SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement |

¨ Confidential, For Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) | |

| x Definitive Proxy Statement |

||

| ¨ Definitive Additional Materials | ||

| ¨ Soliciting Material Under Rule 14a-12 |

Washington Real Estate Investment Trust

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

¨ Fee paid previously with preliminary materials:

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1. | Amount previously paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

WASHINGTON REAL ESTATE INVESTMENT TRUST

6110 Executive Boulevard, Suite 800

Rockville, Maryland 20852

Telephone 301-984-9400

Facsimile 301-984-9610

Website www.writ.com

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

March 28, 2005

Dear Shareholder,

You are cordially invited to attend the Annual Meeting of Shareholders of Washington Real Estate Investment Trust to be held on Thursday, May 12, 2005. The formal Notice of the meeting and a Proxy Statement describing the proposals to be voted upon are enclosed.

Two Trustees are nominated for election at the meeting, and the Board of Trustees recommends that shareholders vote in favor of their election. In addition, the Proxy Statement includes a shareholder proposal concerning compensation. The Board of Trustees recommends that shareholders vote against the proposal as not in their best interest.

Please read the Proxy Statement, then complete, sign and return your proxy card in the enclosed envelope. You may also vote via telephone or the Internet. Just follow the instructions on the enclosed card.

Regardless of the number of shares you own, your vote is important.

Please note: The location of this year’s annual shareholder meeting has been changed from previous years.

Best Regards,

/s/ Edmund B. Cronin, Jr.

Edmund B. Cronin, Jr.

Chairman of the Board

WASHINGTON REAL ESTATE INVESTMENT TRUST

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

March 28, 2005

Dear Shareholder,

The Annual Meeting of the Shareholders (the “Annual Meeting”) of the Washington Real Estate Investment Trust (the “Trust” or “WRIT”) will be held at the Bethesda North Marriott Hotel & Conference Center, 5701 Marinelli Road, North Bethesda, Maryland (Northwest corner of Rockville Pike and Marinelli Rd., across the street from the White Flint Metro Stop) on Thursday, May 12, 2005 at 11:00 a.m., for the following purposes:

| 1. | To elect two Trustees; |

| 2. | To consider a shareholder proposal concerning compensation; |

| 3. | To transact such other business as may properly come before the meeting. |

The Trustees have fixed the close of business on March 17, 2005 as the record date for shares entitled to notice of and to vote at the Annual Meeting.

The Annual Report of the Trust, Proxy Statement and a Proxy Card are enclosed with this Notice.

You are requested, whether or not you plan to be present at the Annual Meeting, to sign and promptly return the Proxy Card in the enclosed business reply envelope. Alternatively, you may vote by telephone or the Internet, if you prefer. To do so, you should follow the instructions on the enclosed Proxy Card.

Sincerely,

/s/ Laura M. Franklin

Laura M. Franklin

Corporate Secretary

| Page | ||

| 1 | ||

| 1 | ||

| 4 | ||

| 5 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 12 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 14 | ||

| APPENDIX A: Corporate Governance/Nominating Committee Charter |

A-1 | |

| B-1 | ||

| C-1 | ||

WASHINGTON REAL ESTATE INVESTMENT TRUST

6110 Executive Boulevard, Suite 800

Rockville, Maryland 20852

PROXY STATEMENT

This Proxy Statement is furnished by the Trust’s Board of Trustees (the “Board”) in connection with its solicitation of proxies for use at the Annual Meeting of Shareholders on May 12, 2005 and at any and all adjournments thereof. Mailing of this Proxy Statement, the form of Proxy and the Annual Report of the Trust will commence on or about March 28, 2005 to shareholders of record as of March 17, 2005. All proxies will be voted in accordance with the instructions contained therein, and if no instructions are specified, the proxies will be voted in accordance with the recommendations of the Board. Therefore, if no instructions are specified, the proxies will be voted FOR the election of the two Trustee nominees listed and AGAINST the shareholder proposal. Abstentions and broker non-votes (proxies that indicate that brokers or nominees have not received instructions from the beneficial owner of shares) are counted for purposes of determining the presence or absence of a quorum for the transaction of business. Abstentions are counted in tabulating the total number of votes cast on proposals presented to shareholders, whereas broker non-votes are not counted for purposes of determining the total number of votes cast. A Proxy on the enclosed form may be revoked by the shareholder at any time prior to its exercise at the Annual Meeting by submitting, to the Corporate Secretary of the Trust, a duly executed Proxy bearing a later date or by attending the Annual Meeting and orally withdrawing the Proxy.

The voting securities of the Trust consist of shares of beneficial interest, $0.01 par value (“Shares”), of which 42,003,659 Shares were issued and outstanding at the close of business on March 17, 2005. The Trust has no other class of voting security. Each Share outstanding on March 17, 2005 will be entitled to one vote. Shareholders do not have cumulative voting rights.

THE BOARD OF TRUSTEES AND MANAGEMENT

The Board consists of seven Trustees divided into two classes of two Trustees each and one class of three Trustees. The terms of the Trustees continue until the Annual Meetings to be held in 2005, 2006 and 2007, respectively, and until their respective successors are elected. At each Annual Meeting, two or three Trustees are elected, subject to the limitations described below, for a term of three years to succeed those Trustees whose terms expire at such Annual Meeting. The Trust’s Bylaws provide that no person shall be nominated for election as a Trustee after their 72nd birthday.

The Board held eight meetings in 2004. During 2004, each incumbent Trustee attended more than 75% of the total number of Board and committee meetings he or she was eligible to attend. The Trust’s non-management Trustees meet at regularly scheduled executive sessions without management, presided by Mr. McDaniel, the chairman of the Corporate Governance Committee.

The Board has determined that all Trustees with the exception of Mr. Cronin are “independent” as that term is defined in the applicable listing standards of the New York Stock Exchange. The Board has determined that Mr. Osnos is an independent Board member as that term is defined in the New York Stock Exchange rules. In making this determination, the Board concluded that, although Mr. Osnos is an employee of the Trust’s outside counsel, because the Trust’s payments to such counsel are not material to the firm or the Trust, the relationship does not constitute a material relationship with the Trust.

The Board provides a process for shareholders to send communications to the entire Board, or any of the Trustees. Shareholders may send these written communications c/o Corporate Secretary, Washington Real Estate Investment Trust, 6110 Executive Boulevard, Suite 800, Rockville, Maryland 20852. All communications will be compiled by the Corporate Secretary and submitted to the Board or the Trustees on a periodic basis.

All members of the Board attended the Annual Shareholders Meeting in 2004. The Board does not have a formal written policy requiring Trustees to attend the Annual Shareholders Meeting, although Trustees have traditionally attended.

The Corporate Governance/Nominating Committee held one meeting in 2004. The Committee members are Messrs. McDaniel, Derrick, Osnos and Ms. Williams. All members of the Committee are “independent” as that term is defined in the applicable listing standards of the New York Stock Exchange. The Committee performs the duties described in the Corporate Governance/Nominating Committee Charter, adopted by the Board, a copy of which, as revised on November 29, 2004, is included as Appendix A. Among other things, the Committee develops and recommends corporate governance principles,

1

evaluates the performance of the Chief Executive Officer in light of Trust goals and objectives, and recommends nominees for election to the Board of Trustees as outlined in Appendix A. The Committee will consider nominees to the Board submitted by shareholders in writing addressed to the attention of the Committee at the executive offices of the Trust in Rockville, Maryland. The Committee’s minimum qualifications and specific qualities and skills required for Trustees are set forth in item number 7 of Appendix A on page A-2. In addition to considering candidates suggested by shareholders, the Committee considers potential candidates recommended by current Trustees, Trust Officers, employees and others. The Committee screens all potential candidates in the same manner regardless of the source of the recommendation. The Committee’s review is typically based on any written materials provided with respect to the potential candidate. The Committee determines whether the candidate meets the Trust’s minimum qualifications and specific qualities and skills for Trustees and whether requesting additional information or an interview is appropriate.

