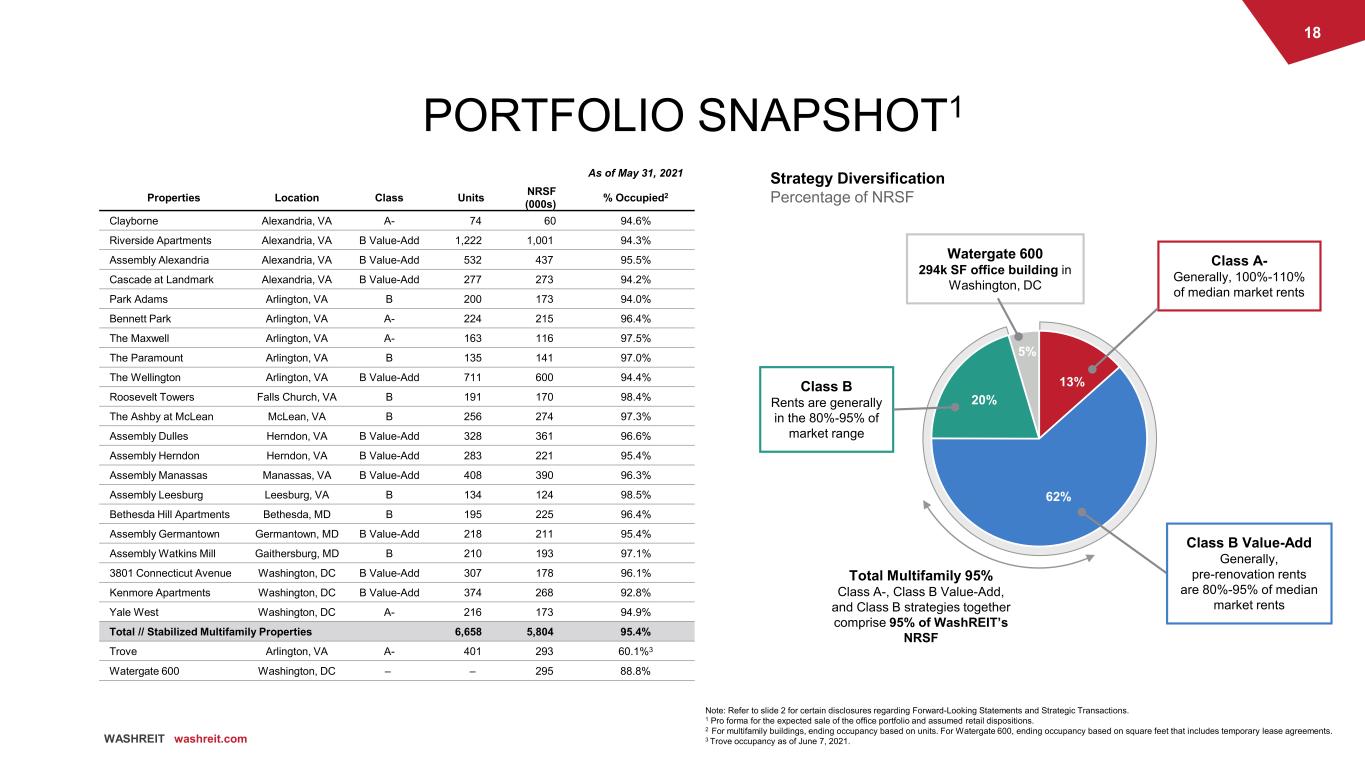

18 WASHREIT washreit.com PORTFOLIO SNAPSHOT1 Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Pro forma for the expected sale of the office portfolio and assumed retail dispositions. 2 For multifamily buildings, ending occupancy based on units. For Watergate 600, ending occupancy based on square feet that includes temporary lease agreements. 3 Trove occupancy as of June 7, 2021. As of May 31, 2021 Properties Location Class Units NRSF (000s) % Occupied 2 Clayborne Alexandria, VA A- 74 60 94.6% Riverside Apartments Alexandria, VA B Value-Add 1,222 1,001 94.3% Assembly Alexandria Alexandria, VA B Value-Add 532 437 95.5% Cascade at Landmark Alexandria, VA B Value-Add 277 273 94.2% Park Adams Arlington, VA B 200 173 94.0% Bennett Park Arlington, VA A- 224 215 96.4% The Maxwell Arlington, VA A- 163 116 97.5% The Paramount Arlington, VA B 135 141 97.0% The Wellington Arlington, VA B Value-Add 711 600 94.4% Roosevelt Towers Falls Church, VA B 191 170 98.4% The Ashby at McLean McLean, VA B 256 274 97.3% Assembly Dulles Herndon, VA B Value-Add 328 361 96.6% Assembly Herndon Herndon, VA B Value-Add 283 221 95.4% Assembly Manassas Manassas, VA B Value-Add 408 390 96.3% Assembly Leesburg Leesburg, VA B 134 124 98.5% Bethesda Hill Apartments Bethesda, MD B 195 225 96.4% Assembly Germantown Germantown, MD B Value-Add 218 211 95.4% Assembly Watkins Mill Gaithersburg, MD B 210 193 97.1% 3801 Connecticut Avenue Washington, DC B Value-Add 307 178 96.1% Kenmore Apartments Washington, DC B Value-Add 374 268 92.8% Yale West Washington, DC A- 216 173 94.9% Total // Stabilized Multifamily Properties 6,658 5,804 95.4% Trove Arlington, VA A- 401 293 60.1%3 Watergate 600 Washington, DC – – 295 88.8% Class A- Generally, 100%-110% of median market rents Total Multifamily 95% Class A-, Class B Value-Add, and Class B strategies together comprise 95% of WashREIT’s NRSF Class B Rents are generally in the 80%-95% of market range Watergate 600 294k SF office building in Washington, DC Strategy Diversification Percentage of NRSF 20% 5% 13% Class B Value-Add Generally, pre-renovation rents are 80%-95% of median market rents 62%

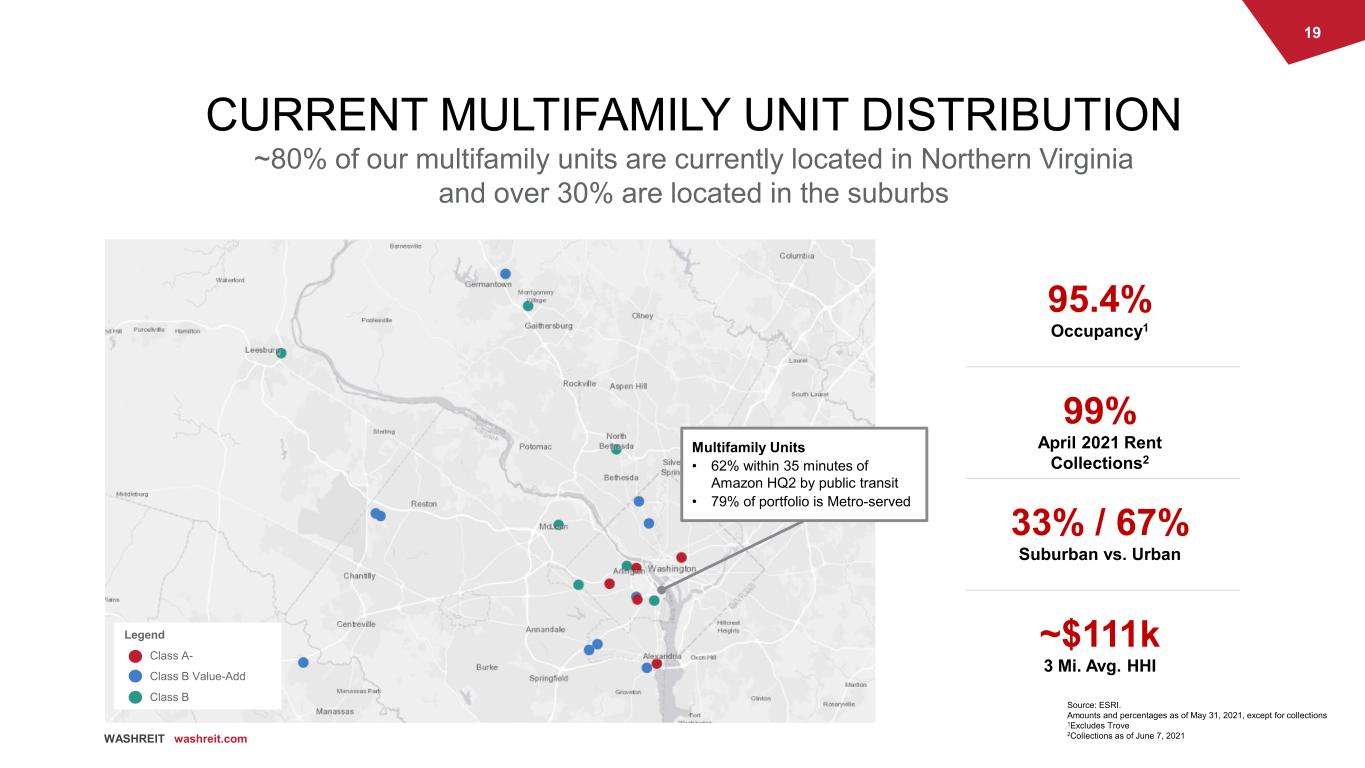

19 WASHREIT washreit.com 95.4% Occupancy1 99% April 2021 Rent Collections2 ~$111k 3 Mi. Avg. HHI CURRENT MULTIFAMILY UNIT DISTRIBUTION ~80% of our multifamily units are currently located in Northern Virginia and over 30% are located in the suburbs Source: ESRI. Amounts and percentages as of May 31, 2021, except for collections 1Excludes Trove 2Collections as of June 7, 2021 33% / 67% Suburban vs. Urban Multifamily Units • 62% within 35 minutes of Amazon HQ2 by public transit • 79% of portfolio is Metro-served Legend Class A- Class B Value-Add Class B

20 WASHREIT washreit.com MULTIFAMILY EXPANSION STRATEGY Riverside Alexandria, Virginia

21 WASHREIT washreit.com + Significant Demand Drivers Population growth, in-migration, extended renting tenure and unaffordability of for-sale housing for targeted renter segments + Stronger Rent Growth Driven by solid demand, rising home prices, and minimal new product at mid-range rents + Lower Recurring Capital Expenditures FAD capex in 2020 as a percentage of portfolio NOI: 6% for multifamily vs. approximately 20% office1 + More Consistent Returns Less downtime, more stable cash flows, more diversified resident base + Improves Our Business Profile Multifamily is a less risky asset class with more stable cash flows and few capital expenditures, together with geographic expansion into new markets significantly improves our business profile + Improves Our Credit Profile Estimated $421 million of debt repayments and deployment of remaining disposition proceeds into future multifamily acquisitions should enable us to reduce our leverage to mid to high 5x range, with new leverage governors in place to target 5.0x to 6.0x on a sustained basis 1FY 2020 actual capital expenditures and NOI. WHY MULTIFAMILY? Trove Arlington, Virginia

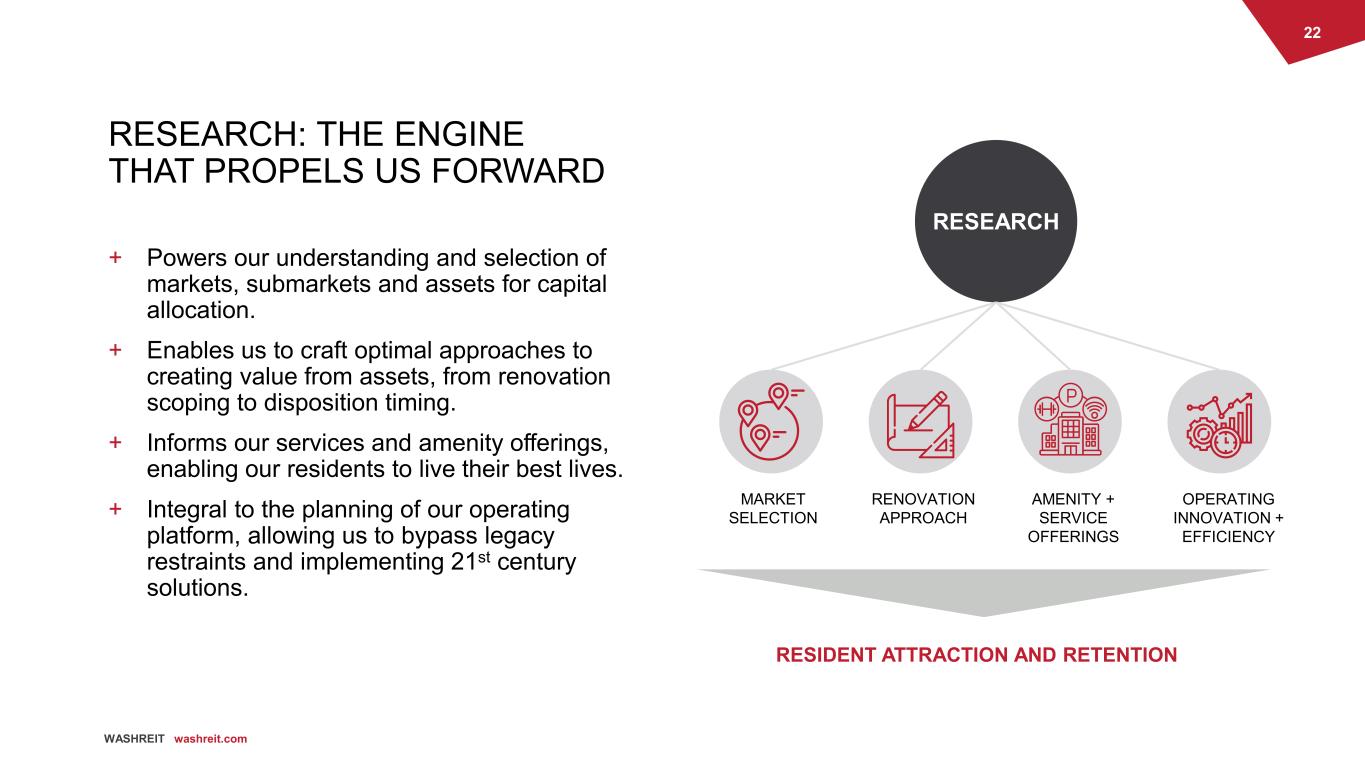

22 WASHREIT washreit.com RESEARCH: THE ENGINE THAT PROPELS US FORWARD + Powers our understanding and selection of markets, submarkets and assets for capital allocation. + Enables us to craft optimal approaches to creating value from assets, from renovation scoping to disposition timing. + Informs our services and amenity offerings, enabling our residents to live their best lives. + Integral to the planning of our operating platform, allowing us to bypass legacy restraints and implementing 21st century solutions. RESEARCH MARKET SELECTION RENOVATION APPROACH AMENITY + SERVICE OFFERINGS OPERATING INNOVATION + EFFICIENCY RESIDENT ATTRACTION AND RETENTION

23 WASHREIT washreit.com WASHINGTON, DC LEARNINGS FOR NEW MARKETS WashREIT’s strategies for expansion markets are a natural progression of our experience and learnings in the Washington, DC metro market. Our findings indicate: • Demand is deepest at mid-market rents. • Affordability is a pressing rental issue at multiple price points across the mid-market rent spectrum. • Rents can be consistently grown, even in a high supply market, if a portfolio’s price point does not compete directly with new product price points and wages for mid-market renters are growing. While each market is unique, our learnings about demand, affordability, and supply conditions in the Washington, DC metro market will be incorporated into strategies for the Southeastern markets researched and targeted by WashREIT. Rapid growth in developing knowledge worker markets of the Southeast creates an optimal balance of strong demand in mid-market renter, increasing wages, and limited new supply affordable at our targeted price points. WASHREIT washreit.com

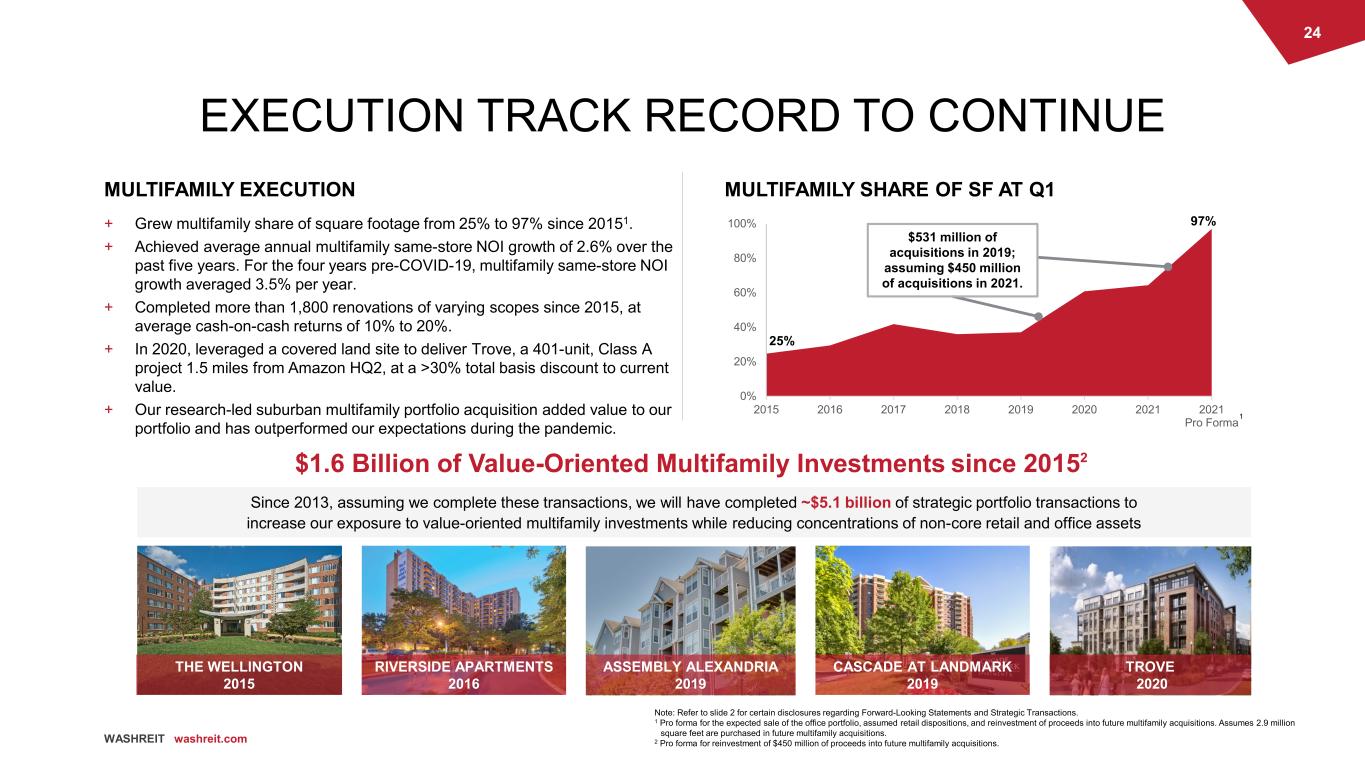

24 WASHREIT washreit.com 0% 20% 40% 60% 80% 100% 2015 2016 2017 2018 2019 2020 2021 2021 Pro Forma TROVE 2020 RIVERSIDE APARTMENTS 2016 ASSEMBLY ALEXANDRIA 2019 CASCADE AT LANDMARK 2019 $1.6 Billion of Value-Oriented Multifamily Investments since 20152 Since 2013, assuming we complete these transactions, we will have completed ~$5.1 billion of strategic portfolio transactions to increase our exposure to value-oriented multifamily investments while reducing concentrations of non-core retail and office assets MULTIFAMILY EXECUTION + Grew multifamily share of square footage from 25% to 97% since 20151. + Achieved average annual multifamily same-store NOI growth of 2.6% over the past five years. For the four years pre-COVID-19, multifamily same-store NOI growth averaged 3.5% per year. + Completed more than 1,800 renovations of varying scopes since 2015, at average cash-on-cash returns of 10% to 20%. + In 2020, leveraged a covered land site to deliver Trove, a 401-unit, Class A project 1.5 miles from Amazon HQ2, at a >30% total basis discount to current value. + Our research-led suburban multifamily portfolio acquisition added value to our portfolio and has outperformed our expectations during the pandemic. EXECUTION TRACK RECORD TO CONTINUE THE WELLINGTON 2015 MULTIFAMILY SHARE OF SF AT Q1 Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Pro forma for the expected sale of the office portfolio, assumed retail dispositions, and reinvestment of proceeds into future multifamily acquisitions. Assumes 2.9 million square feet are purchased in future multifamily acquisitions. 2 Pro forma for reinvestment of $450 million of proceeds into future multifamily acquisitions. 1 25% 97% $531 million of acquisitions in 2019; assuming $450 million of acquisitions in 2021.

