000010489412/312024Q1falsehttp://fasb.org/us-gaap/2023#RealEstateMemberhttp://fasb.org/us-gaap/2023#RealEstateMember100001048942024-01-012024-03-3100001048942024-04-29xbrli:shares00001048942024-03-31iso4217:USD00001048942023-12-31iso4217:USDxbrli:shares00001048942023-01-012023-03-310000104894us-gaap:CommonStockMember2023-12-310000104894us-gaap:AdditionalPaidInCapitalMember2023-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-12-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000104894us-gaap:ParentMember2023-12-310000104894us-gaap:NoncontrollingInterestMember2023-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2024-01-012024-03-310000104894us-gaap:ParentMember2024-01-012024-03-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000104894us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000104894us-gaap:CommonStockMember2024-01-012024-03-310000104894us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000104894us-gaap:CommonStockMember2024-03-310000104894us-gaap:AdditionalPaidInCapitalMember2024-03-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2024-03-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000104894us-gaap:ParentMember2024-03-310000104894us-gaap:NoncontrollingInterestMember2024-03-310000104894us-gaap:CommonStockMember2022-12-310000104894us-gaap:AdditionalPaidInCapitalMember2022-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-12-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000104894us-gaap:ParentMember2022-12-310000104894us-gaap:NoncontrollingInterestMember2022-12-3100001048942022-12-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-01-012023-03-310000104894us-gaap:ParentMember2023-01-012023-03-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000104894us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000104894us-gaap:CommonStockMember2023-01-012023-03-310000104894us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000104894us-gaap:CommonStockMember2023-03-310000104894us-gaap:AdditionalPaidInCapitalMember2023-03-310000104894us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-03-310000104894us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000104894us-gaap:ParentMember2023-03-310000104894us-gaap:NoncontrollingInterestMember2023-03-3100001048942023-03-310000104894elme:TaxableReitSubsidiaryMember2023-12-310000104894elme:TaxableReitSubsidiaryMember2024-03-310000104894us-gaap:RevolvingCreditFacilityMember2023-03-310000104894elme:RiversideDevelopmentsMember2024-03-310000104894elme:A2018TermLoanMemberus-gaap:LoansPayableMember2021-09-300000104894us-gaap:RevolvingCreditFacilityMember2021-07-012021-09-30elme:extension_option0000104894elme:CreditAgreementAmendedAndRestatedMember2021-09-300000104894elme:AdjustedSecuredOvernightFinancingRateSOFRMemberelme:VariableRateComponentOneMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-03-31xbrli:pure0000104894srt:MinimumMemberelme:AdjustedSecuredOvernightFinancingRateSOFRMemberelme:VariableRateComponentOneMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-03-310000104894elme:AdjustedSecuredOvernightFinancingRateSOFRMembersrt:MaximumMemberelme:VariableRateComponentOneMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-03-310000104894srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-03-310000104894srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-03-310000104894elme:AdjustedSecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310000104894elme:AdjustedSecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMemberelme:VariableRateComponentTwoMember2024-01-012024-03-310000104894us-gaap:RevolvingCreditFacilityMemberelme:VariableRateComponentTwoMember2024-01-012024-03-310000104894us-gaap:RevolvingCreditFacilityMember2024-03-310000104894us-gaap:RevolvingCreditFacilityMember2023-12-310000104894us-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310000104894elme:A2023TermLoanMemberus-gaap:UnsecuredDebtMember2023-03-310000104894elme:AdjustedSecuredOvernightFinancingRateSOFRMemberelme:A2023TermLoanMemberus-gaap:UnsecuredDebtMemberelme:VariableRateComponentOneMember2023-01-012023-03-310000104894elme:AdjustedSecuredOvernightFinancingRateSOFRMemberelme:A2023TermLoanMemberus-gaap:UnsecuredDebtMemberelme:VariableRateComponentTwoMember2023-01-012023-03-310000104894elme:A2023TermLoanMemberus-gaap:UnsecuredDebtMember2023-01-012023-03-310000104894us-gaap:UnsecuredDebtMemberelme:A2018TermLoanMember2023-03-310000104894us-gaap:InterestRateSwapMember2023-03-31elme:arrangement0000104894us-gaap:InterestRateSwapMember2023-07-210000104894us-gaap:InterestRateSwapMemberus-gaap:SubsequentEventMember2024-05-020000104894elme:AdjustedDailySecuredOvernightFinancingRateMemberus-gaap:SubsequentEventMemberus-gaap:InterestRateSwapMember2024-05-020000104894us-gaap:InterestRateSwapMemberelme:A2023TermLoanAMember2024-03-310000104894us-gaap:InterestRateSwapMemberelme:A2023TermLoanAMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2024-03-310000104894us-gaap:InterestRateSwapMemberelme:A2023TermLoanAMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310000104894us-gaap:InterestRateSwapMemberelme:A2023TermLoanBMember2024-03-310000104894us-gaap:InterestRateSwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMemberelme:A2023TermLoanBMember2024-03-310000104894us-gaap:InterestRateSwapMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMemberelme:A2023TermLoanBMember2023-12-310000104894us-gaap:InterestRateSwapMember2024-03-310000104894us-gaap:InterestRateSwapMember2023-12-310000104894us-gaap:InterestRateSwapMember2024-01-012024-03-310000104894elme:InterestRateSwapPreviouslySettledMember2024-01-012024-03-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-03-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2024-03-310000104894us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-03-310000104894us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-03-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310000104894us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000104894us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-03-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2024-03-310000104894us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-03-310000104894us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-03-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000104894us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2023-12-310000104894us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000104894us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000104894us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310000104894us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310000104894us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000104894us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000104894elme:WashingtonRealEstateInvestmentTrust2016OmnibusIncentivePlanMember2024-03-310000104894elme:WashingtonRealEstateInvestmentTrust2016OmnibusIncentivePlanMember2024-01-012024-03-310000104894elme:RestrictedShareAwardsMember2024-01-012024-03-310000104894elme:RestrictedShareAwardsMember2023-01-012023-03-310000104894elme:RestrictedShareAwardsMember2024-03-310000104894elme:PropertyConcentrationRiskMemberelme:RiversideApartmentsMemberus-gaap:SalesRevenueNetMember2024-01-012024-03-310000104894elme:OutsideOfWashingtonDCMetroRegionMember2024-03-310000104894srt:OfficeBuildingMember2024-03-31elme:property0000104894elme:ResidentialSegmentMember2024-01-012024-03-310000104894us-gaap:CorporateAndOtherMember2024-01-012024-03-310000104894elme:ResidentialSegmentMember2024-03-310000104894us-gaap:CorporateAndOtherMember2024-03-310000104894elme:ResidentialSegmentMember2023-01-012023-03-310000104894us-gaap:CorporateAndOtherMember2023-01-012023-03-310000104894elme:ResidentialSegmentMember2023-03-310000104894us-gaap:CorporateAndOtherMember2023-03-31elme:segment0000104894elme:EquityDistributionAgreementMember2024-02-200000104894elme:AtTheMarketOfferingProgramMember2024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________

FORM 10-Q

___________________________________________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For quarterly period ended March 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

COMMISSION FILE NO. 1-6622

| | |

ELME COMMUNITIES |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Maryland | | 53-0261100 |

| (State of incorporation) | | (IRS Employer Identification Number) |

7550 WISCONSIN AVE, SUITE 900, BETHESDA, MD 20814

(Address of principal executive office) (Zip code)

Registrant’s telephone number, including area code: (202) 774-3200

___________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Shares of Beneficial Interest | ELME | NYSE |

___________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 29, 2024, 88,004,082 common shares were outstanding.

ELME COMMUNITIES

INDEX

| | | | | | | | |

| | | Page |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| |

| |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| | |

PART I

FINANCIAL INFORMATION

ITEM 1: FINANCIAL STATEMENTS

The information furnished in the accompanying unaudited Consolidated Balance Sheets, Condensed Consolidated Statements of Operations, Condensed Consolidated Statements of Comprehensive Income (Loss), Consolidated Statements of Equity and Consolidated Statements of Cash Flows reflects all adjustments, consisting of normal recurring items, which are, in the opinion of management, necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods. The accompanying financial statements and notes thereto should be read in conjunction with the financial statements and notes for the three years ended December 31, 2023 included in our 2023 Annual Report on Form 10-K filed on February 16, 2024.