The Compensation Committee met five times in 2004. Committee members are Messrs. Nason, Kendall and Ms. Williams. All members of the Committee are “independent” as that term is defined in the applicable listing standards of the New York Stock Exchange. The Committee is responsible for making recommendations to the Board with respect to executive compensation decisions. See the “Report on Executive Compensation” on page 7 of this Proxy Statement. A copy of the Compensation Committee Charter, adopted by the Board, as revised on November 29, 2004, is included in Appendix B.

The Audit Committee met ten times in 2004. The Committee members are currently Messrs. Kendall, Derrick, McDaniel and Nason. Mr. Osnos resigned from the Committee on March 14, 2005. All members of the Committee are “independent” as that term is defined in the applicable listing standards of the New York Stock Exchange. The Board has determined that Mr. Kendall qualifies as an Audit Committee Financial Expert, as that term is defined in the rules of the SEC. The Audit Committee assists the Board in discharging its responsibility of oversight, but the existence of the Committee does not alter the responsibilities of the Trust’s management and the independent accountant with respect to the accounting and control functions and financial statement presentation. For a more detailed description of the Audit Committee’s duties and responsibilities see the “Audit Committee Report” on page 10 of this Proxy Statement. A copy of the Audit Committee Charter adopted by the Board, as revised on November 29, 2004, is included in Appendix C.

The six non-officer Trustees of the Trust received an annual retainer of $20,000 plus a $1,100 per meeting fee for attending Board and committee meetings. In addition, each non-officer Trustee received an annual grant of 2,000 Share options and 400 unrestricted Shares, both vested immediately. The Trust has approved a non-qualified deferred compensation plan for the Trustees. The plan will allow any Trustee to defer a percentage of his or her cash compensation. Compensation deferred will be credited with interest. Upon the expiration of a Trustee’s term, the compensation plus interest can be paid in either a lump sum or in installments at the discretion of the Trustee. Upon death, the Trustee’s beneficiary will receive a lump sum pay out. The plan is unfunded and payments are to be made from general assets of the Trust.

In November 2004, the Board of Trustees approved revisions to the Trustee Compensation Program, which specifies the compensation of Trustees who are not employees of the Trust. The first cash and Share grant benefits under the amended Program will be paid in 2005. The Program, as revised, provides for Trustee compensation as follows:

| • | The annual retainer will be increased from $20,000 to $25,000. |

| • | Board meeting fees will be eliminated. |

| • | Committee meeting fees will be $1,000 per meeting. |

| • | The Committee Chair annual retainers are as follows: |

| 1. | Audit Committee |

$7,500 | ||

| 2. | Corporate Governance Committee |

$3,000 | ||

| 3. | Compensation Committee |

$3,000 |

| • | Audit Committee members will be paid an additional annual retainer of $3,750. |

| • | Trustee annual long-term incentive compensation will be changed from options for 2,000 Shares and 400 restricted Shares to $30,000 in restricted Shares. Restricted Shares will vest immediately upon grant and will be restricted from sale for the period of the Trustees’ service. |

During 2004, the Trust utilized the legal services of the law firm of Arent Fox PLLC, of which Trustee David M. Osnos is of-counsel. The amount of fees paid to Arent Fox did not exceed 5% of that firm’s 2004 gross revenues.

2

The following table sets forth the names and biographical information concerning each of the current Trustees.

| NAME |

PRINCIPAL OCCUPATION |

SERVED AS TRUSTEE SINCE |

AGE |

TERM EXPIRES | ||||

| Clifford M. Kendall |

Director, VSE Corporation | 1999 | 73 | 2005 | ||||

| Susan J. Williams |

Chief Executive Officer and President, Williams Aron & Associates | 1999 | 64 | 2005 | ||||

| John M. Derrick, Jr. |

(Retired) Chairman, Pepco Holdings, Inc. | 1997 | 65 | 2006 | ||||

| Charles T. Nason |

Chairman, Acacia Life Insurance Company | 2000 | 58 | 2006 | ||||

| Edmund B. Cronin, Jr. |

Chairman, President and Chief Executive Officer, WRIT | 1994 | 67 | 2007 | ||||

| John P. McDaniel |

Chief Executive Officer, MedStar Health | 1998 | 62 | 2007 | ||||

| David M. Osnos |

Attorney, Arent Fox PLLC | 1987 | 73 | 2007 |

Mr. Edmund B. Cronin, Jr. is Chairman, President and Chief Executive Officer (“CEO”) of the Trust. Prior to joining the Trust in 1994, Mr. Cronin was President and CEO of H.G. Smithy Company and its subsidiaries from 1976 to 1994, providing a full range of corporate and institutional real estate services. Mr. Cronin is also a Director of Pepco Holdings, Inc. (formerly PEPCO), John J. Kirlin Companies (mechanical contractors), Federal City Council, Economic Club of Washington, the National Association of Real Estate Investment Trusts (NAREIT) and Chairman of the Board of Georgetown University Hospital.

Mr. John P. McDaniel is CEO of MedStar Health, a multi-institutional, not-for-profit healthcare organization serving Washington D.C., Maryland, Virginia and the mid-Atlantic region, since its inception in 1982. Mr. McDaniel serves on the Board of Directors of LifelinkMD and Thrivent Financial for Lutherans, and is a Trustee of Georgetown University. Mr. McDaniel is a past Chairman of the Greater Washington Board of Trade, a member of the Executive Committee of the Federal City Council, a member of the Maryland State Racing Commission, and a member of the Board of the Greater Baltimore Committee. Mr. McDaniel is a Fellow of the American College of Healthcare Executives and a member of the Economic Club of Washington.

Mr. David M. Osnos is of-counsel with Arent Fox PLLC (legal counsel to the Trust) and has been an attorney with the firm since 1956. His principal areas of practice include real estate, tax, securities, corporate, estate planning and sports law. He is a Director or Trustee of numerous organizations including EastGroup Properties (real estate investment trust), VSE Corporation (engineering) and Washington Wizards Basketball Club.

Mr. Clifford M. Kendall is a Director of VSE Corporation and was Chairman of the Board of On-Site Sourcing, Inc., until it was sold on February 20, 2004. Previously Mr. Kendall served as Chairman and CEO of Computer Data Systems, Inc. (CDSI) from 1971 to 1991 and as Chairman from 1991 to 1997, and after the merger of Affiliated Computer Service, Inc. (ACS) and CDSI, as a Director of ACS from 1997 through 2003. Mr. Kendall is a past Chairman of the Board and Executive Committee for The Technology Council of Maryland. He is a Director of The Lighthouse. Mr. Kendall serves on the Board of Trustees of George Washington University and is Chairman of the Board of Regents for the University System of Maryland. He is past Chairman of the Greater Washington Board of Trade and has served as Chairman of the Montgomery/Prince Georges County CEO Roundtable.

Ms. Susan J. Williams is CEO of Williams Aron & Associates, a public affairs consulting firm. Ms. Williams was Founding Partner and served as President of Bracy Williams & Company, government affairs and public relations consultants from 1982 to 2001. Ms. Williams’ career includes public service as a legislative professional on Capitol Hill as well as Assistant Secretary of Transportation. She also played a founding role in Project Head Start. Ms. Williams is a past Chair of The Greater Washington Board of Trade. She served on the Board of Directors of the Henry L. Stimson Center, the American Institute for Public Service, the Historical Society of Washington, D.C., the National Aquarium in Baltimore, and the D.C. Agenda Project. She is currently a member of the Economic Club of Washington and the Federal City Council.

Mr. John M. Derrick Jr. is retired Chairman of Pepco Holdings, Inc. He joined Potomac Electric Power Company (“PEPCO”) its predecessor in 1961 and served as President and CEO from 1997 until 1999 and as Chairman and CEO from 1999 until July 2003, and Chairman until May 2004. In August 2002, PEPCO became Pepco Holdings, Inc. From 1992 until 1997, he served as President and Chief Operating Officer. Mr. Derrick is a member of the Institute of Electrical and Electronic Engineers, the National Society of Professional Engineers and the Washington Society of Engineers. He is past Chairman of the United States Energy Association and he has served as a Director of the United States Chamber of Commerce, a trustee of the Federal City Council and Chairman of the Greater Washington Initiative. He is past Chairman of the Maryland Chamber of Commerce and the Greater Washington Board of Trade.