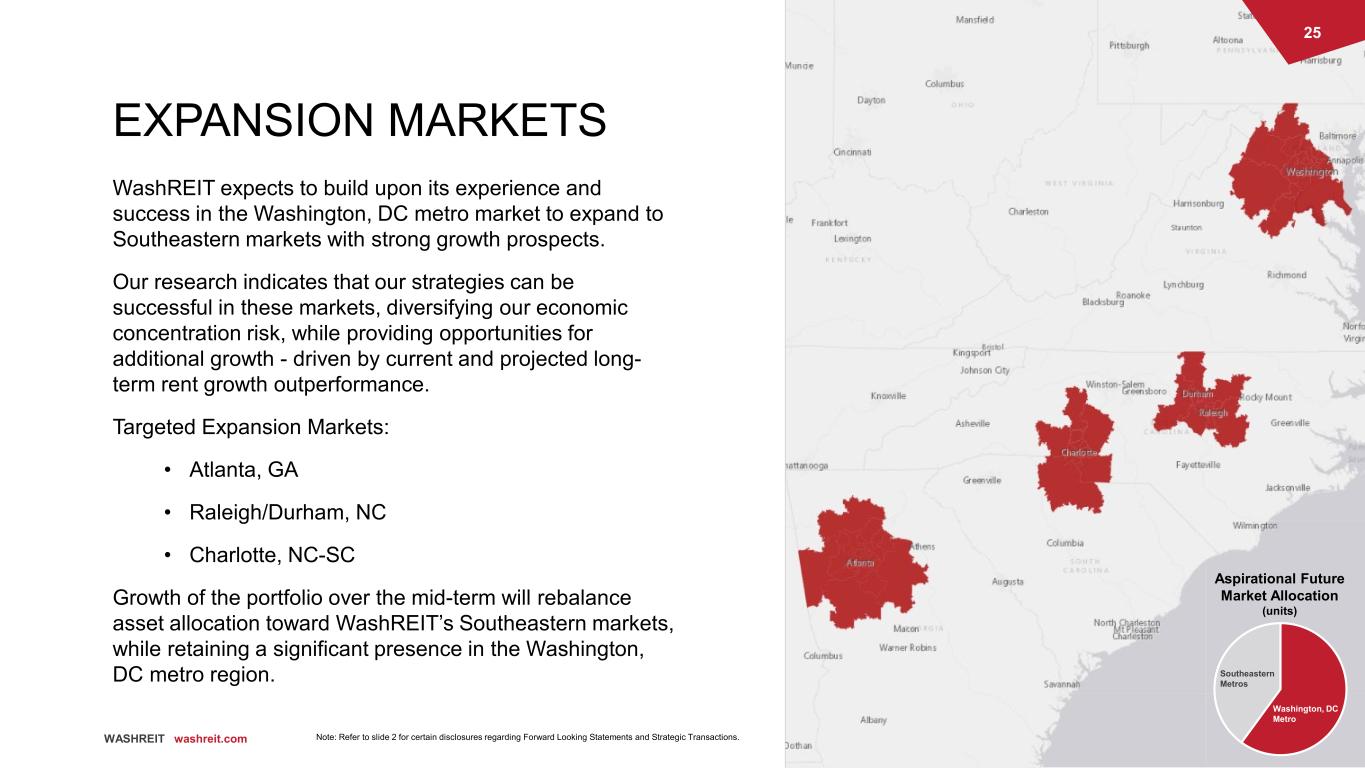

25 WASHREIT washreit.com ACCENT IMAGE Place and image in this space. Resize and use the crop tool to fit on top of this box. EXPANSION MARKETS WashREIT expects to build upon its experience and success in the Washington, DC metro market to expand to Southeastern markets with strong growth prospects. Our research indicates that our strategies can be successful in these markets, diversifying our economic concentration risk, while providing opportunities for additional growth - driven by current and projected long- term rent growth outperformance. Targeted Expansion Markets: • Atlanta, GA • Raleigh/Durham, NC • Charlotte, NC-SC Growth of the portfolio over the mid-term will rebalance asset allocation toward WashREIT’s Southeastern markets, while retaining a significant presence in the Washington, DC metro region. Washington, DC Metro Southeastern Metros Aspirational Future Market Allocation (units) Note: Refer to slide 2 for certain disclosures regarding Forward Looking Statements and Strategic Transactions.

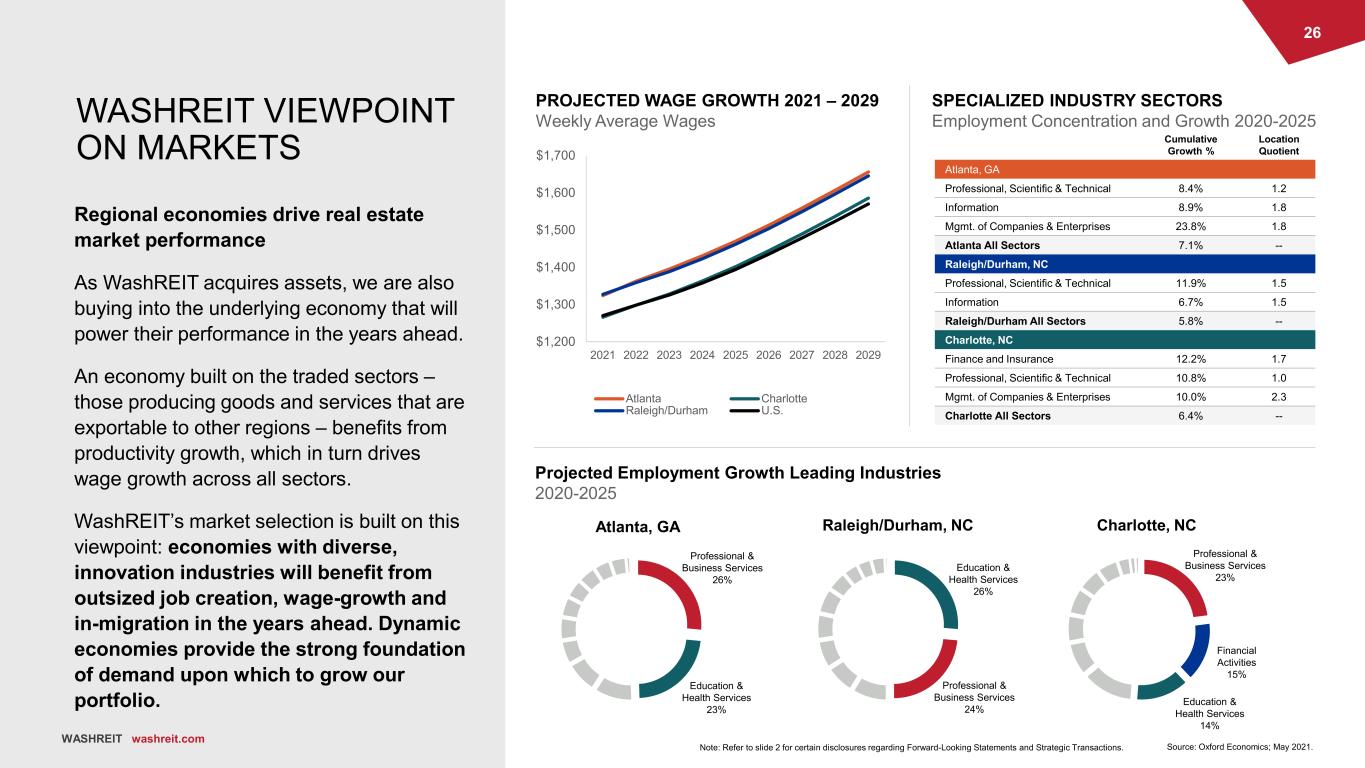

26 WASHREIT washreit.com WASHREIT VIEWPOINT ON MARKETS Regional economies drive real estate market performance As WashREIT acquires assets, we are also buying into the underlying economy that will power their performance in the years ahead. An economy built on the traded sectors – those producing goods and services that are exportable to other regions – benefits from productivity growth, which in turn drives wage growth across all sectors. WashREIT’s market selection is built on this viewpoint: economies with diverse, innovation industries will benefit from outsized job creation, wage-growth and in-migration in the years ahead. Dynamic economies provide the strong foundation of demand upon which to grow our portfolio. Charlotte, NC Raleigh/Durham, NC Atlanta, GA Professional & Business Services 23% Financial Activities 15% Education & Health Services 14% Education & Health Services 23% Professional & Business Services 26% Professional & Business Services 24% Education & Health Services 26% $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 2021 2022 2023 2024 2025 2026 2027 2028 2029 Atlanta Charlotte Raleigh/Durham U.S. Projected Employment Growth Leading Industries 2020-2025 PROJECTED WAGE GROWTH 2021 – 2029 Weekly Average Wages SPECIALIZED INDUSTRY SECTORS Employment Concentration and Growth 2020-2025 Cumulative Growth % Location Quotient Atlanta, GA Professional, Scientific & Technical 8.4% 1.2 Information 8.9% 1.8 Mgmt. of Companies & Enterprises 23.8% 1.8 Atlanta All Sectors 7.1% -- Raleigh/Durham, NC Professional, Scientific & Technical 11.9% 1.5 Information 6.7% 1.5 Raleigh/Durham All Sectors 5.8% -- Charlotte, NC Finance and Insurance 12.2% 1.7 Professional, Scientific & Technical 10.8% 1.0 Mgmt. of Companies & Enterprises 10.0% 2.3 Charlotte All Sectors 6.4% -- Source: Oxford Economics; May 2021. WASHREIT washreit.com Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions.

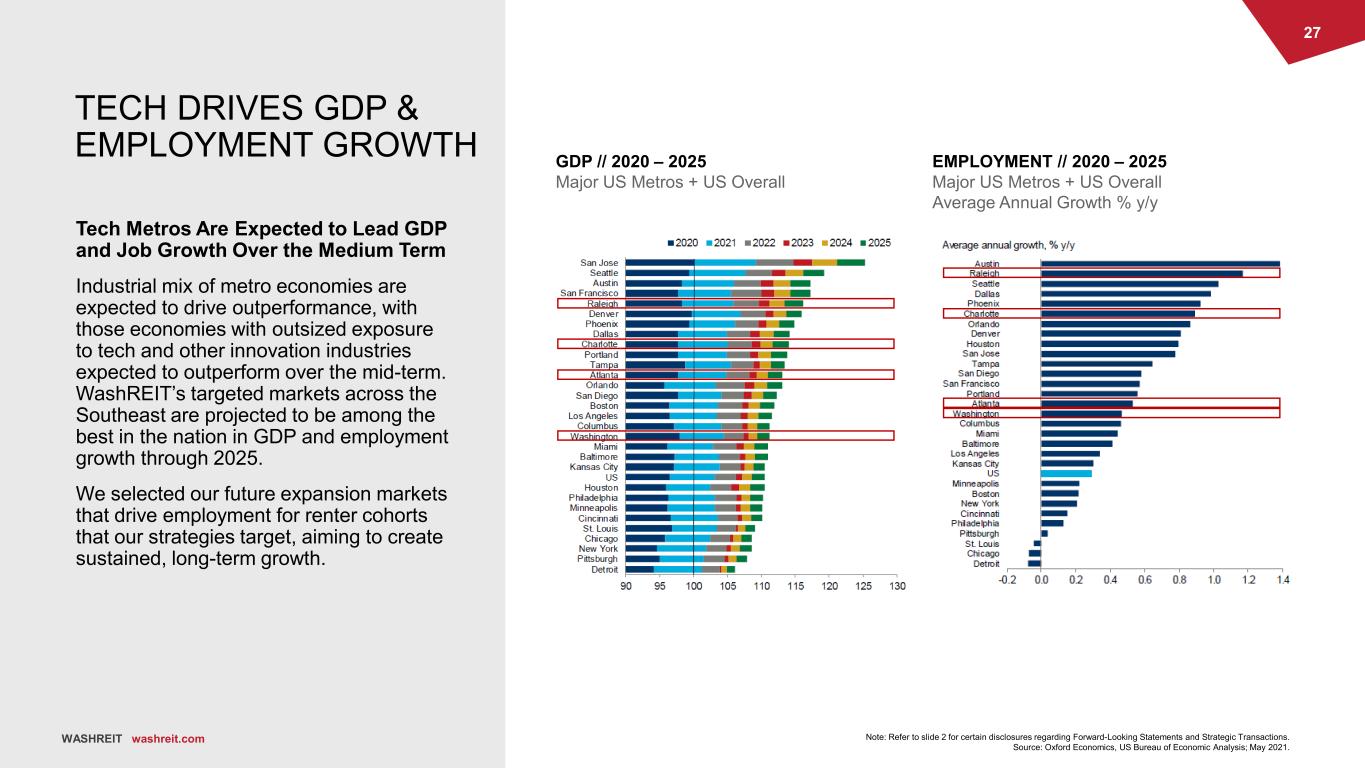

27 WASHREIT washreit.com TECH DRIVES GDP & EMPLOYMENT GROWTH Tech Metros Are Expected to Lead GDP and Job Growth Over the Medium Term Industrial mix of metro economies are expected to drive outperformance, with those economies with outsized exposure to tech and other innovation industries expected to outperform over the mid-term. WashREIT’s targeted markets across the Southeast are projected to be among the best in the nation in GDP and employment growth through 2025. We selected our future expansion markets that drive employment for renter cohorts that our strategies target, aiming to create sustained, long-term growth. Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. Source: Oxford Economics, US Bureau of Economic Analysis; May 2021. GDP // 2020 – 2025 Major US Metros + US Overall EMPLOYMENT // 2020 – 2025 Major US Metros + US Overall Average Annual Growth % y/y WASHREIT washreit.com

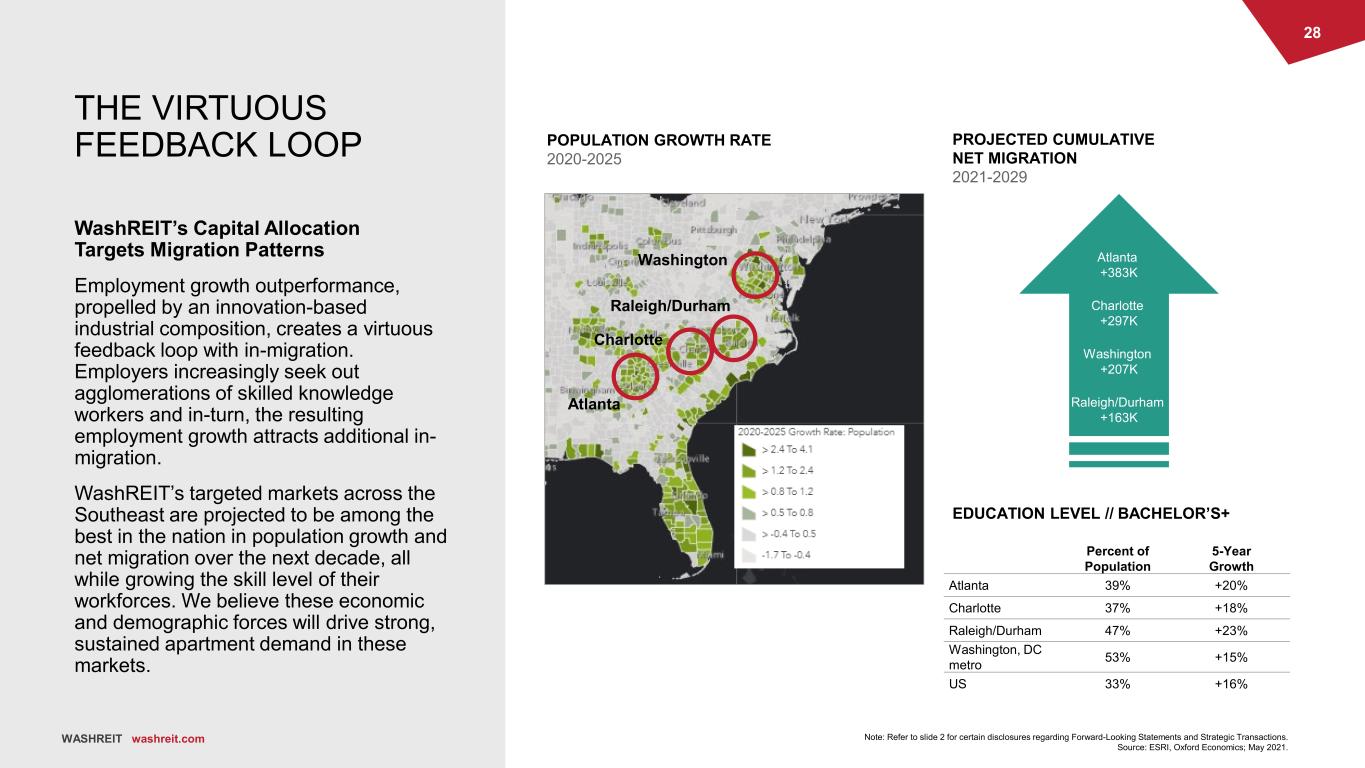

28 WASHREIT washreit.com Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. Source: ESRI, Oxford Economics; May 2021. POPULATION GROWTH RATE 2020-2025 PROJECTED CUMULATIVE NET MIGRATION 2021-2029 Atlanta +383K Washington +207K Charlotte +297K Raleigh/Durham +163K Percent of Population 5-Year Growth Atlanta 39% +20% Charlotte 37% +18% Raleigh/Durham 47% +23% Washington, DC metro 53% +15% US 33% +16% EDUCATION LEVEL // BACHELOR’S+ THE VIRTUOUS FEEDBACK LOOP WashREIT’s Capital Allocation Targets Migration Patterns Employment growth outperformance, propelled by an innovation-based industrial composition, creates a virtuous feedback loop with in-migration. Employers increasingly seek out agglomerations of skilled knowledge workers and in-turn, the resulting employment growth attracts additional in- migration. WashREIT’s targeted markets across the Southeast are projected to be among the best in the nation in population growth and net migration over the next decade, all while growing the skill level of their workforces. We believe these economic and demographic forces will drive strong, sustained apartment demand in these markets. WASHREIT washreit.com Washington Raleigh/Durham Charlotte Atlanta