ELME COMMUNITIES AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| (Unaudited) | |

| Assets | | | |

| Land | $ | 383,808 | | | $ | 384,097 | |

| Income producing property | 1,966,412 | | | 1,960,020 | |

| 2,350,220 | | | 2,344,117 | |

| Accumulated depreciation and amortization | (550,421) | | | (528,024) | |

| Net income producing property | 1,799,799 | | | 1,816,093 | |

| Properties under development or held for future development | 30,980 | | | 30,980 | |

| Total real estate held for investment, net | 1,830,779 | | | 1,847,073 | |

| | | |

| Cash and cash equivalents | 4,199 | | | 5,984 | |

| Restricted cash | 2,704 | | | 2,554 | |

| Rents and other receivables | 12,886 | | | 17,642 | |

| Prepaid expenses and other assets | 25,971 | | | 26,775 | |

| | | |

| Total assets | $ | 1,876,539 | | | $ | 1,900,028 | |

| Liabilities | | | |

| Notes payable, net | $ | 522,539 | | | $ | 522,345 | |

| | | |

| Line of credit | 160,000 | | | 157,000 | |

| Accounts payable and other liabilities | 31,112 | | | 38,997 | |

| Dividend payable | 15,888 | | | 15,863 | |

| Advance rents | 4,361 | | | 5,248 | |

| Tenant security deposits | 6,235 | | | 6,225 | |

| | | |

| Total liabilities | 740,135 | | | 745,678 | |

| Equity | | | |

| Shareholders’ equity | | | |

Preferred shares; $0.01 par value; 10,000 shares authorized; no shares issued or outstanding | — | | | — | |

Shares of beneficial interest, $0.01 par value; 150,000 shares authorized; 88,003 and 87,867 shares issued and outstanding, as of March 31, 2024 and December 31, 2023, respectively | 880 | | | 879 | |

| Additional paid in capital | 1,736,524 | | | 1,735,530 | |

| Distributions in excess of net income | (588,923) | | | (569,391) | |

| Accumulated other comprehensive loss | (12,365) | | | (12,958) | |

| Total shareholders’ equity | 1,136,116 | | | 1,154,060 | |

| Noncontrolling interests in subsidiaries | 288 | | | 290 | |

| Total equity | 1,136,404 | | | 1,154,350 | |

| Total liabilities and equity | $ | 1,876,539 | | | $ | 1,900,028 | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Revenue | | | | | | | |

| Real estate rental revenue | $ | 59,513 | | | $ | 55,809 | | | | | |

| Expenses | | | | | | | |

| Property operating and maintenance | 13,464 | | | 12,339 | | | | | |

| Real estate taxes and insurance | 8,255 | | | 7,182 | | | | | |

| Property management | 2,218 | | | 1,769 | | | | | |

| General and administrative | 6,196 | | | 6,841 | | | | | |

| Transformation costs | — | | | 2,900 | | | | | |

| Depreciation and amortization | 24,943 | | | 21,536 | | | | | |

| | | | | | | |

| | | | | | | |

| 55,076 | | | 52,567 | | | | | |

| | | | | | | |

| Real estate operating income | 4,437 | | | 3,242 | | | | | |

| Other income (expense) | | | | | | | |

| Interest expense | (9,494) | | | (6,831) | | | | | |

| | | | | | | |

| Loss on extinguishment of debt | — | | | (54) | | | | | |

| Other income | 1,410 | | | — | | | | | |

| | | | | | | |

| (8,084) | | | (6,885) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss | $ | (3,647) | | | $ | (3,643) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic net loss per common share | $ | (0.04) | | | $ | (0.04) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted net loss per common share | $ | (0.04) | | | $ | (0.04) | | | | | |

| | | | | | | |

| Weighted average shares outstanding – basic | 87,885 | | | 87,649 | | | | | |

| Weighted average shares outstanding – diluted | 87,885 | | | 87,649 | | | | | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Net loss | $ | (3,647) | | | $ | (3,643) | | | | | |

| Other comprehensive income: | | | | | | | |

| Unrealized gain (loss) on interest rate hedges | 83 | | | (333) | | | | | |

| Reclassification of unrealized loss on interest rate derivatives to earnings | 510 | | | 510 | | | | | |

| Comprehensive loss | $ | (3,054) | | | $ | (3,466) | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(IN THOUSANDS)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Issued and Out-standing | | Shares of Beneficial Interest at Par Value | | Additional Paid in Capital | | Distributions in Excess of

Net Income | | Accumulated Other Comprehensive Loss | | Total Shareholders’ Equity | | Noncontrolling Interests in Subsidiaries | | Total Equity |

| Balance, December 31, 2023 | 87,867 | | | $ | 879 | | | $ | 1,735,530 | | | $ | (569,391) | | | $ | (12,958) | | | $ | 1,154,060 | | | $ | 290 | | | $ | 1,154,350 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (3,647) | | | — | | | (3,647) | | | — | | | (3,647) | |

| Unrealized gain on interest rate hedges | — | | | — | | | — | | | — | | | 83 | | | 83 | | | — | | | 83 | |

| | | | | | | | | | | | | | | |

| Amortization of swap settlements | — | | | — | | | — | | | — | | | 510 | | | 510 | | | — | | | 510 | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (2) | | | (2) | |

| | | | | | | | | | | | | | | |

Dividends ($0.18 per common share) | — | | | — | | | — | | | (15,885) | | | — | | | (15,885) | | | — | | | (15,885) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Share grants, net of forfeitures and tax withholdings | 136 | | | 1 | | | 994 | | | — | | | — | | | 995 | | | — | | | 995 | |

| Balance, March 31, 2024 | 88,003 | | | $ | 880 | | | $ | 1,736,524 | | | $ | (588,923) | | | $ | (12,365) | | | $ | 1,136,116 | | | $ | 288 | | | $ | 1,136,404 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares Issued and Out-standing | | Shares of Beneficial Interest at Par Value | | Additional Paid in Capital | | Distributions in Excess of

Net Income | | Accumulated Other Comprehensive Loss | | Total Shareholders’ Equity | | Noncontrolling Interests in Subsidiaries | | Total Equity |

| Balance, December 31, 2022 | 87,534 | | | $ | 875 | | | $ | 1,729,854 | | | $ | (453,008) | | | $ | (14,233) | | | $ | 1,263,488 | | | $ | 298 | | | $ | 1,263,786 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (3,643) | | | — | | | (3,643) | | | — | | | (3,643) | |

| Unrealized loss on interest rate hedges | — | | | — | | | — | | | — | | | (333) | | | (333) | | | — | | | (333) | |

| | | | | | | | | | | | | | | |

| Amortization of swap settlements | — | | | — | | | — | | | — | | | 510 | | | 510 | | | — | | | 510 | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (2) | | | (2) | |

Dividends ($0.18 per common share) | — | | | — | | | — | | | (15,852) | | | — | | | (15,852) | | | — | | | (15,852) | |

| | | | | | | | | | | | | | | |

| Shares issued under Dividend Reinvestment Program | 14 | | | — | | | 248 | | | — | | | — | | | 248 | | | — | | | 248 | |

| Share grants, net of forfeitures and tax withholdings | 161 | | | 2 | | | 1,599 | | | — | | | — | | | 1,601 | | | — | | | 1,601 | |

| Balance, March 31, 2023 | 87,709 | | | $ | 877 | | | $ | 1,731,701 | | | $ | (472,503) | | | $ | (14,056) | | | $ | 1,246,019 | | | $ | 296 | | | $ | 1,246,315 | |

See accompanying notes to the consolidated financial statements.