3

Mr. Charles T. Nason currently serves as Chairman of Acacia Life Insurance Company, as well as Acacia Federal Savings Bank and Calvert Group Limited, all Acacia subsidiaries. He had previously served as Chief Executive Officer of Acacia from 1988 through 2003. The Acacia Group is a Washington D.C. based financial services organization with assets under management in excess of $12 billion. Mr. Nason is a director of The Greater Washington Board of Trade, The Federal City Council, MedStar, Inc. and is a member of The Economic Club of Washington. He is also Vice-Chairman of the Board of Trustees of Washington and Jefferson College. In addition, he is past Chairman of the Greater Washington Board of Trade, a past Director of The American Council of Life Insurance and past Chairman of Insurance Marketplace Standards Association.

The following table contains information regarding the Executive Officers and other Officers of the Trust other than the Trust’s Chairman, President and CEO, Mr. Cronin. These Officers are elected annually by the Board and serve at the Board’s discretion.

| NAME |

AGE |

POSITION | ||

| Executive Officers |

||||

| George F. McKenzie |

49 | Executive Vice President, Real Estate | ||

| Laura M. Franklin |

44 | Senior Vice President, Accounting, Administration and Corporate Secretary | ||

| Sara L. Grootwassink |

37 | Chief Financial Officer | ||

| Officers |

||||

| Brian J. Fitzgerald |

43 | Managing Director, Leasing | ||

| Kenneth C. Reed |

52 | Managing Director, Property Management | ||

| Thomas L. Regnell |

48 | Managing Director, Acquisitions | ||

Mr. George F. McKenzie joined the Trust in September 1996 and was elected Executive Vice President, Real Estate in 2002. From 1985 to 1996, Mr. McKenzie served with the Prudential Realty Group, a subsidiary of Prudential Insurance Company of America as Vice President, Investment & Sales. Prior assignments included real estate finance originations and asset management in the mid-Atlantic region.

Ms. Laura M. Franklin, CPA, joined the Trust in August 1993 as Assistant Vice President, Finance. In 1995 she was named Vice President, Chief Accounting Officer and Corporate Secretary to the Trust. In 2002, she was named Senior Vice President, Accounting, Administration and Corporate Secretary. Prior to joining WRIT she was employed by The Reznick Group, specializing in audit and tax services for real estate clients. Ms. Franklin is a member of the NAREIT Best Financial Practices Council and is a director of KEEN USA and KEEN Greater DC, a non-profit organization that provides recreational opportunities for children and young adults with mental and physical disabilities.

Ms. Sara L. Grootwassink, CPA, CFA, joined the Trust in December 2001 as Managing Director, Finance and Capital Markets. In 2002, Ms. Grootwassink was named Chief Financial Officer. From 1999 through 2001, Ms. Grootwassink served as Vice President, Finance and Investor Relations at Corporate Office Properties Trust and, from 1998 through 1999, as Equity Analyst at Johnston, Lemon & Co. Previously, Ms. Grootwassink served as Vice President Commercial Real Estate at Riggs Bank, N.A. Ms. Grootwassink is a Director of CapitalSource, Inc., a commercial finance firm and serves on the Strategic Planning Committee of Washington Hospital Center. Ms. Grootwassink serves on the editorial advisory board of Real Estate Portfolio magazine, is a member of the Economic Club of Washington, and formerly served on NAREIT’s Investor Advisory Council.

Mr. Brian J. Fitzgerald joined the Trust in January 1996 as Vice President, Leasing. In 2001, Mr. Fitzgerald was named Managing Director, Leasing. From 1984 to 1993, Mr. Fitzgerald served as a commercial leasing broker with Smithy Braedon Company. In 1993, he became a Vice President of H. G. Smithy Company, with responsibilities for managing all agency leasing activities. From the date of the merger of H. G. Smithy Commercial Management Group with Cushman & Wakefield of Washington, D.C., Inc. in June 1994 until joining the Trust, Mr. Fitzgerald managed institutional agency leasing activities at Cushman & Wakefield, Inc. of Washington, D.C.

Mr. Kenneth C. Reed joined the Trust in June 1995 as Vice President, Property Management. In 2001, Mr. Reed was named Managing Director, Property Management. Mr. Reed served as President of CSN Management Corporation from 1988 to 1998. CSN managed WRIT’s properties until its assets were acquired by WRIT in 1998.

Mr. Thomas L. Regnell joined the Trust in January 1995 as Vice President, Acquisitions. In 2001, Mr. Regnell was named Managing Director, Acquisitions. From 1992 through 1994, Mr. Regnell served as an Investment (Acquisitions) Officer with Federal Realty Investment Trust. Previously, Mr. Regnell was a Vice President with Spaulding & Slye Company, a real estate development, brokerage and management company.

4

There are no family relationships between any Trustee and/or Executive Officer. There are no related party transactions between any Trustees or members of management and WRIT.

Ownership of Shares by Trustees and Executive Officers

The following table sets forth certain information concerning all Shares beneficially owned as of March 17, 2005 by each Trustee, by the nominees for Trustee, by each of the “Named Officers” (as defined in “Executive Compensation” below) and by all Trustees, Executive Officers and Officers as a group. Unless otherwise indicated, the voting and investment powers for the Shares listed are held solely by the named holder and/or the holder’s spouse.

| NAME |

SHARES OWNED (1) |

PERCENTAGE OF TOTAL |

|||

| Edmund B. Cronin, Jr. |

373,198 | 0.89 | % | ||

| John M. Derrick, Jr. |

20,424 | 0.05 | % | ||

| Laura M. Franklin |

87,992 | 0.21 | % | ||

| Sara L. Grootwassink |

34,935 | 0.08 | % | ||

| Clifford M. Kendall |

22,200 | 0.05 | % | ||

| John P. McDaniel |

21,150 | 0.05 | % | ||

| George F. McKenzie |

193,576 | 0.46 | % | ||

| Charles T. Nason |

19,467 | 0.05 | % | ||

| David M. Osnos |

20,800 | 0.05 | % | ||

| Robert W. Pivik |

0 | 0.00 | % | ||

| Susan J. Williams |

15,900 | 0.04 | % | ||

| All Trustees, Executive Officers and Officers as a group (14 persons) |

1,070,066 | 2.55 | % | ||

| (1) | Includes Shares subject to options exercisable within 60 days, as follows: Mr. Cronin, 211,503; Mr. Derrick, 10,000; Ms. Franklin, 41,471; Ms. Grootwassink, 14,815; Mr. Kendall, 8,000; Mr. McDaniel, 14,000; Mr. McKenzie, 127,334; Mr. Nason, 10,000; Mr. Osnos, 8,000; Mr. Pivik, 0; Ms. Williams, 12,000; and all Trustees, Executive Officers and Officers as a group, 572,777. |

Ownership of Shares by Certain Beneficial Owners

The Trust, based upon a Schedule 13G dated December 31, 2004 filed with the Securities and Exchange Commission (“SEC”), believes that the following person currently beneficially owns more than five percent of the outstanding Shares.

| NAME |

SHARES OWNED |

PERCENTAGE OF TOTAL |

||||

| T. Rowe Price Associates, Inc. |

2,959,300 | (1) | 7.00 | % | ||

| 100 E. Pratt Street |

||||||

| Baltimore, Maryland 21202 |

| (1) | These securities are owned by various individual and institutional investors which T. Rowe Price Associates, Inc. (“Price Associates”) serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. |

5

The Summary Compensation Table shows the compensation awarded, earned or paid during the past three years to the Trust’s CEO and each of the Trust’s three other Executive Officers whose compensation exceeded $100,000 for the period(s) indicated (the “Named Officers”).