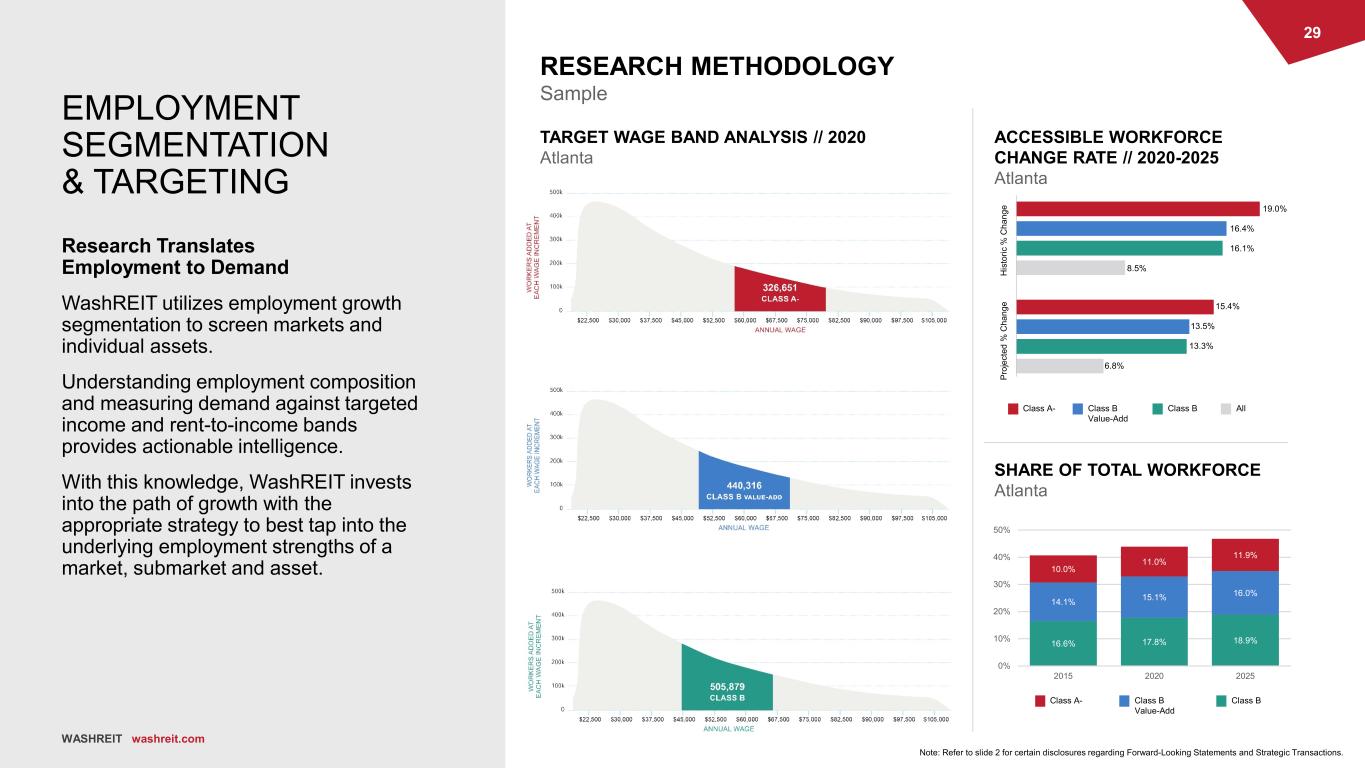

29 WASHREIT washreit.com Research Translates Employment to Demand WashREIT utilizes employment growth segmentation to screen markets and individual assets. Understanding employment composition and measuring demand against targeted income and rent-to-income bands provides actionable intelligence. With this knowledge, WashREIT invests into the path of growth with the appropriate strategy to best tap into the underlying employment strengths of a market, submarket and asset. EMPLOYMENT SEGMENTATION & TARGETING TARGET WAGE BAND ANALYSIS // 2020 Atlanta WASHREIT washreit.com ACCESSIBLE WORKFORCE CHANGE RATE // 2020-2025 Atlanta SHARE OF TOTAL WORKFORCE Atlanta 16.6% 17.8% 18.9% 14.1% 15.1% 16.0% 10.0% 11.0% 11.9% 0% 10% 20% 30% 40% 50% 2015 2020 2025 Class A- Class B Value-Add Class B Class A- Class B Value-Add Class B H is to ric % C ha ng e P ro je ct ed % C ha ng e 19.0% 16.4% 16.1% 8.5% 6.8% 13.3% 15.4% 13.5% All RESEARCH METHODOLOGY Sample Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions.

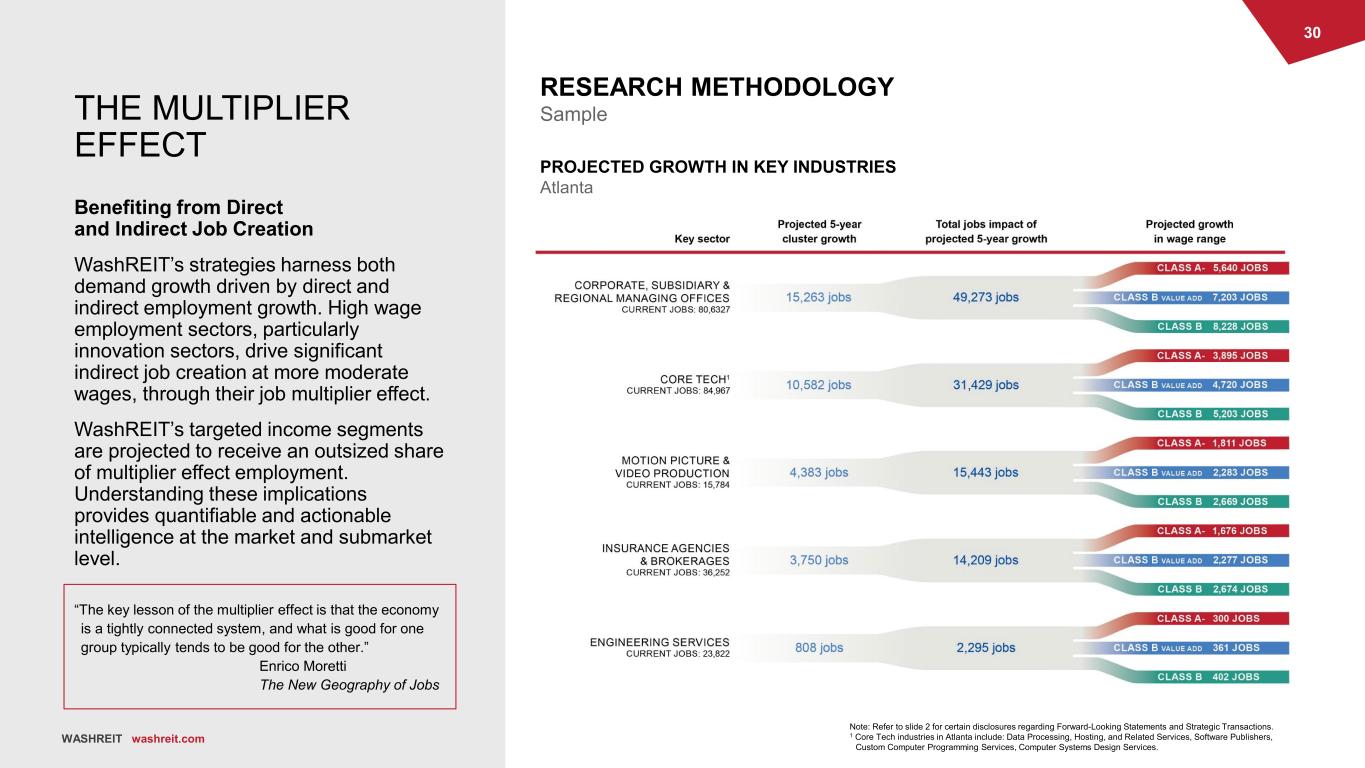

30 WASHREIT washreit.com THE MULTIPLIER EFFECT Benefiting from Direct and Indirect Job Creation WashREIT’s strategies harness both demand growth driven by direct and indirect employment growth. High wage employment sectors, particularly innovation sectors, drive significant indirect job creation at more moderate wages, through their job multiplier effect. WashREIT’s targeted income segments are projected to receive an outsized share of multiplier effect employment. Understanding these implications provides quantifiable and actionable intelligence at the market and submarket level. PROJECTED GROWTH IN KEY INDUSTRIES Atlanta Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 Core Tech industries in Atlanta include: Data Processing, Hosting, and Related Services, Software Publishers, Custom Computer Programming Services, Computer Systems Design Services. WASHREIT washreit.com “The key lesson of the multiplier effect is that the economy is a tightly connected system, and what is good for one group typically tends to be good for the other.” Enrico Moretti The New Geography of Jobs RESEARCH METHODOLOGY Sample

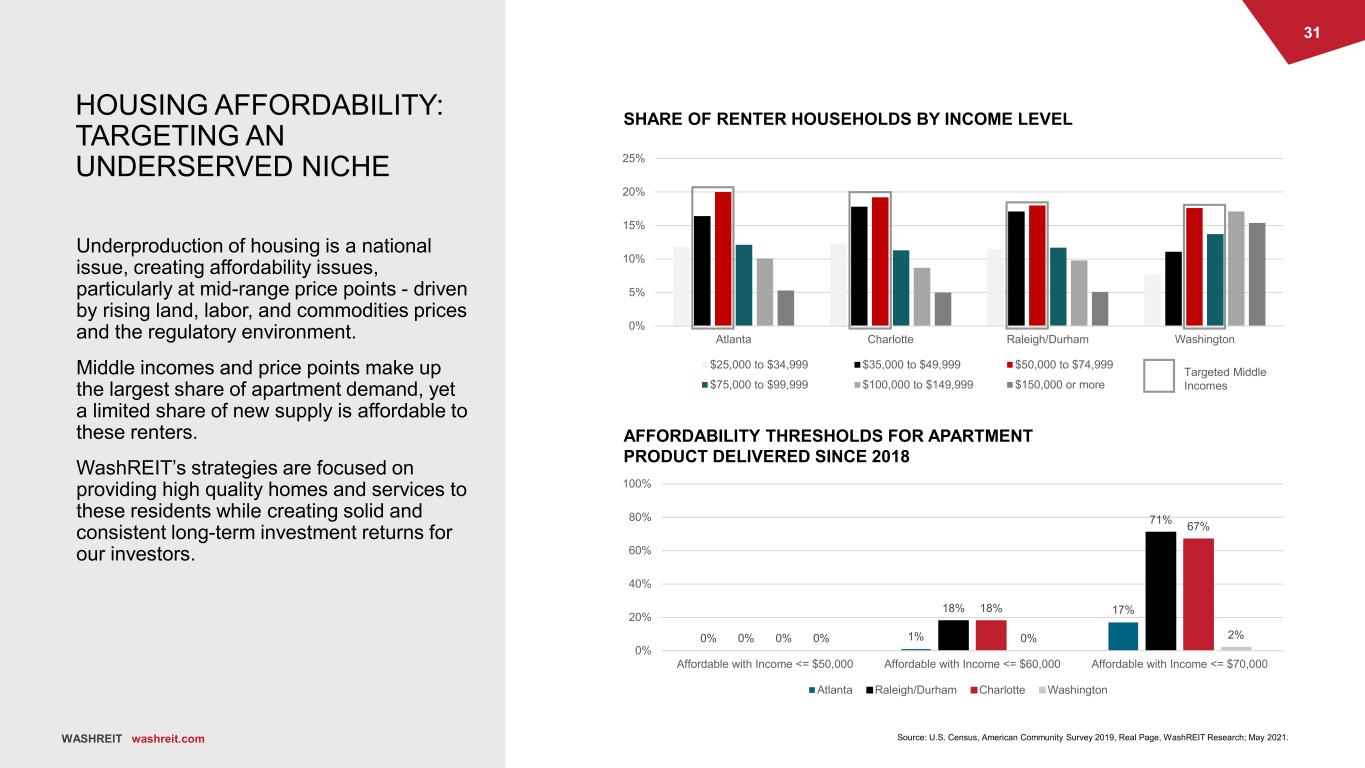

31 WASHREIT washreit.com 0% 5% 10% 15% 20% 25% Atlanta Charlotte Raleigh/Durham Washington $25,000 to $34,999 $35,000 to $49,999 $50,000 to $74,999 $75,000 to $99,999 $100,000 to $149,999 $150,000 or more Targeted Middle Incomes WASHREIT washreit.com HOUSING AFFORDABILITY: TARGETING AN UNDERSERVED NICHE Underproduction of housing is a national issue, creating affordability issues, particularly at mid-range price points - driven by rising land, labor, and commodities prices and the regulatory environment. Middle incomes and price points make up the largest share of apartment demand, yet a limited share of new supply is affordable to these renters. WashREIT’s strategies are focused on providing high quality homes and services to these residents while creating solid and consistent long-term investment returns for our investors. 0% 1% 17% 0% 18% 71% 0% 18% 67% 0% 0% 2% 0% 20% 40% 60% 80% 100% Affordable with Income <= $50,000 Affordable with Income <= $60,000 Affordable with Income <= $70,000 Atlanta Raleigh/Durham Charlotte Washington Source: U.S. Census, American Community Survey 2019, Real Page, WashREIT Research; May 2021. SHARE OF RENTER HOUSEHOLDS BY INCOME LEVEL AFFORDABILITY THRESHOLDS FOR APARTMENT PRODUCT DELIVERED SINCE 2018

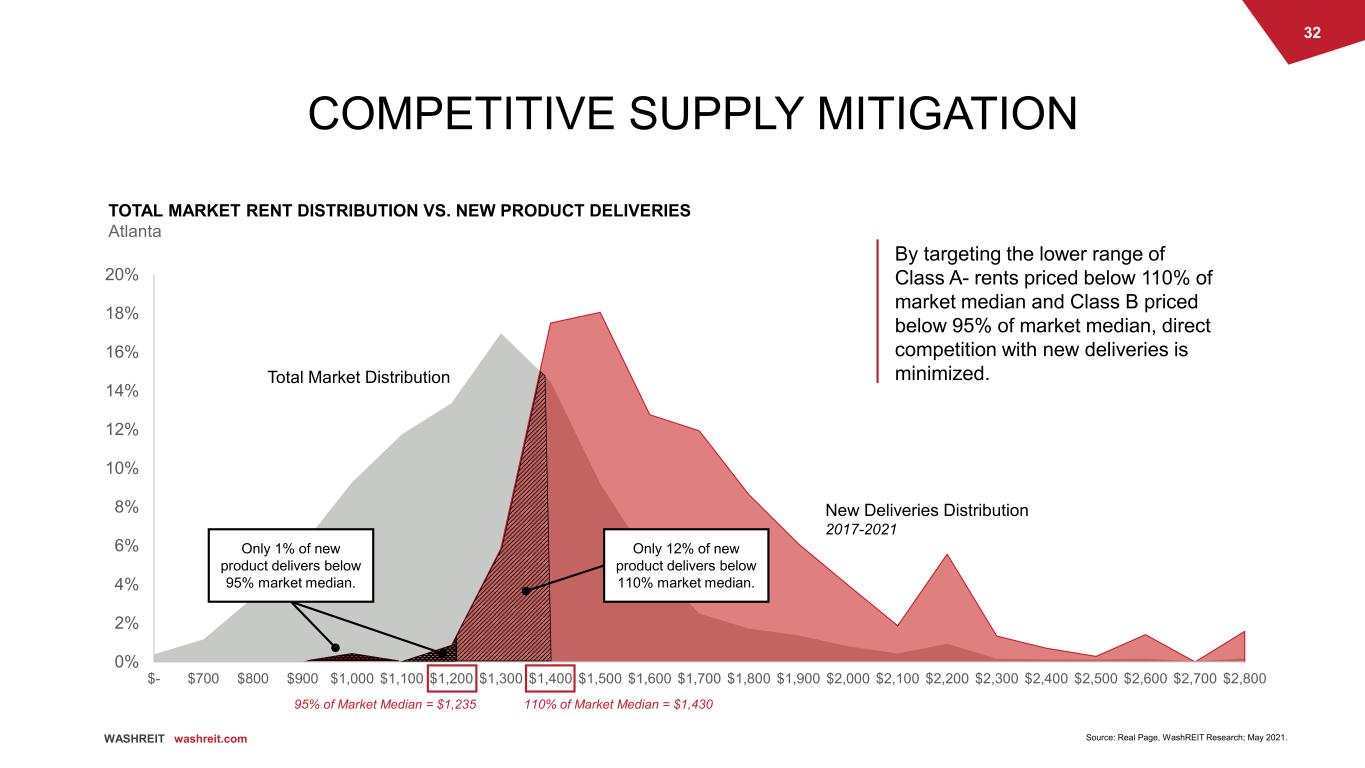

32 WASHREIT washreit.com 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% $- $700 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 $1,900 $2,000 $2,100 $2,200 $2,300 $2,400 $2,500 $2,600 $2,700 $2,800 COMPETITIVE SUPPLY MITIGATION Total Market Distribution New Deliveries Distribution 2017-2021 110% of Market Median = $1,430 By targeting the lower range of Class A- rents priced below 110% of market median and Class B priced below 95% of market median, direct competition with new deliveries is minimized. Source: Real Page, WashREIT Research; May 2021. 95% of Market Median = $1,235 TOTAL MARKET RENT DISTRIBUTION VS. NEW PRODUCT DELIVERIES Atlanta Only 12% of new product delivers below 110% market median. Only 1% of new product delivers below 95% market median.