| | | | | | | | | | | |

| ELME COMMUNITIES AND SUBSIDIARIES |

| | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (IN THOUSANDS) |

| (UNAUDITED) |

| | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (3,647) | | | $ | (3,643) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 24,943 | | | 21,536 | |

| Credit losses on lease related receivables | 1,451 | | | 703 | |

| | | |

| | | |

| | | |

| Share-based compensation expense | 1,090 | | | 1,188 | |

| | | |

| Net amortization of debt premiums, discounts and related financing costs | 1,058 | | | 1,048 | |

| | | |

| Loss on extinguishment of debt | — | | | 54 | |

| Gain on land easements | (1,410) | | | — | |

| Changes in operating other assets | (941) | | | (872) | |

| Changes in operating other liabilities | (1,328) | | | (3,725) | |

| Net cash provided by operating activities | 21,216 | | | 16,289 | |

| Cash flows from investing activities | | | |

| | | |

| | | |

| | | |

| Capital improvements to real estate | (13,617) | | | (5,569) | |

| | | |

| | | |

| | | |

| Non-real estate capital improvements | (5) | | | (222) | |

| Payments received for land easements | 3,862 | | | — | |

| Net cash used in investing activities | (9,760) | | | (5,791) | |

| Cash flows from financing activities | | | |

| Line of credit borrowings (repayments), net | 3,000 | | | (20,000) | |

| Dividends paid | (15,911) | | | (14,917) | |

| | | |

| | | |

| | | |

| Repayments of unsecured term loan debt | — | | | (100,000) | |

| Proceeds from term loan | — | | | 125,000 | |

| | | |

| Payment of financing costs | — | | | (844) | |

| Distributions to noncontrolling interests | (2) | | | (2) | |

| Proceeds from dividend reinvestment program | — | | | 248 | |

| | | |

| Payment of tax withholdings for restricted share awards | (178) | | | (1,304) | |

| Net cash used in financing activities | (13,091) | | | (11,819) | |

| Net decrease in cash, cash equivalents and restricted cash | (1,635) | | | (1,321) | |

| Cash, cash equivalents and restricted cash at beginning of period | 8,538 | | | 9,852 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 6,903 | | | $ | 8,531 | |

| | | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest, net of amounts capitalized | $ | 11,972 | | | $ | 8,954 | |

| Change in accrued capital improvements and development costs | (7,309) | | | 216 | |

| Dividend payable | 15,888 | | | 15,869 | |

| | | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | |

| Cash and cash equivalents | $ | 4,199 | | | $ | 7,044 | |

| Restricted cash | 2,704 | | | 1,487 | |

| Cash, cash equivalents and restricted cash | $ | 6,903 | | | $ | 8,531 | |

See accompanying notes to the consolidated financial statements.

ELME COMMUNITIES AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2024

(UNAUDITED)

NOTE 1: NATURE OF BUSINESS

Elme Communities, a Maryland real estate investment trust, is a self-administered equity real estate investment trust (“REIT”), and successor to a trust organized in 1960. Our business primarily consists of the ownership of apartment communities in the greater Washington, DC metro and Sunbelt regions. Within these notes to the financial statements, we refer to the three months ended March 31, 2024 and March 31, 2023 as the “2024 Quarter” and the “2023 Quarter,” respectively.

Federal Income Taxes

We believe that we qualify as a REIT under Sections 856-860 of the Internal Revenue Code of 1986, as amended (the “Code”), and intend to continue to qualify as such. To maintain our status as a REIT, we are, among other things, required to distribute 90% of our REIT taxable income (determined before the deduction for dividends paid and excluding net capital gains to our shareholders) on an annual basis. When selling a property, we generally have the option of (a) reinvesting the sales proceeds of property sold in a way that allows us to defer recognition of some or all taxable gain realized on the sale, (b) distributing gains to the shareholders with no tax to us or (c) treating net long-term capital gains as having been distributed to our shareholders, paying the tax on the gain deemed distributed and allocating the tax paid as a credit to our shareholders.

Generally, and subject to our ongoing qualification as a REIT, no provisions for income taxes are necessary except for taxes on undistributed taxable income and taxes on the income generated by our taxable REIT subsidiary (“TRS”). Our TRS is subject to corporate federal and state income tax on its taxable income at regular statutory rates. As of both March 31, 2024 and December 31, 2023, our TRS had a deferred tax asset of $1.4 million that was fully reserved.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATIONS

Significant Accounting Policies

We have prepared our consolidated financial statements using the accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2023.

Recent Accounting Pronouncements

In March 2020, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2020-04, Reference Rate Reform (“Topic 848”), which was amended in December 2022 by ASU 2022-06, Reference Rate Reform (Topic 848). Topic 848 contains practical expedients for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance in Topic 848 is optional and may be elected through December 31, 2024 as reference rate reform activities occur. During the 2023 Quarter, we executed an amendment to the $700.0 million unsecured revolving credit facility (“Revolving Credit Facility”) to convert the benchmark interest rate from LIBOR to an adjusted SOFR ("Secured Overnight Financing Rate"). We elected to apply the optional expedients in Topic 848 to (i) assert that the hedged interest payments remain probable regardless of any expected modification in terms related to reference rate reform, and (ii) continue the method of assessing effectiveness as documented in the original hedge documentation so that the reference rate on the hypothetical derivative matches the reference rate on the hedging instrument. Application of these expedients preserves the presentation of derivatives consistent with past presentation. The impact of this guidance did not have a material impact on our consolidated financial statements.

In November 2023, the FASB issued an amendment to the segment reporting standards which requires disclosure for each reportable segment, on an interim and annual basis, the significant expense categories and amounts that are regularly provided to the chief operating decision maker and included in each reported measure of a segment’s profit or loss. Additionally, it requires a disclosure of the title and position of the individual or the name of the group or committee identified as the chief operating decision maker. The new standard will be effective for annual periods beginning on January 1, 2024 and interim periods beginning on January 1, 2025 on a retrospective basis. We are currently evaluating the impact of adopting the standard on our consolidated financial statements.

In March 2024, the Securities and Exchange Commission (“SEC”) issued its final rule that requires registrants to provide climate disclosures in their annual reports and registration statements, beginning with annual reports for the year ending December 31, 2025. On April 4, 2024, the SEC voluntarily stayed the final rule pending the completion of judicial review of cases pending in the Eighth Circuit. We are continuing to evaluate the disclosure impact of the final rule.

Principles of Consolidation and Basis of Presentation

The accompanying unaudited consolidated financial statements include the consolidated accounts of Elme Communities and our subsidiaries and entities in which Elme Communities has a controlling financial interest. All intercompany balances and transactions have been eliminated in consolidation.

We have prepared the accompanying unaudited financial statements pursuant to the rules and regulations of the SEC. Certain information and note disclosures normally included in annual financial statements prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) have been condensed or omitted pursuant to those rules and regulations, although we believe that the disclosures made are adequate to make the information presented not misleading. In addition, in the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of the results for the periods presented have been included. These unaudited financial statements should be read in conjunction with the financial statements and notes included in our Annual Report on Form 10-K for the year ended December 31, 2023.

Lessee Accounting

For leases where we are the lessee, primarily our corporate office operating lease, we recognize a right-of-use asset and a lease liability in accordance with Accounting Standards Codification (“ASC”) Topic 842. The right-of-use asset and associated liability is equal to the present value of the minimum lease payments, applying our incremental borrowing rate. Our borrowing rate is computed based on observable borrowing rates taking into consideration our credit quality and adjusting to a secured borrowing rate for similar assets and term.

Lease expense for the operating lease is recognized on a straight-line basis over the expected lease term and is included in “General and administrative expense.”

Restricted Cash

Restricted cash includes funds held in escrow for tenant security deposits.

Transformation Costs

Transformation costs include costs related to the strategic shift away from the commercial sector to the residential sector, including the allocation of internal costs, consulting, advisory and termination benefits.

Use of Estimates in the Financial Statements

The preparation of financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

NOTE 3: REAL ESTATE

Development/Redevelopment

We have properties under development/redevelopment and held for current or future development. As of March 31, 2024, we have invested $30.4 million, including the cost of acquired land, in a residential development adjacent to Riverside Apartments. During the second quarter of 2022, we paused development activities at the aforementioned property and ceased associated capitalization of interest on spending and real estate taxes.