SUMMARY COMPENSATION TABLE

| YEAR |

ANNUAL CASH COMPENSATION |

LONG-TERM COMPENSATION |

ALL OTHER COMPENSATION (3) | |||||||||||||

| NAME AND PRINCIPAL POSITION |

SALARY |

BONUS |

RESTRICTED SHARE |

SHARES UNDERLYING OPTIONS (2) |

||||||||||||

| Edmund B. Cronin, Jr. |

2004 2003 2002 |

$ $ $ |

500,000 466,745 440,325 |

$ $ $ |

147,854 391,600 — |

$ $ $ |

850,981 587,583 39,626 |

— — 49,336 |

$ $ $ |

19,430 18,580 15,025 | ||||||

| George F. McKenzie, |

2004 2003 2002 |

$ $ $ |

300,000 271,095 255,750 |

$ $ $ |

88,712 227,450 — |

$ $ $ |

468,769 280,638 17,906 |

— — 23,880 |

$ $ $ |

18,405 18,382 78,279 | ||||||

| Laura M. Franklin, |

2004 2003 2002 |

$ $ $ |

237,000 206,700 195,000 |

$ $ $ |

70,083 173,420 — |

$ $ $ |

355,236 202,415 13,650 |

— — 16,993 |

$ $ $ |

6,740 6,573 33,494 | ||||||

| Sara L. Grootwassink, |

2004 2003 2002 |

$ $ $ |

211,000 180,200 170,000 |

$ $ $ |

62,394 151,200 — |

$ $ $ |

373,889 176,457 11,911 |

— — 14,815 |

$ $ $ |

6,391 5,627 18,035 | ||||||

| (1) | Represents Share grants awarded in accordance with the Incentive Compensation Program approved by the Trustees in 1997. The aggregate holdings and market value of the unvested restricted Shares held as of December 31, 2004, by the individuals listed are: Mr. Cronin (45,548 Shares, $1,542,697); Mr. McKenzie (23,658 Shares, $801,290); Ms. Franklin (17,232 Shares, $583,655); and Ms. Grootwassink (16,947 Shares, $573,981). The “value” is calculated according to SEC rules assuming all Shares are vested as of December 31, 2004, even though not all of the awards have vested. In most cases, Share grants vest 20% per year beginning on the first anniversary of the grant date. Dividends on all restricted Shares, including restricted Shares that have not vested, are paid at the same rate and at the same time as paid to all shareowners. |

| (2) | All options reflected in the table were granted under the Washington Real Estate Investment Trust 2001 Stock Option Plan (“New Stock Option Plan”) in accordance with the Incentive Compensation Program approved by the Trustees in 1997. Options granted under the New Stock Option Plan vest 50% per year beginning on the first anniversary of the grant date. |

| (3) | Represents the 2004 economic benefit from life insurance policies, 401(k) match and auto allowance for each Executive Officer as follows: $7,280, $6,150 and $6,000, respectively, for Mr. Cronin; $1,455, $6,150 and $10,800, respectively, for Mr. McKenzie; $590, $6,150 and $0, respectively, for Ms. Franklin; $241, $6,150 and $0, respectively, for Ms. Grootwassink. |

6

Aggregated Option Exercises and Option Value Table

The following table shows information concerning the exercise of options during 2004 by each of the Named Officers and the year-end value of unexercised options.

AGGREGATED OPTION EXERCISES IN 2004 AND YEAR-END OPTION VALUES

| SHARES ON EXERCISE |

VALUE REALIZED |

NUMBER OF UNEXERCISED OPTIONS AT DECEMBER 31, 2004 |

VALUE OF UNEXERCISED IN THE MONEY OPTIONS AT DECEMBER 31, 2004 | ||||||||||||

| NAME |

EXERCISABLE |

UNEXERCISABLE |

EXERCISABLE |

UNEXERCISABLE | |||||||||||

| Edmund B. Cronin, Jr. |

146,698 | $ | 2,644,046 | 211,503 | — | $ | 2,206,264 | $ | — | ||||||

| George F. McKenzie |

19,685 | $ | 328,413 | 127,334 | — | $ | 1,532,619 | $ | — | ||||||

| Laura M. Franklin |

24,746 | $ | 316,870 | 41,471 | — | $ | 411,644 | $ | — | ||||||

| Sara L. Grootwassink |

— | $ | — | 14,815 | — | $ | 122,372 | $ | — | ||||||

Compensation Committee Interlocks and Insider Participation

The Board determined executive compensation for 2004. The Compensation Committee, composed of Messrs. Nason, Kendall and Ms. Williams, was responsible for making recommendations to the Board with respect to compensation decisions. There are no Compensation Committee interlocks and no Trust employee serves on the Compensation Committee.

REPORT ON EXECUTIVE COMPENSATION

2004 Executive Compensation Program

For 2004, the Board, upon recommendation of the Compensation Committee, continued the Incentive Compensation Program (the “Program”) with modifications based upon the recommendations prepared by an independent consultant to align executive compensation with shareholder interests through salaries, cash bonuses and Share grants tied to WRIT’s performance in comparison to a peer group.

Under the Program the Compensation Committee set salaries for the Trust’s Executive Officers based upon (i) a review of the compensation paid to similarly situated Executive Officers employed by companies comprising the Morgan Stanley REIT Index; and (ii) a subjective evaluation of each Executive Officer’s performance throughout the year. See “Executive Compensation — Performance Graph” for additional discussion regarding the Morgan Stanley REIT Index. Cash bonuses were determined through a comparison of WRIT’s 2004 FFO per share growth in excess of the weighted average FFO per share growth of our peer group.

We maintain a Share Grant Plan for all Officers and Trustees. In 2004, Officers received an award of Shares with a market value equal to a percentage of their cash compensation (45% for the Chief Executive Officer, 37% for Executive Vice Presidents, 35% for Senior Vice Presidents and 25% for Managing Directors.) Shares granted to Officers under the Share Grant Plan vest 20% per year over five years beginning on the first anniversary of the grant date and are restricted from transfer for five years from the date of grant. Some members of middle management received share grant awards that will vest 20% per year over five years beginning December 17, 2004. Officers no longer receive annual awards of Share options.

During 2004, a special award of 59,859 restricted Shares was granted to Executive Officers and Officers. The Board awarded this in recognition of the Trust’s performance for 2003, as both Executive Officers and Officers received lower cash bonuses than were indicated by the Program.

In November 2004, the Board of Trustees approved an amended short-term and long-term incentive plan for Executive Officers, Officers and other members of management. The first cash benefits under the amended short-term plan will be paid in late 2005, and the first Share grants under the amended long-term plan will be made in 2006, in each case based upon 2005 results.

7

The goals of the new plan are the following:

| • | To allow WRIT to attract and retain talented officers and executives. |

| • | To provide added incentives to achieve various objective performance targets. |

| • | To link compensation to shareholder results by rewarding competitive and superior shareholder returns as compared to a peer group of companies representing the real estate investment trust industry. |

The short-term incentive compensation plan provides for the annual payment of cash bonuses based upon WRIT’s achievement of its annual targets for funds from operations (FFO) per share and earnings before interest, taxes, depreciation and amortization (EBITDA). Each target will be determined in November of the preceding year by management and approved by the Board of Trustees. These measures will be weighted 50% each, and actual results for these measures will be compared to target levels annually. The combined results will then be adjusted by a multiplier, depending upon the condition of four objective measures of the market environment, in the event that WRIT significantly under-performs or outperforms its targets based on market factors unforeseen at the time the targets are set. The environmental factors could weight financial results within a range of 96-104%. The officers and executives will be paid cash awards equal to various percentages of their salaries based on the percentages resulting from the foregoing calculations and their positions, with minimum and maximum thresholds.

The long-term incentive plan was designed to align WRIT’s management with shareholders. The long-term incentive plan provides for the annual grant of restricted WRIT Shares based on WRIT’s 5-year rolling average total shareholder return compared to a weighted-average peer group. The awards will be granted in the form of restricted Shares, with a value equal to various percentages of their salaries based upon the foregoing comparison, with minimum and maximum thresholds. The Shares will be granted pursuant to WRIT’s existing Share grant plan, will vest ratably over a five-year period from the date of grant and will not be permitted to be sold until the entire award has vested.