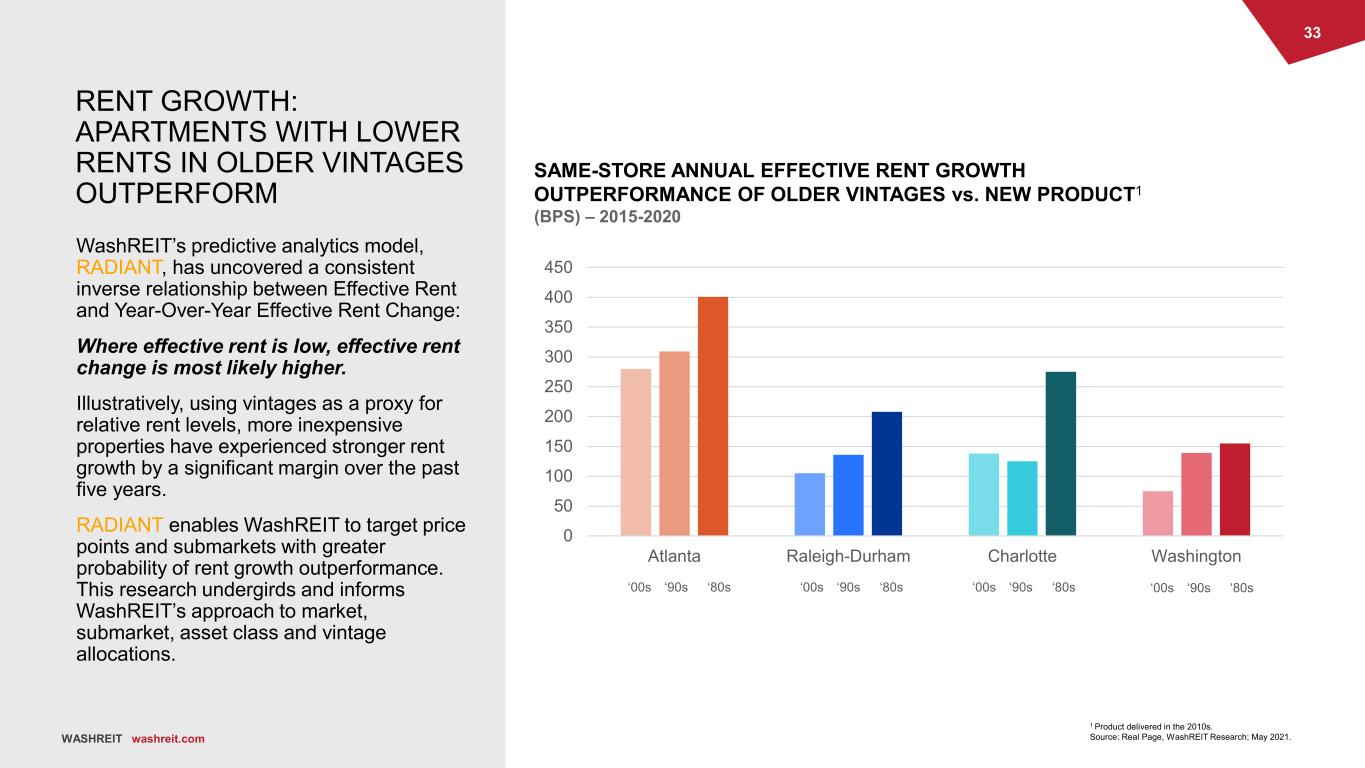

33 WASHREIT washreit.comWASHREIT washreit.com RENT GROWTH: APARTMENTS WITH LOWER RENTS IN OLDER VINTAGES OUTPERFORM WashREIT’s predictive analytics model, RADIANT, has uncovered a consistent inverse relationship between Effective Rent and Year-Over-Year Effective Rent Change: Where effective rent is low, effective rent change is most likely higher. Illustratively, using vintages as a proxy for relative rent levels, more inexpensive properties have experienced stronger rent growth by a significant margin over the past five years. RADIANT enables WashREIT to target price points and submarkets with greater probability of rent growth outperformance. This research undergirds and informs WashREIT’s approach to market, submarket, asset class and vintage allocations. 1 Product delivered in the 2010s. Source: Real Page, WashREIT Research; May 2021. SAME-STORE ANNUAL EFFECTIVE RENT GROWTH OUTPERFORMANCE OF OLDER VINTAGES vs. NEW PRODUCT1 (BPS) – 2015-2020 0 50 100 150 200 250 300 350 400 450 Atlanta Raleigh-Durham Charlotte Washington ‘80s‘90s‘00s ‘80s‘90s‘00s ‘80s‘90s‘00s ‘80s‘90s‘00s

34 WASHREIT washreit.com WASHREIT PORTFOLIO STRATEGIES We target submarkets with attributes we believe are most likely to drive rent growth, tailoring our specific investment strategy to best create value. Vintage: 2000’s Rent Growth Drivers: Operational Improvements, Unit Upgrades, Prop-Tech, Submarket Rent Growth, Future Renovations Price Point: 100%-110% of market median rent Vintage: 1980’s, 1990’s, 2000’s Rent Growth Drivers: Operational Improvements, Full Renovations, Submarket Rent Growth Price Point: 80%-95% of market median, pre- renovation rent Vintage: 1980’s, 1990’s, 2000’s Rent Growth Drivers: Operational Improvements, Submarket Rent Growth, Future Renovations Price Point: 80%-95% of market median rent CLASS A- CLASS B VALUE-ADD CLASS B Targeted Go-Forward Capital Allocation Targeted Go-Forward Capital Allocation Targeted Go-Forward Capital Allocation

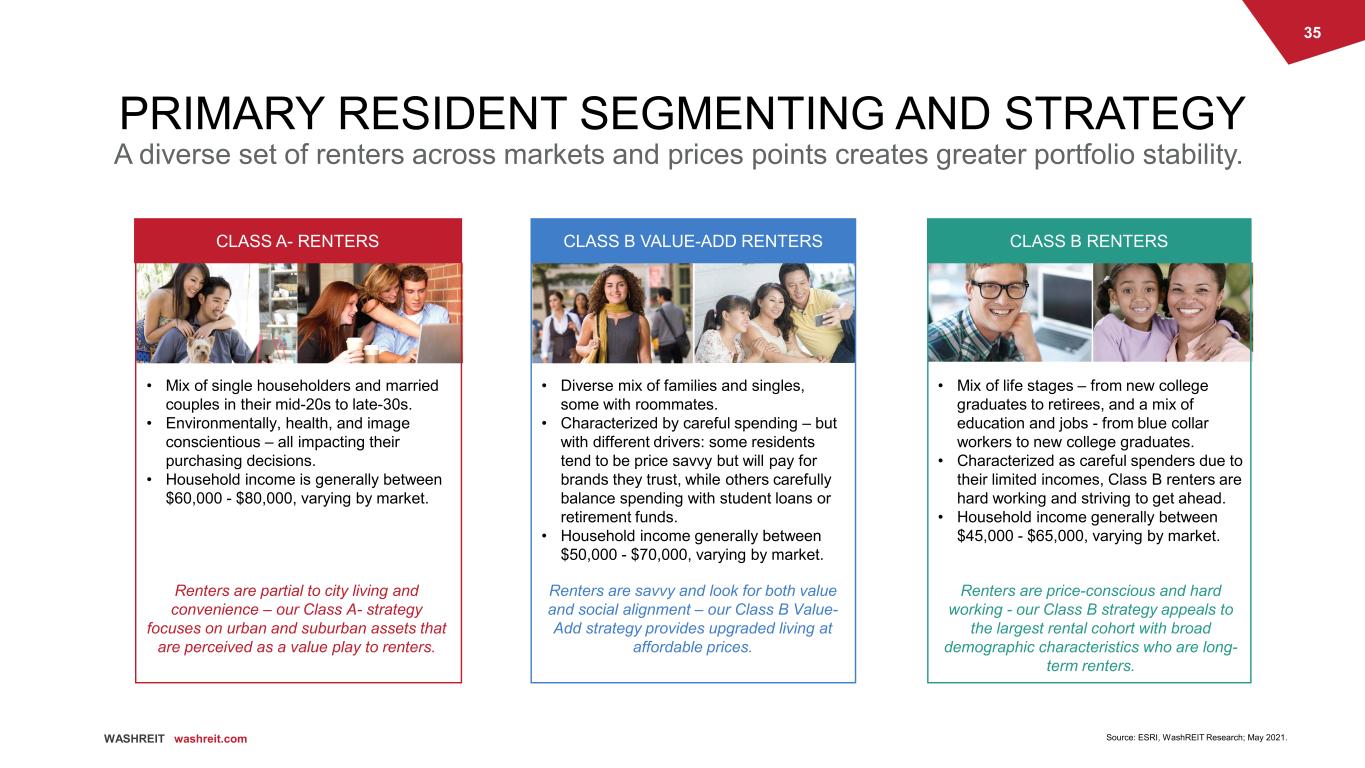

35 WASHREIT washreit.com PRIMARY RESIDENT SEGMENTING AND STRATEGY A diverse set of renters across markets and prices points creates greater portfolio stability. CLASS A- RENTERS CLASS B VALUE-ADD RENTERS CLASS B RENTERS • Mix of single householders and married couples in their mid-20s to late-30s. • Environmentally, health, and image conscientious – all impacting their purchasing decisions. • Household income is generally between $60,000 - $80,000, varying by market. • Diverse mix of families and singles, some with roommates. • Characterized by careful spending – but with different drivers: some residents tend to be price savvy but will pay for brands they trust, while others carefully balance spending with student loans or retirement funds. • Household income generally between $50,000 - $70,000, varying by market. • Mix of life stages – from new college graduates to retirees, and a mix of education and jobs - from blue collar workers to new college graduates. • Characterized as careful spenders due to their limited incomes, Class B renters are hard working and striving to get ahead. • Household income generally between $45,000 - $65,000, varying by market. Renters are partial to city living and convenience – our Class A- strategy focuses on urban and suburban assets that are perceived as a value play to renters. Renters are savvy and look for both value and social alignment – our Class B Value- Add strategy provides upgraded living at affordable prices. Renters are price-conscious and hard working - our Class B strategy appeals to the largest rental cohort with broad demographic characteristics who are long- term renters. Source: ESRI, WashREIT Research; May 2021.

36 WASHREIT washreit.com PORTFOLIO VALUE PROPOSITION FOR RESIDENTS We approach renters, regardless of their rental price point, with a specific value proposition: living in a WashREIT apartment will provide you the best balance of price, quality and resident experience that fits your budget. Value-conscious renters, who cannot afford most of the new product coming to market, yet desire high-quality, modern units finishes and amenities Value-conscious renters that are comfortable with older finishes and are not looking to upgrade. “Within my budget, clean, safe, well-maintained” Higher-wage yet value-conscious renters, who are balancing a desire for like-new exterior architecture, modern units finishes, club-like amenities, and services, against cost CLASS A - Value Luxury CLASS B VALUE-ADD Upgraded Interiors CLASS B Budget-Friendly

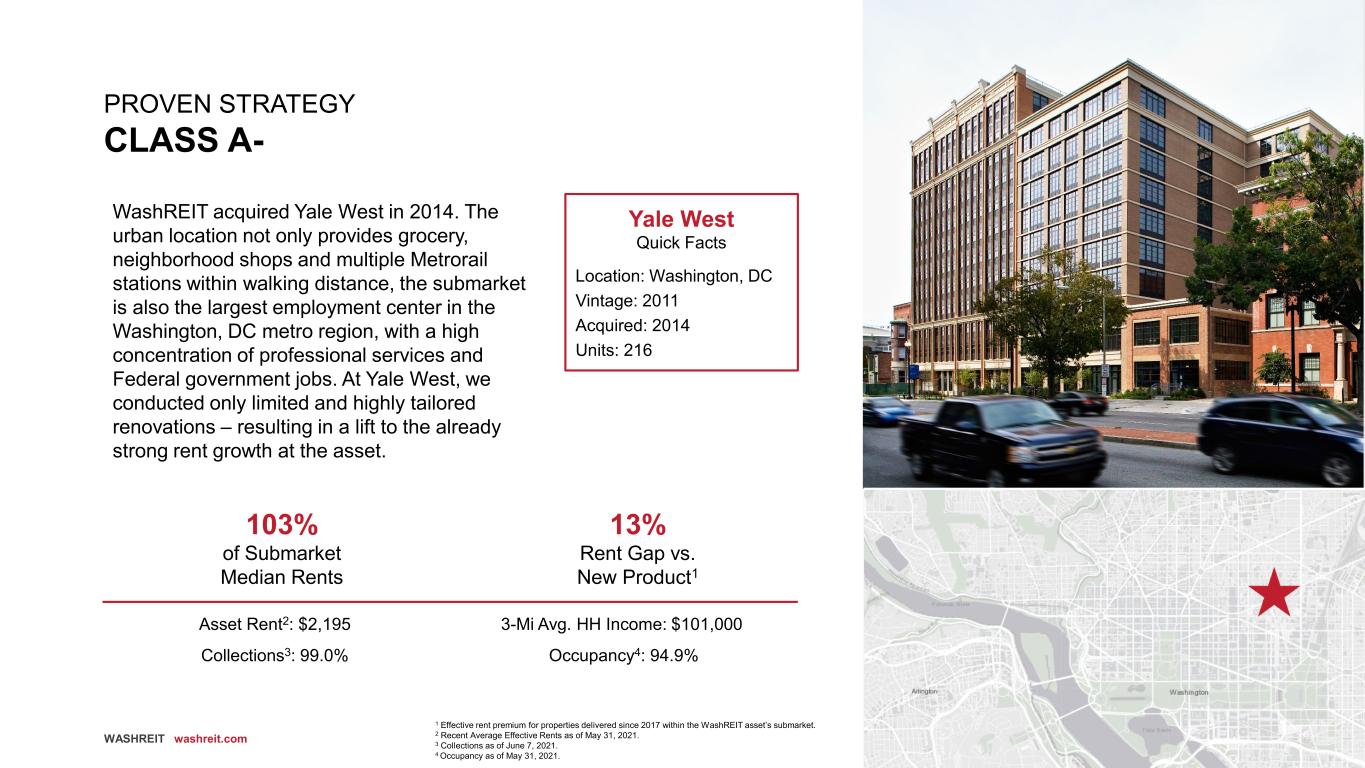

37 WASHREIT washreit.com 1 Effective rent premium for properties delivered since 2017 within the WashREIT asset’s submarket. 2 Recent Average Effective Rents as of May 31, 2021. 3 Collections as of June 7, 2021. 4 Occupancy as of May 31, 2021. PROVEN STRATEGY CLASS A- Yale West Quick Facts Location: Washington, DC Vintage: 2011 Acquired: 2014 Units: 216 WashREIT acquired Yale West in 2014. The urban location not only provides grocery, neighborhood shops and multiple Metrorail stations within walking distance, the submarket is also the largest employment center in the Washington, DC metro region, with a high concentration of professional services and Federal government jobs. At Yale West, we conducted only limited and highly tailored renovations – resulting in a lift to the already strong rent growth at the asset. 103% of Submarket Median Rents 13% Rent Gap vs. New Product1 Asset Rent2: $2,195 3-Mi Avg. HH Income: $101,000 Collections3: 99.0% Occupancy4: 94.9%

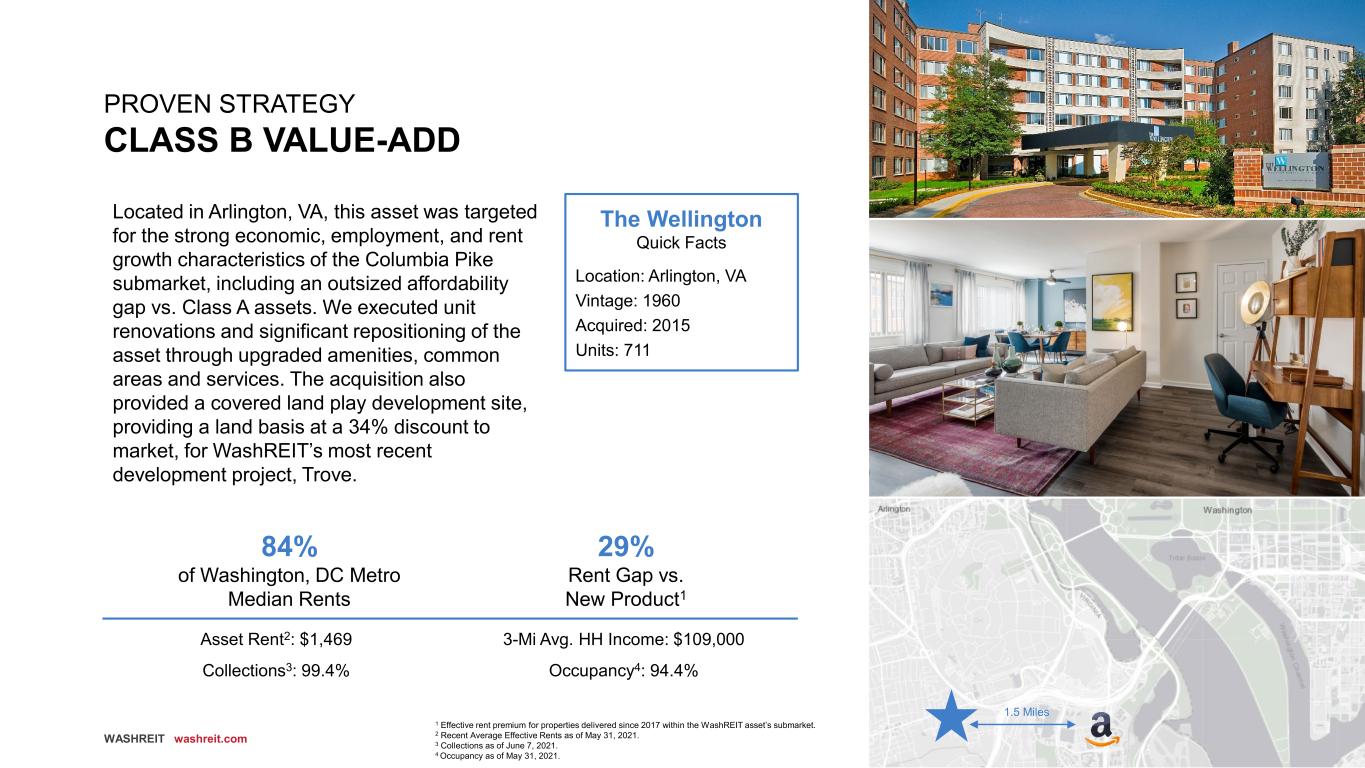

38 WASHREIT washreit.com PROVEN STRATEGY CLASS B VALUE-ADD The Wellington Quick Facts Location: Arlington, VA Vintage: 1960 Acquired: 2015 Units: 711 Located in Arlington, VA, this asset was targeted for the strong economic, employment, and rent growth characteristics of the Columbia Pike submarket, including an outsized affordability gap vs. Class A assets. We executed unit renovations and significant repositioning of the asset through upgraded amenities, common areas and services. The acquisition also provided a covered land play development site, providing a land basis at a 34% discount to market, for WashREIT’s most recent development project, Trove. 84% of Washington, DC Metro Median Rents 29% Rent Gap vs. New Product1 1.5 Miles Asset Rent2: $1,469 3-Mi Avg. HH Income: $109,000 Collections3: 99.4% Occupancy4: 94.4% 1 Effective rent premium for properties delivered since 2017 within the WashREIT asset’s submarket. 2 Recent Average Effective Rents as of May 31, 2021. 3 Collections as of June 7, 2021. 4 Occupancy as of May 31, 2021.