Properties Sold and Held for Sale

We intend to hold our properties for investment with a view to long-term appreciation, to engage in the business of acquiring, developing and owning our properties and to make occasional sales of properties that no longer meet our long-term strategy or return objectives and where market conditions for sale are favorable. The proceeds from the sales may be reinvested into other properties, used to fund development operations or to support other corporate needs or distributed to our shareholders. Depreciation on these properties is discontinued at the time they are classified as held for sale, but operating revenues, operating expenses and interest expense continue to be recognized until the date of sale.

We did not sell or classify any properties as held for sale during the 2024 Quarter or in 2023.

As of March 31, 2024, we assessed our properties, including assets held for development, for impairment and did not recognize any impairment charges during the 2024 Quarter. We applied reasonable estimates and judgments in evaluating each of the properties as of March 31, 2024. Should external or internal circumstances change requiring the need to shorten holding periods or adjust future estimated cash flows from our properties, we could be required to record impairment charges in the future.

NOTE 4: UNSECURED LINE OF CREDIT PAYABLE

During the third quarter of 2021, we entered into an amended and restated credit agreement (“Credit Agreement”) which provides for the Revolving Credit Facility and the continuation of an existing $250.0 million unsecured term loan (“2018 Term Loan”). The Revolving Credit Facility has a four-year term ending in August 2025, with two six-month extension options. The Credit Agreement has an accordion feature that allows us to increase the aggregate facility to $1.5 billion, subject to the lenders’ agreement to provide additional revolving loan commitments or term loans.

During the 2023 Quarter, we executed an amendment to the Revolving Credit Facility to convert the benchmark interest rate from LIBOR to an adjusted SOFR, with no change in the applicable interest rate margins. The Revolving Credit Facility bears interest at a rate of adjusted SOFR plus 0.10% plus a margin ranging from 0.70% to 1.40%. In addition, the Revolving Credit Facility requires the payment of a facility fee ranging from 0.10% to 0.30% (in each case, depending on Elme Communities’ credit rating) on the $700.0 million committed revolving loan capacity, without regard to usage. As of March 31, 2024, the interest rate on the Revolving Credit Facility is based on an adjusted daily SOFR (inclusive of the 0.10% credit spread adjustment) plus 0.85% applicable margin, the daily SOFR is 5.34% and the facility fee is 0.20%.

All outstanding advances for the Revolving Credit Facility are due and payable upon maturity in August 2025, unless extended pursuant to one or both of the two six-month extension options. Interest only payments are due and payable generally on a monthly basis.

The amount of the Revolving Credit Facility’s unsecured line of credit unused and available at March 31, 2024 was as follows (in thousands):

| | | | | |

| Committed capacity | $ | 700,000 | |

| Borrowings outstanding | (160,000) | |

| |

| Unused and available | $ | 540,000 | |

We executed borrowings and repayments on the Revolving Credit Facility during the 2024 Quarter as follows (in thousands):

| | | | | | | | | | | | | | |

| Balance, December 31, 2023 | $ | 157,000 | |

| Borrowings | 37,000 | |

| Repayments | (34,000) | |

| Balance, March 31, 2024 | $ | 160,000 | |

NOTE 5: NOTES PAYABLE

During the 2023 Quarter, we entered into a $125.0 million unsecured term loan (“2023 Term Loan”) with an interest rate of adjusted SOFR (subject to a credit spread adjustment of 10 basis points) plus a margin of 95 basis points (subject to adjustment depending on Elme Communities’ credit rating). The 2023 Term Loan has a two-year term ending in January 2025, with two one-year extension options. We used the proceeds to prepay the $100.0 million 2018 Term Loan in full and a portion of our borrowings under our Revolving Credit Facility.

NOTE 6: DERIVATIVE INSTRUMENTS

During the 2023 Quarter, we entered into two interest rate swap arrangements with an aggregate notional amount of $125.0 million that effectively fixed the interest at 4.73% for the 2023 Term Loan beginning on July 21, 2023 through the 2023 Term Loan’s maturity date of January 10, 2025.

Subsequent to the end of the 2024 Quarter, we entered into two forward interest rate swap arrangements with an aggregate notional amount of $150.0 million beginning on January 10, 2025 through January 10, 2026. These forward interest rate swap arrangements will effectively fix a portion of our variable rate debt based on an adjusted daily SOFR at 4.72% (subject to applicable interest rate margins).

The interest rate swap arrangements are recorded at fair value in accordance with GAAP, based on discounted cash flow methodologies and observable inputs. We record the effective portion of changes in fair value of the cash flow hedges in Other comprehensive income (loss). We assess the effectiveness of a cash flow hedge both at inception and on an ongoing basis. If a cash flow hedge is no longer expected to be effective, hedge accounting is discontinued. Hedge ineffectiveness of our cash flow hedges is recorded in earnings.

The fair values of the interest rate swaps as of March 31, 2024 and December 31, 2023, were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value |

| | | | Derivative Assets |

| Derivative Instrument | Aggregate Notional Amount | Effective Date | Maturity Date | March 31, 2024 | | December 31, 2023 |

| | | | | | |

| Interest rate swap | 75,000 | | July 21, 2023 | January 10, 2025 | $ | 790 | | | $ | 740 | |

| Interest rate swap | 50,000 | | July 21, 2023 | January 10, 2025 | 527 | | | 494 | |

| | | | $ | 1,317 | | | $ | 1,234 | |

We record interest rate swaps on our consolidated balance sheets within Prepaid expenses and other assets when in a net asset position and within Accounts payable and other liabilities when in a net liability position. The net unrealized gains and losses on the effective swaps were recognized in Other comprehensive income (loss), as follows (in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Unrealized gain (loss) on interest rate hedges | $ | 83 | | | $ | (333) | | | | | |

Amounts reported in Accumulated other comprehensive loss related to effective cash flow hedges will be reclassified to interest expense as interest payments are made on our variable-rate debt. During the next twelve months, we estimate that an additional $1.3 million related to our two outstanding interest rate swap arrangements will be reclassified as a decrease to interest expense.

The losses reclassified from Accumulated other comprehensive loss into interest expense for the three months ended March 31, 2024 and 2023, were as follows (in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Loss reclassified from accumulated other comprehensive loss into interest expense | $ | 510 | | | $ | 510 | | | | | |

During the next twelve months, we estimate that an additional $2.0 million related to the previously settled interest rate swap arrangements will be reclassified as an increase to interest expense.

We have agreements with each of our derivative counterparties that contain a provision whereby we could be declared in default on our derivative obligations if repayment of the underlying indebtedness is accelerated by the lender due to our default on the indebtedness. As of March 31, 2024, the fair value of derivative assets, including accrued interest, was $1.3 million and we did not have any derivatives in a liability position. As of March 31, 2024, we have not posted any collateral related to these agreements.

Derivative instruments expose us to credit risk in the event of non-performance by the counterparty under the terms of the interest rate hedge agreements. We believe that we minimize our credit risk on these transactions by dealing with major, creditworthy financial institutions. We monitor the credit ratings of counterparties and our exposure to any single entity, thus minimizing our credit risk concentration.

NOTE 7: FAIR VALUE DISCLOSURES

Assets and Liabilities Measured at Fair Value on a Recurring Basis

For assets and liabilities measured at fair value on a recurring basis, quantitative disclosures about the fair value measurements are required to be disclosed separately for each major category of assets and liabilities, as follows:

Level 1: Quoted prices in active markets for identical assets

Level 2: Significant other observable inputs

Level 3: Significant unobservable inputs

The only assets or liabilities we had at March 31, 2024 and December 31, 2023 that are recorded at fair value on a recurring basis are the assets held in the Supplemental Executive Retirement Plan (“SERP”), which primarily consist of investments in mutual funds, and the interest rate derivatives (see note 6).

We base the valuations related to the SERP on quoted prices in active markets and accordingly these valuations fall into Level 1 in the fair value hierarchy.