The Trust has adopted a non-qualified deferred compensation plan for the Officers and members of the Board of Trustees. The plan allows for a deferral of a percentage of annual cash compensation and Trustee fees. The plan is unfunded and payments are to be made out of the general assets of the Trust.

The Committee and the Board believe that compensation paid to the Trust’s Executive Officers is comparable to that paid by the companies comprising the Morgan Stanley REIT Index.

Chief Executive Officer Compensation

Mr. Cronin’s 2004 compensation consisted of his salary, bonus and Share grants based upon the Executive Compensation Program described above. Mr. Cronin’s salary was recommended by the Compensation Committee based upon (i) a review of the compensation paid to Chief Executive Officers employed by companies comprising the Morgan Stanley REIT Index and (ii) a subjective evaluation of Mr. Cronin’s performance throughout the year. In general, the REIT Index comparison and the subjective evaluation were weighted equally by the Committee and the Board when making the decision to set Mr. Cronin’s salary at $500,000. As described above under the Program, Mr. Cronin’s 2004 bonus was based upon a comparison of WRIT’s 2004 FFO per share growth to the weighted average FFO per share growth of our peer group, and his Share grants was a fixed percentage of his cash compensation. The Committee and the Board, confirmed by an independent consultant, believe that compensation paid to Mr. Cronin is comparable to compensation paid to the CEOs of the companies comprising the Morgan Stanley REIT Index.

Supplemental Executive Retirement Plan

The Trust established a Supplemental Executive Retirement Plan (“SERP”) effective July 1, 2002 for the benefit of the CEO. Upon the CEO’s termination of employment from the Trust for any reason other than death, discharge for cause or total and permanent disability, the CEO will be entitled to receive an annual benefit equal to his accrued benefit times his vested interest. The CEO shall vest in accordance with the following schedule for each year of continuous employment with the Trust measured by reference to his birthday and commencing with the CEO’s sixty-fifth (65th) birthday:

| Years of Continuous Employment |

Percentage Vested |

||

| 1 | 0 | % | |

| 2 | 0 | % | |

| 3 | 50 | % | |

| 4 | 75 | % | |

| 5 | 100 | % |

8

The CEO shall be 100% vested upon his seventieth (70th) birthday, if having remained employed through that date. In addition, the CEO shall become 100% vested in the event of his termination of employment prior to his seventieth (70th) birthday due to the incurrence of a total and permanent disability (as defined in the Trust’s long-term disability plan). In addition, the Board of Trustees may, in its sole and absolute discretion, elect to accelerate the rate of vesting in whole or in part at any time.

The Trust purchased a universal life insurance policy on the CEO’s life to serve as a source of funds to assist the Trust in meeting its liabilities under the SERP. Through an endorsement split dollar arrangement, the Trust has made available to the CEO pre-retirement life insurance coverage through age 70.

In the event the CEO continues in the employment of the Trust until age 70, the annual benefit to be paid to the CEO shall be $200,000. The SERP is not subject to the vesting, funding and fiduciary requirements under ERISA.

Under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), a publicly held company such as the Trust will not be allowed a federal income tax deduction for compensation paid to the Chief Executive Officer or one of the other four most highly compensated Officers (other than the CEO) to the extent that compensation (including certain stock-based compensation) paid to such Officer exceeds $1 million in any fiscal year, unless such compensation satisfies certain exceptions set forth in the Code. The Board intends to evaluate elements of compensation in light of Section 162(m), but may enter into arrangements that do not satisfy such exceptions to Section 162(m), as the Board determines to be appropriate.

THE COMPENSATION COMMITTEE

Charles T. Nason, Compensation Committee Chairman

Clifford M. Kendall, Compensation Committee Member

Susan J. Williams, Compensation Committee Member

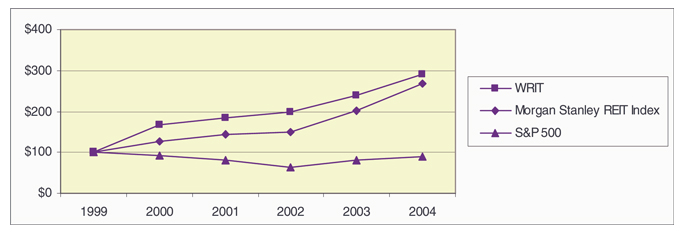

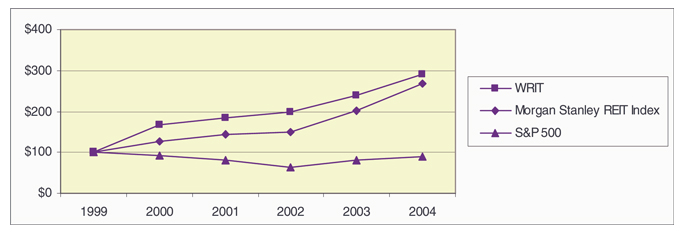

Set forth below is a graph comparing the cumulative total shareholder return (assumes reinvestment of dividends) on the Shares with the cumulative total return of companies making up the Standard & Poor’s 500 Stock Index and The Morgan Stanley REIT Index. The Morgan Stanley REIT Index is a total-return index comprised of 121 of the most actively traded real estate investment trusts.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

| 1999 |

2000 |

2001 |

2002 |

2003 |

2004 | |||||||||||||

| WRIT |

$ | 100 | $ | 166 | $ | 184 | $ | 199 | $ | 239 | $ | 290 | ||||||

| Morgan Stanley REIT Index |

$ | 100 | $ | 127 | $ | 143 | $ | 148 | $ | 203 | $ | 267 | ||||||

| S&P 500 |

$ | 100 | $ | 91 | $ | 80 | $ | 63 | $ | 80 | $ | 89 | ||||||

9

The Board maintains an Audit Committee, currently comprised of four of the Trust’s outside Trustees. The Board and the Audit Committee believe that the Audit Committee’s current member composition satisfies Section 303A of the New York Stock Exchange’s listed company manual. The Audit Committee oversees the Trust’s financial process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. The independent registered public accounting firm, Ernst & Young LLP, are responsible for expressing an opinion on the conformity of those financial statements with generally accepted accounting principles and the effectiveness of the company’s internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board.

In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, and not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements and management’s assessment of the effectiveness of the Trust’s internal controls over financial reporting.

The Audit Committee discussed with the Trust’s independent registered public accounting firm the overall scope and plans for their audit. The Committee meets with the independent auditors, with and without management present, to discuss the results of their examination, their evaluation of the Trust’s internal controls and the overall quality of the Trust’s financial reporting.

The Audit Committee reviewed with the independent registered public accounting firm their judgments as to the quality, and not just the acceptability, of the Trust’s accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards, including Statement on Auditing Standards No. 61, “Communication with Audit Committees.” In addition, the Committee has discussed with the independent registered public accounting firm their independence from management and the Trust, including the matters in the written disclosures and the letter from the independent registered public accounting firm required by the Independence Standards Board, Standard No. 1, “Independence Discussions with Audit Committees.”

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited financial statements be included in the Trust’s Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the SEC.