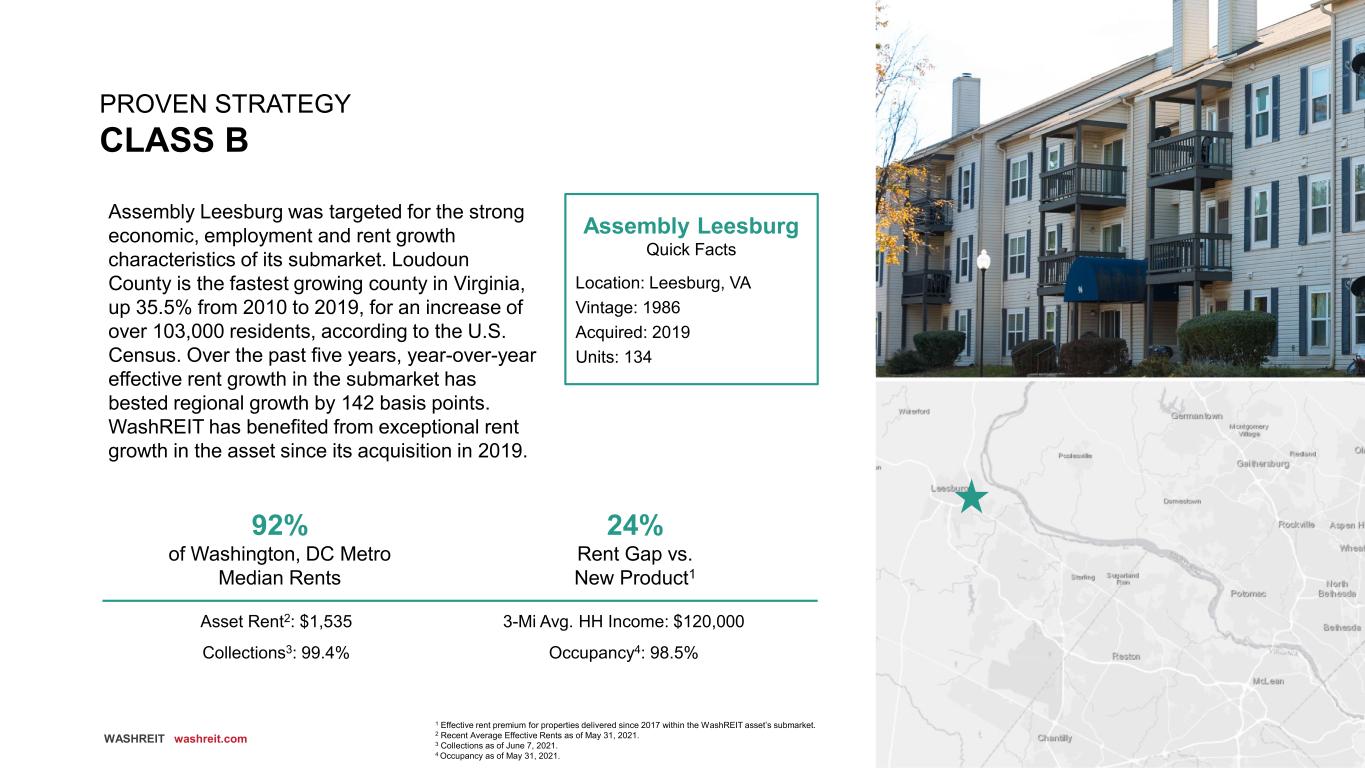

39 WASHREIT washreit.com PROVEN STRATEGY CLASS B Assembly Leesburg Quick Facts Location: Leesburg, VA Vintage: 1986 Acquired: 2019 Units: 134 Assembly Leesburg was targeted for the strong economic, employment and rent growth characteristics of its submarket. Loudoun County is the fastest growing county in Virginia, up 35.5% from 2010 to 2019, for an increase of over 103,000 residents, according to the U.S. Census. Over the past five years, year-over-year effective rent growth in the submarket has bested regional growth by 142 basis points. WashREIT has benefited from exceptional rent growth in the asset since its acquisition in 2019. 92% of Washington, DC Metro Median Rents 24% Rent Gap vs. New Product1 Asset Rent2: $1,535 3-Mi Avg. HH Income: $120,000 Collections3: 99.4% Occupancy4: 98.5% 1 Effective rent premium for properties delivered since 2017 within the WashREIT asset’s submarket. 2 Recent Average Effective Rents as of May 31, 2021. 3 Collections as of June 7, 2021. 4 Occupancy as of May 31, 2021.

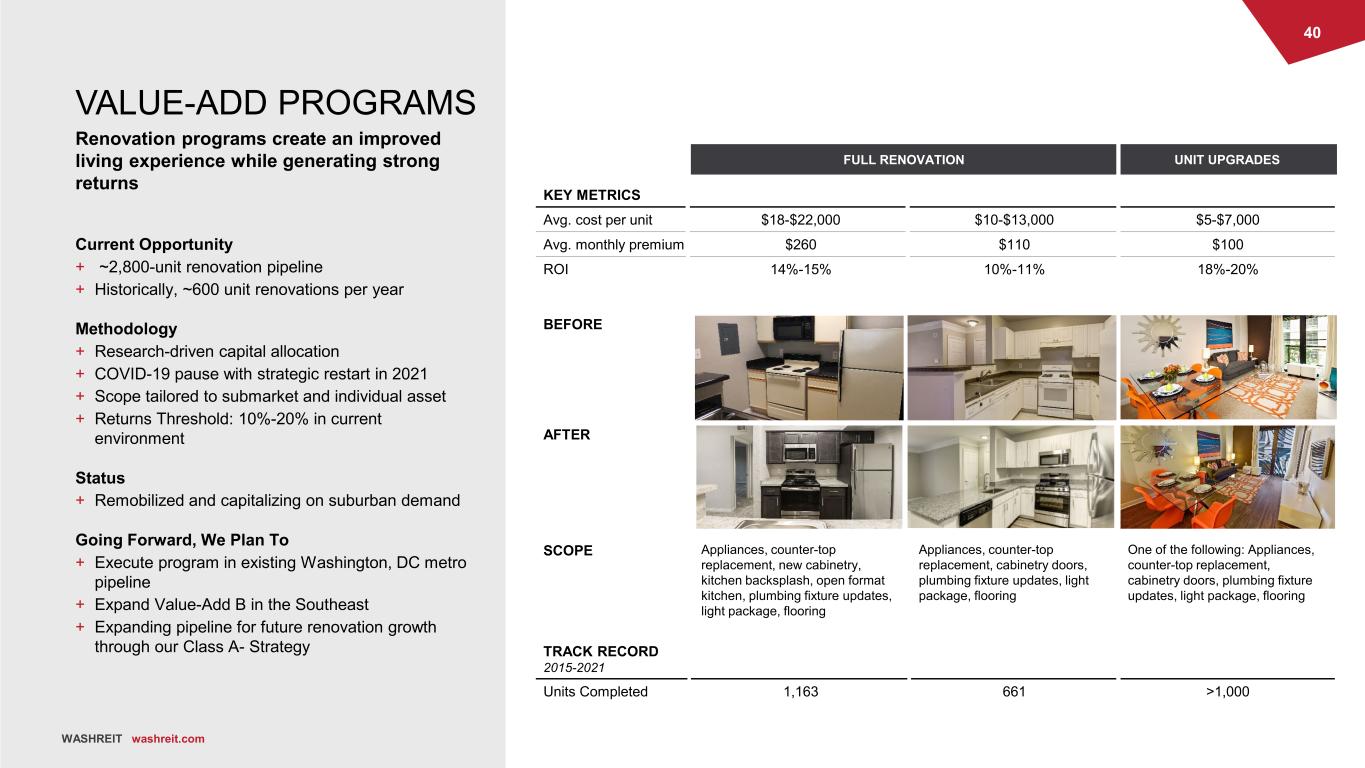

40 WASHREIT washreit.com VALUE-ADD PROGRAMS FULL RENOVATION KEY METRICS Avg. cost per unit $18-$22,000 $10-$13,000 $5-$7,000 Avg. monthly premium $260 $110 $100 ROI 14%-15% 10%-11% 18%-20% BEFORE UNIT UPGRADES Current Opportunity + ~2,800-unit renovation pipeline + Historically, ~600 unit renovations per year Methodology + Research-driven capital allocation + COVID-19 pause with strategic restart in 2021 + Scope tailored to submarket and individual asset + Returns Threshold: 10%-20% in current environment Status + Remobilized and capitalizing on suburban demand Going Forward, We Plan To + Execute program in existing Washington, DC metro pipeline + Expand Value-Add B in the Southeast + Expanding pipeline for future renovation growth through our Class A- Strategy SCOPE Appliances, counter-top replacement, new cabinetry, kitchen backsplash, open format kitchen, plumbing fixture updates, light package, flooring Appliances, counter-top replacement, cabinetry doors, plumbing fixture updates, light package, flooring One of the following: Appliances, counter-top replacement, cabinetry doors, plumbing fixture updates, light package, flooring TRACK RECORD 2015-2021 Units Completed 1,163 661 >1,000 AFTER Renovation programs create an improved living experience while generating strong returns WASHREIT washreit.com

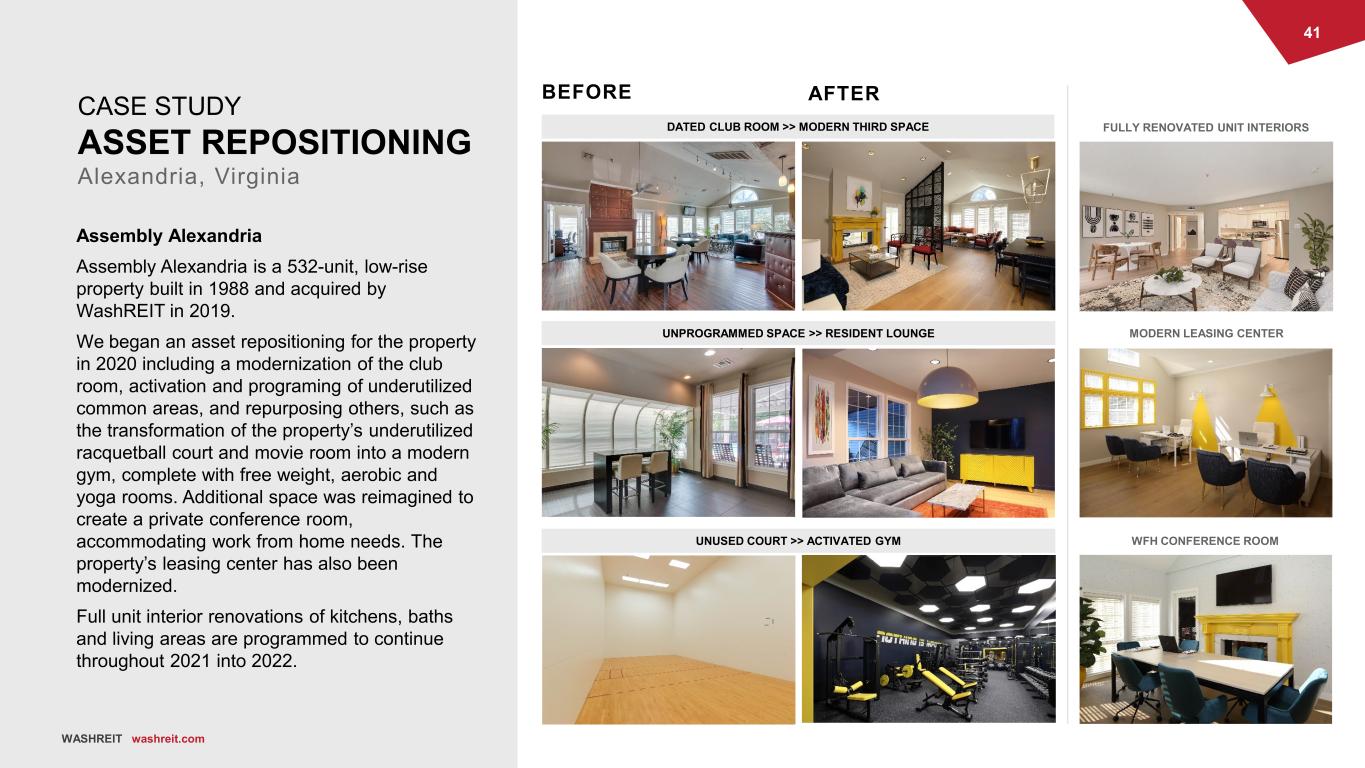

41 WASHREIT washreit.com Assembly Alexandria Assembly Alexandria is a 532-unit, low-rise property built in 1988 and acquired by WashREIT in 2019. We began an asset repositioning for the property in 2020 including a modernization of the club room, activation and programing of underutilized common areas, and repurposing others, such as the transformation of the property’s underutilized racquetball court and movie room into a modern gym, complete with free weight, aerobic and yoga rooms. Additional space was reimagined to create a private conference room, accommodating work from home needs. The property’s leasing center has also been modernized. Full unit interior renovations of kitchens, baths and living areas are programmed to continue throughout 2021 into 2022. BEFORE AFTER MODERN LEASING CENTER WFH CONFERENCE ROOM FULLY RENOVATED UNIT INTERIORSDATED CLUB ROOM >> MODERN THIRD SPACE CASE STUDY ASSET REPOSITIONING Alexandria, Virginia WASHREIT washreit.com UNPROGRAMMED SPACE >> RESIDENT LOUNGE UNUSED COURT >> ACTIVATED GYM

42 WASHREIT washreit.com PREPARED TO MOVE NOW + Leveraging our proven relationship with a third- party property manger to immediately ramp up operations of acquired properties + Expanding our multifamily team with leadership in our Southeast expansion markets + Building our multifamily operating platform of the future via a road map developed over the past year + Scoping and tailoring our value-add programming to improve the residential experience and enhance returns in our expansion markets, across our strategies Assembly Alexandria Alexandria, Virginia Operations

43 WASHREIT washreit.com “The problem is there’s no moderate-income housing for people to move up from lower-cost housing, or to move down from an expensive apartment if their circumstances change. REITs can provide investment into that middle level of housing,” Christopher Ptomey Executive Director Terwilliger Center for Housing Urban Land Institute DELIVERING ON ESG PRIORITIES INTEGRATING CLIMATE RISK Climate risk assessments are fully integrated into our acquisition process, from deal identification to underwriting, due diligence, and investment committee. We evaluate the physical risks impacting property operations and expenses and the transition risks impacting the investment strategy. And we maintain climate risk transparency through our commitment to Task Force on Climate-related Financial Disclosures (TCFD). IMPACT IMPROVEMENT OPPORTUNITIES Operating high-performing buildings will continue to be our focus, and we will raise the bar of any acquisitions to meet WashREIT standards for sustainability. We prioritize energy and water efficiency, resident health and wellness, sustainable purchasing, and resource conservation. We will seek to close the gap between existing operations and our standards as part of our onboarding process, similar to the approach taken in pursuing BREEAM certification for the Assembly portfolio. BRIDGING THE HOUSING AFFORDABILITY GAP WashREIT’s focus on providing quality, affordable housing to the underserved middle-income market meets a pressing social need and maintains existing communities, while providing consistent and solid returns to our investors.

44 WASHREIT washreit.com Accelerate WashREIT’s transformation into a multifamily REIT operating in the Washington, DC metro and Southeastern markets Provide financial flexibility to prudently invest in high-growth Southeastern region Significantly reset earnings growth profile and enhance geographic diversification Streamline and simplify business model to promote sustainable growth Improve cash flow characteristics – lower volatility, lower capex, and greater growth going forward Reduce net leverage with a target of mid to high 5x range1 1 Act TRANSACTIONS HIGHLIGHTS If completed, the strategic transactions would: Note: Refer to slide 2 for certain disclosures regarding Forward-Looking Statements and Strategic Transactions. 1 See footnote 3 on slide 7 for additional information regarding net leverage presentation.