The valuation of the interest rate derivatives is determined using widely accepted valuation techniques, including discounted cash flow analysis on the expected cash flows of each interest rate derivative. This analysis reflects the contractual terms of the interest rate derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The fair values of interest rate derivatives are determined using the market standard methodology of netting the discounted future fixed cash payments (or receipts) and the discounted expected variable cash receipts (or payments). The variable cash payments (or receipts) are based on an expectation of future interest rates (forward

curves) derived from observable market interest rate curves. To comply with the provisions of ASC 820, Fair Value Measurement, we incorporate credit valuation adjustments in the fair value measurements to appropriately reflect both our own nonperformance risk and the respective counterparty’s nonperformance risk. These credit valuation adjustments were concluded to not be significant inputs for the fair value calculations for the periods presented. In adjusting the fair value of our derivative contracts for the effect of nonperformance risk, we have considered the impact of netting and any applicable credit enhancements, such as the posting of collateral, thresholds, mutual puts and guarantees. The valuation of interest rate derivatives fall into Level 2 in the fair value hierarchy.

The fair values of these assets as of March 31, 2024 and December 31, 2023 were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| | Fair

Value | | Level 1 | | Level 2 | | Level 3 | | Fair

Value | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | | | | | | | | | |

| SERP | $ | 2,064 | | | $ | 2,064 | | | $ | — | | | $ | — | | | $ | 1,984 | | | $ | 1,984 | | | $ | — | | | $ | — | |

| Interest rate derivatives | 1,317 | | | — | | | 1,317 | | | — | | | 1,234 | | | — | | | 1,234 | | | — | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Certain assets not measured at fair value on an ongoing basis but subject to fair value adjustments only in certain circumstances, such as when there is evidence of impairment, are measured at fair value on a nonrecurring basis. In the 2024 Quarter, the Company did not have any assets or liabilities measured at fair value on a nonrecurring basis.

Financial Assets and Liabilities Not Measured at Fair Value

The following disclosures of estimated fair value were determined by management using available market information and established valuation methodologies, including discounted cash flow models. Many of these estimates involve significant judgment. The estimated fair value disclosed may not necessarily be indicative of the amounts we could realize on disposition of the financial instruments. The use of different market assumptions or estimation methodologies could have an effect on the estimated fair value amounts. In addition, fair value estimates are made at a point in time and thus, estimates of fair value subsequent to March 31, 2024 may differ significantly from the amounts presented. The valuations of cash and cash equivalents and restricted cash fall into Level 1 in the fair value hierarchy and the valuations of debt instruments fall into Level 3 in the fair value hierarchy.

As of March 31, 2024 and December 31, 2023, the carrying values and estimated fair values of our financial instruments were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Carrying Value | | Fair Value | | Carrying Value | | Fair Value |

| Cash and cash equivalents | $ | 4,199 | | | $ | 4,199 | | | $ | 5,984 | | | $ | 5,984 | |

| Restricted cash | 2,704 | | | 2,704 | | | 2,554 | | | 2,554 | |

| | | | | | | |

| Line of credit | 160,000 | | | 160,000 | | | 157,000 | | | 157,000 | |

| Notes payable, net | 522,539 | | | 467,991 | | | 522,345 | | | 466,668 | |

NOTE 8: SHARE-BASED COMPENSATION

Elme Communities maintains short-term (“STIP”) and long-term (“LTIP”) incentive plans that allow for stock-based awards to officers and non-officer employees. Stock based awards are provided to officers and non-officer employees, as well as trustees, under the Washington Real Estate Investment Trust 2016 Omnibus Incentive Plan, as amended, which allows for awards in the form of restricted shares, restricted share units, options and other awards up to an aggregate of 2,400,000 shares over the ten-year period in which the plan will be in effect. Restricted share units are converted into shares of our stock upon full vesting through the issuance of new shares.

Total Compensation Expense

Total compensation expense recognized in the consolidated financial statements for all outstanding share-based awards was $1.1 million and $1.2 million for the 2024 Quarter and 2023 Quarter, respectively.

Restricted Share Awards

The total fair values of restricted share awards vested was $0.6 million and $3.4 million for the 2024 Quarter and 2023 Quarter, respectively.

The total unvested restricted share awards at March 31, 2024 was 443,439 shares, which had a weighted average grant date fair value of $16.96 per share. As of March 31, 2024, the total compensation cost related to unvested restricted share awards was $6.2 million, which we expect to recognize over a weighted average period of 27 months.

NOTE 9: EARNINGS PER COMMON SHARE

We determine “Basic earnings per share” using the two-class method as our unvested restricted share awards and units have non-forfeitable rights to dividends, and are therefore considered participating securities. We compute basic earnings per share by dividing net income less the allocation of undistributed earnings to unvested restricted share awards and units by the weighted-average number of common shares outstanding for the period.

We also determine “Diluted earnings per share” as the more dilutive of the two-class method or the treasury stock method with respect to the unvested restricted share awards. We further evaluate any other potentially dilutive securities at the end of the period and adjust the basic earnings per share calculation for the impact of those securities that are dilutive. Our dilutive earnings per share calculation includes the dilutive impact of operating partnership units under the if-converted method and our share based awards with performance conditions prior to the grant date and all market condition awards under the contingently issuable method.

The computations of basic and diluted earnings per share for the three months ended March 31, 2024 and 2023 were as follows (in thousands, except per share data):

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Numerator: | | | | | | | |

| Net loss | $ | (3,647) | | | $ | (3,643) | | | | | |

| | | | | | | |

| Allocation of earnings to unvested restricted share awards | (80) | | | (70) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted net loss | $ | (3,727) | | | $ | (3,713) | | | | | |

| Denominator: | | | | | | | |

| Weighted average shares outstanding – basic and diluted | 87,885 | | | 87,649 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic net loss per common share | $ | (0.04) | | | $ | (0.04) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted net loss per common share | $ | (0.04) | | | $ | (0.04) | | | | | |

| | | | | | | |

| Dividends declared per common share | $ | 0.18 | | | $ | 0.18 | | | | | |

NOTE 10: SEGMENT INFORMATION

We operate in a single reportable segment which includes the ownership, development, redevelopment and acquisition of apartment communities. None of our operating properties meet the criteria to be considered separate operating segments on a stand-alone basis. Within the residential segment, we do not distinguish or group our consolidated operations based on size (only one community, Riverside Apartments, comprises more than 10% of consolidated revenues), type (all assets in the segment are residential) or geography (all but six communities are within the Washington, DC metro region). Further, our apartment communities have similar long-term economic characteristics and provide similar products and services to our residents. As a result, our operating properties are aggregated into a single reportable segment: residential.

We have one remaining office property, Watergate 600, which does not meet the criteria for a reportable segment, and has been classified within “Other” on our segment disclosure tables.

We evaluate performance based upon net operating income (“NOI”) of the combined properties in the segment. Our reportable operating segment consolidates similar properties. GAAP requires that segment disclosures present the measure(s) used by the chief operating decision maker for purposes of assessing each segment’s performance. NOI is a key measurement of our segment profit and loss and is defined as real estate rental revenue less real estate expenses.

The following tables present revenues, NOI, capital expenditures and total assets for the three months ended March 31, 2024 and 2023 from our Residential segment as well as Other, and reconcile NOI to net loss as reported (in thousands):

| | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2024 |

| | Residential | | Other (1) | | Consolidated |

| Real estate rental revenue | $ | 54,871 | | | $ | 4,642 | | | $ | 59,513 | |

| Real estate expenses | 20,358 | | | 1,361 | | | 21,719 | |

| Net operating income | $ | 34,513 | | | $ | 3,281 | | | $ | 37,794 | |

| Other income (expense): | | | | | |

| Property management expenses | | | | | (2,218) | |

| General and administrative expenses | | | | | (6,196) | |

| | | | | |

| Depreciation and amortization | | | | | (24,943) | |

| | | | | |

| Interest expense | | | | | (9,494) | |

| | | | | |

| | | | | |

| Other income | | | | | 1,410 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net loss | | | | | $ | (3,647) | |

| | | | | |

| | | | | |

| Capital expenditures | $ | 13,565 | | | $ | 57 | | | $ | 13,622 | |

| Total assets | $ | 1,751,228 | | | $ | 125,311 | | | $ | 1,876,539 | |

| | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 |

| | Residential | | Other (1) | | Consolidated |

| Real estate rental revenue | $ | 50,991 | | | $ | 4,818 | | | $ | 55,809 | |

| Real estate expenses | 18,144 | | | 1,377 | | | 19,521 | |

| Net operating income | $ | 32,847 | | | $ | 3,441 | | | $ | 36,288 | |

| Other expense: | | | | | |

| Property management expenses | | | | | (1,769) | |

| General and administrative expenses | | | | | (6,841) | |

| Transformation costs | | | | | (2,900) | |

| Depreciation and amortization | | | | | (21,536) | |

| | | | | |

| Interest expense | | | | | (6,831) | |

| | | | | |

| Loss on extinguishment of debt | | | | | (54) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net loss | | | | | $ | (3,643) | |

| | | | | |

| | | | | |

| Capital expenditures | $ | 5,417 | | | $ | 374 | | | $ | 5,791 | |

| Total assets | $ | 1,676,596 | | | $ | 178,403 | | | $ | 1,854,999 | |

| | | | | |

| (1) Other represents Watergate 600, an office property that does not meet the qualitative or quantitative criteria for a reportable segment. |