THE AUDIT COMMITTEE

Clifford M. Kendall, Audit Committee Chairman

John M. Derrick, Jr., Audit Committee Member

John P. McDaniel, Audit Committee Member

Charles T. Nason, Audit Committee Member

Principal Accounting Firm Fees

The following table sets forth the aggregate fees billed to the Trust for the year ended December 31, 2004 by the Trust’s independent registered public accounting firm, Ernst & Young LLP. The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the public accountant’s independence.

| 2004 |

2003 |

Explanatory Notes | ||||||

| Audit Fees (a), (c) |

$ | 639,200 | $ | 408,600 | (f) | |||

| Audit-Related Fees (b), (d), (e) |

$ | 66,600 | $ | 22,900 | (g) | |||

| Tax Fees (b) |

$ | 132,000 | $ | 142,000 | (h) | |||

| All Other Fees (b) |

$ | 0 | $ | 27,800 | (i) | |||

| Total Fees |

$ | 837,800 | $ | 601,300 | ||||

| (a) | Includes fees and expenses related to the fiscal year audit and interim reviews, notwithstanding when the fees and expenses were billed or when the services rendered. |

| (b) | Includes fees and expenses for services rendered from January through the end of the fiscal year, notwithstanding when the fees and expenses were billed. |

| (c) | Audit fees include the annual audit fee and fees for comfort letters, attest services, consents, and assistance with and the review of documents filed with the SEC. |

| (d) | Audit-related fees include fees incurred for consultation concerning financial accounting and reporting standards, performance of agreed upon procedures and other audit or attest services not required by statute or regulation. |

10

| (e) | 2004 audit-related fees include fees incurred for consultation regarding Sarbanes-Oxley implementation. |

| (f) | 2003 Audit Fees include (i) $238,000 for audit and review engagement fees, (ii) $140,750 for comfort work related to public offerings, and (iii) $29,850 for Sarbanes – Oxley Act consultation and other audit work. |

| (g) | 2003 Audit-Related Fees relate to the audit of the results of 1776 G Street, a property acquired in 2003. |

| (h) | Fees for tax services, including tax compliance, tax advice and tax planning. |

| (i) | 2003 Other Fees includes advisory services related to the Company’s compensation programs. |

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires advance approval of all audit, audit-related, tax and other services performed by the independent auditor. The policy provides for pre-approval by the Audit Committee of specifically defined audit and non-audit services. Unless the specific service has been previously pre-approved with respect to that year, the Audit Committee must approve the permitted service before the independent auditor is engaged to perform it. The Audit Committee has delegated to the Chair of the Audit Committee authority to approve permitted services provided that the Chair reports any decisions to the Committee at its next scheduled meeting.

11

ELECTION OF TRUSTEES

Ms. Susan J. Williams and Robert W. Pivik stand for election as Trustees at the Annual Meeting, to serve for three years. It is intended that the proxies given to the persons named in the accompanying Proxy (unless otherwise indicated on such Proxy) will be voted for the election of Ms. Susan J. Williams and Mr. Robert W. Pivik. Ms. Williams currently serves as a Trustee. Mr. Pivik is nominated for the position being vacated by Mr. Kendall. Mr. Kendall, in accordance with the Trust’s Bylaws, retires this year.

Mr. Robert W. Pivik, 67, most recently Chief Operating Officer of Howrey Simon Arnold & White LLP, served 35 years with the public accounting firm of Deloitte & Touche LLP. While at Deloitte & Touche, Mr. Pivik held several senior management positions, including Chief Financial Officer and Managing Partner, Mid-Atlantic Region. Mr. Pivik previously served as Director and Audit Committee Chairman of On-Site Sourcing, Inc. and as Executive Board Member of the Boy Scouts of America – National Capital Area Council. He has also chaired the Marketing Committee for the Greater Washington Board of Trade. His community activities have included membership in Federal City Council and the Economic Club of Washington.

Mr. Pivik was recommended by an independent director. His nomination was approved by the Corporate Governance Committee and the Board.

If a nominee becomes unable or unwilling to stand for election for any reason not presently known or contemplated, the persons named in the enclosed Proxy will have discretionary authority to vote pursuant to the Proxy for a substitute nominee nominated by the Board.

The election of Trustees requires the affirmative vote of the holders of a majority of the shares.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE IN FAVOR OF THE ELECTION OF MS. SUSAN J. WILLIAMS AND MR. ROBERT W. PIVIK.

SHAREHOLDER PROPOSAL ON EXECUTIVE COMPENSATION

Mr. Donald A. Saltz, 3842 Legation Street, N.W., Washington, DC 20015 (owner of 7,120 Common Shares), has advised the Trust that he plans to present the following proposal at the Annual Meeting. The proposal is included in this Proxy Statement pursuant to the rules of the SEC.

Executive Compensation Proposal

“This is a recommendation to the trustees and officers of WRIT that bonus awards, if made at all, be held to perhaps 10 percent of salary and not given in huge proportions.”

Proponent’s Supporting Statement

“In 2003, the Trust paid out bonuses amounting to 84 percent of salaries to the four officers listed in the proxy statement. The bonuses were awarded even though the Trust that year had lower earnings and but a small increase in cash flow. The persons who were given the bonuses also received substantial salary increases from the prior year. The awarding of very large bonuses appears to be improper fiduciary responsibility by the Trust’s management.”

RECOMMENDATION OF THE BOARD OF TRUSTEES

For the reasons described below, the Board believes that the Shareholder Proposal is not in the best interests of the Trust and its shareholders and therefore recommends a vote “AGAINST” the Shareholder Proposal.

The Board of Trustees and the Compensation Committee strongly support the concept of performance-based executive compensation programs that are designed to create long-term shareholder value and that are competitive with market compensation for senior management. Consistent with this philosophy, the Trust’s executive compensation programs have been based on the Trust’s FFO per share performance, and in 2003 and 2004, this performance was benchmarked against a peer group. In 2002, the Trusts’ FFO per share performance did not exceed the specified goal, and therefore no bonuses were paid to senior management for 2002.

12

The primary shortcoming of the Shareholder Proposal is that it would severely restrict the Trust’s ability to competitively recruit and retain executive talent, particularly when competing for talent against the Trust’s peer group of public real estate investment trusts as well as local private real estate companies. The Board and the Compensation Committee believe that unilaterally restricting potential incentive compensation for executives would place the Trust at a significant competitive disadvantage in recruiting and retaining its executives.

In accordance with its Board approved charter, the Compensation Committee, which is composed entirely of independent Trustees in compliance with the listing standards of the New York Stock Exchange, reviews and approves all policies under which compensation is paid to the Trust’s executives. Each year, the Compensation Committee also issues a comprehensive report on executive compensation, which is included in the Trust’s Proxy Statement, and discloses the compensation of the Trust’s most highly paid executive management.

In selecting the appropriate compensation programs to use for the Trust’s executives, the Compensation Committee must consider several factors, including the goals that the Board has established for the Trust, the competitive practices of comparable real estate investment trusts and prevailing market compensation levels. As described in the Report on Executive Compensation, bonuses are based on overall Trust financial performance.

The Board believes that its existing executive compensation program is properly aligned with shareholders’ interests, as it is tied to the Trust’s financial performance. In addition, the Board consults regularly with independent compensation consultants to review both the reasonableness and competitiveness of the Trust’s executive compensation programs.

The approval of the proposal requires the affirmative vote of the holders of a majority of the shares.

THE BOARD OF TRUSTEES RECOMMENDS THAT SHAREHOLDERS VOTE “AGAINST” THE SHAREHOLDER PROPOSAL RELATED TO EXECUTIVE COMPENSATION.

Independent Registered Public Accounting Firm

The firm of Ernst & Young LLP served as the Trust’s independent registered public accounting firm for 2004. The Audit Committee has appointed Ernst & Young LLP as the Trust’s independent registered public accounting firm for 2005.

Representatives of Ernst & Young LLP are expected to attend the Annual Meeting and will have the opportunity to make a statement if they desire to do so. They are also expected to be available to respond to appropriate questions.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that Trustees, Executive Officers and persons who own more than 10 percent of the Shares file initial reports of ownership of the Shares and changes in such ownership with the Securities and Exchange Commission. To the Trust’s knowledge, based solely on a review of copies of forms submitted to the Trust during and with respect to 2004 and on written representations from our Trustees and Executive Officers, all required reports were filed on a timely basis during 2004.

The Trust’s 2004 Annual Report to Shareholders is being mailed to shareholders concurrently with this Proxy Statement and does not form part of proxy solicitation material.

WRIT has adopted a code of ethics that applies to all of its Trustees, Officers and employees. The Trust has made the Code of Ethics available on its website, www.writ.com. A copy of the code is also available upon written request. WRIT intends to post on its website any amendments to, or waivers from, a provision of the Code of Ethics promptly following the date of such amendment or waiver.