45 WASHREIT washreit.com “Estimated 2021 NOI” illustrates the estimated 2021 NOI from our existing properties, excluding NOI attributable to office assets expected to be sold in the office portfolio sale and to our retail assets, which are assumed to be sold in 2021 which management believes is important given the magnitude of the strategic transactions. The calculation of Estimated 2021 NOI is also based on the following assumptions: • Estimated Same-Store Multifamily NOI adjusts historical NOI of our existing same store multifamily assets for anticipated increases in occupancy, effective rental rates, revenues and expenses, as well as changes in NOI considering historical seasonal patterns. Once we achieve targeted occupancy levels for each season, we will focus on driving higher effective rental rates. Estimated Same-Store Multifamily NOI is not adjusted for NOI from multifamily asset acquisitions or for any associated acquisition costs or general and administrative expenses. • Annualized estimated 2021 NOI for Trove is an internal management estimate calculated based upon market data for similar assets, including rental rates and pace of lease-up and concessions. • Estimated Stabilized NOI for Trove represents annualized estimated stabilized NOI for Q2 2022 and is an internal management estimate calculated based upon market data for similar assets, assuming stabilization occurs around year end 2021, and excluding the impact of leasing costs and concessions. • Estimated 2021 NOI for Watergate 600 is calculated using scheduled contractual rent in existing leasing contracts. Assumes renewals and early terminations consistent with historic renewals and early terminations. • Please see slide 2 of this presentation for a discussion of the risks that could cause actual results to differ materially from these estimated results. We can give no assurance that any of the above-listed assumptions will be correct. “Net leverage” or "targeted leverage" (i.e., Net Debt / Adjusted EBITDA) illustrates pro forma net leverage after giving effect to the expected the office portfolio sale transaction, the assumed sale of all of our existing retail assets and the reinvestment of proceeds into future multifamily investments and repayment of existing debt, which management believes is important given the magnitude of the strategic transactions. More specifically, the calculation of Net Debt/Adjusted EBITDA is based on the following assumptions: • Assumes (1) the expected sale of office portfolio is consummated in July of 2021 for gross proceeds of $766 million and (2) all retail assets are sold during Q3 2021 for gross proceeds of approximately $170 million (collectively, the “Asset Sales”). • Assumes repayment of $300 million of 3.95% senior notes due 2022 and $150 million of amounts outstanding under the term loan maturing in 2023 (including the use of an additional $29 million draw from the revolver and excluding prepayment penalties) using net proceeds from the Asset Sales (the "Net Debt Repayment"). • Adjusted EBITDA is an estimate of annual Adjusted EBITDA for the Company assuming (1) completion of the Asset Sales, (2) completion of the Net Debt Repayment, and (3) reinvestment of approximately $450 million of the net proceeds from the Asset Sales into future multifamily investments (“Future Multifamily Acquisitions”). For purposes of this calculation, with respect to Future Multifamily Acquisitions, we assumed an initial cap rate in the low 4% range and averaging in the high 4% range for the first three years, which we selected based on our market research. Because our calculation of Adjusted EBITDA excludes interest expense, real estate depreciation and amortization, non-real estate depreciation, severance expense (including any severance expense related to workforce reductions in connection with proposed and potential asset sales), losses or gains on depreciable real estate (including any such losses or gains related to proposed and potential asset sales), any adjustment for extinguishment of debt or associated interest rate derivatives, such amounts are not reflected in this calculation, but would impact our net income. • Actual results may vary from this illustrative calculation of Net Debt / Adjusted EBITDA, which is not based on the actual or expected results of operations from any specific multifamily investments. In addition, please see slide 2 of this presentation for a discussion of the risks that could cause actual results to differ materially from these estimated results. We can give no assurance that any of the assumptions described above will be correct. ADDITIONAL ASSUMPTIONS

46 WASHREIT washreit.com DEFINITIONS This investor presentation includes certain forward-looking non-GAAP information. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these estimates, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable efforts. Adjusted EBITDA is a non-GAAP measure defined as earnings before interest expense, taxes, depreciation, amortization, gain/loss on sale of real estate, casualty gain/loss, real estate impairment, gain/loss on extinguishment of debt, restructuring expenses (which include severance, accelerated share-based compensation and other expenses related to a restructuring of corporate personnel), acquisition expenses and gain from non-disposal activities. We consider Adjusted EBITDA to be an appropriate supplemental performance measure because it permits investors to view income from operations without the effect of depreciation, and the cost of debt or non-operating gains and losses. FAD Capital Expenditures consists of tenant improvements and incentives, net of reimbursements, external and internal leasing commissions capitalized and recurring capital improvements. Net debt is calculated by subtracting cash and cash equivalents from total outstanding debt as per our consolidated balance sheets at the end of the period. Net Operating Income (“NOI”) is a non-GAAP measure defined as real estate rental revenue less real estate expenses. NOI is calculated as net income, less non-real estate revenue and the results of discontinued operations (including the gain or loss on sale, if any), plus interest expense, depreciation and amortization, general and administrative expenses, acquisition costs, real estate impairment, lease origination expenses, casualty gains and losses, and gain or loss on extinguishment of debt. We also present NOI on a cash basis ("Cash NOI") which is calculated as NOI less the impact of straightlining of rent and amortization of market intangibles. We believe that NOI and cash NOI are useful performance measures because, when compared across periods, they reflect the impact on operations of trends in occupancy rates, rental rates and operating costs on an unleveraged basis, providing perspective not immediately apparent from net income. NOI and cash NOI exclude certain components from net income in order to provide results more closely related to a property’s results of operations. For example, interest expense is not necessarily linked to the operating performance of a real estate asset. In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. As a result of the foregoing, we provide each of NOI and cash NOI as a supplement to net income, calculated in accordance with GAAP. Neither represents net income or income from continuing operations, in either case calculated in accordance with GAAP. As such, NOI and cash NOI should not be considered alternatives to these measures as an indication of our operating performance. Same-store portfolio properties include properties that were owned for the entirety of the years being compared and exclude properties under redevelopment or development and properties acquired, sold or classified as held for sale during the years being compared. We categorize our properties as “same-store” or non-same-store” for purposes of evaluating comparative operating performance. We define development properties as those for which we have planned or ongoing major construction activities on existing or acquired land pursuant to an authorized development plan. We consider a property's development activities to be complete when the property is ready for its intended use. The property is categorized as same-store when it has been ready for its intended use for the entirety of the years being compared. We define redevelopment properties as those for which have planned or ongoing significant development and construction activities on existing or acquired buildings pursuant to an authorized plan, which has an impact on current operating results, occupancy and the ability to lease space with the intended result of a higher economic return on the property. We categorize a redevelopment property as same-store when redevelopment activities have been complete for the majority of each year being compared. Same-store portfolio NOI growth is the change in the NOI of the same-store portfolio properties from the prior reporting period to the current reporting period.

47 WASHREIT washreit.com RECONCILIATIONS

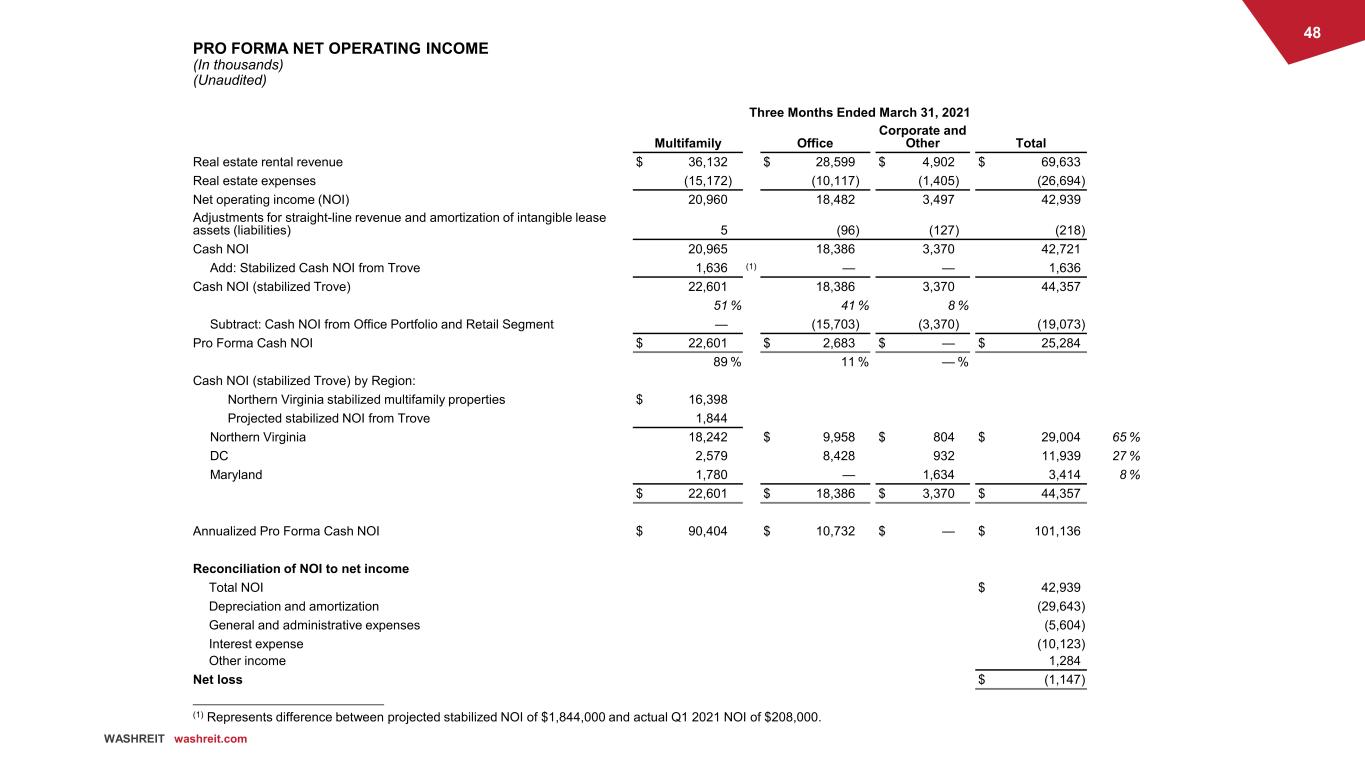

48 WASHREIT washreit.com PRO FORMA NET OPERATING INCOME (In thousands) (Unaudited) Three Months Ended March 31, 2021 Multifamily Office Corporate and Other Total Real estate rental revenue $ 36,132 $ 28,599 $ 4,902 $ 69,633 Real estate expenses (15,172) (10,117) (1,405) (26,694) Net operating income (NOI) 20,960 18,482 3,497 42,939 Adjustments for straight-line revenue and amortization of intangible lease assets (liabilities) 5 (96) (127) (218) Cash NOI 20,965 18,386 3,370 42,721 Add: Stabilized Cash NOI from Trove 1,636 (1) — — 1,636 Cash NOI (stabilized Trove) 22,601 18,386 3,370 44,357 51 % 41 % 8 % Subtract: Cash NOI from Office Portfolio and Retail Segment — (15,703) (3,370) (19,073) Pro Forma Cash NOI $ 22,601 $ 2,683 $ — $ 25,284 89 % 11 % — % Cash NOI (stabilized Trove) by Region: Northern Virginia stabilized multifamily properties $ 16,398 Projected stabilized NOI from Trove 1,844 Northern Virginia 18,242 $ 9,958 $ 804 $ 29,004 65 % DC 2,579 8,428 932 11,939 27 % Maryland 1,780 — 1,634 3,414 8 % $ 22,601 $ 18,386 $ 3,370 $ 44,357 Annualized Pro Forma Cash NOI $ 90,404 $ 10,732 $ — $ 101,136 Reconciliation of NOI to net income Total NOI $ 42,939 Depreciation and amortization (29,643) General and administrative expenses (5,604) Interest expense (10,123) Other income 1,284 Net loss $ (1,147) ______________________________ (1) Represents difference between projected stabilized NOI of $1,844,000 and actual Q1 2021 NOI of $208,000.

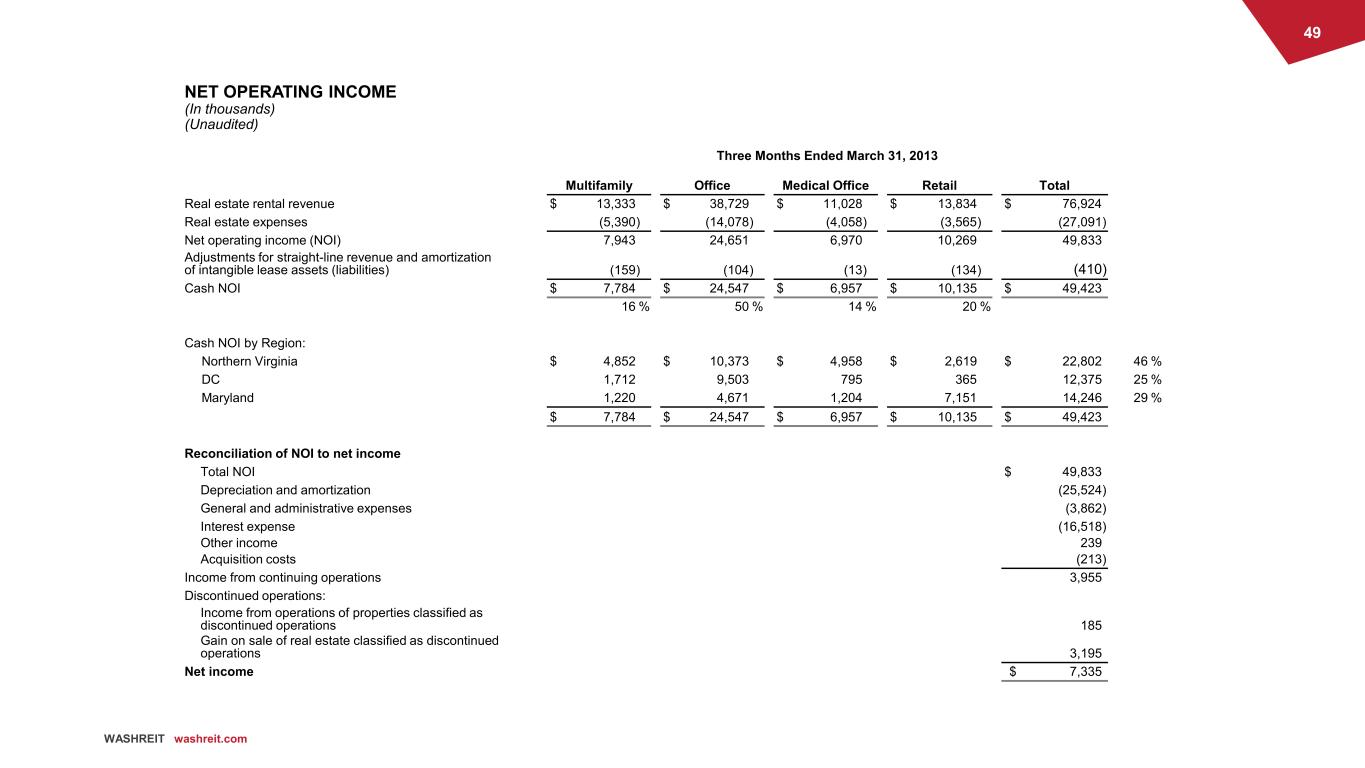

49 WASHREIT washreit.com NET OPERATING INCOME (In thousands) (Unaudited) Three Months Ended March 31, 2013 Multifamily Office Medical Office Retail Total Real estate rental revenue $ 13,333 $ 38,729 $ 11,028 $ 13,834 $ 76,924 Real estate expenses (5,390) (14,078) (4,058) (3,565) (27,091) Net operating income (NOI) 7,943 24,651 6,970 10,269 49,833 Adjustments for straight-line revenue and amortization of intangible lease assets (liabilities) (159) (104) (13) (134) (410) Cash NOI $ 7,784 $ 24,547 $ 6,957 $ 10,135 $ 49,423 16 % 50 % 14 % 20 % Cash NOI by Region: Northern Virginia $ 4,852 $ 10,373 $ 4,958 $ 2,619 $ 22,802 46 % DC 1,712 9,503 795 365 12,375 25 % Maryland 1,220 4,671 1,204 7,151 14,246 29 % $ 7,784 $ 24,547 $ 6,957 $ 10,135 $ 49,423 Reconciliation of NOI to net income Total NOI $ 49,833 Depreciation and amortization (25,524) General and administrative expenses (3,862) Interest expense (16,518) Other income 239 Acquisition costs (213) Income from continuing operations 3,955 Discontinued operations: Income from operations of properties classified as discontinued operations 185 Gain on sale of real estate classified as discontinued operations 3,195 Net income $ 7,335

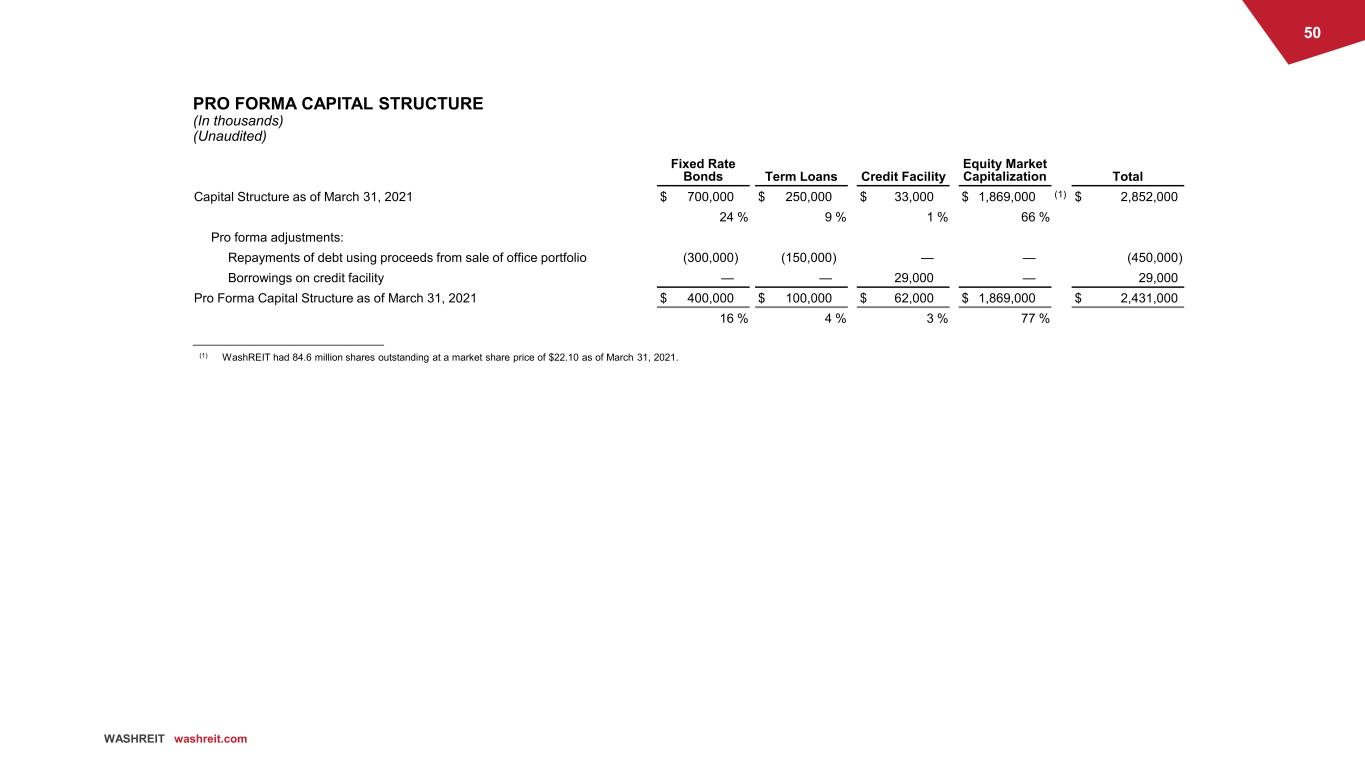

50 WASHREIT washreit.com PRO FORMA CAPITAL STRUCTURE (In thousands) (Unaudited) Fixed Rate Bonds Term Loans Credit Facility Equity Market Capitalization Total Capital Structure as of March 31, 2021 $ 700,000 $ 250,000 $ 33,000 $ 1,869,000 (1) $ 2,852,000 24 % 9 % 1 % 66 % Pro forma adjustments: Repayments of debt using proceeds from sale of office portfolio (300,000) (150,000) — — (450,000) Borrowings on credit facility — — 29,000 — 29,000 Pro Forma Capital Structure as of March 31, 2021 $ 400,000 $ 100,000 $ 62,000 $ 1,869,000 $ 2,431,000 16 % 4 % 3 % 77 % ______________________________ (1) WashREIT had 84.6 million shares outstanding at a market share price of $22.10 as of March 31, 2021.