NOTE 11: SHAREHOLDERS' EQUITY

On February 20, 2024, we entered into an equity distribution agreement (the “Equity Distribution Agreement”) with Wells Fargo Securities, LLC, BNY Mellon Capital Markets, LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, KeyBanc Capital Markets Inc., TD Securities (USA) LLC and Truist Securities, Inc. as agents and forward sellers, as applicable, (collectively, the “Agents” or “Forward Sellers”, as applicable), and Wells Fargo Bank, National Association, The Bank of New York Mellon, Citibank, N.A., Goldman Sachs & Co. LLC, KeyBanc Capital Markets Inc., The Toronto-Dominion Bank and Truist Bank as forward purchasers pursuant to which up to an aggregate gross sales price of $350,000,000 of Elme’s common shares of beneficial interest, $0.01 par value per share, may be offered and sold from time to time through the Agents, acting as the Company’s sales agents or, if applicable, the Forward Sellers, or directly to the Agents as principals for their own accounts. In connection with entry into the Equity Distribution Agreement, we terminated our prior at-the-market offering program. At the time of such termination, approximately $340.0 million remained unsold under such prior program.

We did not issue common shares under the Equity Distribution Agreement or any prior equity distribution agreements during the 2024 Quarter or 2023 Quarter.

We have a dividend reinvestment program whereby shareholders may use their dividends and optional cash payments to purchase common shares. The shares sold under this program may either be common shares issued by us or common shares purchased in the open market. Net proceeds under this program are used for general corporate purposes.

We did not issue common shares under the dividend reinvestment program during the 2024 Quarter. Our issuances and net proceeds on the dividend reinvestment program for the three months ended March 31, 2023 were as follows ($ in thousands, except per share data):

| | | | | | | | | | | | | |

| | Three Months Ended March 31, | | |

| | | 2023 | | | | |

| Issuance of common shares | | | 14 | | | | | |

| Weighted average price per share | | | $ | 17.66 | | | | | |

| Net proceeds | | | $ | 248 | | | | | |

ITEM 2: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements and the notes thereto appearing in Item 1 of this report and the more detailed information contained in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (“SEC”) on February 16, 2024.

We refer to the three months ended March 31, 2024 and March 31, 2023 as the “2024 Quarter” and the “2023 Quarter,” respectively.

Forward-Looking Statements

This Form 10-Q contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Such statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Elme Communities to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Additional factors which may cause the actual results, performance, or achievements of Elme Communities to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements include, but are not limited to: the risks associated with ownership of real estate in general and our real estate assets in particular; the economic health of the areas in which our properties are located, particularly with respect to the greater Washington, DC metro and Sunbelt regions; risks associated with our ability to execute on our strategies, including new strategies with respect to our operations and our portfolio, including the acquisition of apartment homes in the Sunbelt markets and our ability to realize any anticipated operational benefits from our internalization of community management functions; the risk of failure to enter into and/or complete acquisitions and dispositions; changes in the composition of our portfolio; reductions in or actual or threatened changes to the timing of federal government spending; the economic health of our residents; the impact from macroeconomic factors (including inflation, increases in interest rates, potential economic slowdowns or recessions and geopolitical conflicts); risks related to our ability to control our expenses if revenues decrease; compliance with applicable laws and corporate social responsibility goals, including those concerning the environment and access by persons with disabilities; risks related to not having adequate insurance to cover potential losses; changes in the market value of securities; terrorist attacks or actions and/or cyber-attacks; whether we will succeed in the day-to-day property management and leasing activities that we have previously outsourced; the availability and terms of financing and capital and the general volatility of securities markets; the risks related to our organizational structure and limitations of share ownership; failure to qualify and maintain our qualification as a REIT and the risks of changes in laws affecting REITs; and other risks and uncertainties detailed from time to time in our filings with the SEC, including our 2023 Form 10-K filed on February 16, 2024. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We undertake no obligation to update our forward-looking statements or risk factors to reflect new information, future events, or otherwise.

General

Introductory Matters

We provide our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) in addition to the accompanying consolidated financial statements and notes to assist readers in understanding our results of operations and financial condition. We organize the MD&A as follows:

•Overview. Discussion of our business outlook, operating results, investment and financing activity and capital requirements to provide context for the remainder of MD&A.

•Results of Operations. Discussion of our financial results comparing the 2024 Quarter to the 2023 Quarter.

•Liquidity and Capital Resources. Discussion of our financial condition and analysis of changes in our capital structure and cash flows.

•Funds From Operations. Calculation of NAREIT Funds From Operations (“NAREIT FFO”), a non-GAAP supplemental measure to net income.

•Critical Accounting Estimates. Descriptions of accounting policies that reflect significant judgments and estimates used in the preparation of our consolidated financial statements.

When evaluating our financial condition and operating performance, we focus on the following financial and non-financial indicators:

•Net operating income (“NOI”), calculated as set forth below under the caption “Results of Operations - Net Operating Income.” NOI is a non-GAAP supplemental measure to net income.

•Funds From Operations (“NAREIT FFO”), calculated as set forth below under the caption “Funds from Operations.” NAREIT FFO is a non-GAAP supplemental measure to net income.

•Average occupancy, calculated as average daily occupied apartment homes as a percentage of total apartment homes.

For purposes of evaluating comparative operating performance, we categorize our properties as “same-store” or “non-same-store.” Same-store portfolio properties include properties that were owned for the entirety of the years being compared, and exclude properties under redevelopment or development and properties acquired, sold or classified as held for sale during the years being compared. We define development properties as those for which we have planned or ongoing major construction activities on existing or acquired land pursuant to an authorized development plan. Development properties are categorized as same-store when they have reached stabilized occupancy (90%) before the start of the prior year. We define redevelopment properties as those for which we have planned or ongoing significant development and construction activities on existing or acquired buildings pursuant to an authorized plan, which has an impact on current operating results, occupancy and the ability to lease space with the intended result of a higher economic return on the property. We categorize a redevelopment property as same-store when redevelopment activities have been complete for the majority of each year being compared.

Overview

Our revenues are derived primarily from the ownership and operation of income producing property. As of March 31, 2024, we owned approximately 9,400 residential apartment homes in the Washington, DC metro and Sunbelt regions. We also own and operate approximately 300,000 square feet of commercial space in the Washington, DC metro region.

Operating Results

Net loss, NOI and NAREIT FFO for the three months ended March 31, 2024 and 2023 were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| 2024 | | 2023 | | $ Change | | % Change |

| Net loss | $ | (3,647) | | | $ | (3,643) | | | $ | (4) | | | 0.1 | % |

NOI (1) | $ | 37,794 | | | $ | 36,288 | | | $ | 1,506 | | | 4.2 | % |

NAREIT FFO (2) | $ | 21,296 | | | $ | 17,893 | | | $ | 3,403 | | | 19.0 | % |

______________________________ | | | | | | | |

(1) See page 24 of the MD&A for a reconciliation of NOI to net income. |

(2) See page 31 of the MD&A for a reconciliation of NAREIT FFO to net income. |

The increase in net loss is primarily due to higher depreciation and amortization expenses ($3.4 million), interest expense ($2.7 million) and property management expense ($0.4 million) in the 2024 Quarter. These were partially offset by lower transformation costs (as described in Note 2 to the consolidated financial statements) ($2.9 million), higher NOI ($1.5 million), higher other income ($1.4 million) and lower general and administrative expenses ($0.6 million).