13

Corporate Governance Guidelines

WRIT has adopted Corporate Governance Guidelines. The Guidelines, as well as the Committee Charters, are available on the website, www.writ.com and upon written request.

Solicitation of Proxies may be made by mail, personal interview, telephone or other means by Officers, Trustees and regular employees of the Trust for which they shall receive no compensation in addition to their normal compensation. The Trust may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of Shares that those companies or persons hold of record. The Trust will reimburse these forwarding expenses. The cost of the solicitation of proxies will be paid by the Trust.

Shareholders may present proposals to be considered for inclusion in the Proxy Statement relating to the 2006 Annual Meeting, provided they are received by the Trust no later than December 2, 2005 and are in compliance with applicable laws and SEC regulations.

Shareholder proposals to be brought before any meeting of shareholders or nominations of persons for election as a Trustee at any meeting of shareholders must be made pursuant to timely notice in writing to the Corporate Secretary. The notice must set forth certain information concerning such proposal or such shareholder and the nominees, as specified in the rules of the Securities and Exchange Commission and the Trust’s Bylaws. The presiding Officer of the meeting will refuse to acknowledge any proposal not made in compliance with the foregoing procedures.

/s/ Laura M. Franklin

Laura M. Franklin

Corporate Secretary

March 28, 2005

14

WASHINGTON REAL ESTATE INVESTMENT TRUST

CORPORATE GOVERNANCE/NOMINATING COMMITTEE CHARTER

Adopted as of February 20, 2003

Revised as of November 29, 2004

Committee Purpose

The Corporate Governance/Nominating Committee’s (the “Committee”) purpose shall be to identify individuals qualified to become Trustee members, and to select, or to recommend that the Board of Trustees (the “Board”) select, the Trustee nominees for the next Annual Meeting of Shareholders; and develop and recommend to the Board a set of corporate governance principles applicable to Washington Real Estate Investment Trust (the “Trust”), thereby helping to ensure that the Trust is properly managed to protect and enhance shareholder value and to meet the Trust’s obligations to shareholders, to its customers, to the industry and to the law.

Committee Composition and Operation

The Committee shall consist of no fewer than three, nor more than six Trustees, none of whom are employees of the Trust or any of its affiliates and all of whom are independent as required under the rules promulgated from time to time by the New York Stock Exchange and the Securities and Exchange Commission.

The Board shall have the authority to remove at any time one or more of the members of the Committee, to fill any vacancy that may exist on the Committee or to fill any newly created Committee membership caused by the increase in the size of the Committee.

The Committee shall meet at least once annually, or more frequently as circumstances require, and shall endeavor to meet periodically during the year to receive updates from management or its outside advisors concerning issues of relevance to the Committee (such as new developments and trends in corporate governance). Each meeting shall include a time of executive session.

The Committee may create one or more sub–Committees to which it may delegate some or all of its authority.

The Committee may make such rules of procedure as it deems necessary or appropriate for its efficient functioning, including with respect to notice of and presence at meetings of the Committee.

Committee Duties and Responsibilities

| 1. | The Committee shall develop and recommend to the Board a set of corporate governance principles applicable to the Trust, including recommendations regarding the structure, charter, practices and policies of the Board, including recommending amendments to the Trust’s Charter and Bylaws. |

| 2. | The Committee shall assess the Board’s performance and effectiveness and ensure that appropriate skill sets are considered when seeking new Trustee members. |

| 3. | The Committee shall ensure that processes are in place for development of corporate strategy and structure including management development, management succession and management performance criteria. |

| 4. | The Committee shall ensure that oversight of technology and systems used by the Trust are adequate to properly run the business and for it to remain competitive. |

A-1

| 5. | The Committee shall review, and report to the Board the Committee’s recommendations on, the Chairman of the Board’s proposals with regard to Committee chairmanships and assignments. |

| 6. | The Committee shall annually evaluate the Chief Executive Officer’s performance in light of the corporate goals and objectives relevant to compensation reviewed and approved by the Compensation Committee, and shall report its appraisal to the Board. |

| 7. | The Committee shall recommend to the Board candidates (a) for nomination for election as Trustees by shareholders at the Annual Meeting of Shareholders and (b) for election by the Board for Trustees if vacancies occur other than at the Annual Meeting of Shareholders. The Corporate Governance/Nominating Committee has sole authority to retain and terminate any search firm to be used to identify Trustee candidates, including sole authority to approve the search firm’s fees and other retention terms. Criteria considered by the Committee shall include, among others, the following: the need for independence of a majority of the Board, as required under the rules promulgated from time to time by the New York Stock Exchange and the Securities and Exchange Commission; potential nominees’ experience in relevant industry; the Board’s commitment to diversity (e.g., gender, race, geography) among Board members; a need for complimentary skills among board members (e.g., financial literacy for Audit Committee members); the number of other boards on which a potential nominee serves; desire for continuity; and, highest standards of ethics and integrity. |

| 8. | The Committee shall conduct an annual evaluation of its performance of its duties and the continuing adequacy of its charter, which may include presentations by advisers retained by the Committee for this purpose. |

| 9. | The Committee shall report to the Board at least annually (and more frequently, if the Committee believes its activities merit such reporting) as to the Committee’s activities. |

A-2

WASHINGTON REAL ESTATE INVESTMENT TRUST

COMPENSATION COMMITTEE CHARTER

Adopted as of February 20, 2003

Revised as of November 29, 2004

Committee Purpose

The Compensation Committee’s (the “Committee”) purpose shall be to discharge the Board of Trustees (the “Board”) responsibilities relating to compensation of the persons named as executive officers of the Trust in its annual meeting proxy statement and any other persons identified as Executives herein, to make recommendations to the Board on the employee compensation and benefit plan matters described below, and to produce an annual report on executive compensation for inclusion in the Trust’s proxy statement, in accordance with applicable rules and regulations.

Committee Composition and Operation

The Committee shall consist of no fewer than three, nor more than six Trustees, none of whom are employees of the Trust or any of its affiliates and all of whom are independent as required under the rules promulgated from time to time by the New York Stock Exchange and the Securities and Exchange Commission.

The Board shall have the authority to remove at any time one or more of the members of the Committee, to fill any vacancy that may exist on the Committee or to fill any newly created Committee membership caused by the increase in the size of the Committee.

The Committee may create one or more sub–Committees to which it may delegate some or all of its authority provided, however, that it may not delegate to a sub–Committee the power and authority to authorize the issuance of shares of the Trust’s Shares of Beneficial Interest or options to purchase shares (or securities convertible into or exercisable for any such shares or options).

The Committee may make such rules of procedure as it deems necessary or appropriate for its efficient functioning, including with respect to notice of and presence at meetings of the Committee.

The Committee shall meet at least once annually, or more frequently as circumstances require, and shall endeavor to meet periodically during the year to receive updates from management or its outside advisors concerning issues of relevance to the Committee.