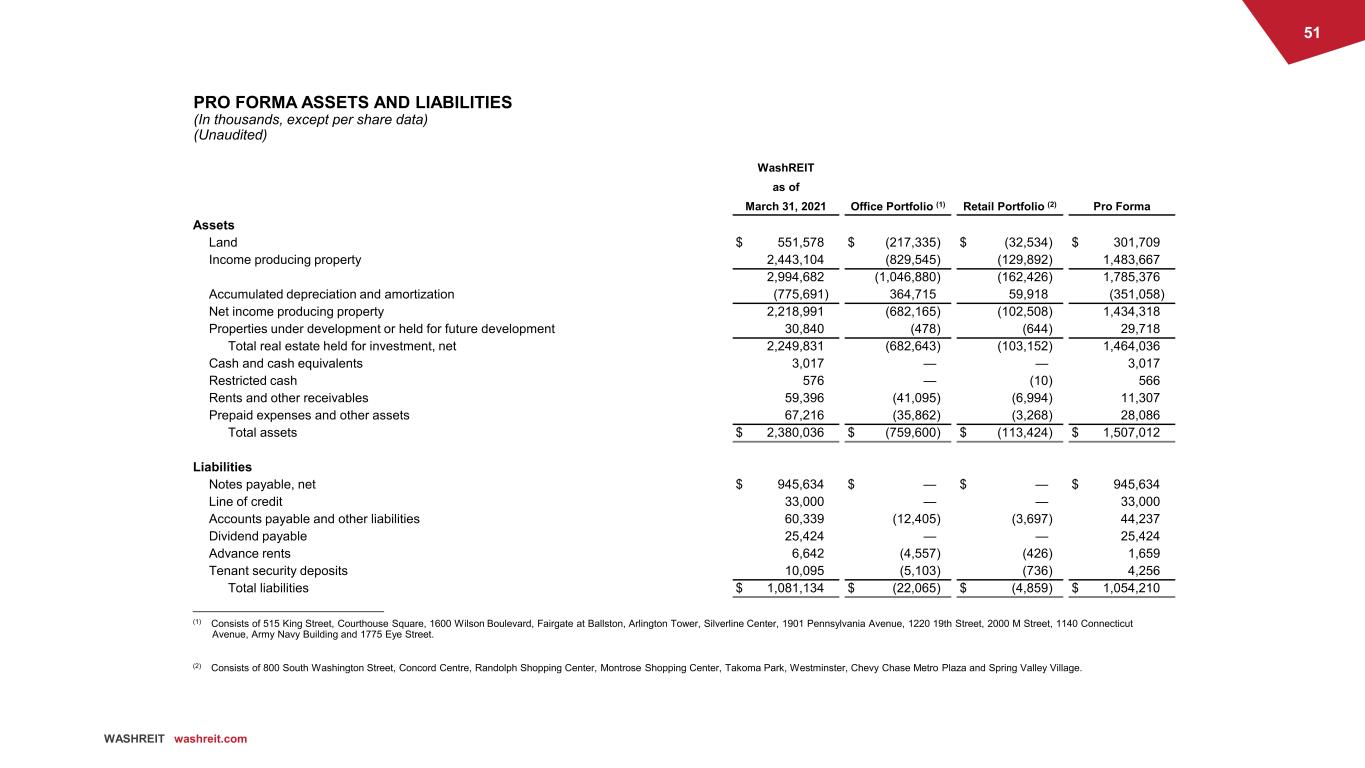

51 WASHREIT washreit.com PRO FORMA ASSETS AND LIABILITIES (In thousands, except per share data) (Unaudited) WashREIT as of March 31, 2021 Office Portfolio (1) Retail Portfolio (2) Pro Forma Assets Land $ 551,578 $ (217,335) $ (32,534) $ 301,709 Income producing property 2,443,104 (829,545) (129,892) 1,483,667 2,994,682 (1,046,880) (162,426) 1,785,376 Accumulated depreciation and amortization (775,691) 364,715 59,918 (351,058) Net income producing property 2,218,991 (682,165) (102,508) 1,434,318 Properties under development or held for future development 30,840 (478) (644) 29,718 Total real estate held for investment, net 2,249,831 (682,643) (103,152) 1,464,036 Cash and cash equivalents 3,017 — — 3,017 Restricted cash 576 — (10) 566 Rents and other receivables 59,396 (41,095) (6,994) 11,307 Prepaid expenses and other assets 67,216 (35,862) (3,268) 28,086 Total assets $ 2,380,036 $ (759,600) $ (113,424) $ 1,507,012 Liabilities Notes payable, net $ 945,634 $ — $ — $ 945,634 Line of credit 33,000 — — 33,000 Accounts payable and other liabilities 60,339 (12,405) (3,697) 44,237 Dividend payable 25,424 — — 25,424 Advance rents 6,642 (4,557) (426) 1,659 Tenant security deposits 10,095 (5,103) (736) 4,256 Total liabilities $ 1,081,134 $ (22,065) $ (4,859) $ 1,054,210 ______________________________ (1) Consists of 515 King Street, Courthouse Square, 1600 Wilson Boulevard, Fairgate at Ballston, Arlington Tower, Silverline Center, 1901 Pennsylvania Avenue, 1220 19th Street, 2000 M Street, 1140 Connecticut Avenue, Army Navy Building and 1775 Eye Street. (2) Consists of 800 South Washington Street, Concord Centre, Randolph Shopping Center, Montrose Shopping Center, Takoma Park, Westminster, Chevy Chase Metro Plaza and Spring Valley Village.

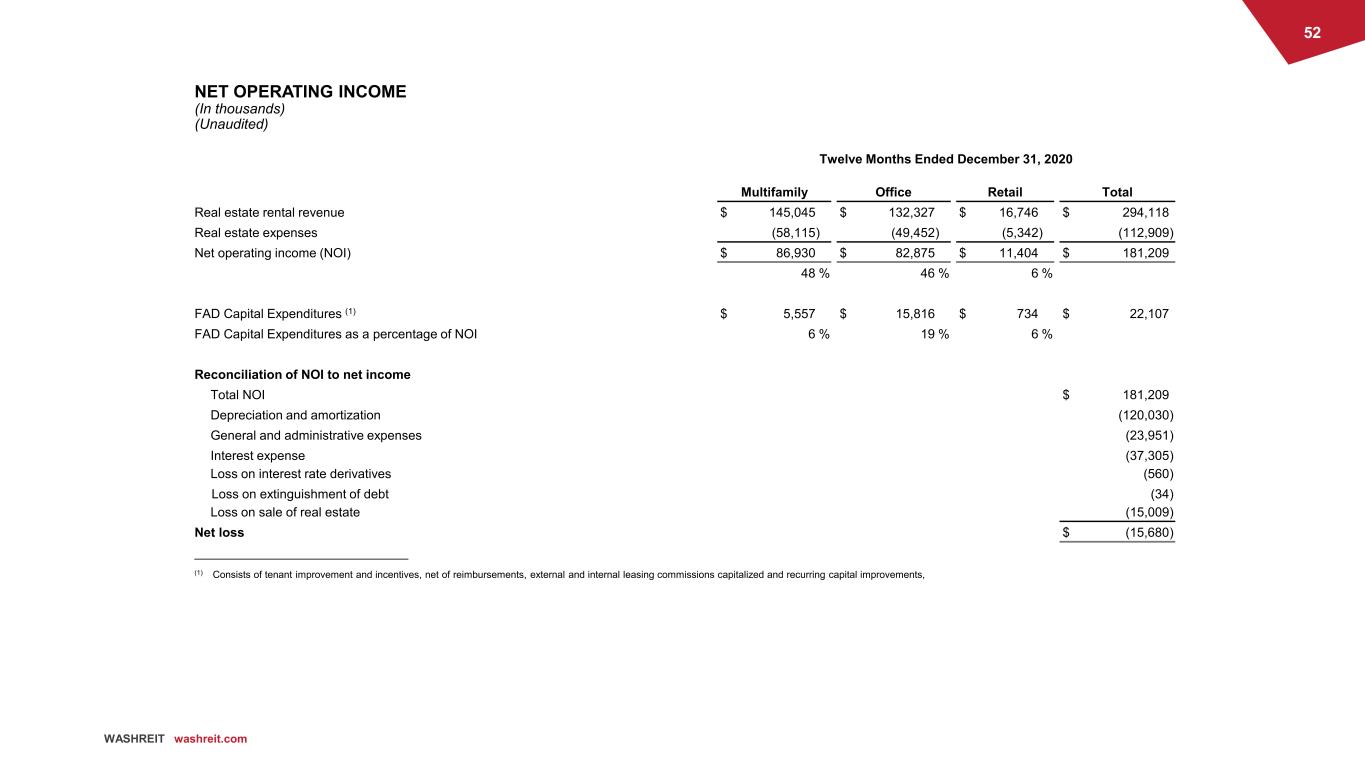

52 WASHREIT washreit.com NET OPERATING INCOME (In thousands) (Unaudited) Twelve Months Ended December 31, 2020 Multifamily Office Retail Total Real estate rental revenue $ 145,045 $ 132,327 $ 16,746 $ 294,118 Real estate expenses (58,115) (49,452) (5,342) (112,909) Net operating income (NOI) $ 86,930 $ 82,875 $ 11,404 $ 181,209 48 % 46 % 6 % FAD Capital Expenditures (1) $ 5,557 $ 15,816 $ 734 $ 22,107 FAD Capital Expenditures as a percentage of NOI 6 % 19 % 6 % Reconciliation of NOI to net income Total NOI $ 181,209 Depreciation and amortization (120,030) General and administrative expenses (23,951) Interest expense (37,305) Loss on interest rate derivatives (560) Loss on extinguishment of debt (34) Loss on sale of real estate (15,009) Net loss $ (15,680) ______________________________ (1) Consists of tenant improvement and incentives, net of reimbursements, external and internal leasing commissions capitalized and recurring capital improvements,

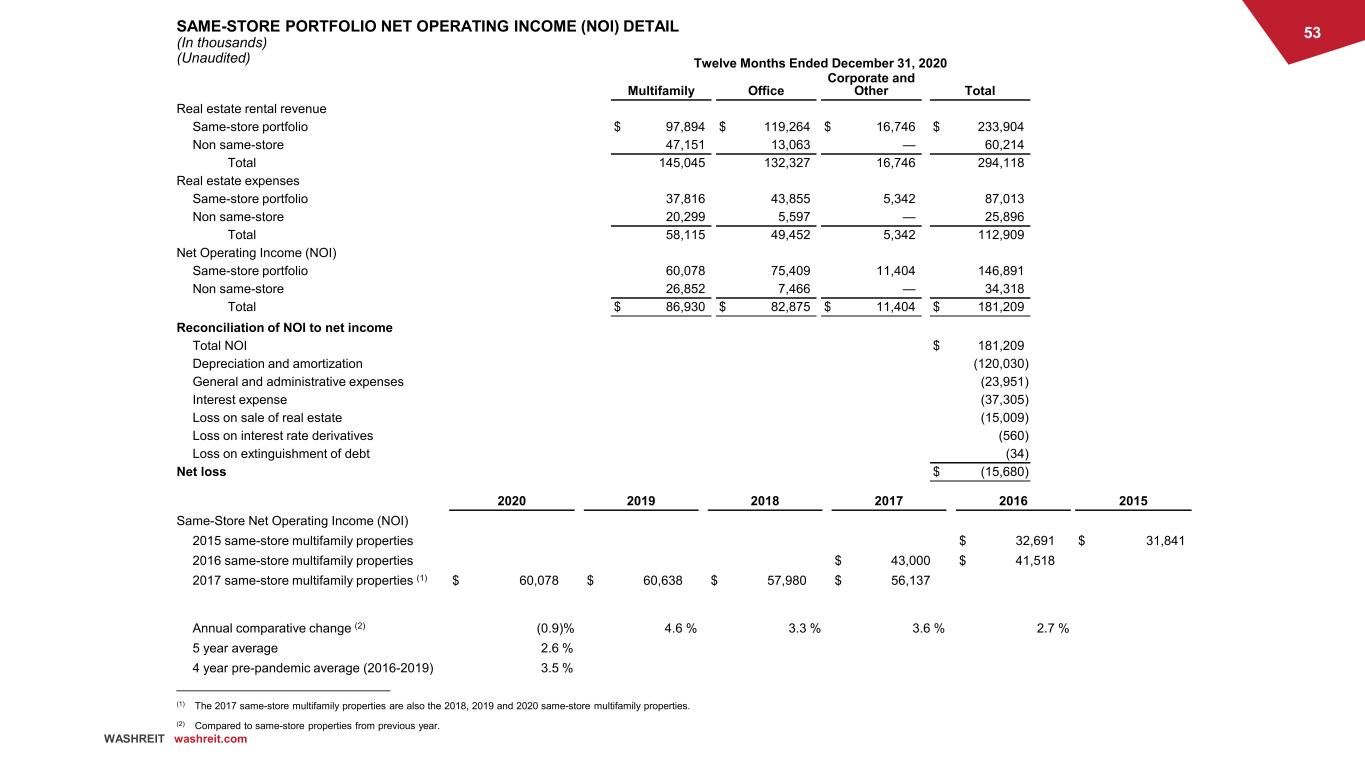

53 WASHREIT washreit.com SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) DETAIL (In thousands) (Unaudited) Twelve Months Ended December 31, 2020 Multifamily Office Corporate and Other Total Real estate rental revenue Same-store portfolio $ 97,894 $ 119,264 $ 16,746 $ 233,904 Non same-store 47,151 13,063 — 60,214 Total 145,045 132,327 16,746 294,118 Real estate expenses Same-store portfolio 37,816 43,855 5,342 87,013 Non same-store 20,299 5,597 — 25,896 Total 58,115 49,452 5,342 112,909 Net Operating Income (NOI) Same-store portfolio 60,078 75,409 11,404 146,891 Non same-store 26,852 7,466 — 34,318 Total $ 86,930 $ 82,875 $ 11,404 $ 181,209 Reconciliation of NOI to net income Total NOI $ 181,209 Depreciation and amortization (120,030) General and administrative expenses (23,951) Interest expense (37,305) Loss on sale of real estate (15,009) Loss on interest rate derivatives (560) Loss on extinguishment of debt (34) Net loss $ (15,680) 2020 2019 2018 2017 2016 2015 Same-Store Net Operating Income (NOI) 2015 same-store multifamily properties $ 32,691 $ 31,841 2016 same-store multifamily properties $ 43,000 $ 41,518 2017 same-store multifamily properties (1) $ 60,078 $ 60,638 $ 57,980 $ 56,137 Annual comparative change (2) (0.9)% 4.6 % 3.3 % 3.6 % 2.7 % 5 year average 2.6 % 4 year pre-pandemic average (2016-2019) 3.5 % ______________________________ (1) The 2017 same-store multifamily properties are also the 2018, 2019 and 2020 same-store multifamily properties. (2) Compared to same-store properties from previous year.

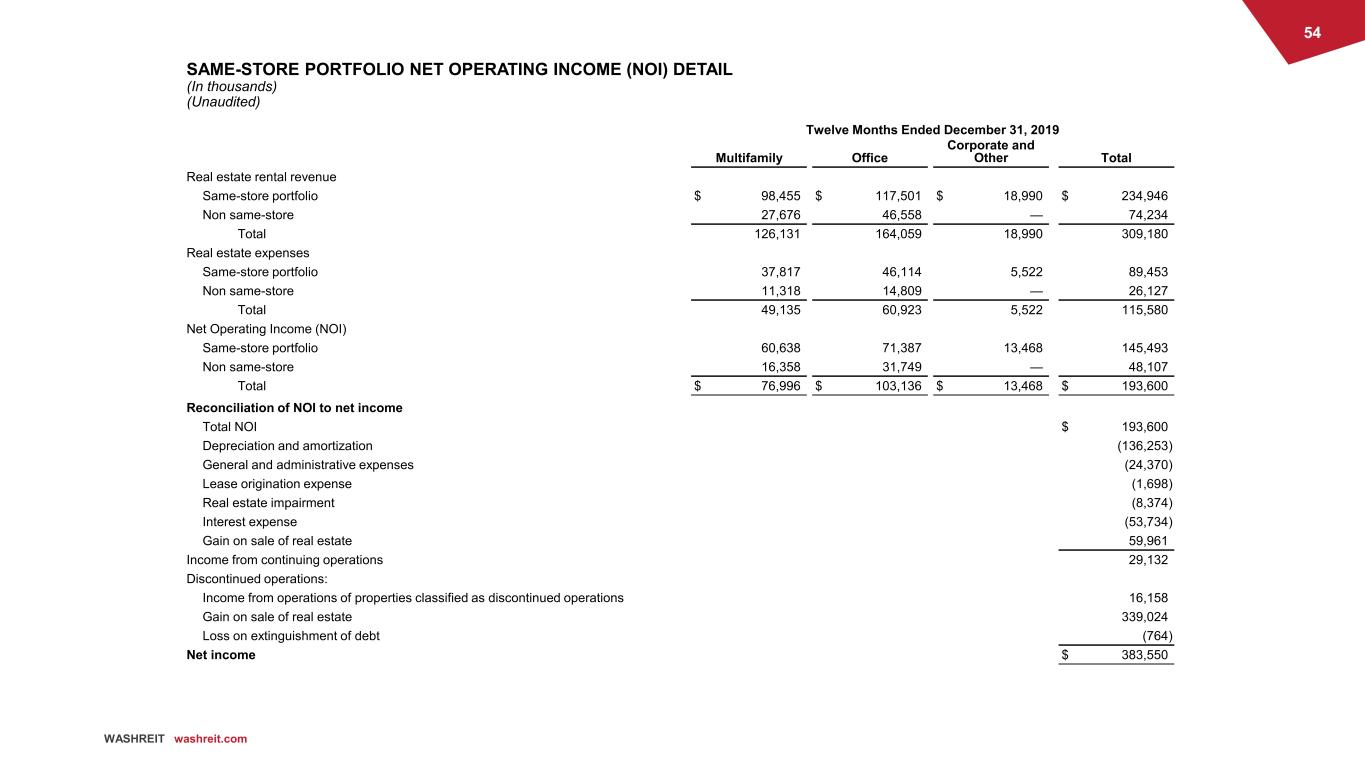

54 WASHREIT washreit.com SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) DETAIL (In thousands) (Unaudited) Twelve Months Ended December 31, 2019 Multifamily Office Corporate and Other Total Real estate rental revenue Same-store portfolio $ 98,455 $ 117,501 $ 18,990 $ 234,946 Non same-store 27,676 46,558 — 74,234 Total 126,131 164,059 18,990 309,180 Real estate expenses Same-store portfolio 37,817 46,114 5,522 89,453 Non same-store 11,318 14,809 — 26,127 Total 49,135 60,923 5,522 115,580 Net Operating Income (NOI) Same-store portfolio 60,638 71,387 13,468 145,493 Non same-store 16,358 31,749 — 48,107 Total $ 76,996 $ 103,136 $ 13,468 $ 193,600 Reconciliation of NOI to net income Total NOI $ 193,600 Depreciation and amortization (136,253) General and administrative expenses (24,370) Lease origination expense (1,698) Real estate impairment (8,374) Interest expense (53,734) Gain on sale of real estate 59,961 Income from continuing operations 29,132 Discontinued operations: Income from operations of properties classified as discontinued operations 16,158 Gain on sale of real estate 339,024 Loss on extinguishment of debt (764) Net income $ 383,550