The increase in NOI is primarily due to the acquisition of Elme Druid Hills ($1.6 million) in the third quarter of 2023 and higher NOI from same-store properties ($0.1 million), partially offset by lower NOI at Watergate 600 ($0.2 million). The higher same-store NOI was primarily due to higher rental rates. Residential same-store average occupancy for our portfolio decreased to 94.4% as of March 31, 2024 from 95.3% as of March 31, 2023.

The higher NAREIT FFO is primarily due to lower transformation costs ($2.9 million), higher NOI ($1.5 million), higher other income ($1.4 million) and lower general and administrative expenses ($0.6 million). These were partially offset by higher interest ($2.7 million) and higher property management ($0.4 million) expenses.

Investment Activity

There were no significant investment transactions during the 2024 Quarter.

Financing Activity

As of March 31, 2024, the interest rate on the Revolving Credit Facility is based on an adjusted daily SOFR (inclusive of the 0.10% credit spread adjustment) plus 0.85% applicable margin, the daily SOFR is 5.34% and the facility fee is 0.20%. As of April 29, 2024, our Revolving Credit Facility has a borrowing capacity of $532.0 million.

Subsequent to the end of the 2024 Quarter, we entered into two forward interest rate swap arrangements with an aggregate notional amount of $150.0 million beginning on January 10, 2025 through January 10, 2026. These forward interest rate swap arrangements will effectively fix a portion of our variable rate debt based on an adjusted daily SOFR at 4.72% (subject to applicable interest rate margins)

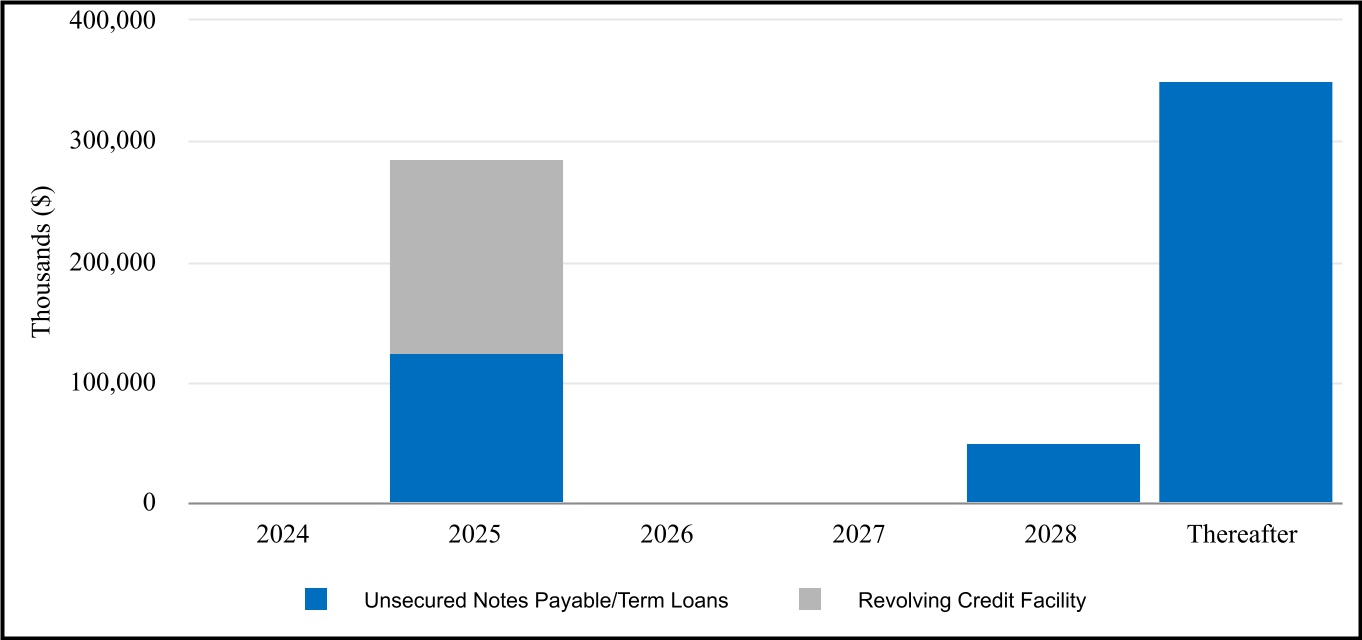

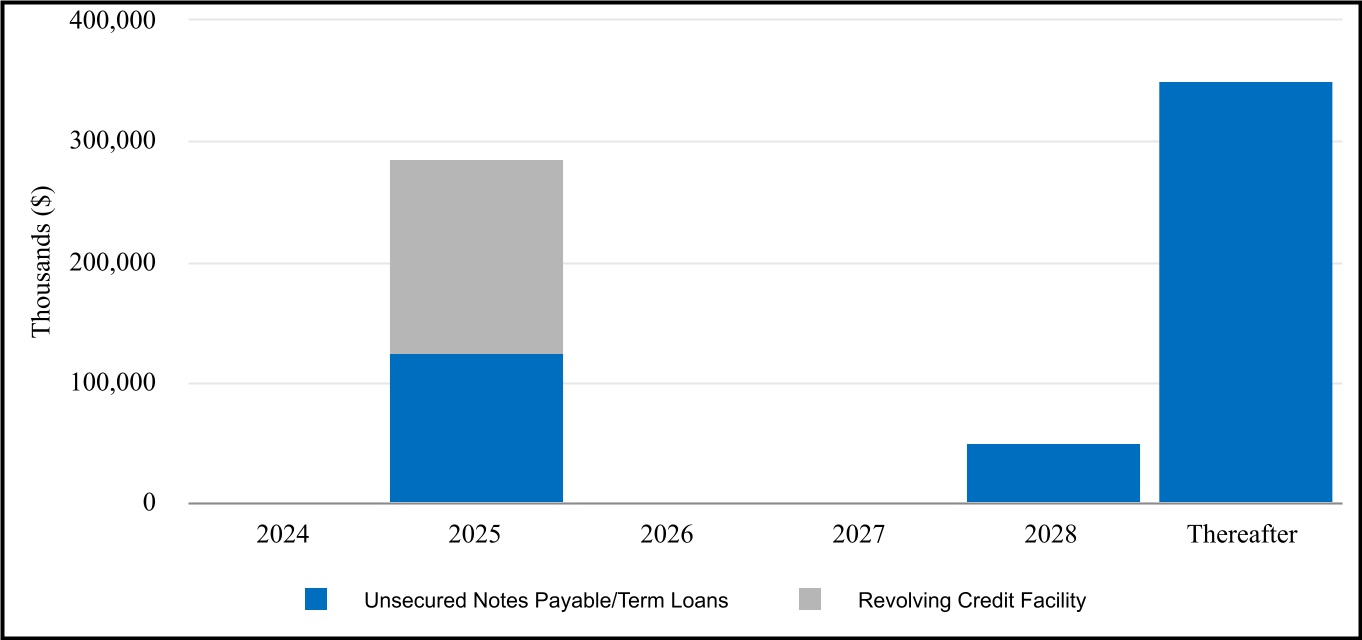

Capital Requirements

We have no debt maturities scheduled until the first quarter of 2025. We expect to have additional capital requirements as set forth on page 27 (Liquidity and Capital Resources – Capital Requirements).

Results of Operations

The discussion that follows is based on our consolidated results of operations for the 2024 Quarter and 2023 Quarter.