Committee Duties and Responsibilities

| 1. | The Committee shall review and approve corporate goals and objectives relevant to CEO compensation, and shall set the CEO’s compensation level based on the annual evaluation performed by the Corporate Governance/Nominating Committee. In determining the long–term incentive component of CEO compensation, the Committee should consider the Trust’s performance and relative shareholder return, the value of similar incentive awards to CEOs at comparable organizations, and the awards given to the Trust’s CEO in past years. |

| 2. | The Committee shall have sole authority to retain and terminate any compensation consulting firm or other advisors it may desire to use to assist it in the evaluation of Trustee, CEO or senior executive compensation or to discharge its other duties hereunder, including sole authority to approve the firm’s fees and other retention terms. |

B-1

| 3. | The Committee shall have full power and authority to set the maximum salary limit for officers and employees that may be fixed by the Chief Executive Officer and to determine the compensation of each officer of Washington Real Estate Investment Trust and any employee whose salary exceeds the level of authorization held by the Chief Executive Officer. |

| 4. | The Committee shall have full power and authority to fix the salaries and other compensation (including Annual and Long Term Incentive Awards) of the five most highly compensated officers of the Trust, and any individual who the Board has determined to be an executive officer subject to the reporting requirements of the Section 16(a) of the Securities Exchange Act of 1934 (together, the “Executives”). In addition, the Committee shall recommend to the full Board the salaries and other compensation of any individual who is not an Executive but whose total compensation (including Annual and Long Term Incentive Awards) exceeds the total compensation (including such incentive compensation) of the lowest ranked proxy reported salary and compensation. |

| 5. | The Committee shall review and make recommendations to the Board with respect to incentive compensation plans and equity–based plans, including the Long Term Incentive Plan, Executive Benefit Plans and Tax Qualified Retirement Plans, and shall fix the level or amount of benefits to be received by Executives there under. |

| 6. | The Committee shall oversee the administration of the Annual Incentive Plans of the Trust and its subsidiaries, if any, including the following: |

| a. | Approve the Executive Annual Incentive Plan of the Trust, including plan design, performance targets, target level awards, participants and awards for participants exceeding the salary limit that may be fixed by the Chief Executive Officer. |

| b. | Approve Executive Incentive Plans for the Trust’s subsidiaries, if any, including plan design, target award levels and review plan results and awards as approved by the subsidiary Board. |

| 7. | The Committee shall oversee the Administration of the Long Term Incentive Plan as approved by the Board, including plan design, award levels, participants and awards made under the plan; provided that, the Committee shall have sole authority to approve any awards made to Executives there under. |

| 8. | The Committee shall review compensation practices applicable to the Board. |

| 9. | The Committee shall report periodically to the Board regarding the activities and actions of the Committee. |

| 10. | The Committee shall conduct an annual evaluation of its performance of its duties and the continuing adequacy of its charter, which may include presentations by advisors retained by the Committee for this purpose. |

| 11. | The Committee shall produce an annual report on executive compensation for inclusion in the Trust’s proxy statement, in accordance with applicable rules and regulations. |

| 12. | The Committee shall report to the Board at least annually (and more frequently, if the Committee believes its activities merit such reporting) as to the Committee’s activities. |

B-2

WASHINGTON REAL ESTATE INVESTMENT TRUST

AUDIT COMMITTEE CHARTER

Adopted as of February 20, 2003

Revised as of November 29, 2004

Committee Purpose

The Audit Committee’s (the “Committee”) purpose shall be to (A) represent and assist the Board of Trustees (the “Board”) in oversight of (1) the integrity of Washington Real Estate Investment Trust’s (the “Trust”) accounting and financial reporting processes and audits of the Trust’s financial statements, (2) the Trust’s processes for compliance with legal and regulatory requirements, (3) the independent auditor’s qualifications and independence, and (4) the performance of the Trust’s internal audit function and independent auditors; and (B) prepare the report that Securities and Exchange Commission rules require be included in the Trust’s annual proxy statement. The Audit Committee represents and assists the Board in discharging its responsibility of oversight, but the existence of the Committee does not alter the traditional roles and responsibilities of the Trust’s management and the independent auditor with respect to the accounting and control functions and financial statement presentation.

Committee Composition and Operation

The Committee shall consist of no fewer than three Trustees, none of whom are employees of the Trust or any of its affiliates and all of whom are independent as required under the rules promulgated from time to time by the New York Stock Exchange and the Securities and Exchange Commission. No Committee member may serve on the audit committee of more than three public companies.

The Board shall have the authority to remove at any time one or more of the members of the Committee, to fill any vacancy that may exist on the Committee or to fill any newly created Committee membership caused by the increase in the size of the Committee.

The Committee shall meet at least four times annually, or more frequently as circumstances require.

The Committee may create one or more sub–Committees to which it may delegate some or all of its authority.

The Committee may make such rules of procedure as it deems necessary or appropriate for its efficient functioning.

Committee Duties and Responsibilities

| 1. | The Committee shall have sole authority to (A) retain and terminate the Trust’s independent auditors; (B) pre–approve all audit engagement fees and terms, including the scope and timing of the audit, in conformance with the approval requirements as promulgated from time to time by the New York Stock Exchange and the Securities and Exchange Commission; and (C) pre–approve any significant audit–related relationship with the independent auditor. The Committee shall have sole authority to evaluate and determine whether consulting services to be obtained by the Trust are “audit–related” or “non–audit related” for purposes of applying the Trust’s policies and the applicable rules as promulgated from time to time by the New York Stock Exchange and the Securities and Exchange Commission with regard to such services. |

| 2. | The Committee shall be directly responsible for oversight of the work of any independent auditor employed by the Trust for the purpose of preparing or issuing an audit report or related work (including resolution of disagreements between management and the auditor regarding financial reporting), and each such independent auditor shall report directly to the Committee. |

C-1

| 3. | The Committee shall, at least annually, obtain and review a report by the independent auditor describing: the firm’s internal quality control procedures; any material issues raised by the most recent internal quality control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and (to assess the auditor’s independence) all relationships between the auditor and the Trust. |

After reviewing the foregoing report, and the independent auditor’s work throughout the year, the Audit Committee will evaluate the auditor’s qualifications, performance and independence. The evaluation will include the review and evaluation of the lead partner of the independent auditor. In making its evaluation, the Audit Committee will take into account the opinions of management and the Trust’s internal auditors. In addition to assuring the regular rotation of the lead audit partner as required by law, the Audit Committee will further consider whether, in order to assure continuing auditor independence, there should be regular rotation of the audit firm itself. The Audit Committee will present its conclusions with respect to the independent auditor to the full Board.

| 4. | The Committee shall review the organization and schedule of annual audits conducted by the Trust’s internal auditor and review with management and the internal auditors significant recommendations made by the internal auditors and the implementation of those recommendations. |

| 5. | The Committee shall review periodically with the independent auditor and management the Trust’s policies and procedures with respect to internal auditing, accounting and financial controls, as well as any internal control report required to be included in the Trust’s Annual Report on Form 10–K. This review shall also include a review, upon completion of the annual audit, of the reports or opinions proposed to be rendered in connection with the annual audit; the independent auditor’s views of the Trust’s financial and accounting personnel; the cooperation which the independent auditor received in the course of its review; and any significant findings of the independent auditor with respect to change in accounting principles and practices, significant transactions outside the normal course of the Trust’s business and any recommendations which the independent auditor may have with respect to improving internal accounting controls, choice of accounting principles or management systems. |

| 6. | The Committee shall review and discuss the annual audited financial statements and quarterly financial statements with management and the independent auditor, including the Trust’s disclosures in its Annual and Quarterly reports under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| 7. | The Committee shall review with the independent auditor and with management the Trust’s conflict of interest policies. |

| 8. | The Committee shall report regularly to the Board, and review with the full Board any issues that arise with respect to the quality or integrity of the Trust’s financial statements, the Trust’s compliance with legal or regulatory requirements, the performance and independence of the Trust’s independent auditors, or the performance of the internal audit function. The Committee shall also make such recommendations to the Board as the Committee deems appropriate. |

| 9. | The Committee shall meet separately, periodically, with management, with internal auditors and with independent auditors. |

| 10. | The Committee shall discuss and review with management the Trust’s guidelines and policies with respect to risk assessment and risk management, including the Trust’s major financial risk exposures and the steps management has taken to monitor and control such exposures. However, the Committee’s duties and responsibilities in this regard do not alter the obligation of the CEO and senior management to assess and manage the Trust’s exposure to risk. |

C-2

| 11. | The Committee shall review with the independent auditor (A) any audit problems or difficulties (including any restrictions on the scope of the independent auditor’s activities or on access to requested information, and any significant disagreements with management); and (B) management’s response. The review will also include discussion of the responsibilities, budget and staffing the Trust’s internal audit function. |

| 12. | The Committee shall set clear hiring policies for employees or former employees of the independent auditor. |

| 13. | The Committee shall, as appropriate to carry out its duties, obtain advice and assistance from independent legal, accounting or other advisors. The Committee shall have full power and authority to retain such advisors as and when the Committee deems it appropriate to do so, and to authorize the payment of compensation any such advisors, without first seeking Trustees’ approval. |