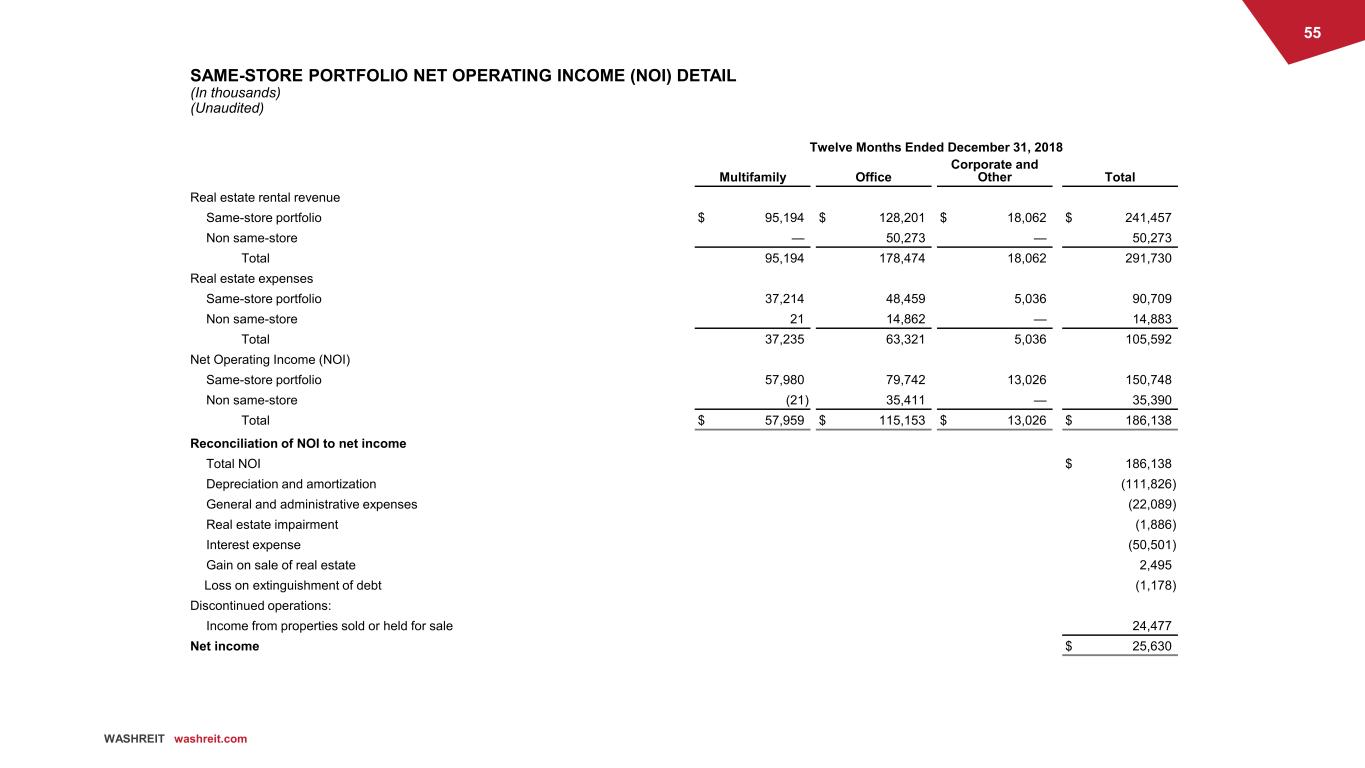

55 WASHREIT washreit.com SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) DETAIL (In thousands) (Unaudited) Twelve Months Ended December 31, 2018 Multifamily Office Corporate and Other Total Real estate rental revenue Same-store portfolio $ 95,194 $ 128,201 $ 18,062 $ 241,457 Non same-store — 50,273 — 50,273 Total 95,194 178,474 18,062 291,730 Real estate expenses Same-store portfolio 37,214 48,459 5,036 90,709 Non same-store 21 14,862 — 14,883 Total 37,235 63,321 5,036 105,592 Net Operating Income (NOI) Same-store portfolio 57,980 79,742 13,026 150,748 Non same-store (21) 35,411 — 35,390 Total $ 57,959 $ 115,153 $ 13,026 $ 186,138 Reconciliation of NOI to net income Total NOI $ 186,138 Depreciation and amortization (111,826) General and administrative expenses (22,089) Real estate impairment (1,886) Interest expense (50,501) Gain on sale of real estate 2,495 Loss on extinguishment of debt (1,178) Discontinued operations: Income from properties sold or held for sale 24,477 Net income $ 25,630

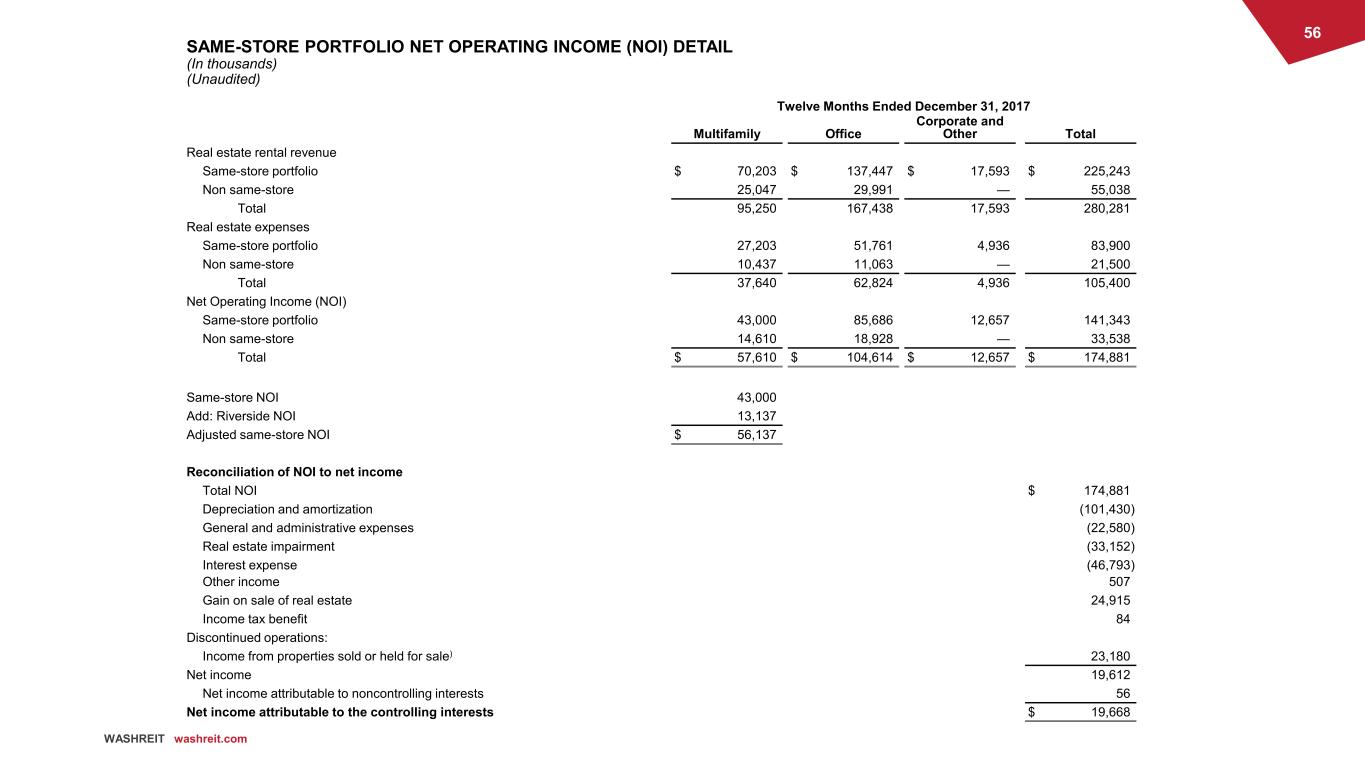

56 WASHREIT washreit.com SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) DETAIL (In thousands) (Unaudited) Twelve Months Ended December 31, 2017 Multifamily Office Corporate and Other Total Real estate rental revenue Same-store portfolio $ 70,203 $ 137,447 $ 17,593 $ 225,243 Non same-store 25,047 29,991 — 55,038 Total 95,250 167,438 17,593 280,281 Real estate expenses Same-store portfolio 27,203 51,761 4,936 83,900 Non same-store 10,437 11,063 — 21,500 Total 37,640 62,824 4,936 105,400 Net Operating Income (NOI) Same-store portfolio 43,000 85,686 12,657 141,343 Non same-store 14,610 18,928 — 33,538 Total $ 57,610 $ 104,614 $ 12,657 $ 174,881 Same-store NOI 43,000 Add: Riverside NOI 13,137 Adjusted same-store NOI $ 56,137 Reconciliation of NOI to net income Total NOI $ 174,881 Depreciation and amortization (101,430) General and administrative expenses (22,580) Real estate impairment (33,152) Interest expense (46,793) Other income 507 Gain on sale of real estate 24,915 Income tax benefit 84 Discontinued operations: Income from properties sold or held for sale) 23,180 Net income 19,612 Net income attributable to noncontrolling interests 56 Net income attributable to the controlling interests $ 19,668

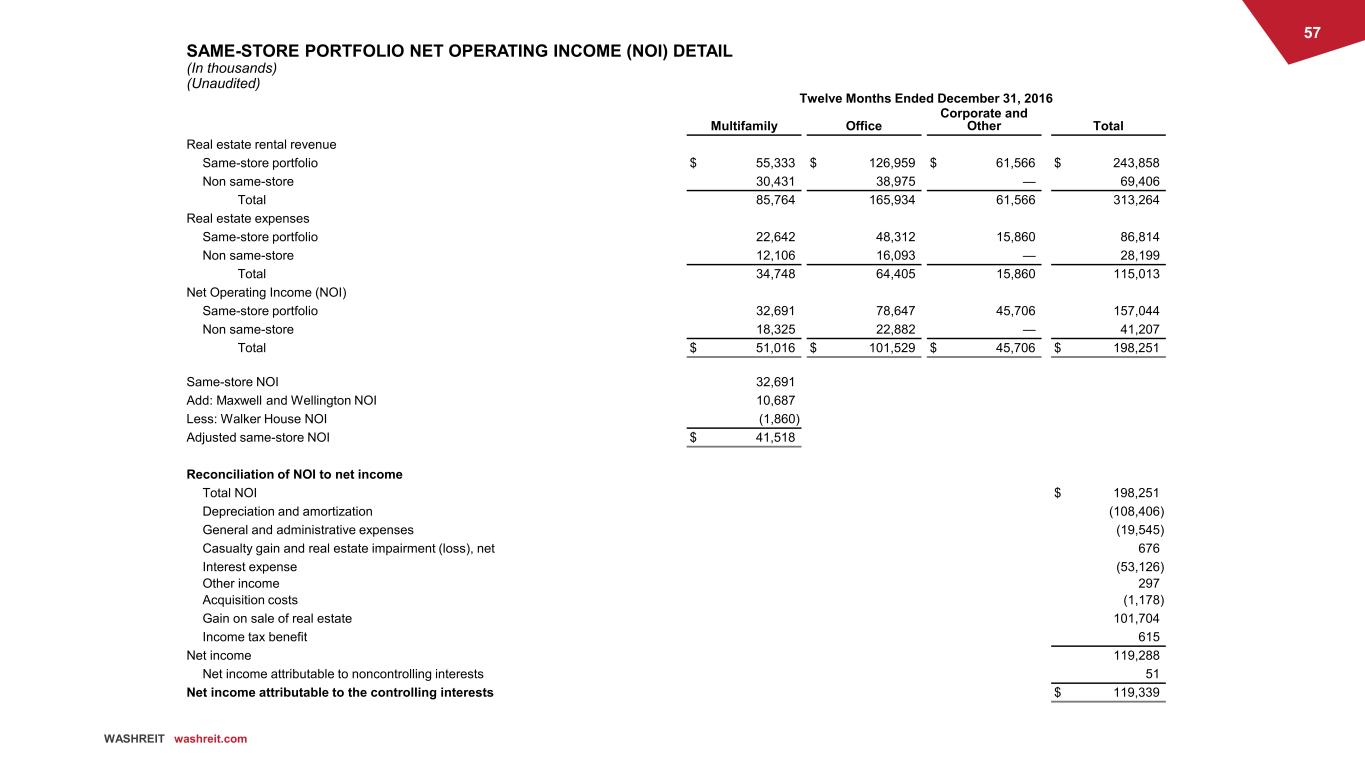

57 WASHREIT washreit.com SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) DETAIL (In thousands) (Unaudited) Twelve Months Ended December 31, 2016 Multifamily Office Corporate and Other Total Real estate rental revenue Same-store portfolio $ 55,333 $ 126,959 $ 61,566 $ 243,858 Non same-store 30,431 38,975 — 69,406 Total 85,764 165,934 61,566 313,264 Real estate expenses Same-store portfolio 22,642 48,312 15,860 86,814 Non same-store 12,106 16,093 — 28,199 Total 34,748 64,405 15,860 115,013 Net Operating Income (NOI) Same-store portfolio 32,691 78,647 45,706 157,044 Non same-store 18,325 22,882 — 41,207 Total $ 51,016 $ 101,529 $ 45,706 $ 198,251 Same-store NOI 32,691 Add: Maxwell and Wellington NOI 10,687 Less: Walker House NOI (1,860) Adjusted same-store NOI $ 41,518 Reconciliation of NOI to net income Total NOI $ 198,251 Depreciation and amortization (108,406) General and administrative expenses (19,545) Casualty gain and real estate impairment (loss), net 676 Interest expense (53,126) Other income 297 Acquisition costs (1,178) Gain on sale of real estate 101,704 Income tax benefit 615 Net income 119,288 Net income attributable to noncontrolling interests 51 Net income attributable to the controlling interests $ 119,339

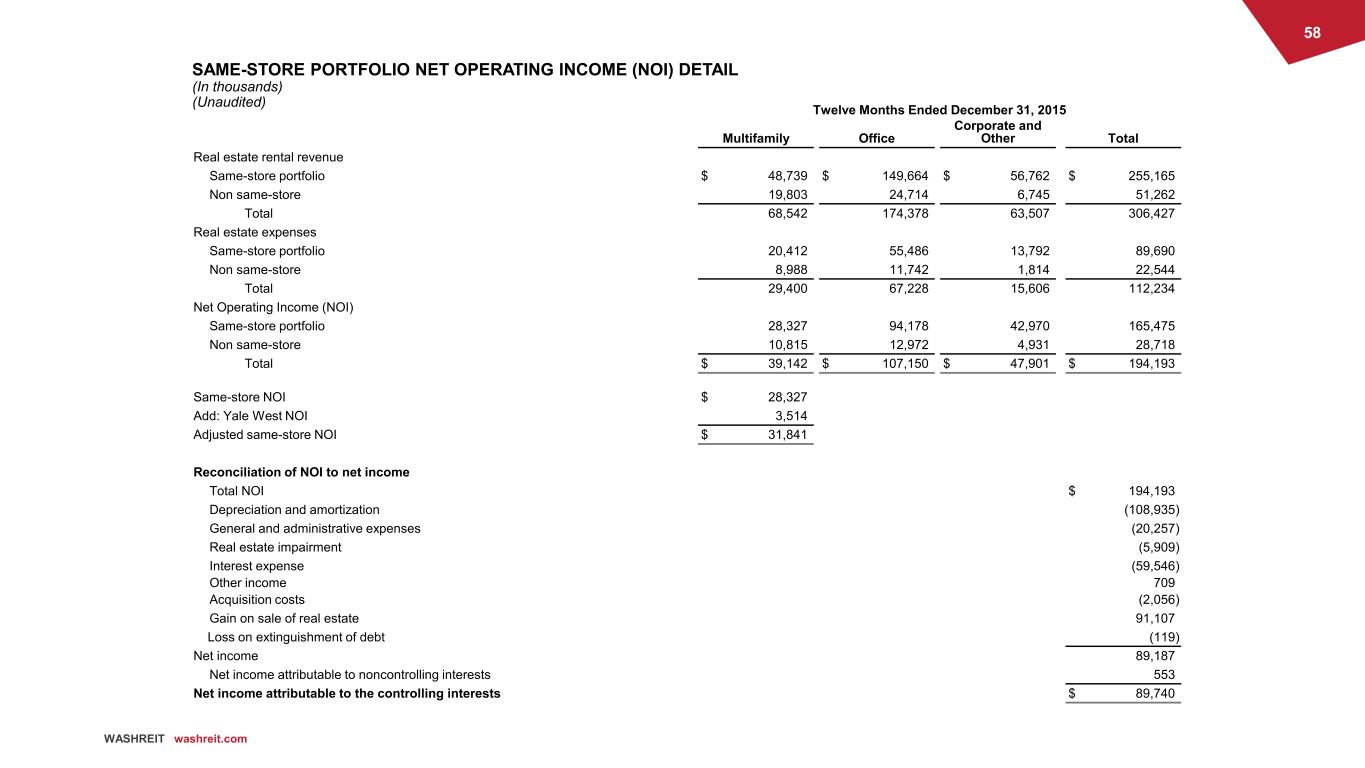

58 WASHREIT washreit.com SAME-STORE PORTFOLIO NET OPERATING INCOME (NOI) DETAIL (In thousands) (Unaudited) Twelve Months Ended December 31, 2015 Multifamily Office Corporate and Other Total Real estate rental revenue Same-store portfolio $ 48,739 $ 149,664 $ 56,762 $ 255,165 Non same-store 19,803 24,714 6,745 51,262 Total 68,542 174,378 63,507 306,427 Real estate expenses Same-store portfolio 20,412 55,486 13,792 89,690 Non same-store 8,988 11,742 1,814 22,544 Total 29,400 67,228 15,606 112,234 Net Operating Income (NOI) Same-store portfolio 28,327 94,178 42,970 165,475 Non same-store 10,815 12,972 4,931 28,718 Total $ 39,142 $ 107,150 $ 47,901 $ 194,193 Same-store NOI $ 28,327 Add: Yale West NOI 3,514 Adjusted same-store NOI $ 31,841 Reconciliation of NOI to net income Total NOI $ 194,193 Depreciation and amortization (108,935) General and administrative expenses (20,257) Real estate impairment (5,909) Interest expense (59,546) Other income 709 Acquisition costs (2,056) Gain on sale of real estate 91,107 Loss on extinguishment of debt (119) Net income 89,187 Net income attributable to noncontrolling interests 553 Net income attributable to the controlling interests $ 89,740

59 WASHREIT washreit.com Investor Presentation Accelerating Our Transformation into a Multifamily REIT June 15, 2021