Net Operating Income

NOI, defined as real estate rental revenue less direct real estate operating expenses, is a non-GAAP measure. NOI is calculated as net income, less non-real estate revenue and the results of discontinued operations (including the gain or loss on sale, if any), plus interest expense, depreciation and amortization, lease origination expenses, general and administrative expenses, acquisition costs, real estate impairment, casualty gain and losses and gain or loss on extinguishment of debt. NOI does not include management expenses, which consist of corporate property management costs and property management fees paid to third parties. NOI is the primary performance measure we use to assess the results of our operations at the property level. We believe that NOI is a useful performance measure because, when compared across periods, it reflects the impact on operations of trends in occupancy rates, rental rates and operating costs on an unleveraged basis, providing perspective not immediately apparent from net income. NOI excludes certain components from net income in order to provide results more closely related to a property’s results of operations. For example, interest expense is not necessarily linked to the operating performance of a real estate asset. In addition, depreciation and amortization, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. As a result of the foregoing, we provide NOI as a supplement to net income, calculated in accordance with GAAP. NOI does not represent net income or income from continuing operations calculated in accordance with GAAP. As such, NOI should not be considered an alternative to these measures as an indication of our operating performance. A reconciliation of net loss to NOI follows.

2024 Quarter Compared to 2023 Quarter

The following table reconciles net loss to NOI and provides the basis for our discussion of our consolidated results of operations and NOI in the 2024 Quarter compared to the 2023 Quarter. All amounts are in thousands, except percentage amounts. | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| 2024 | | 2023 | | $ Change | | % Change |

| Net loss | $ | (3,647) | | | $ | (3,643) | | | $ | (4) | | | 0.1 | % |

| Adjustments: | | | | | | | |

| Property management expense | 2,218 | | | 1,769 | | | 449 | | | 25.4 | % |

| General and administrative expense | 6,196 | | | 6,841 | | | (645) | | | (9.4) | % |

| Transformation costs | — | | | 2,900 | | | (2,900) | | | (100.0) | % |

| Real estate depreciation and amortization | 24,943 | | | 21,536 | | | 3,407 | | | 15.8 | % |

| | | | | | | |

| | | | | | | |

| Interest expense | 9,494 | | | 6,831 | | | 2,663 | | | 39.0 | % |

| | | | | | | |

| Loss on extinguishment of debt, net | — | | | 54 | | | (54) | | | (100.0) | % |

| Other income | (1,410) | | | — | | | (1,410) | | | 100.0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total net operating income (NOI) | $ | 37,794 | | | $ | 36,288 | | | $ | 1,506 | | | 4.2 | % |

| | | | | | | |

| Residential revenue: | | | | | | | |

| Same-store portfolio | $ | 52,374 | | | $ | 50,991 | | | $ | 1,383 | | | 2.7 | % |

Acquisitions (1) | 2,497 | | | — | | | 2,497 | | | 100.0 | % |

| | | | | | | |

| | | | | | | |

| Total | 54,871 | | | 50,991 | | | 3,880 | | | 7.6 | % |

| Residential expenses: | | | | | | | |

| Same-store portfolio | 19,354 | | | 18,086 | | | 1,268 | | | 7.0 | % |

| Acquisitions | 947 | | | — | | | 947 | | | 100.0 | % |

| Development | 57 | | | 58 | | | (1) | | | (1.7) | % |

| | | | | | | |

| Total | 20,358 | | | 18,144 | | | 2,214 | | | 12.2 | % |

| Residential NOI: | | | | | | | |

| Same-store portfolio | 33,020 | | | 32,905 | | | 115 | | | 0.3 | % |

| Acquisitions | 1,550 | | | — | | | 1,550 | | | 100.0 | % |

| Development | (57) | | | (58) | | | 1 | | | (1.7) | % |

| | | | | | | |

| Total | 34,513 | | | 32,847 | | | 1,666 | | | 5.1 | % |

Other NOI (2) | 3,281 | | | 3,441 | | | (160) | | | (4.6) | % |

| Total NOI | $ | 37,794 | | | $ | 36,288 | | | $ | 1,506 | | | 4.2 | % |

______________________________

(1)Acquisitions:

2023: Elme Druid Hills

(2)Other: Watergate 600

Residential Revenue

Real estate rental revenue from our apartment communities is comprised of (a) rent from operating leases of multifamily residential apartments with terms of approximately one year or less, recognized on a straight-line basis, (b) revenue from the recovery of operating expenses from our residents, (c) credit losses on lease related receivables, (d) revenue from leases of retail space at our apartment communities and (e) parking and other tenant charges.

Real estate rental revenue from same-store residential properties increased $1.4 million, or 2.7%, to $52.4 million for the 2024 Quarter, compared to $51.0 million for the 2023 Quarter, primarily due to higher rental income ($1.6 million), higher recoveries ($0.7 million) and higher other rental and fee income ($0.3 million), partially offset by higher credit losses ($0.7 million) and higher vacancy loss ($0.4 million).

Real estate rental revenue from acquisitions increased $2.5 million due to the acquisition of Elme Druid Hills during the third quarter of 2023.

Average occupancy for residential properties for the 2024 Quarter and 2023 Quarter was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | March 31, 2023 | | % Change |

| Same-Store | | Non-Same-Store | | Total | | Same-Store | | Non-Same-Store | | Total | | Same-Store | | Non-Same-Store | | Total |

| 94.4 | % | | 92.4 | % | | 94.3 | % | | 95.3 | % | | N/A | | 95.3 | % | | (0.9) | % | | N/A | | (1.0) | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

The decrease in same-store average occupancy was primarily due to lower average occupancy at Elme Eagles Landing, Elme Sandy Springs, Elme Marietta, Elme Cumberland, and The Kenmore, partially offset by higher average occupancy at Roosevelt Towers, Bennett Park, Elme Bethesda and Elme Leesburg.

Residential Expenses

Residential real estate expenses as a percentage of residential revenue for the 2024 Quarter and the 2023 Quarter were 37.1% and 35.6%, respectively.

Real estate expenses from same-store residential properties increased $1.3 million, or 7.0%, to $19.4 million for the 2024 Quarter, compared to $18.1 million for the 2023 Quarter, primarily due to higher contract maintenance ($0.3 million), higher real estate taxes ($0.3 million), higher insurance ($0.3 million), higher utilities ($0.2 million), and higher administrative ($0.2 million) expenses.

Real estate expenses from acquisitions increased $0.9 million due to the acquisition of Elme Druid Hills during the third quarter of 2023.

Other NOI

Other NOI decreased due to lower revenue at Watergate 600 ($0.2 million).

Other Income and Expenses

General and administrative expense: Decrease of $0.6 million primarily due to higher management fee offset ($1.4 million), lower severance ($0.4 million), corporate office moving expenses in the 2023 Quarter ($0.2 million) and lower rent ($0.2 million) expenses. These were partially offset by higher payroll ($0.6 million), higher professional services ($0.4 million), higher incentive compensation ($0.2 million), higher computer software ($0.2 million) and higher employee benefits ($0.2 million) expenses.

Transformation costs: Decrease of $2.9 million during the 2024 Quarter due to completion of strategic transformation in 2023.

Real estate depreciation and amortization: Increase of $3.4 million primarily due to higher depreciation and amortization at Elme Druid Hills ($2.9 million) and same-store residential properties ($1.4 million). These increases were partially offset by lower depreciation and amortization at Watergate 600 ($0.9 million).

Interest expense: Interest expense by debt type for the three months ended March 31, 2024 and 2023 was as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| Debt Type | 2024 | | 2023 | | $ Change | | % Change |

| Notes payable | $ | 6,120 | | | $ | 5,454 | | | $ | 666 | | | 12.2 | % |

| | | | | | | |

| Line of credit | 3,374 | | | 1,377 | | | 1,997 | | | 145.0 | % |

| | | | | | | |

| Total | $ | 9,494 | | | $ | 6,831 | | | $ | 2,663 | | | 39.0 | % |

•Notes payable: Increase primarily due to the $125.0 million 2023 Term Loan executed in January 2023, partially offset by prepayment of a $100.0 million portion of the 2018 Term Loan in January 2023.

•Line of credit: Increase primarily due to higher weighted average borrowings of $168.3 million and a weighted average interest rate of 6.3% in the 2024 Quarter, as compared to weighted average borrowings of $44.8 million and a weighted average interest rate of 6.1% in the 2023 Quarter.

Other Income: Other income during the 2024 Quarter consists of additional payments received with respect to easements previously conveyed at The Wellington and Takoma Park, a previously owned retail property.

Liquidity and Capital Resources